Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 05 10 MARKS Phantom Property Ltd (PPL) is a property development company with a balance date of 31 March. During the preparation of the

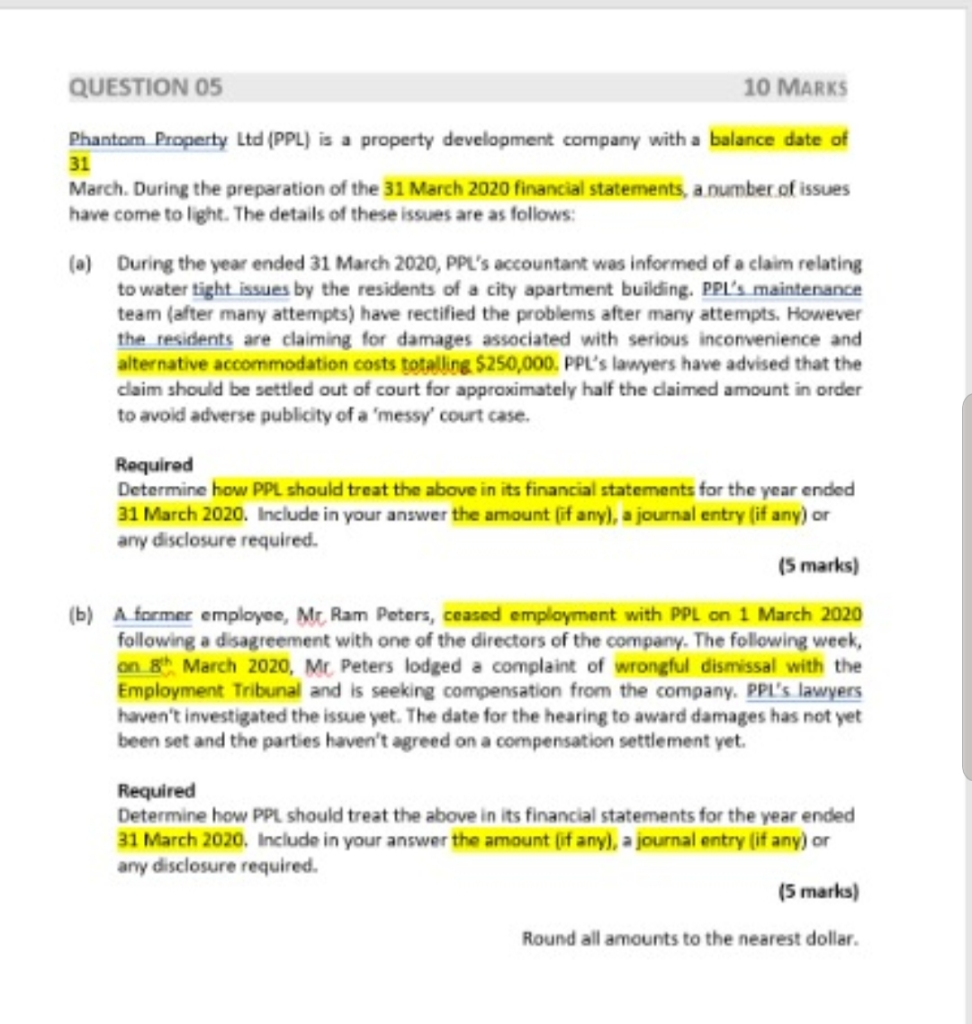

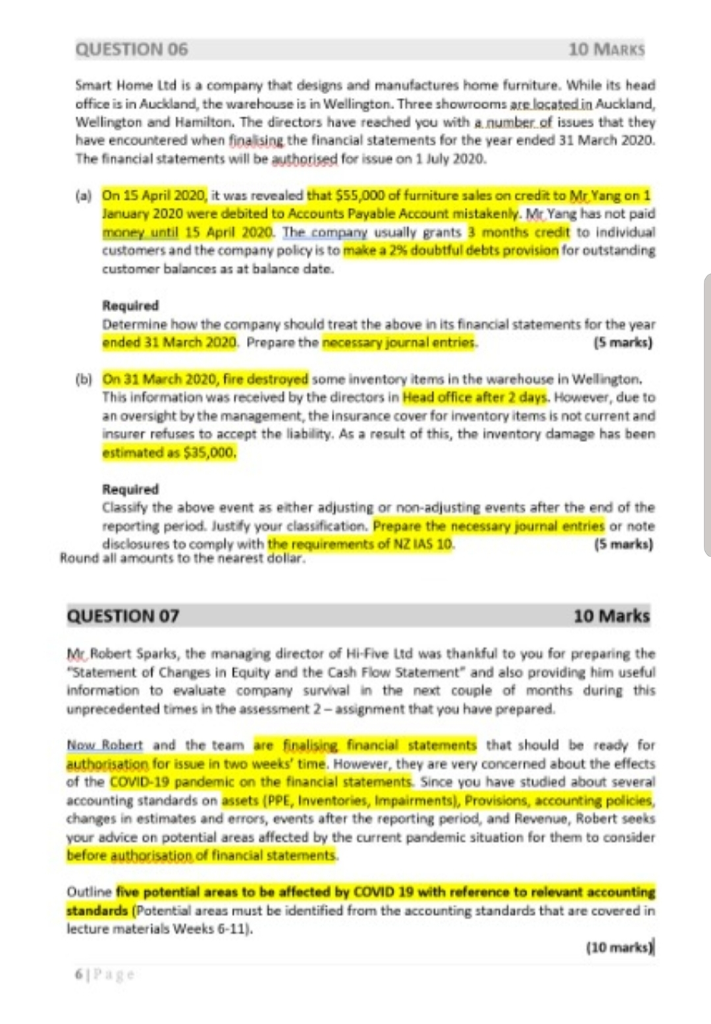

QUESTION 05 10 MARKS Phantom Property Ltd (PPL) is a property development company with a balance date of 31 March. During the preparation of the 31 March 2020 financial statements, a number of issues have come to light. The details of these issues are as follows: (a) During the year ended 31 March 2020, PPL's accountant was informed of a claim relating to water tight issues by the residents of a city apartment building. PPL's maintenance team (after many attempts) have rectified the problems after many attempts. However the residents are claiming for damages associated with serious inconvenience and alternative accommodation costs totalling $250,000. PPL's lawyers have advised that the claim should be settled out of court for approximately half the claimed amount in order to avoid adverse publicity of a 'messy court case. Required Determine how PPL should treat the above in its financial statements for the year ended 31 March 2020. Include in your answer the amount (if any), a journal entry (if any) or any disclosure required. (5 marks) (b) A former employee, Mr Ram Peters, ceased employment with PPL on 1 March 2020 following a disagreement with one of the directors of the company. The following week, on 8h March 2020, Mr Peters lodged a complaint of wrongful dismissal with the Employment Tribunal and is seeking compensation from the company. PPL's lawyers haven't investigated the issue yet. The date for the hearing to award damages has not yet been set and the parties haven't agreed on a compensation settlement yet. Required Determine how PPL should treat the above in its financial statements for the year ended 31 March 2020. Include in your answer the amount (if any), a journal entry (if any) or any disclosure required. (5 marks) Round all amounts to the nearest dollar. QUESTION 06 10 MARKS Smart Home Ltd is a company that designs and manufactures home furniture. While its head office is in Auckland, the warehouse is in Wellington. Three showrooms are located in Auckland, Wellington and Hamilton. The directors have reached you with a number of issues that they have encountered when finalising the financial statements for the year ended 31 March 2020 The financial statements will be authorised for issue on 1 July 2020. (a) On 15 April 2020, it was revealed that $55,000 of furniture sales on credit to Mr Yang on 1 January 2020 were debited to Accounts Payable Account mistakenly. Mr Yang has not paid money until 15 April 2020. The company usually grants 3 months credit to individual customers and the company policy is to make a 2% doubtfuldebts provision for outstanding customer balances as at balance date. Required Determine how the company should treat the above in its financial statements for the year ended 31 March 2020. Prepare the necessary journal entries. (5 marks) (b) On 31 March 2020, fire destroyed some inventory items in the warehouse in Wellington. This information was received by the directors in Head