Answered step by step

Verified Expert Solution

Question

1 Approved Answer

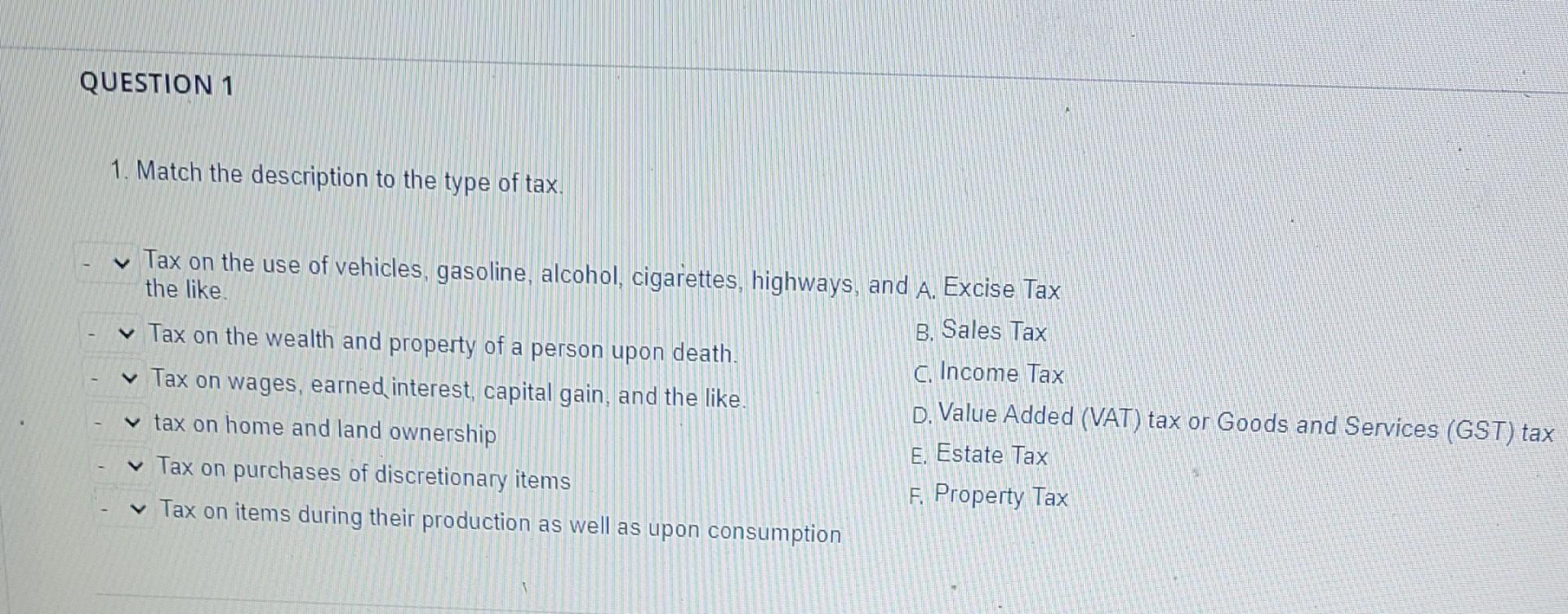

QUESTION 1 1. Match the description to the type of tax. Tax on the use of vehicles, gasoline, alcohol, cigarettes, highways, and A. Excise Tax

