Question

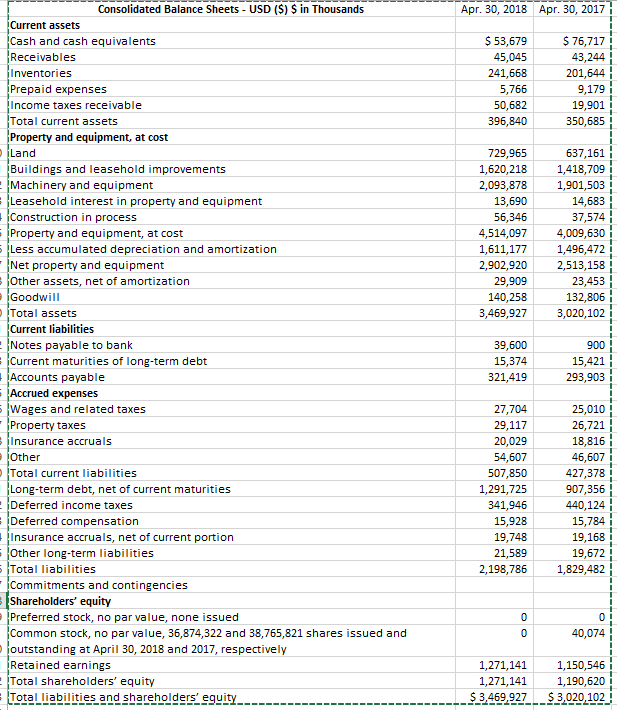

QUESTION 1 1. Identify and compute operating assets. 2018: 2017: No decimal places. QUESTION 2 1. Identify and compute operating liabilities. 2018: 2017: No decimal

QUESTION 1

1. Identify and compute operating assets.

2018:

2017:

No decimal places.

QUESTION 2

1. Identify and compute operating liabilities.

2018:

2017:

No decimal places.

QUESTION 3

1. Identify and compute net operating assets.

2018:

2017:

No decimal places.

QUESTION 4

1. Identify and compute non-operating assets.

2018:

2017:

No decimal places.

QUESTION 5

1. Identify and compute non-operating liabilities.

2018:

2017:

No decimal places.

QUESTION 6

1. Identify and compute net non-operating liabilities.

2018:

2017:

No decimal places.

QUESTION 7

1. Compute ROE using the operating method.

As a percent with two decimal places.

QUESTION 8

1. Compute NOPAT. Assume a statutory tax rate of 30.4%. (no decimal places).

2018:

QUESTION 9

1. Compute RNOA. Assume a statutory tax rate of 30.4%. (as a percent with two decimal places).

2018:

QUESTION 10

1. Compute NOPM. Assume a statutory tax rate of 30.4%. (as a percent with two decimal places).

2018:

QUESTION 11

1. Compute NOAT. Assume a statutory tax rate of 30.4%. (two decimal places).

2018:

QUESTION 12

1. How does Caseys General Store fit with the graph in Exhibit 4.9?

Please explain.

QUESTION 13

1. Compute FLEV. (as a percent with two decimal places).

QUESTION 14

1. Compute Spread. (as a percent with two decimal places).

QUESTION 15

1. How do the operating and non-operating portions of ROE compare?

QUESTION 16

1. Compute the current ratio. (three decimal places).

2018:

2017:

QUESTION 17

1. Compute the quick ratio. (three decimal places).

2018:

2017:

QUESTION 18

1. Is there anything of significance to report?

QUESTION 19

1. Compute the liabilities-to-equity ratio. (Two decimal places).

2018:

2017:

QUESTION 20

1. Compute the times interest earned ratio. (Two decimal places).

2018:

2017:

QUESTION 21

1. How does the liabilities-to-equity ratio for Caseys fit in the bar chart in Exhibit 4B.1?

Consolidated Balance Sheets - USD (S) $ in Thousands Apr. 30, 2018 Apr. 30, 2017 Current assets $76,717 Cash and cash equivalents $ 53,679 Receivables 45,045 43,244 Inventories 241,668 201,644 Prepaid expenses 5,766 50,682 9,179 Income taxes receivable 19,901 Total current assets 396,840 350,685 Property and equipment, at cost Land 729,965 637,161 Buildings and leasehold improvements Machinery and equipment Leasehold interest in property and equipment Construction in process 1,620,218 2,093,878 1,418,709 1,901,503 13,690 14,683 56,346 37,574 Property and equipment, at cost 4,514,097 4,009,630 Less accumulated depreciation and amortization Net property and equipment Other assets, net of amortization Goodwill 1,611,177 1,496,472 2,513,158 2,902,920 29,909 23,453 132,806 140,258 oTotal assets 3,469,927 3,020,102 Current liabilities Notes payable to bank 39,600 900 Current maturities of long-term debt Accounts payable Accrued expenses Wages and related taxes 15,374 15,421 321,419 293,903 27,704 25,010 Property 29,117 26,721 taxes ilnsurance accruals 20,029 18,816 Other 54,607 46,607 Total current liabilities Long-term debt, net of current maturities Deferred income taxes 507,850 427,378 907,356 1,291,725 341,946 440,124 Deferred compensation Insurance accruals, net of current portion Other long-term liabilities Total liabilities Commitments and contingencies Shareholders' equity Preferred stock, no par value, none issued Common stock, no par value, 36,874,322 and 38,765,821 shares issued and outstanding at April 30, 2018 and 2017, respectively Retained earnings Total shareholders' equity Total liabilities and shareholders' equity 15,928 15,784 19,748 21,589 19,168 19,672 2,198,786 1,829,482 0 0 L 0 40,074 1,271,141 1,150,546 1,271,141 1,190,620 $ 3.469.927 $3,020,102

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started