office after 2 days. However, due to an oversight by the management, the insurance cover for inventory items is not current and insurer refuses to accept the liability. As a result of this, the inventory damage has been estimated as $35,000 Required Classify the above event as either adjusting or non-adjusting events after the end of the reporting period. Justify your classification. Prepare the necessary journal entries or note disclosures to comply with the requirements of NZ IAS 10. (5 marks) Round all amounts to the nearest dollar. QUESTION 07 10 Marks Mc Robert Sparks, the managing director of Hi-Five Ltd was thankful to you for preparing the Statement of Changes in Equity and the Cash Flow Statement and also providing him useful Information to evaluate company survival in the next couple of months during this unprecedented times in the assessment 2-assignment that you have prepared. Now Robert and the team are finalising financial statements that should be ready for authorisation for issue in two weeks' time. However, they are very concerned about the effects of the COVID-19 pandemic on the financial statements. Since you have studied about several accounting standards on assets (PPE, Inventories, Impairments), Provisions, accounting policies, changes in estimates and errors, events after the reporting period, and Revenue, Robert seeks your advice on potential areas affected by the current pandemic situation for them to consider before authorisation of financial statements. Outline five potential areas to be affected by COVID 19 with reference to relevant accounting standards (Potential areas must be identified from the accounting standards that are covered in lecture materials Weeks 6-11). (10 marks) QUESTION 05 10 MARKS Phantom Property Ltd (PPL) is a property development company with a balance date of 31 March. During the preparation of the 31 March 2020 financial statements, a number of issues have come to light. The details of these issues are as follows: (a) During the year ended 31 March 2020, PPL's accountant was informed of a claim relating to water tight issues by the residents of a city apartment building. PPL's maintenance team (after many attempts) have rectified the problems after many attempts. However the residents are claiming for damages associated with serious inconvenience and alternative accommodation costs totalling $250,000. PPL's lawyers have advised that the claim should be settled out of court for approximately half the claimed amount in order to avoid adverse publicity of a 'messy court case. Required Determine how PPL should treat the above in its financial statements for the year ended 31 March 2020. Include in your answer the amount (if any), a journal entry (if any) or any disclosure required. (5 marks) (b) A former employee, Mr Ram Peters, ceased employment with PPL on 1 March 2020 following a disagreement with one of the directors of the company. The following week, on 8h March 2020, Mr Peters lodged a complaint of wrongful dismissal with the Employment Tribunal and is seeking compensation from the company. PPL's lawyers haven't investigated the issue yet. The date for the hearing to award damages has not yet been set and the parties haven't agreed