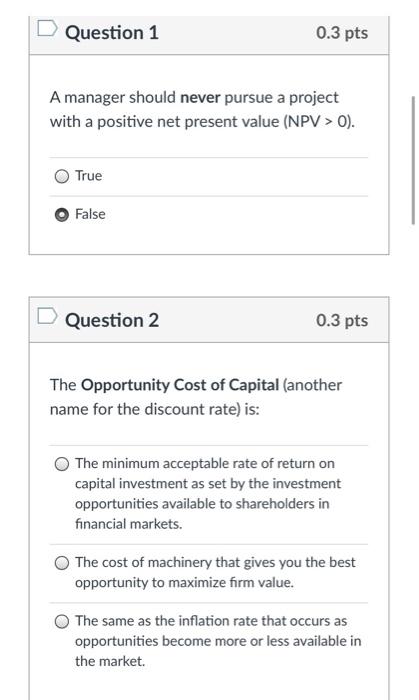

Question: Question 1 0.3 pts A manager should never pursue a project with a positive net present value (NPV > 0). True False Question 2 0.3

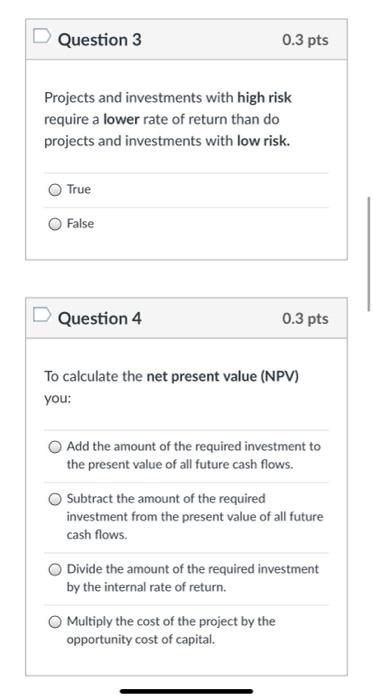

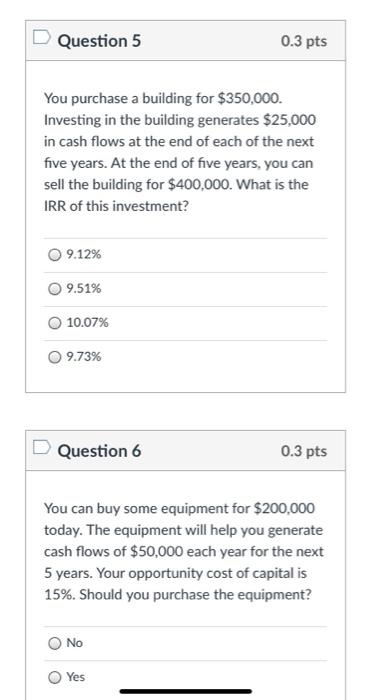

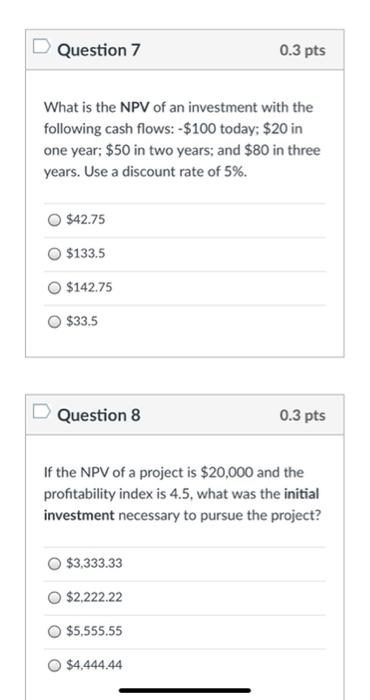

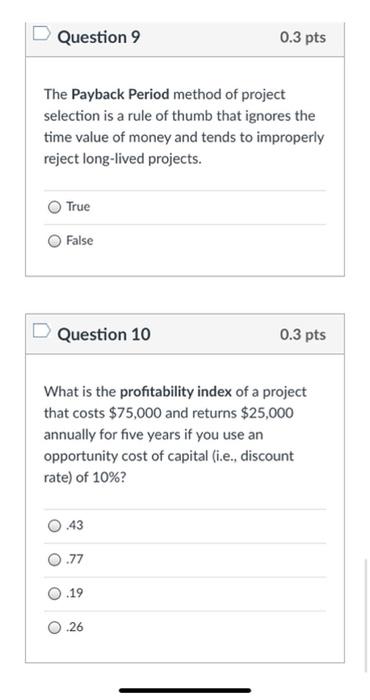

Question 1 0.3 pts A manager should never pursue a project with a positive net present value (NPV > 0). True False Question 2 0.3 pts The Opportunity Cost of Capital (another name for the discount rate) is: The minimum acceptable rate of return on capital investment as set by the investment opportunities available to shareholders in financial markets. The cost of machinery that gives you the best opportunity to maximize firm value. The same as the inflation rate that occurs as opportunities become more or less available in the market. Question 3 0.3 pts Projects and investments with high risk require a lower rate of return than do projects and investments with low risk. True False Question 4 0.3 pts To calculate the net present value (NPV) you: Add the amount of the required investment to the present value of all future cash flows. Subtract the amount of the required investment from the present value of all future cash flows. Divide the amount of the required investment by the internal rate of return. Multiply the cost of the project by the opportunity cost of capital. Question 5 0.3 pts You purchase a building for $350,000. Investing in the building generates $25,000 in cash flows at the end of each of the next five years. At the end of five years, you can sell the building for $400,000. What is the IRR of this investment? 9.12% 9.51% 10.07% 9.73% Question 6 0.3 pts You can buy some equipment for $200.000 today. The equipment will help you generate cash flows of $50,000 each year for the next 5 years. Your opportunity cost of capital is 15%. Should you purchase the equipment? No Yes Question 7 0.3 pts What is the NPV of an investment with the following cash flows:-$100 today; $20 in one year: $50 in two years; and $80 in three years. Use a discount rate of 5%. $42.75 $133.5 $142.75 $33.5 Question 8 0.3 pts If the NPV of a project is $20,000 and the profitability index is 4.5, what was the initial investment necessary to pursue the project? $3,333.33 $2,222.22 $5,555.55 $4,444.44 Question 9 0.3 pts The Payback Period method of project selection is a rule of thumb that ignores the time value of money and tends to improperly reject long-lived projects. True False Question 10 0.3 pts What is the profitability index of a project that costs $75,000 and returns $25,000 annually for five years if you use an opportunity cost of capital (i.e., discount rate) of 10%? .43 .77 .19 0.26

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts