Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 0 of 4 0 . Fran is self - employed as an architect. She had significant travel expenses within the United States this

Question of

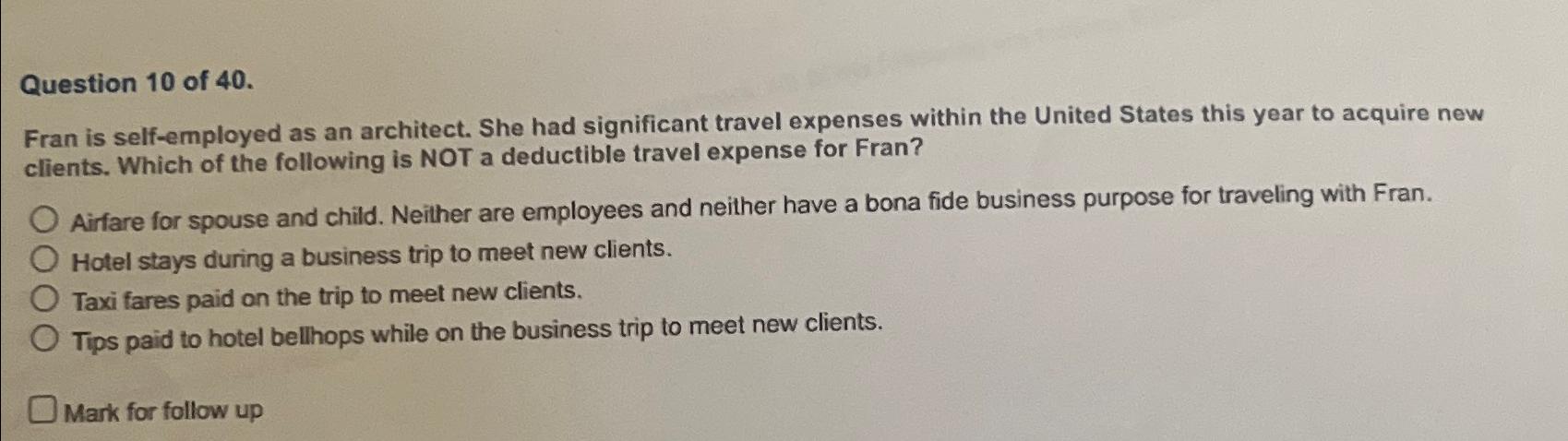

Fran is selfemployed as an architect. She had significant travel expenses within the United States this year to acquire new clients. Which of the following is NOT a deductible travel expense for Fran?

Airfare for spouse and child. Neither are employees and neither have a bona fide business purpose for traveling with Fran.

Hotel stays during a business trip to meet new clients.

Taxi fares paid on the trip to meet new clients.

Tips paid to hotel bellhops while on the business trip to meet new clients.

Mark for follow up

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started