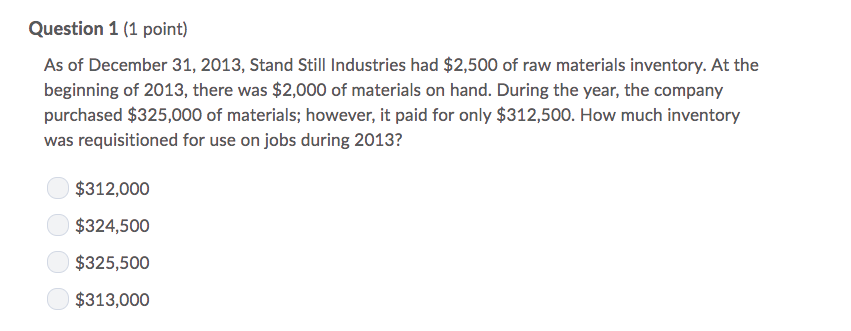

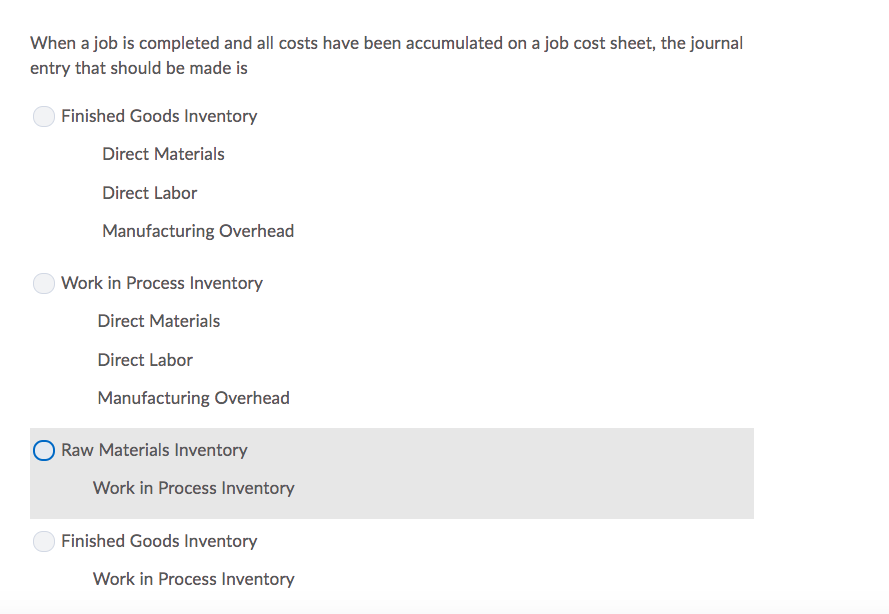

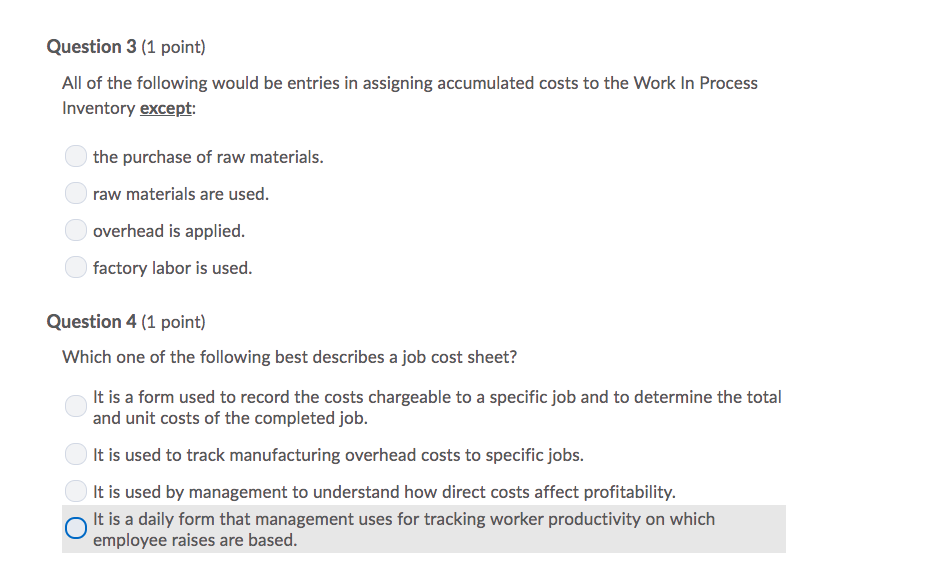

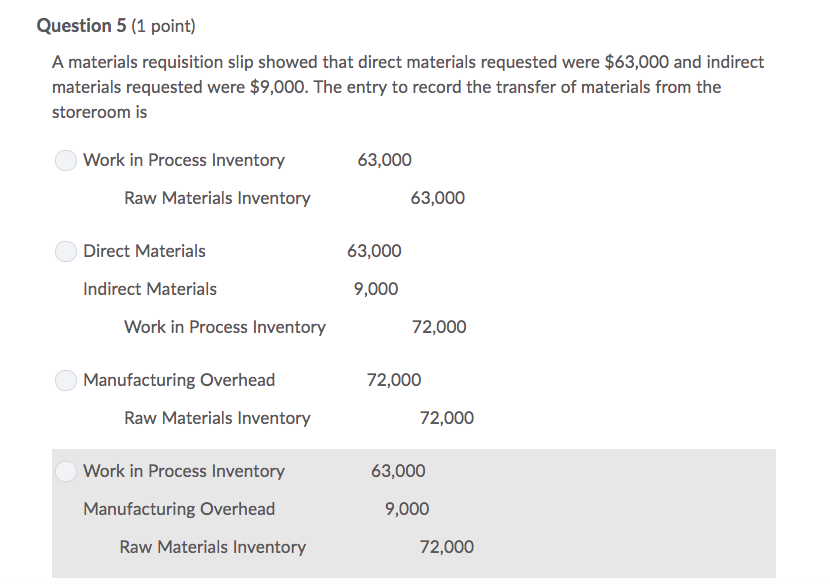

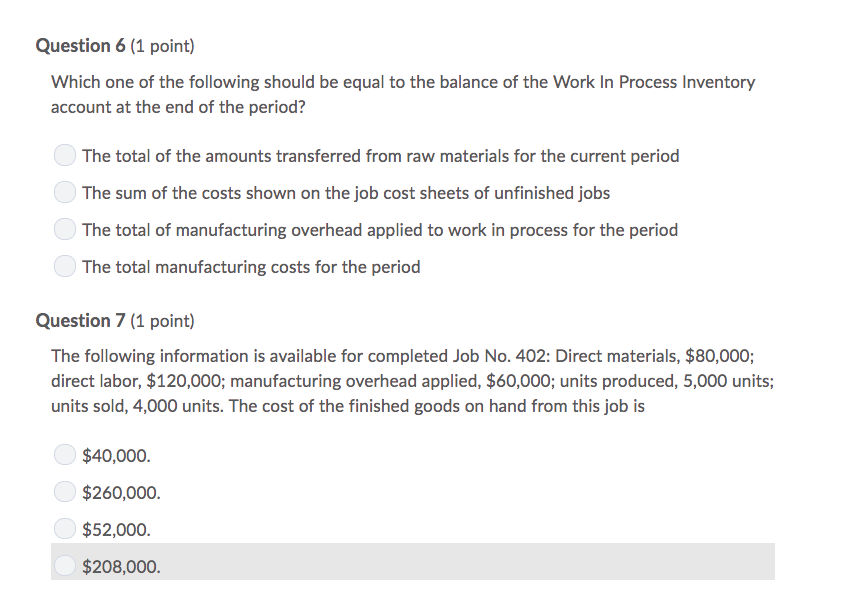

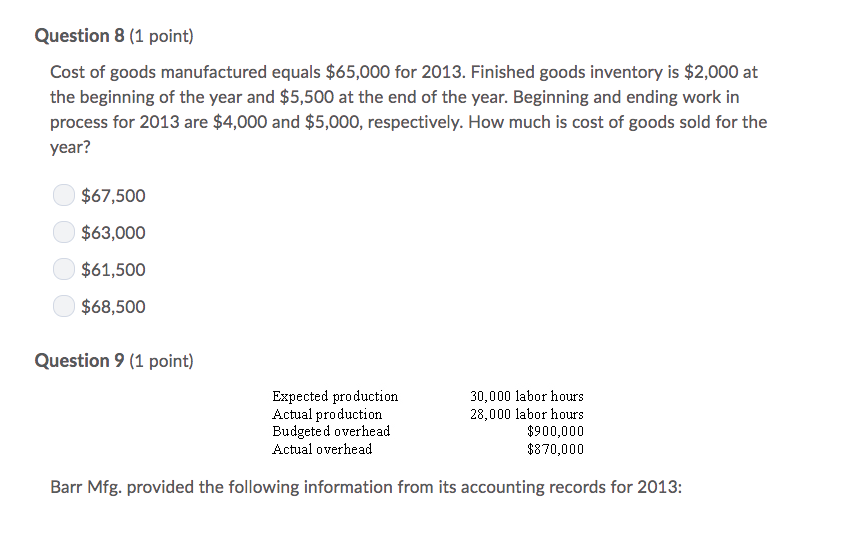

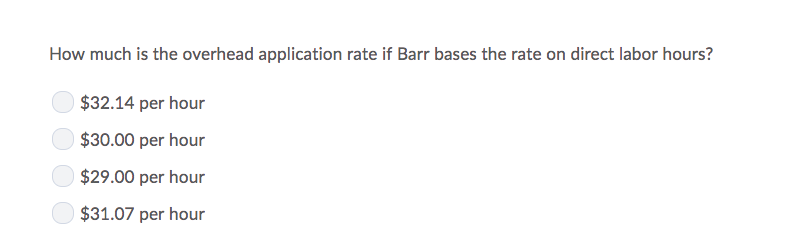

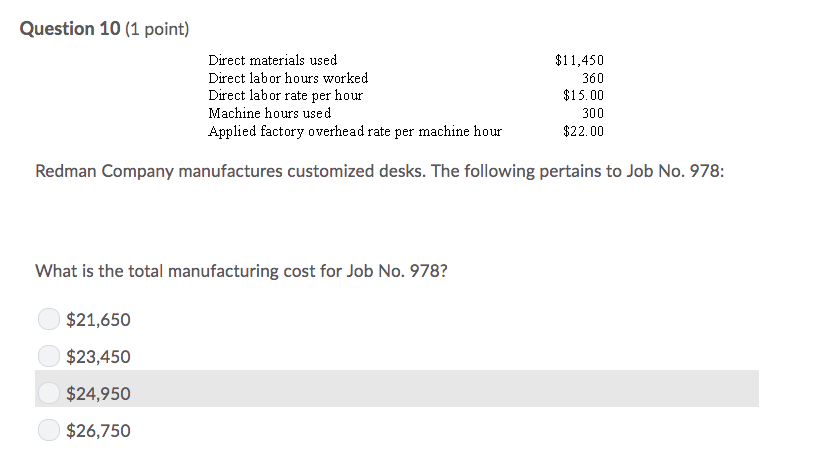

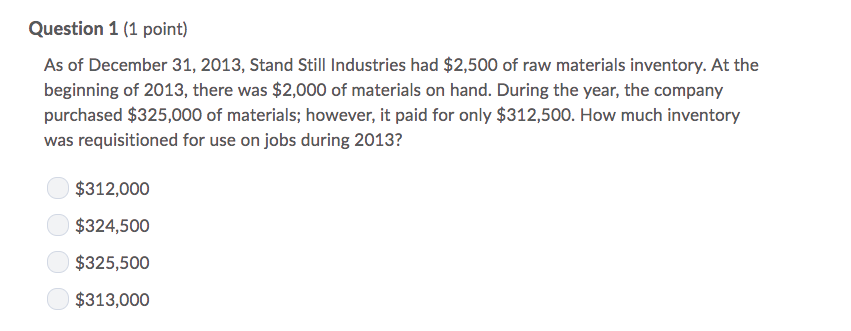

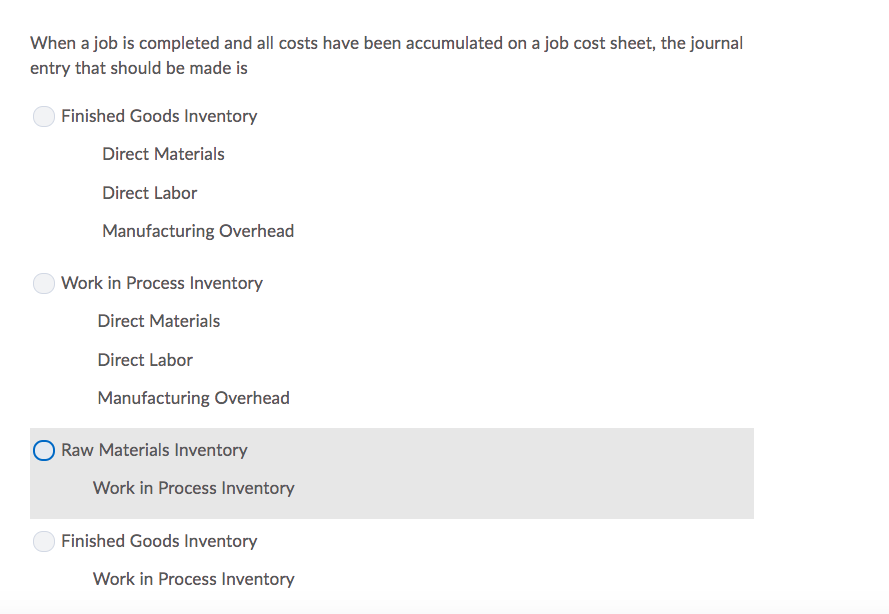

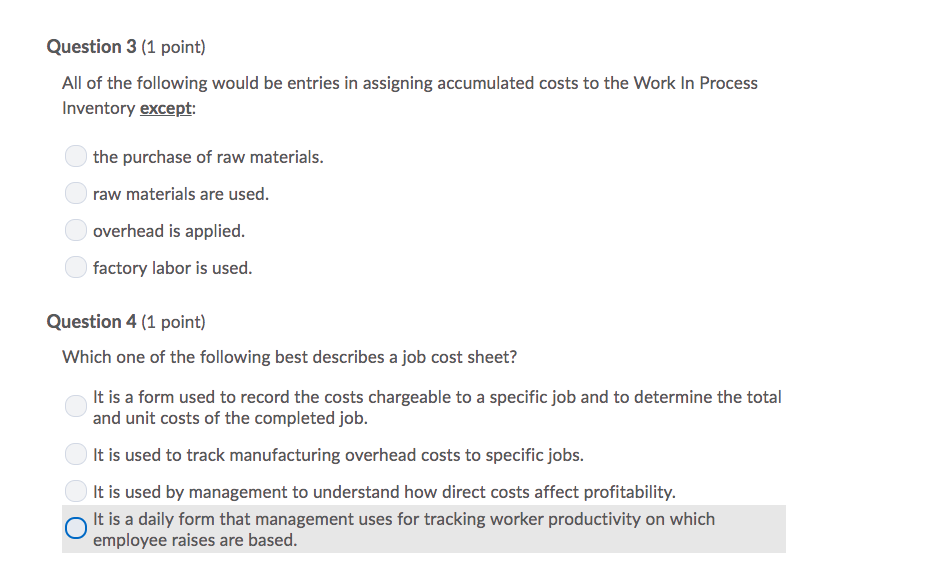

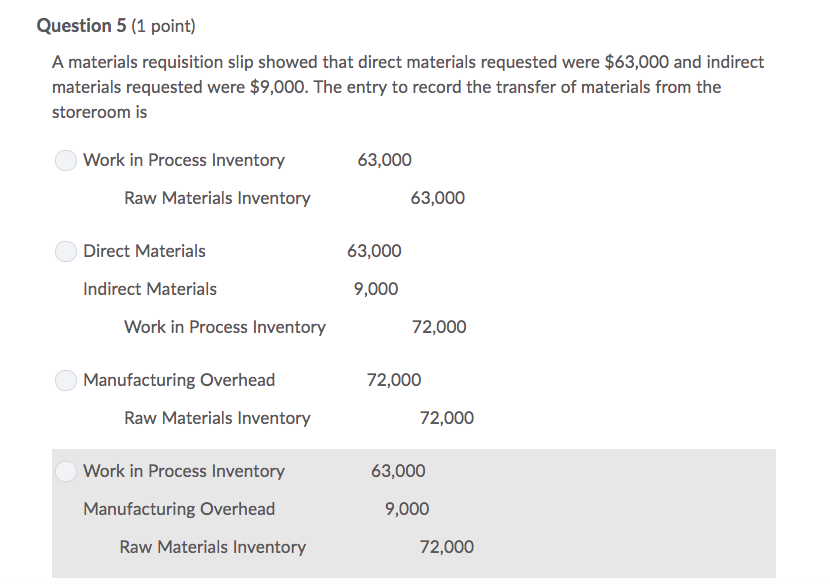

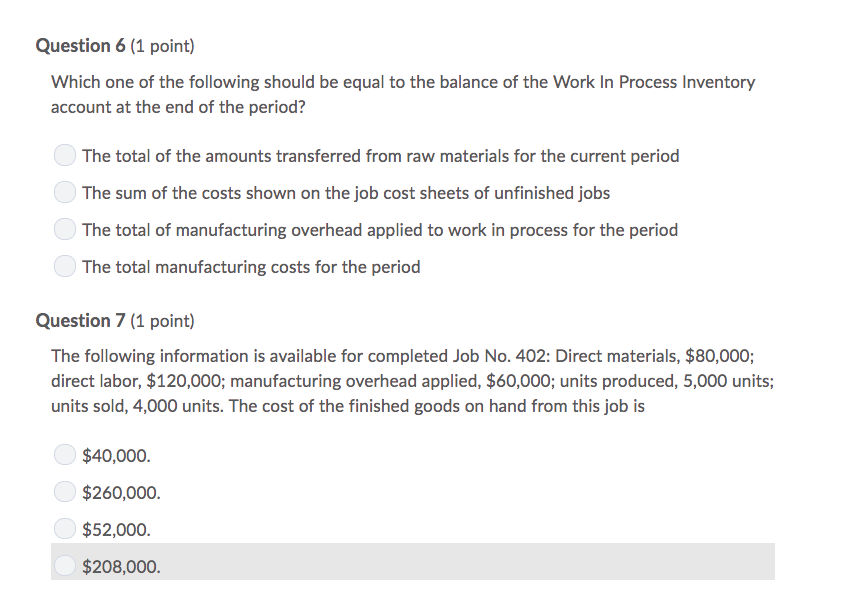

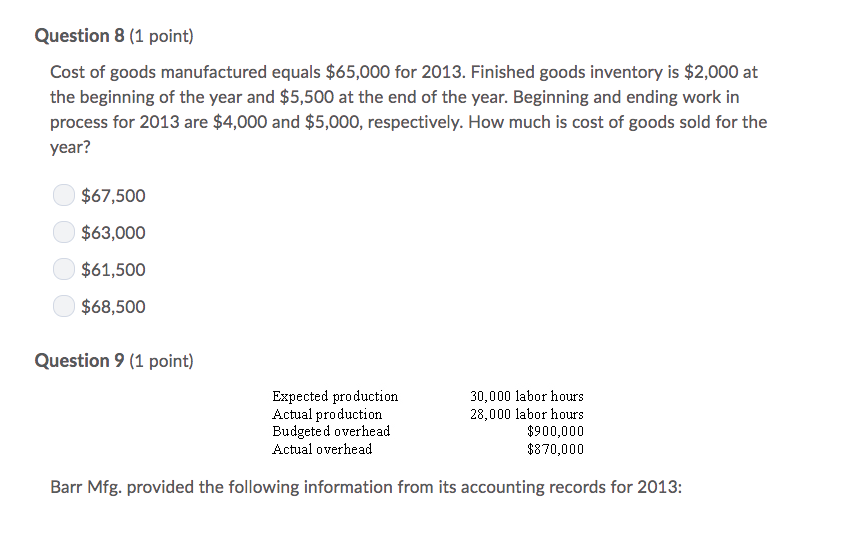

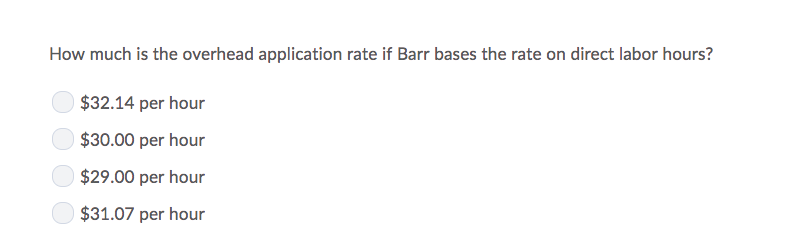

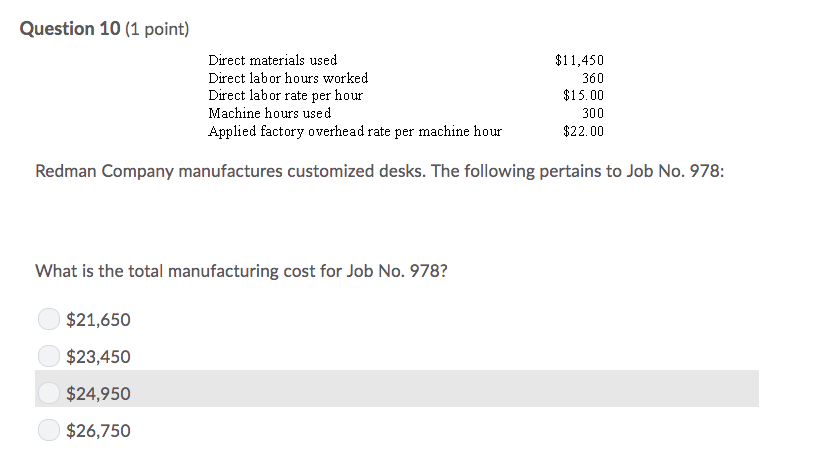

