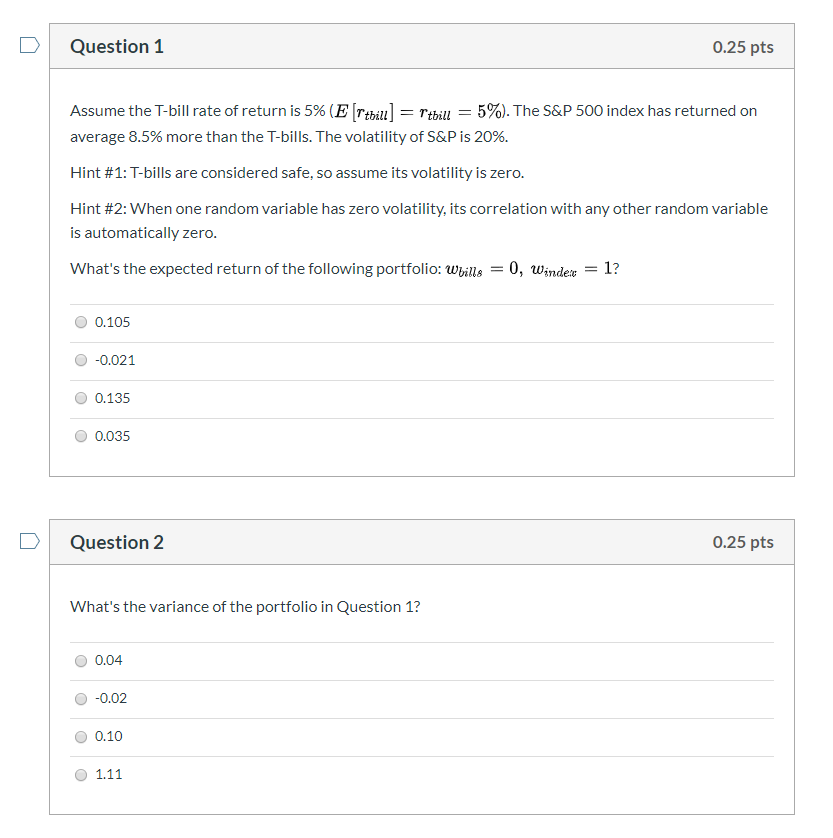

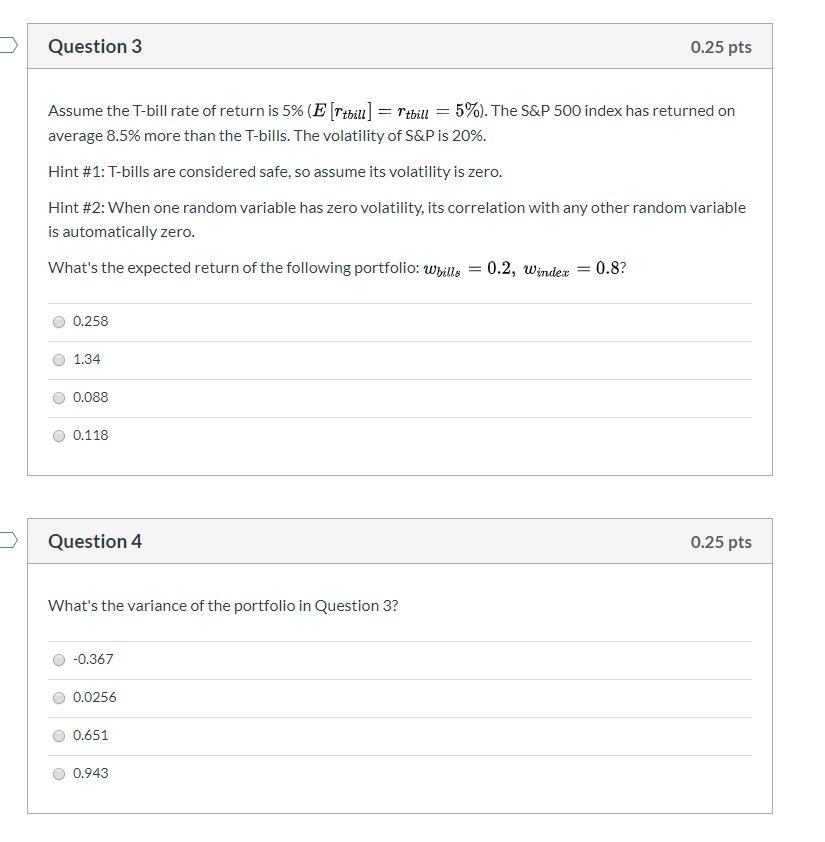

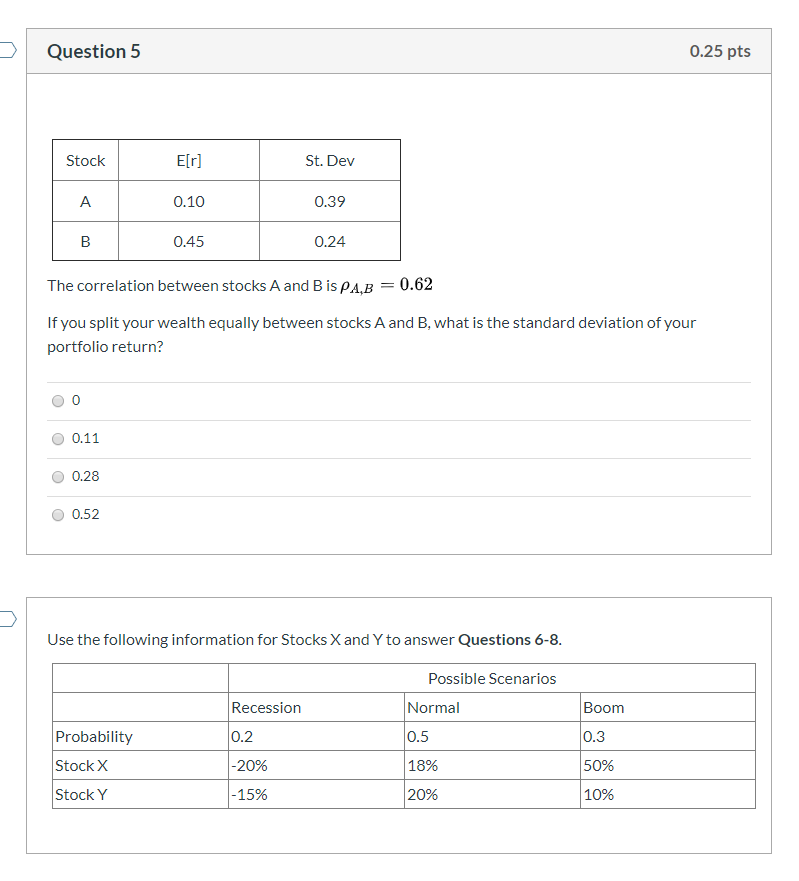

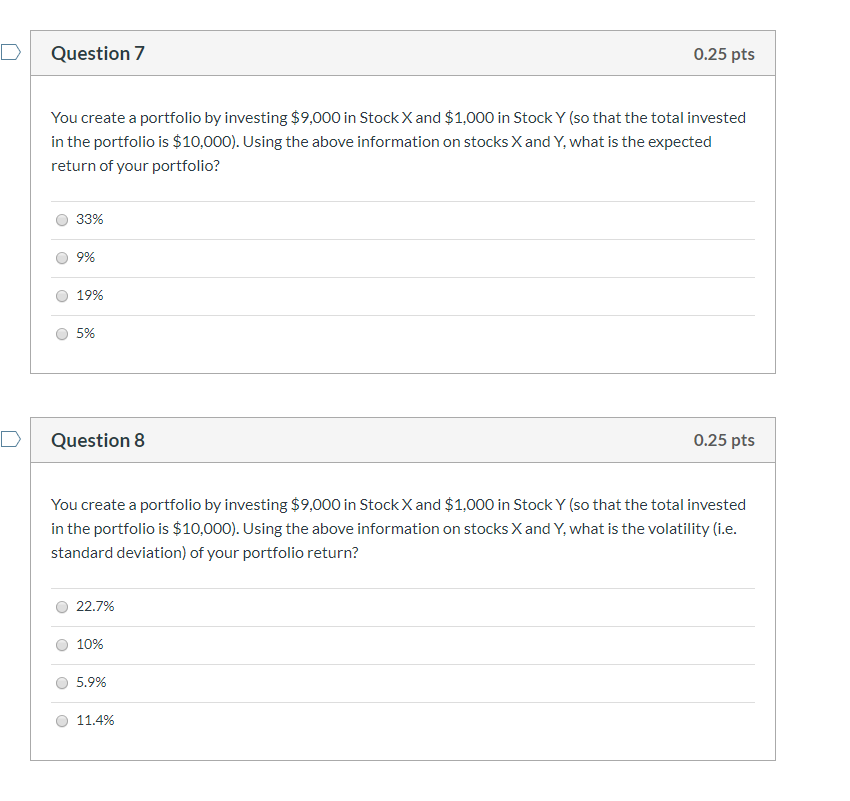

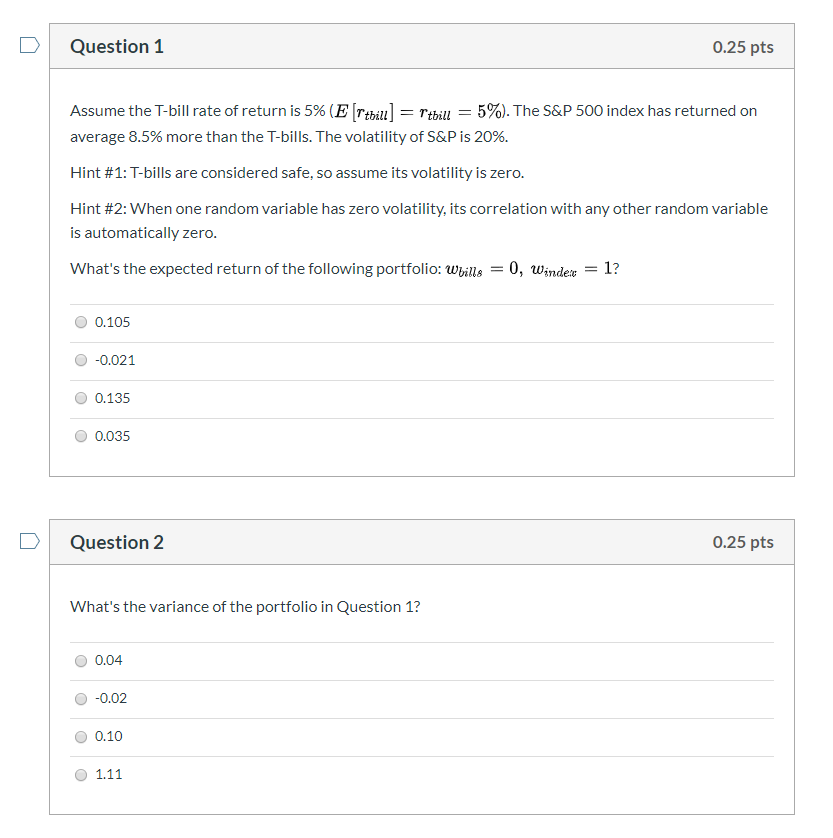

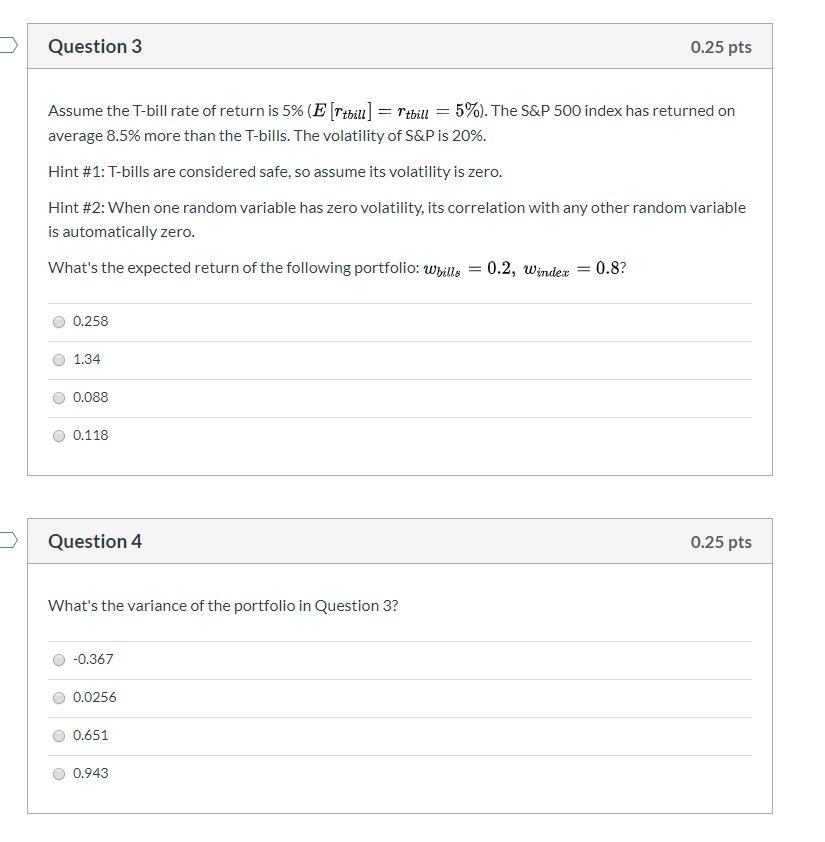

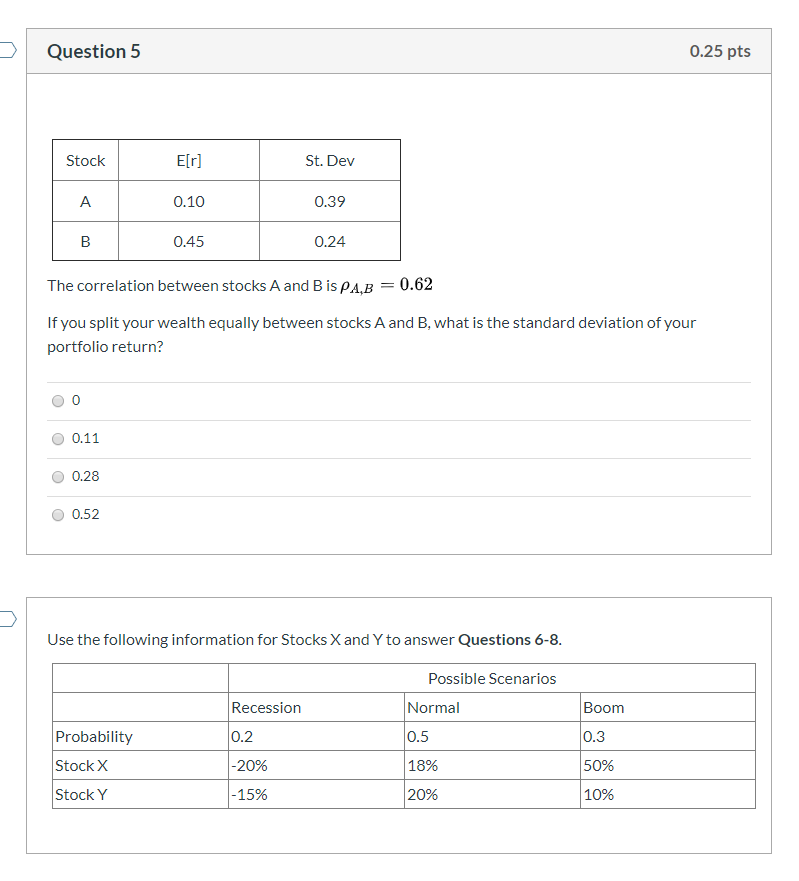

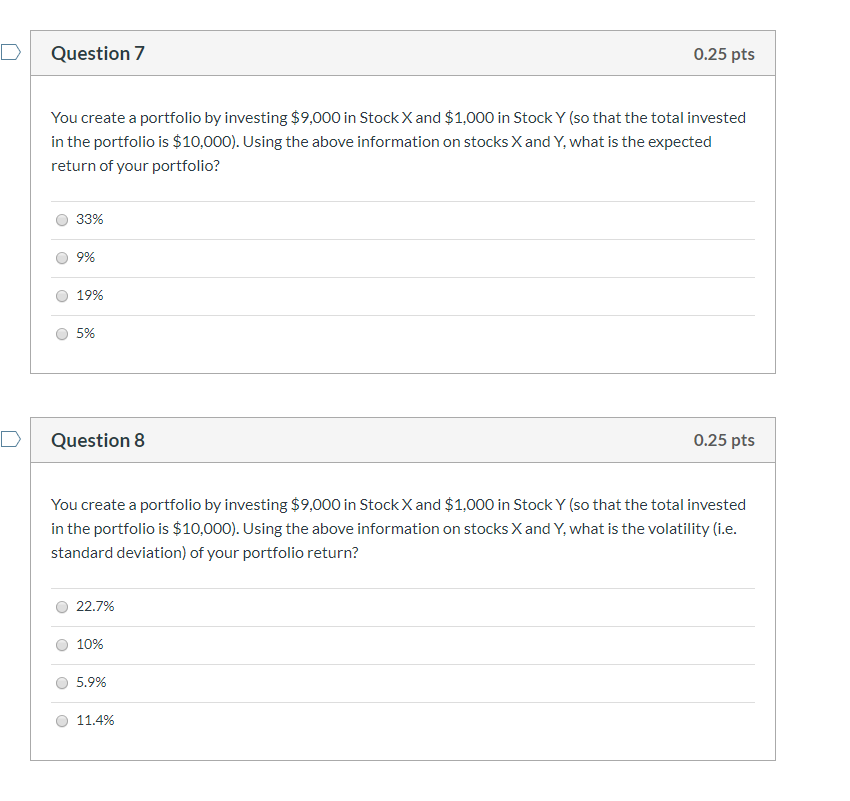

Question 1 0.25 pts Assume the T-bill rate of return is 5% (E [rthilu Ttbill= 5%).The S&P 500 index has returned on average 8.5% more than the T-bills. The