Answered step by step

Verified Expert Solution

Question

1 Approved Answer

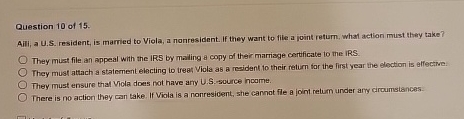

Question 1 0 of 1 5 . Aili, a U . S . resident, is married to Viola, a nonresident. If they want to file

Question of

Aili, a US resident, is married to Viola, a nonresident. If they want to file a joint return, what action must they take?

They must file an appeal with the IRS by maling a copy of their marriage cartificate to the IRS.

They must attach a statement electing to trest Viola as a resident their relum for the first year the election is effective.

They must ensure that Viola does not have any USsource hoome.

There is no action they can take. If Viola is a nonresicent, she cannot fle a joint retum under any circumstances.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started