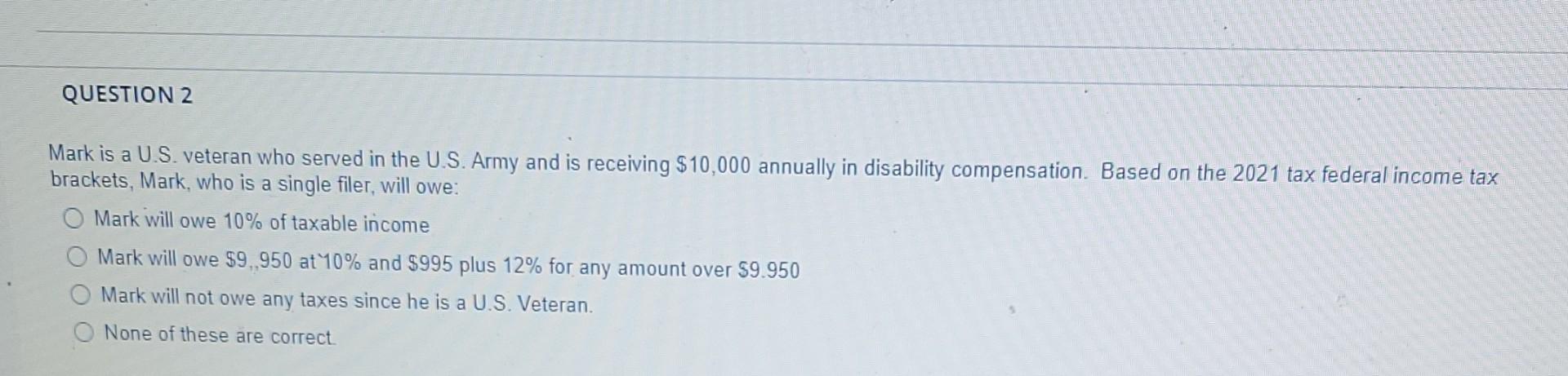

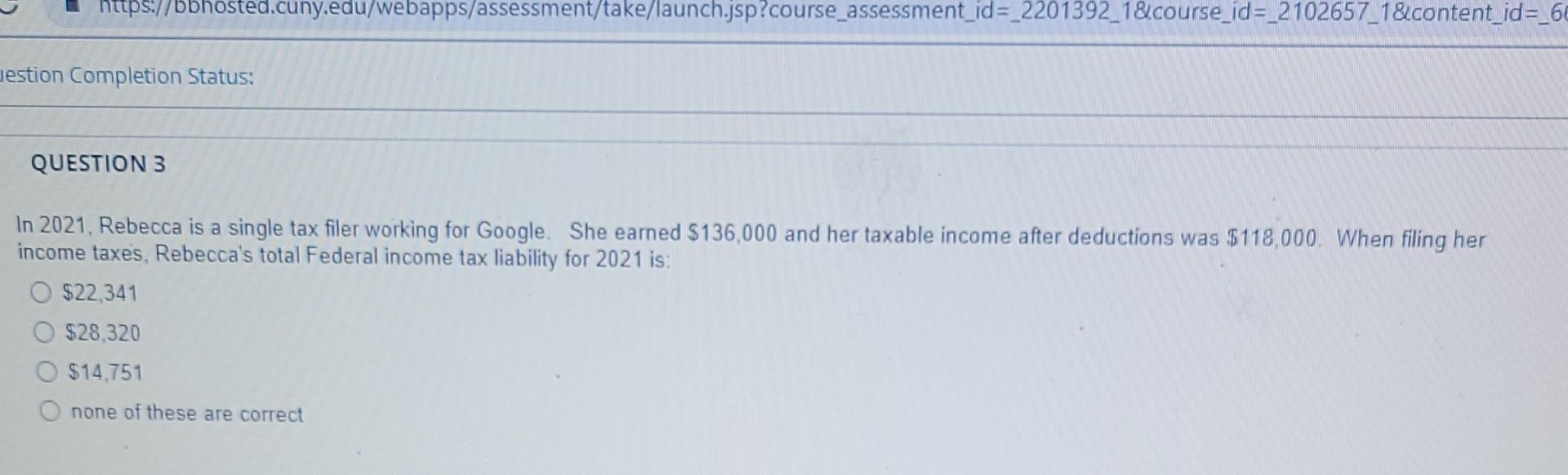

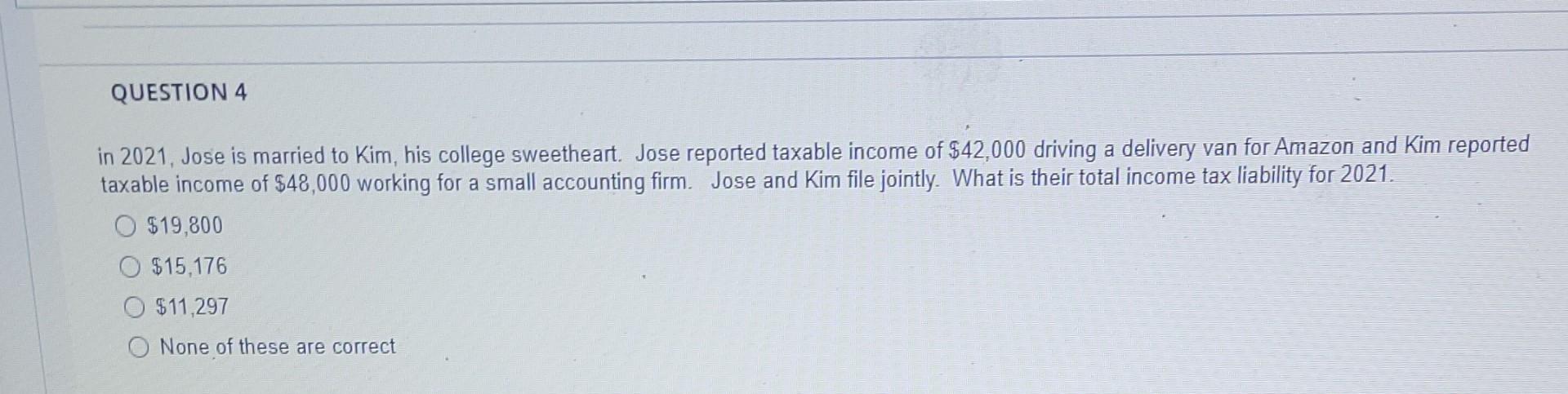

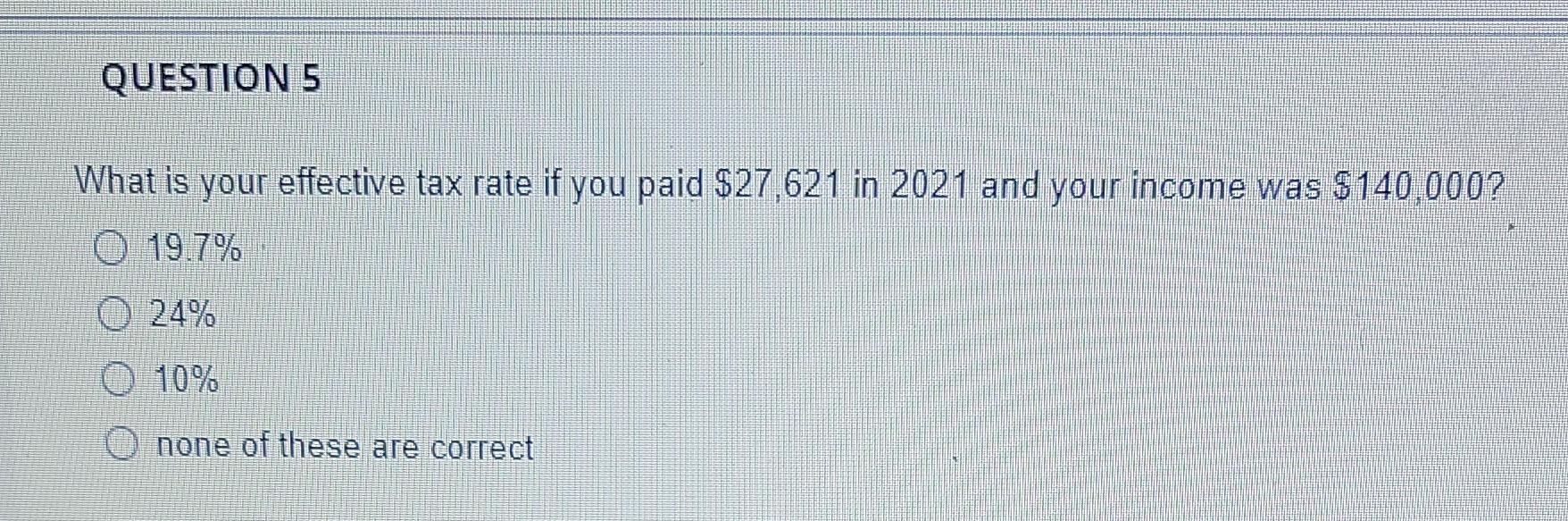

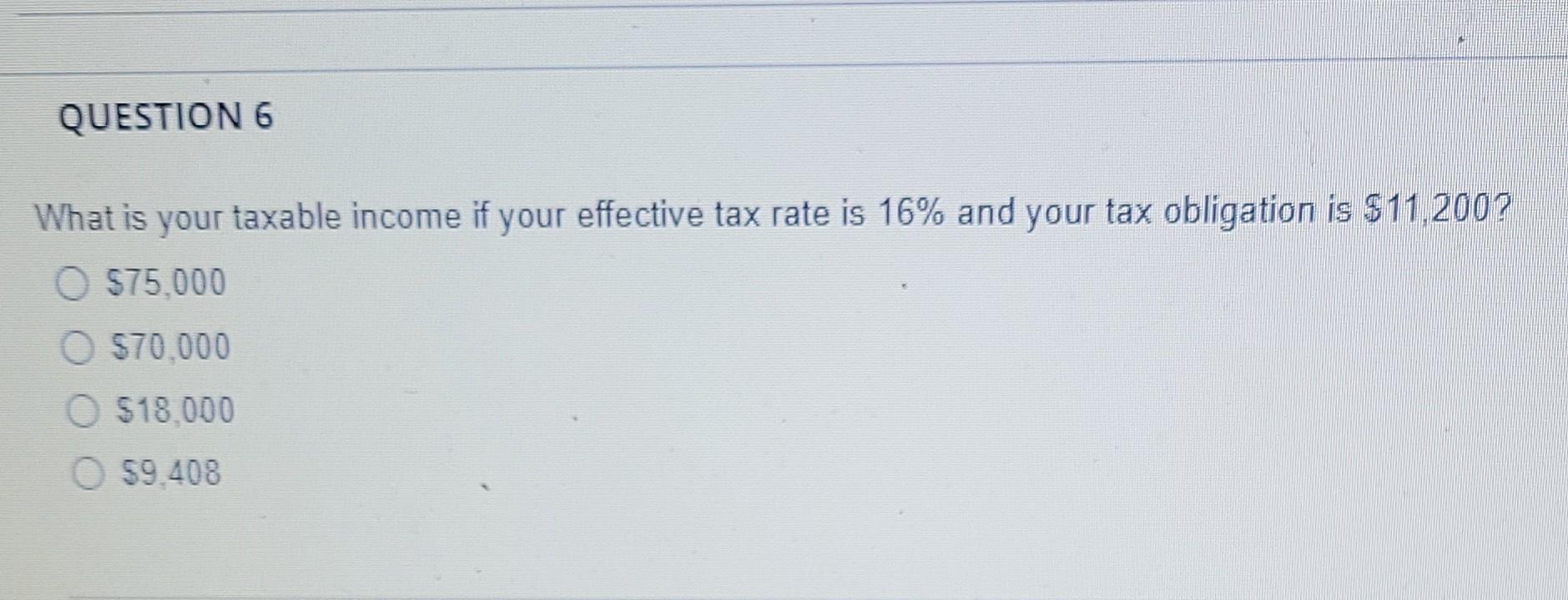

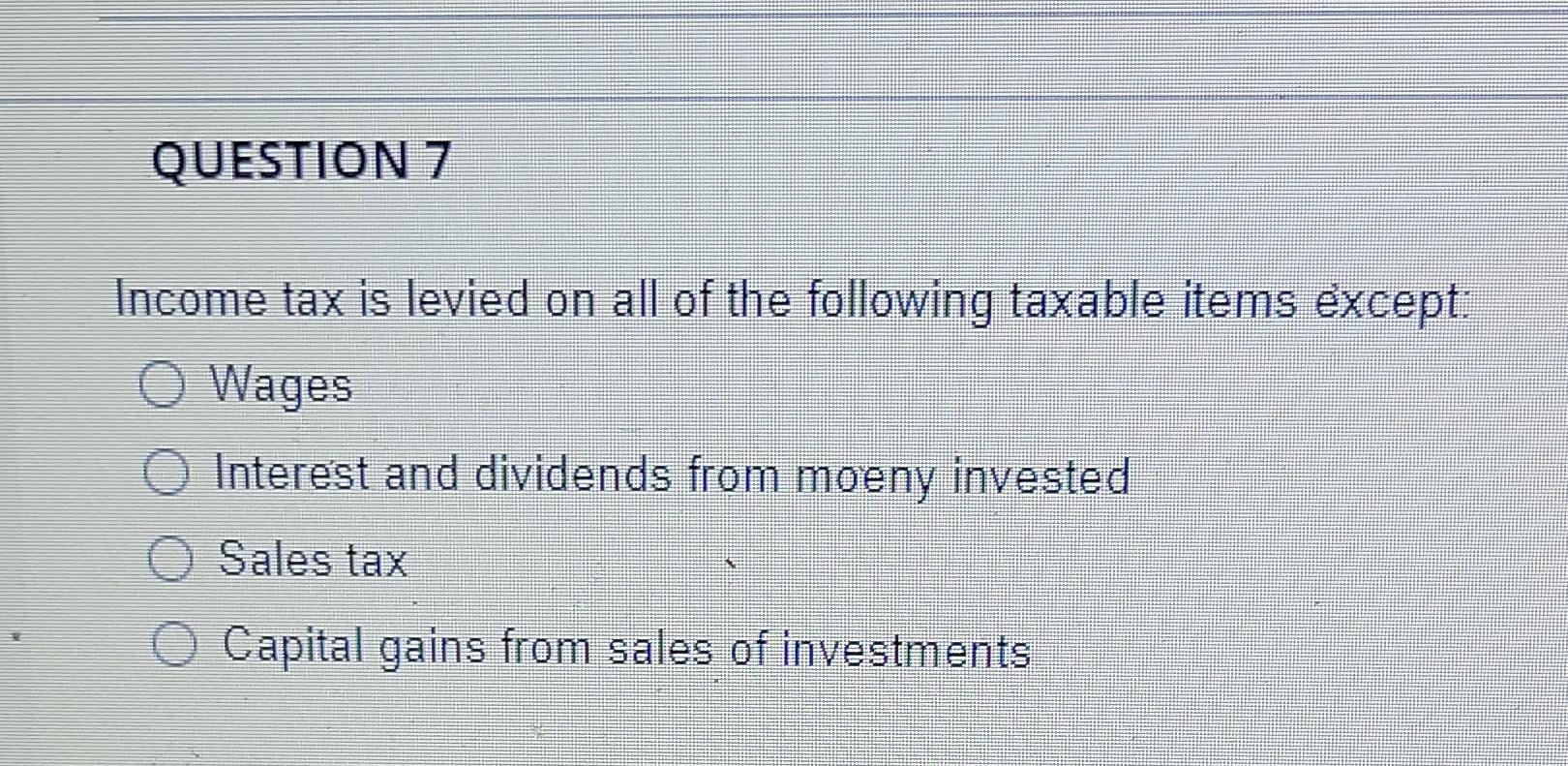

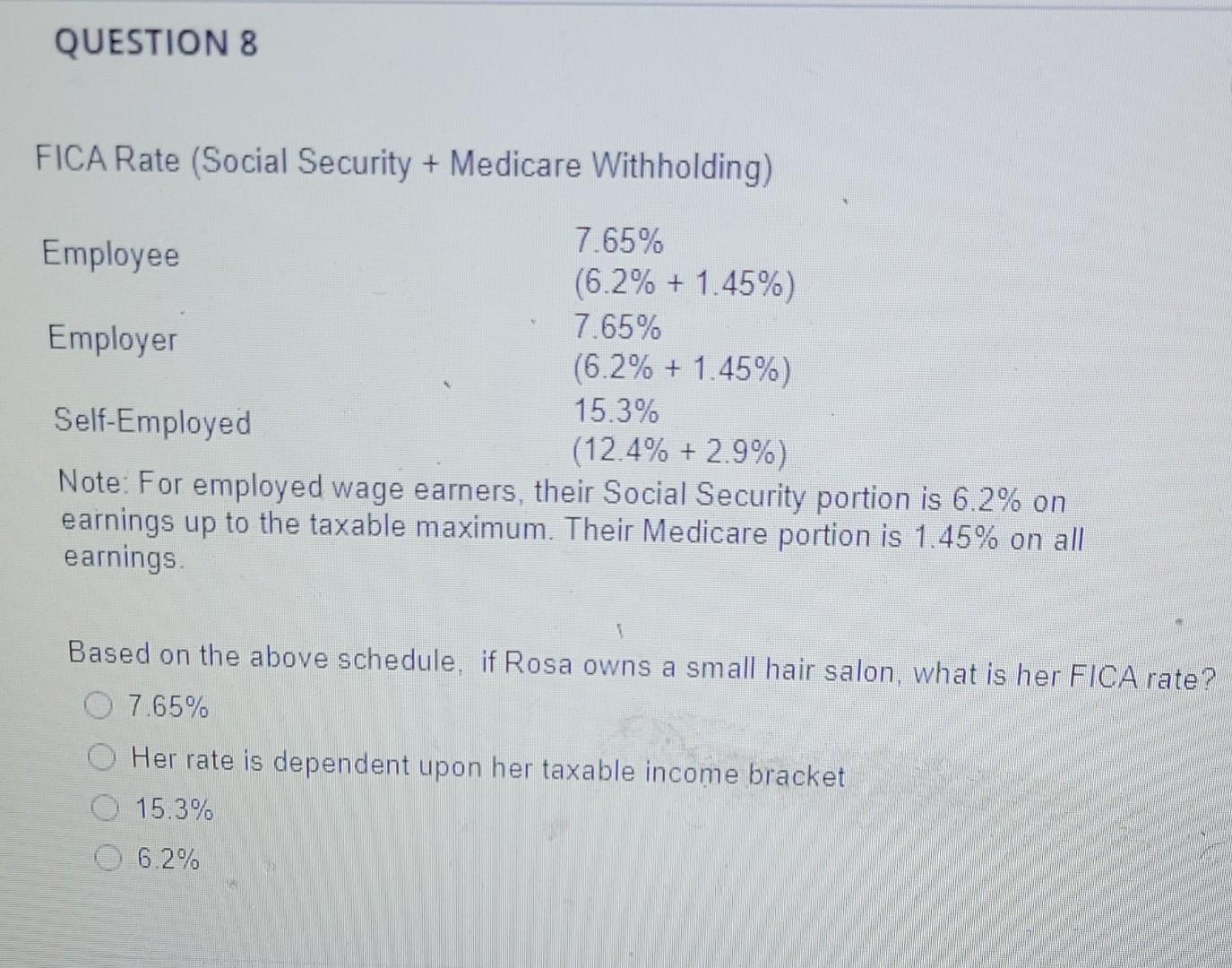

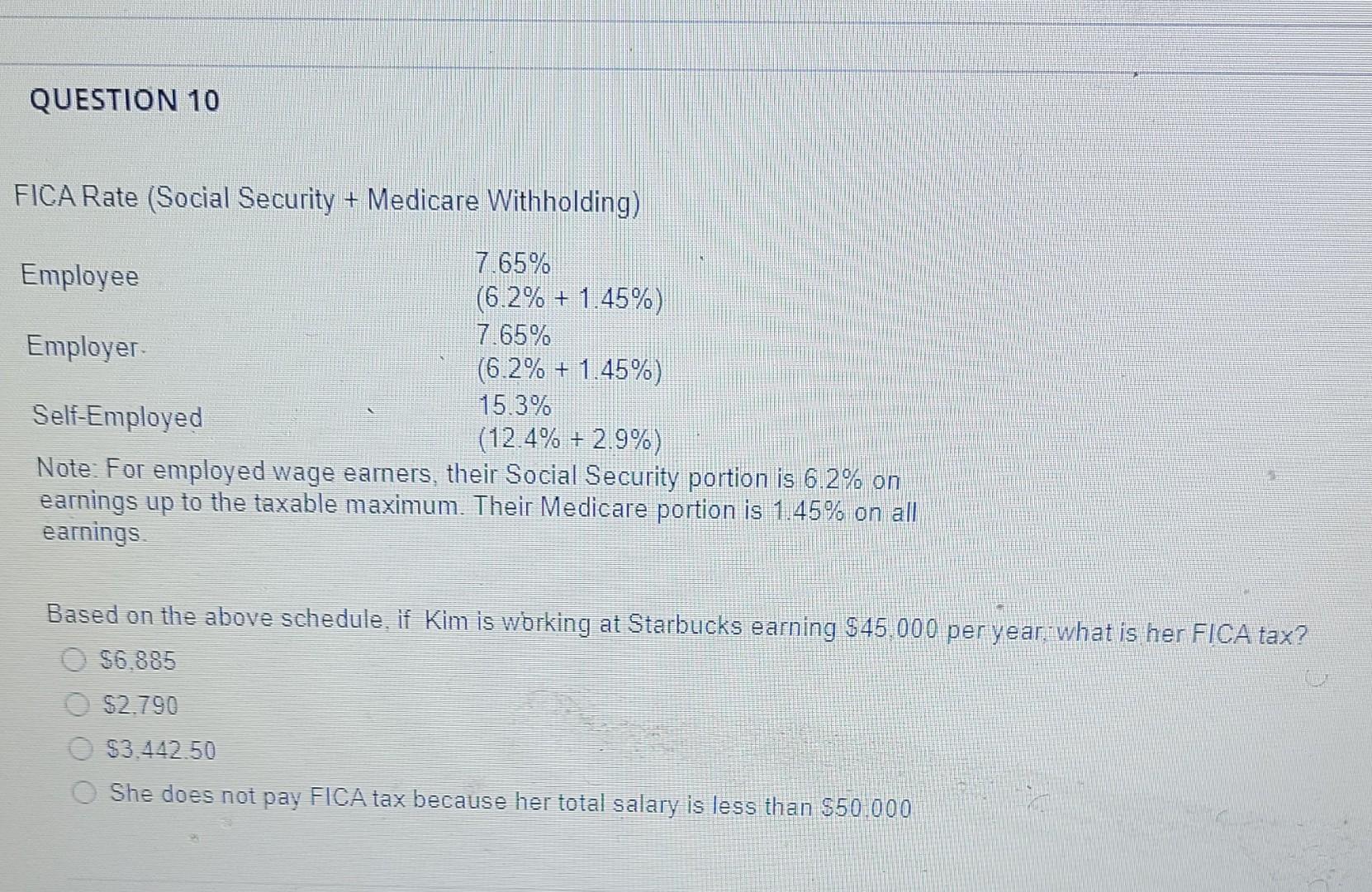

QUESTION 1 1. Match the description to the type of tax. Tax on the use of vehicles, gasoline, alcohol, cigarettes, highways, and A. Excise Tax the like. B. Sales Tax Tax on the wealth and property of a person upon death. C. Income Tax Tax on wages, earned interest, capital gain, and the like. D. Value Added (VAT) tax or Goods and Services (GST) tax v tax on home and land ownership E. Estate Tax Tax on purchases of discretionary items F. Property Tax v Tax on items during their production as well as upon consumption QUESTION 2 Mark is a U.S. veteran who served in the U.S. Army and is receiving $10,000 annually