Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 04 1. The real Return on investment (ROI) of Agro PLC for the last two years was 18.5% and 21.75% respectively while the inflation

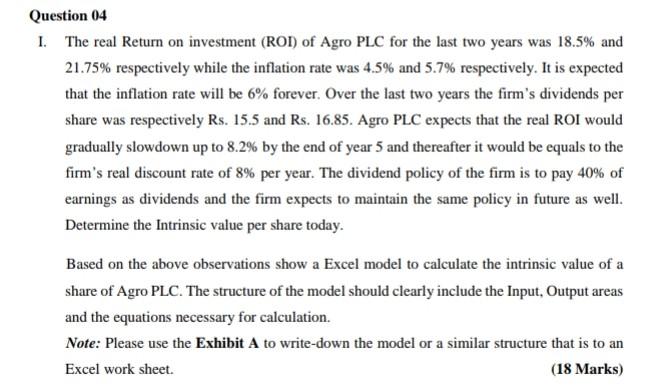

Question 04 1. The real Return on investment (ROI) of Agro PLC for the last two years was 18.5% and 21.75% respectively while the inflation rate was 4.5% and 5.7% respectively. It is expected that the inflation rate will be 6% forever. Over the last two years the firm's dividends per share was respectively Rs. 15.5 and Rs. 16.85. Agro PLC expects that the real ROI would gradually slowdown up to 8.2% by the end of year 5 and thereafter it would be equals to the firm's real discount rate of 8% per year. The dividend policy of the firm is to pay 40% of earnings as dividends and the firm expects to maintain the same policy in future as well. Determine the Intrinsic value per share today. Based on the above observations show a Excel model to calculate the intrinsic value of a share of Agro PLC. The structure of the model should clearly include the Input, Output areas and the equations necessary for calculation. Note: Please use the Exhibit A to write down the model or a similar structure that is to an Excel work sheet. (18 Marks) Question 04 1. The real Return on investment (ROI) of Agro PLC for the last two years was 18.5% and 21.75% respectively while the inflation rate was 4.5% and 5.7% respectively. It is expected that the inflation rate will be 6% forever. Over the last two years the firm's dividends per share was respectively Rs. 15.5 and Rs. 16.85. Agro PLC expects that the real ROI would gradually slowdown up to 8.2% by the end of year 5 and thereafter it would be equals to the firm's real discount rate of 8% per year. The dividend policy of the firm is to pay 40% of earnings as dividends and the firm expects to maintain the same policy in future as well. Determine the Intrinsic value per share today. Based on the above observations show a Excel model to calculate the intrinsic value of a share of Agro PLC. The structure of the model should clearly include the Input, Output areas and the equations necessary for calculation. Note: Please use the Exhibit A to write down the model or a similar structure that is to an Excel work sheet. (18 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started