Question 1 (1 point) As of December 31, 2013, Stand Still Industries had $2,500 of raw materials inventory. At the beginning of 2013, there was $2,000 of materials on hand. During the year, the company purchased $325,000 of materials; however, it paid for only $312,500. How much inventory was requisitioned for use on jobs during 2013? $312,000 $324,500 $325,500 $313,000 When a job is completed and all costs have been accumulated on a job cost sheet, the journal entry that should be made is Finished Goods Inventory Direct Materials Direct Labor Manufacturing Overhead Work in Process Inventory Direct Materials Direct Labor Manufacturing Overhead O Raw Materials Inventory Work in Process Inventory Finished Goods Inventory Work in Process Inventory Question 3 (1 point) All of the following would be entries in assigning accumulated costs to the Work In Process Inventory except: the purchase of raw materials. raw materials are used. overhead is applied. factory labor is used. Question 4 (1 point) Which one of the following best describes a job cost sheet? It is a form used to record the costs chargeable to a specific job and to determine the total and unit costs of the completed job. It is used to track manufacturing overhead costs to specific jobs. It is used by management to understand how direct costs affect profitability. It is a daily form that management uses for tracking worker productivity on which employee raises are based. Question 5 (1 point) A materials requisition slip showed that direct materials requested were $63,000 and