Answered step by step

Verified Expert Solution

Question

1 Approved Answer

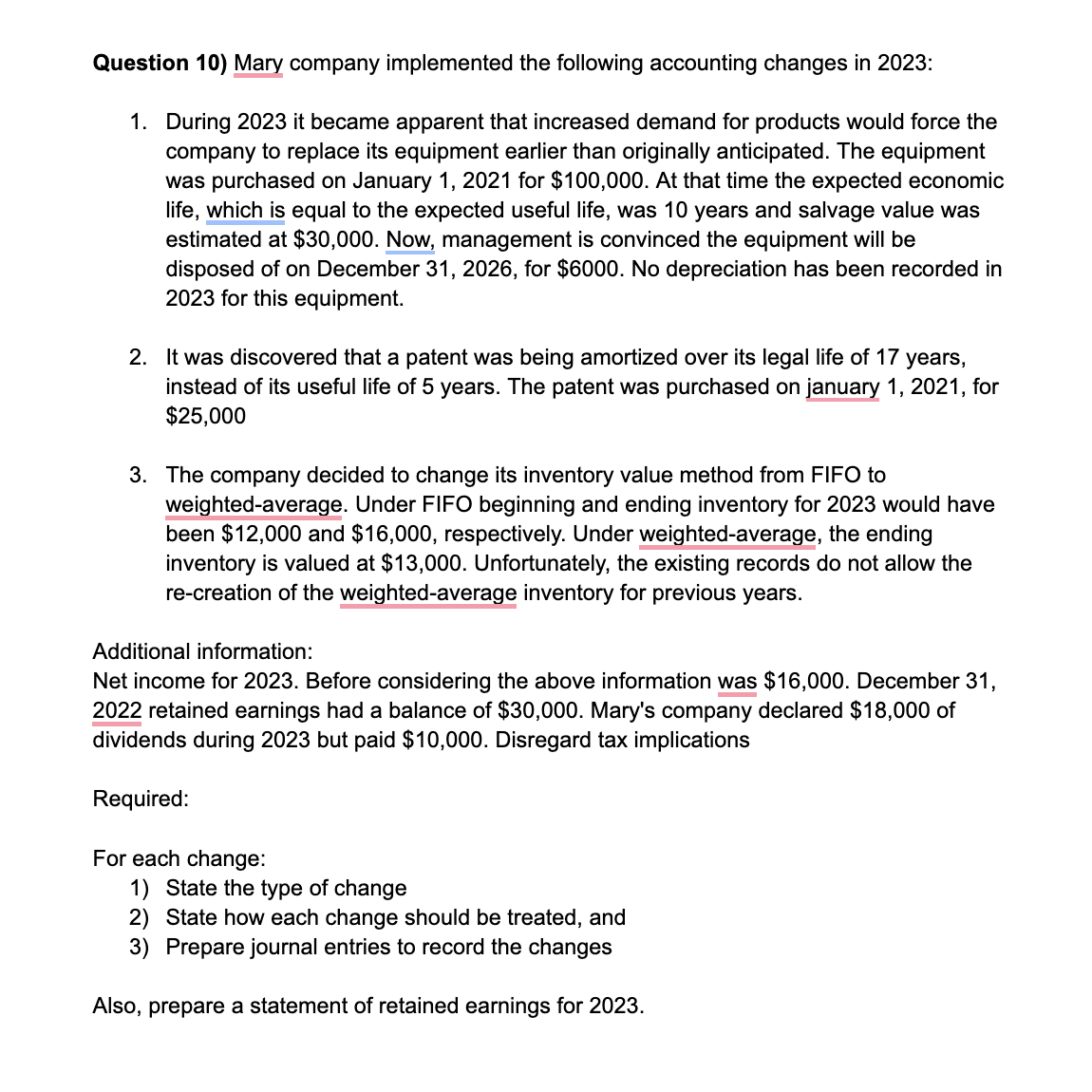

Question 1 0 ) Mary company implemented the following accounting changes in 2 0 2 3 : During 2 0 2 3 it became apparent

Question Mary company implemented the following accounting changes in :

During it became apparent that increased demand for products would force the

company to replace its equipment earlier than originally anticipated. The equipment

was purchased on January for $ At that time the expected economic

life, which is equal to the expected useful life, was years and salvage value was

estimated at $ Now, management is convinced the equipment will be

disposed of on December for $ No depreciation has been recorded in

for this equipment.

It was discovered that a patent was being amortized over its legal life of years,

instead of its useful life of years. The patent was purchased on january for

$

The company decided to change its inventory value method from FIFO to

weightedaverage. Under FIFO beginning and ending inventory for would have

been $ and $ respectively. Under weightedaverage, the ending

inventory is valued at $ Unfortunately, the existing records do not allow the

recreation of the weightedaverage inventory for previous years.

Additional information:

Net income for Before considering the above information was $ December

retained earnings had a balance of $ Mary's company declared $ of

dividends during but paid $ Disregard tax implications

Required:

For each change:

State the type of change

State how each change should be treated, and

Prepare journal entries to record the changes

Also, prepare a statement of retained earnings for

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started