Answered step by step

Verified Expert Solution

Question

1 Approved Answer

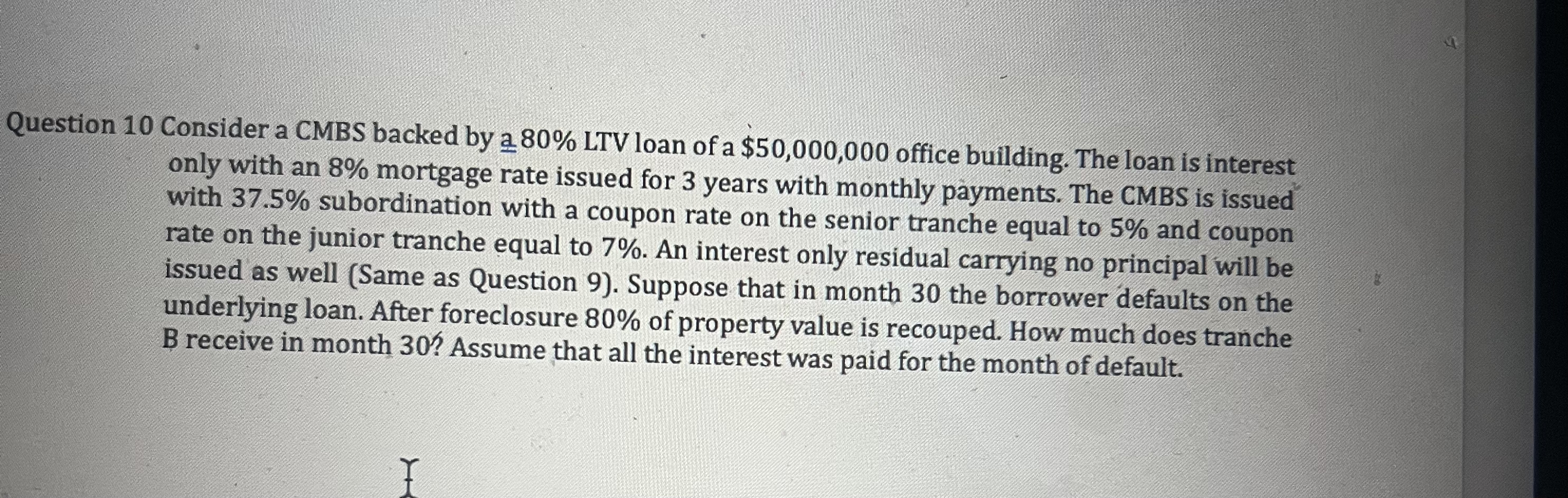

Question 1 0 Consider a CMBS backed by a 8 0 % LTV loan of a $ 5 0 , 0 0 0 , 0

Question Consider a CMBS backed by a LTV loan of a $ office building. The loan is interest only with an mortgage rate issued for years with monthly payments. The CMBS is issued with subordination with a coupon rate on the senior tranche equal to and coupon rate on the junior tranche equal to An interest only residual carrying no principal will be issued as well Same as Question Suppose that in month the borrower defaults on the underlying loan. After foreclosure of property value is recouped. How much does tranche B receive in month Assume that all the interest was paid for the month of default.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started