in disability compensation. Based on the 2021 tax federal income tax brackets, Mark, who is a single filer, will owe: Mark will owe 10% of taxable income O Mark will owe $9.950 at 10% and 5995 plus 12% for any amount over $9.950 Mark will not owe any taxes since he is a U.S. Veteran. None of these are correct https://bbhosted.cuny.edu/webapps/assessment/take/launch.jsp?course_assessment_id=_2201392_1&course_id=_2102657_1&content_id=_6 Jestion Completion Status: QUESTION 3 In 2021, Rebecca is a single tax filer working for Google. She earned $136,000 and her taxable income after deductions was $118,000. When filing her income taxes, Rebecca's total Federal income tax liability for 2021 is: O $22,341 $28,320 $14.751 none of these are correct QUESTION 4 in 2021, Jose is married to Kim, his college sweetheart. Jose reported taxable income of $42,000 driving a delivery van for Amazon and Kim reported taxable income of $48,000 working for a small accounting firm. Jose and Kim file jointly. What is their total income tax liability for 2021. O $19,800 $15,176 $11,297 O None of these are correct QUESTION 5 What is your effective tax rate if you paid $27,621 in 2021 and your income was $140.000? 0 19.7% O 24% O 10% none of these are correct QUESTION 6 What is your taxable income if your effective tax rate is 16% and your tax obligation is $11,200? O $75,000 $70,000 $18.000 59.408 QUESTION 7 Income tax is levied on all of the following taxable items except: O Wages Interest and dividends from moeny invested Sales tax O Capital gains from sales of investments QUESTION 8 FICA Rate (Social Security + Medicare Withholding) 7.65% Employee (6.2% + 1.45%) 7.65% Employer (6.2% + 1.45%) 15.3% Self-Employed (12.4% +2.9%) Note: For employed wage earners, their Social Security portion is 6.2% on earnings up to the taxable maximum. Their Medicare portion is 1.45% on all 1 earnings. Based on the above