indirect materials requested were $9,000. The entry to record the transfer of materials from the storeroom is Work in Process Inventory 63,000 Raw Materials Inventory 63,000 Direct Materials 63,000 Indirect Materials 9,000 Work in Process Inventory 72,000 Manufacturing Overhead 72,000 Raw Materials Inventory 72,000 Work in Process Inventory 63,000 Manufacturing Overhead 9,000 Raw Materials Inventory 72,000 Question 6 (1 point) Which one of the following should be equal to the balance of the Work In Process Inventory account at the end of the period? The total of the amounts transferred from raw materials for the current period The sum of the costs shown on the job cost sheets of unfinished jobs The total of manufacturing overhead applied to work in process for the period The total manufacturing costs for the period Question 7 (1 point) The following information is available for completed Job No. 402: Direct materials, $80,000; direct labor, $120,000; manufacturing overhead applied, $60,000; units produced, 5,000 units; units sold, 4,000 units. The cost of the finished goods on hand from this job is $40,000. $260,000. $52,000. $208,000. Question 8 (1 point) Cost of goods manufactured equals $65,000 for 2013. Finished goods inventory is $2,000 at the beginning of the year and $5,500 at the end of the year. Beginning and ending work in process for 2013 are $4,000 and $5,000, respectively. How much is cost of goods sold for the year? $67,500 $63,000 $61,500 $68,500 Question 9 (1 point) Expected production Actual production Budgeted overhead Actual overhead 30,000 labor hours 28,000 labor hours $900,000 $870,000 Barr Mfg. provided the following information from its accounting records for 2013: How much is the overhead application rate if Barr bases the rate on direct labor hours? $32.14 per hour $30.00 per hour $29.00 per hour $31.07 per hour Question 10 (1 point) Direct materials used Direct labor hours worked Direct labor rate per hour Machine hours used Applied factory overhead rate per machine hour $11,450 360 $15.00 300 $22.00 Redman Company manufactures customized desks. The following pertains to Job No. 978: What is the total manufacturing cost for Job No. 978? $21,650 $23,450 $24,950 $26,750