volatility of S&P is 20%. Hint #1: T-bills are considered safe, so assume its volatility is zero. Hint #2: When one random variable has zero volatility, its correlation with any other random variable is automatically zero. = 0, windex What's the expected return of the following portfolio: wbills 1? 0.105 -0.021 0.135 0.035 Question 2 0.25 pts What's the variance of the portfolio in Question 1? 0.04 -0.02 0.10 1.11 Question 3 0.25 pts Assume the T-bill rate of return is 5% (E |Ttbill] = rtbill average 8.5% more than the T-bills. The volatility of S&P is 20% - 5%). The S&P 500 index has returned on Hint #1: T-bills are considered safe, so assume its volatility is zero. Hint #2:When one random variable has zero volatility, its correlation with any other random variable is automatically zero. What's the expected return of the following portfolio: wbills = 0.2, windex 0.8? 0.258 1.34 0.088 0.118 Question 4 0.25 pts What's the variance of the portfolio in Question 3? -0.367 0.0256 0.651 0.943 Question 5 0.25 pts E[r] Stock St. Dev A 0.10 0.39 B 0.45 0.24 0.62 The correlation between stocks A and B is pA,B If you split your wealth equally between stocks A and B, what is the standard deviation of your portfolio return? 0.11 0.28 0.52 Use the following information for Stocks X and Y to answer Questions 6-8. Possible Scenarios Recession Normal Boom Probability 0.2 O.5 0.3 Stock X -20% 50% 18% Stock Y 10% -15% 20% Question 7 0.25 pts You create a portfolio by investing $9,000 in Stock X and $1,000 in Stock Y (so that the total invested in the portfolio is $10,000). Using the above information on stocks X and Y, what is the expected return of your portfolio? 33% 9% 19% 5% 0.25 pts Question 8 You create a portfolio by investing $9,000 in Stock Xand $1,000 in Stock Y (so that the total invested in the portfolio is $10,000). Using the above information on stocks X and Y, what is the volatility (i.e. standard deviation) of your portfolio return? 22.7% 10% 5.99% 11.4%