schedule, if Rosa owns a small hair salon, what is her FICA rate? O 7.65% Her rate is dependent upon her taxable income bracket O 15.3% O 6.2% QUESTION 9 Luke traded several stocks in Robinhood during the year. At the end of the year, he sold his stock positions in several stocks and earned over $15,000 in profits from his investments. What schedule will Luke have to file in addition to his income tax 1040 form? O Schedule D O Schedule A Schedule B Schedule C QUESTION 10 FICA Rate (Social Security + Medicare Withholding) 7.65% Employee (6.2% + 1.45%) 7.65% Employer (6.2% + 1.45%) 15.3% Self-Employed (12.4% + 2.9%) Note: For employed wage earners, their Social Security portion is 6.2% on earnings up to the taxable maximum. Their Medicare portion is 1.45% on all earnings Based on the above schedule, if Kim is working at Starbucks earning $45.000 per year what is her FICA tax? 96.885 $2.790 $3.442.50 She does not pay FICA tax because her total salary is less than $50 000 QUESTION 12 After you pay taxes you should keep all your employment tax records a. for six years. O b. for at least four years. O c. indefinitely O d. for seven years. e. for a minimum of two years. a QUESTION 13 In which life stage(s) will you likely have low taxable income and fewer deductions or exemptions? O a. Young adulthood O b. Middle adulthood c. Retirement O d.a, and c. O e. b, and c. QUESTION 11 Jack files his own taxes and wants to keep his tax liability real low as his income is only $25,000 annually. To overstate expenses so that his deductions are higher and his tax liability is lower, he falsely claims to have donated $2000 to a local animal shelter on his tax return. While this donation does lower his tax liablility slightly it ialso O is clearly tax evasion exposes Jack to an audit by the IRS This is clearly tax evasion and will also trigger an audit by the IRS None of these are true QUESTION 