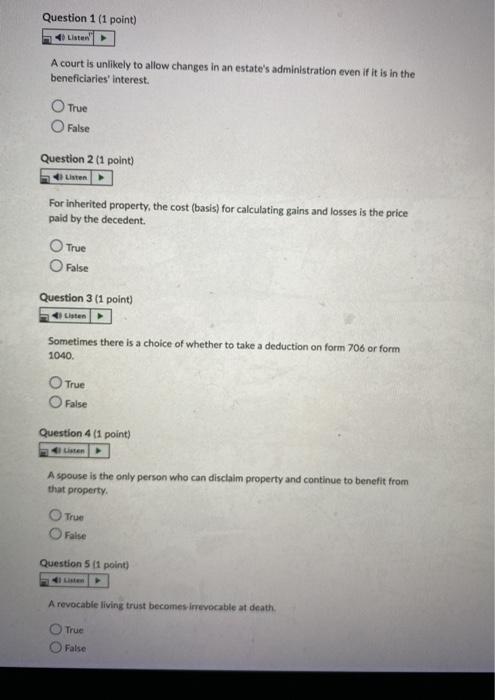

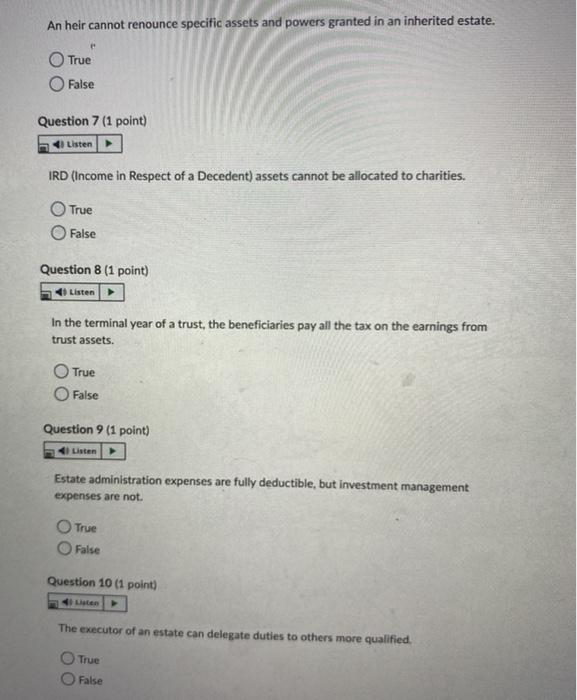

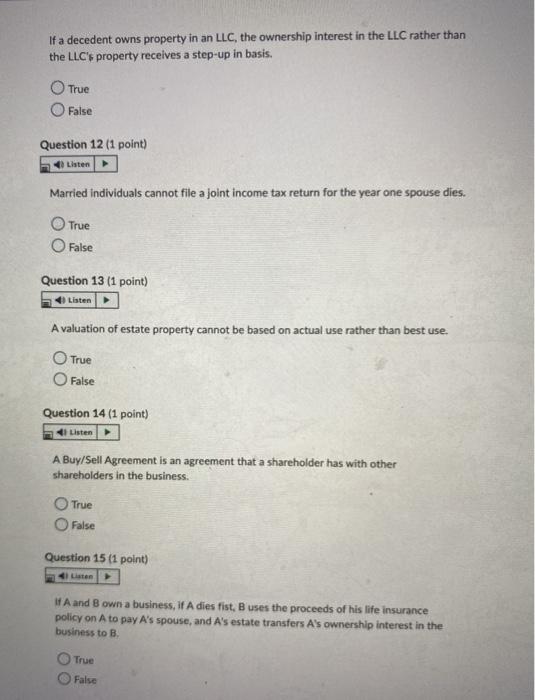

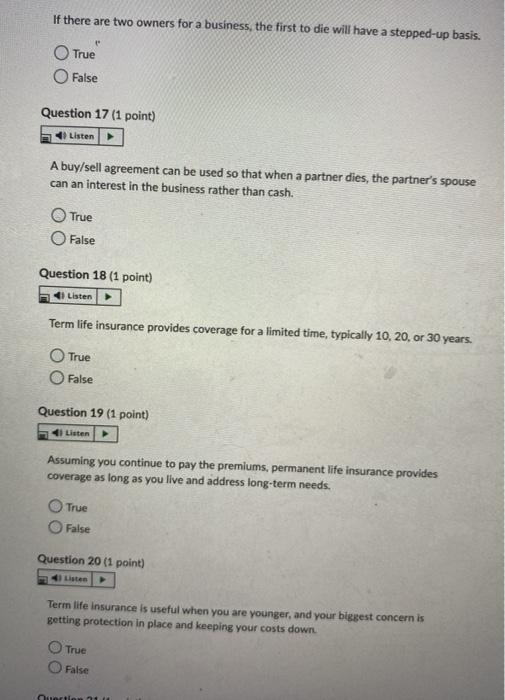

Question 1 (1 point) Listen A court is unlikely to allow changes in an estate's administration even if it is in the beneficiaries' interest True O False Question 2 (1 point) Listen For inherited property, the cost (basis) for calculating gains and losses is the price paid by the decedent. True False Question 3 (1 point) Sometimes there is a choice of whether to take a deduction on form 706 or form 1040 True False Question 4 (1 point) A spouse is the only person who can disclaim property and continue to benefit from that property True False Question 5 11 point) A revocable living trust becomes irrevocable at death True False An heir cannot renounce specific assets and powers granted in an inherited estate. True False Question 7 (1 point) Listen IRD (Income in Respect of a Decedent) assets cannot be allocated to charities. True False Question 8 (1 point) Listen In the terminal year of a trust, the beneficiaries pay all the tax on the earnings from trust assets. True False Question 9 (1 point) Listen Estate administration expenses are fully deductible, but investment management expenses are not True False Question 10 (1 point) Len The executor of an estate can delegate duties to others more qualified. True False If a decedent owns property in an LLC, the ownership interest in the LLC rather than the LLC's property receives a step-up in basis. True O False Question 12 (1 point) Listen Married individuals cannot file a joint income tax return for the year one spouse dies. True False Question 13 (1 point) Listen Avaluation of estate property cannot be based on actual use rather than best use. True O False Question 14 (1 point) Listen A Buy/Sell Agreement is an agreement that a shareholder has with other shareholders in the business. True False Question 15 (1 point) WA and B own a business, if A dies fist, B uses the proceeds of his life insurance policy on A to pay A's spouse, and A's estate transfers A's ownership interest in the business to B True False If there are two owners for a business, the first to die will have a stepped-up basis. True O False Question 17 (1 point) 5 Listen A buy/sell agreement can be used so that when a partner dies, the partner's spouse can an interest in the business rather than cash. True False Question 18 (1 point) Listen Term life insurance provides coverage for a limited time, typically 10, 20, or 30 years. True False Question 19 (1 point) Listen Assuming you continue to pay the premiums, permanent life insurance provides coverage as long as you live and address long-term needs. True False Question 20 (1 point) 4 Listen Term life insurance is useful when you are younger, and your biggest concern is getting protection in place and keeping your costs down. True False Question 11 Question 20 (1 point) Listen Term life insurance is useful when you are younger, and your biggest concern is getting protection in place and keeping your costs down. True O False Question 21 (1 point) Listen Permanent life insurance has three primary categories-whole life, universal life, and cash-value life. True False Question 22 (1 point) Listen Whole life and universal life insurance are less expensive than term life insurance. True O False