on a compensation settlement yet. Required Determine how PPL should treat the above in its financial statements for the year ended 31 March 2020. Include in your answer the amount (if any), a journal entry (if any) or any disclosure required. (5 marks) Round all amounts to the nearest dollar. QUESTION 06 10 MARKS Smart Home Ltd is a company that designs and manufactures home furniture. While its head office is in Auckland, the warehouse is in Wellington. Three showrooms are located in Auckland, Wellington and Hamilton. The directors have reached you with a number of issues that they have encountered when finalising the financial statements for the year ended 31 March 2020 The financial statements will be authorised for issue on 1 July 2020. (a) On 15 April 2020, it was revealed that $55,000 of furniture sales on credit to Mr Yang on 1 January 2020 were debited to Accounts Payable Account mistakenly. Mr Yang has not paid money until 15 April 2020. The company usually grants 3 months credit to individual customers and the company policy is to make a 2% doubtfuldebts provision for outstanding customer balances as at balance date. Required Determine how the company should treat the above in its financial statements for the year ended 31 March 2020. Prepare the necessary journal entries. (5 marks) (b) On 31 March 2020, fire destroyed some inventory items in the warehouse in Wellington. This information was received by the directors in Head office after 2 days. However, due to an oversight by the management, the insurance cover for inventory items is not current and insurer refuses to accept the liability. As a result of this, the inventory damage has been estimated as $35,000 Required Classify the above event as either adjusting or non-adjusting events after the end of the reporting period. Justify your classification. Prepare the necessary journal entries or note disclosures to comply with the requirements of NZ IAS 10. (5 marks) Round all amounts to the nearest dollar. QUESTION 07 10 Marks Mc Robert Sparks, the managing director of Hi-Five Ltd was thankful to you for preparing the Statement of Changes in Equity and the Cash Flow Statement and also providing him useful Information to evaluate company survival in the next couple of months during this unprecedented times in the assessment 2-assignment that you have prepared. Now Robert and the team are finalising financial statements that should be ready for authorisation for issue in two weeks' time. However, they are very concerned about the effects of the COVID-19 pandemic on the financial statements. Since you have studied about several accounting standards on assets (PPE, Inventories, Impairments), Provisions, accounting policies, changes in estimates and errors, events after the reporting period, and Revenue, Robert seeks your advice on potential areas affected by the current pandemic situation for them to consider before authorisation of financial statements. Outline five potential areas to be affected by COVID 19 with reference to relevant accounting standards (Potential areas must be identified from the accounting standards that are covered in lecture materials Weeks 6-11). (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started