14 If you are in the highest tax bracket, your tax rate on long-term capital gains is O a. 10%. O b. 20%. O c.0% O d. 15% e. 37%. QUESTION 15 Separate filing statuses for reporting individual income tax include all the following EXCEPT O a. divorced O b.married filing separately. c. married O d. single o e. head-of-household QUESTION 16 The taxes most relevant for personal financial planning are a. estate taxes. O b.property taxes. O c. sales taxes. d. income taxes. e, excise taxes. QUESTION 17 A sales tax taxes your O a. income based on ability to pay b. discretionary purchases only. O c. food, clothing, and shelter. d. consumption financed by income e. non-discretionary purchases only. QUESTION 18 A tax-advantaged pension plan, such as a 401(k), that both employer and employee may contribute that allows for retirement saving is called a: defined contribution defined benefit plan a pension plan All of these are true QUESTION 19 An employer sends each employee a Form W-2 at the end of each year showing what taxes were withheld O True O False QUESTION 20 You need to retain physical proof of your income and expenses in case the IRS questions the accuracy of your tax return O True False QUESTION 21 The result of deducting adjustments from your total income is your Adjusted Gross Income (AGI). O True False QUESTION 22 Head-of-Household filing status is for a family of one adult with dependents. True O False QUESTION 23 U.S. form 1040 or 1040EZ is the form for an individual tax return O True False QUESTION 24 A consumption tax, like the sales tax, is a regressive tax. O True O False QUESTION 25 In the United States, only federal and state governments impose taxes. 0 True False QUESTION 26 The U.S. tax code is based on the idea that everyone should help finance the government according to ability to pay O True O False

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started