Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 1 Olga is a currency speculator; she is speculating that the price of the euro will go down in the future so she

Question

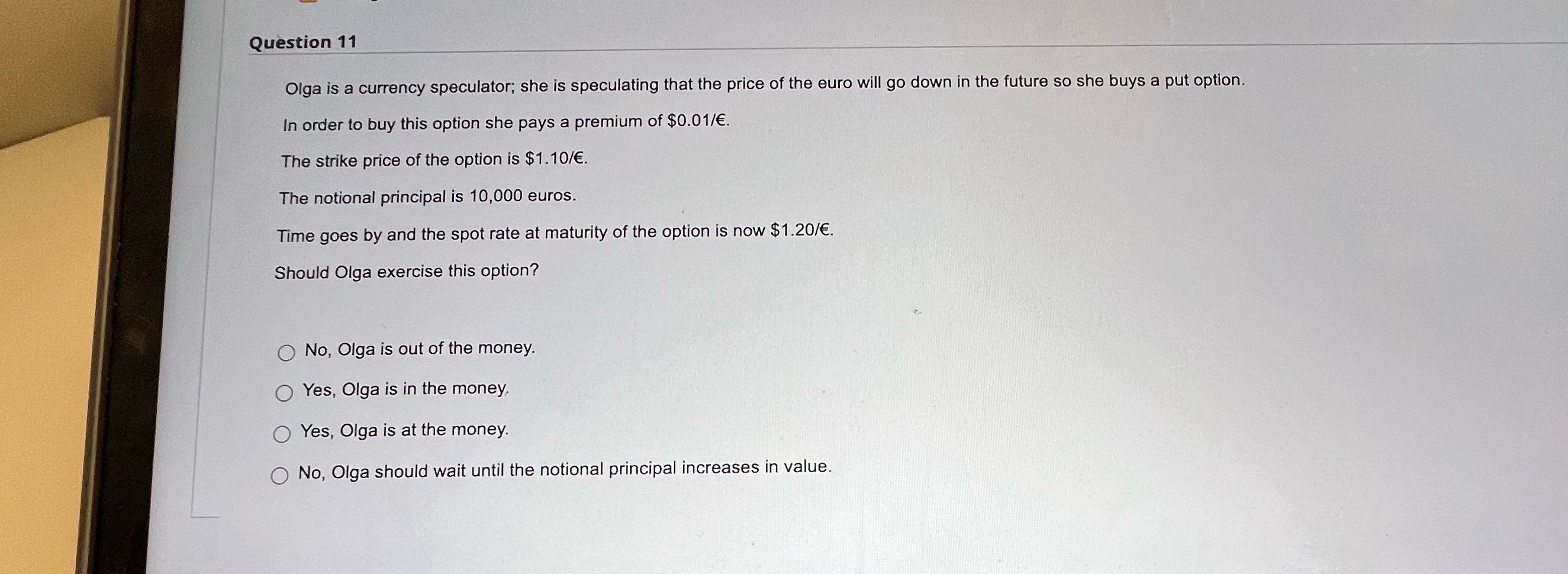

Olga is a currency speculator; she is speculating that the price of the euro will go down in the future so she buys a put option.

In order to buy this option she pays a premium of $

The strike price of the option is $

The notional principal is euros.

Time goes by and the spot rate at maturity of the option is now $

Should Olga exercise this option?

No Olga is out of the money.

Yes, Olga is in the money,

Yes, Olga is at the money.

No Olga should wait until the notional principal increases in value.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started