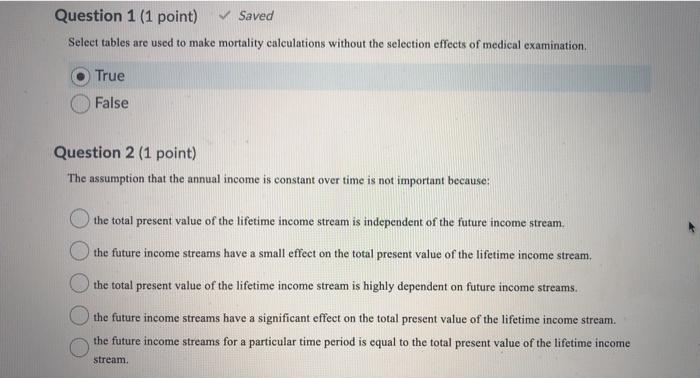

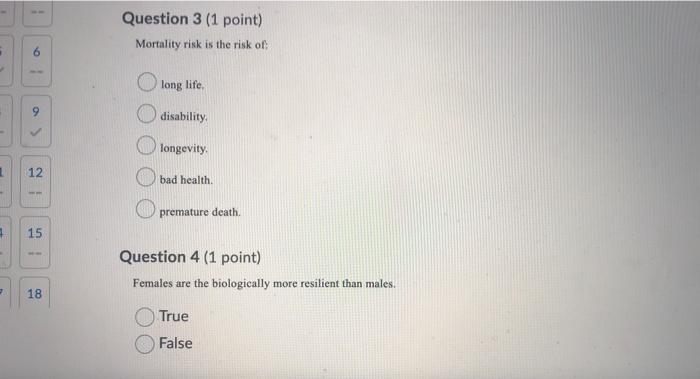

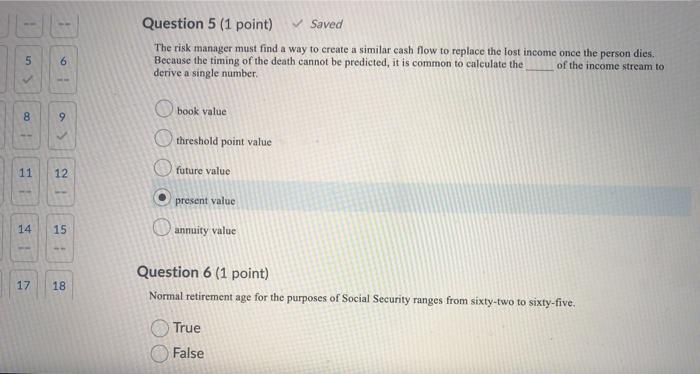

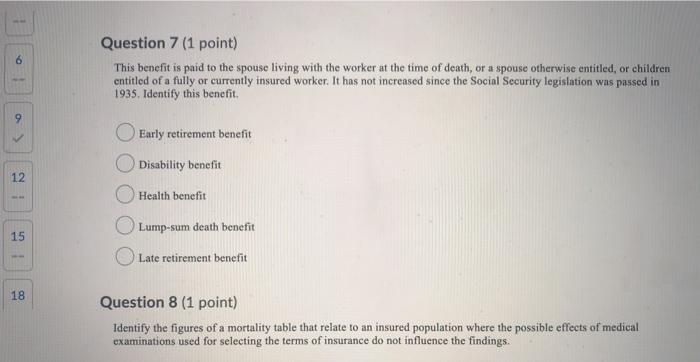

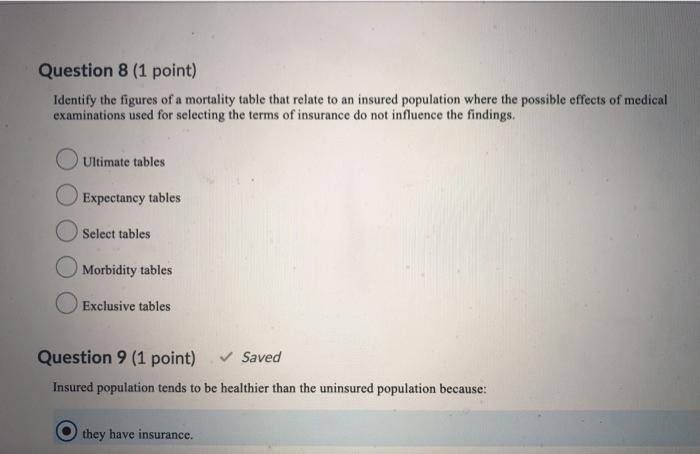

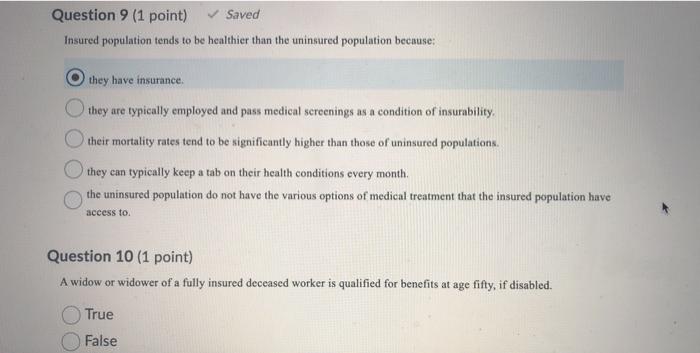

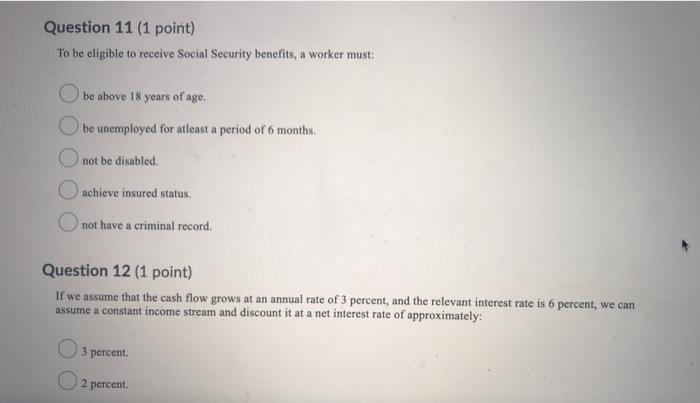

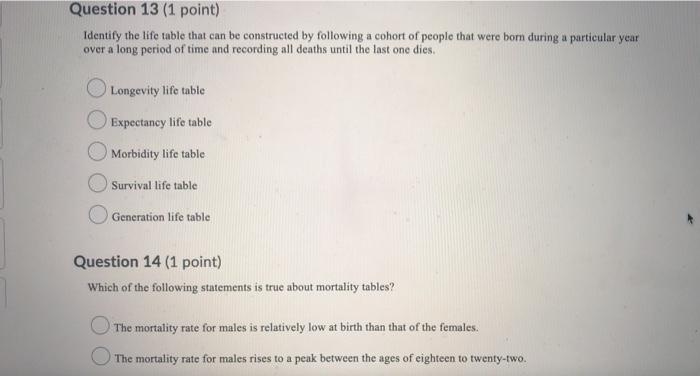

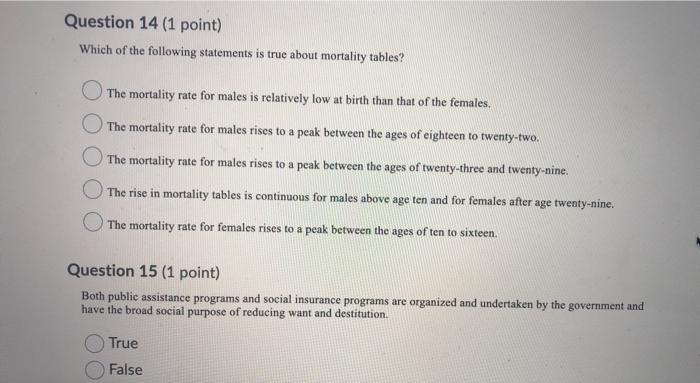

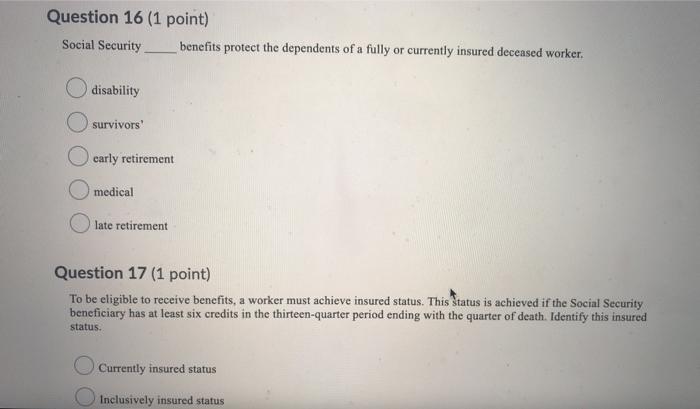

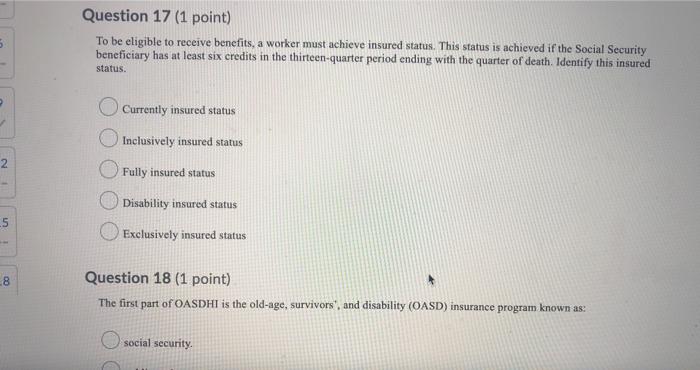

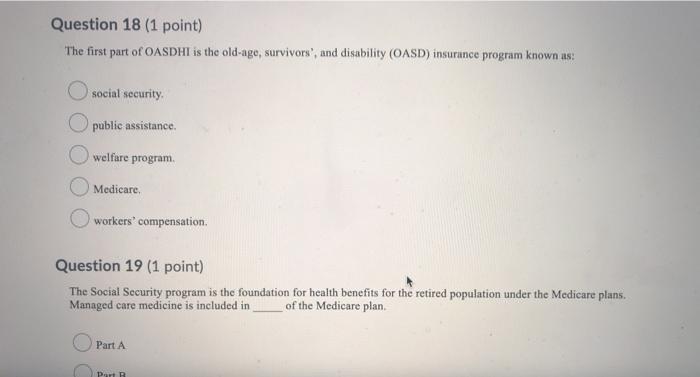

Question 1 (1 point) Saved Select tables are used to make mortality calculations without the selection effects of medical examination, True False Question 2 (1 point) The assumption that the annual income is constant over time is not important because: the total present value of the lifetime income stream is independent of the future income stream the future income streams have a small effect on the total present value of the lifetime income stream, the total present value of the lifetime income stream is highly dependent on future income streams. the future income streams have a significant effect on the total present value of the lifetime income stream the future income streams for a particular time period is equal to the total present value of the lifetime income stream. Question 3 (1 point) Mortality risk is the risk of -- Olong life. disability, longevity 2 12 bad health . premature death 1 15 Question 4 (1 point) Females are the biologically more resilient than males. 22 18 True False Question 5 (1 point) Saved The risk manager must find a way to create a similar cash flow to replace the lost income once the person dies. Because the timing of the death cannot be predicted, it is common to calculate the of the income stream to derive a single number 5 6 8 9 book value threshold point value > 11 12 future value prosent value 14 15 annuity value 17 18 Question 6 (1 point) Normal retirement age for the purposes of Social Security ranges from sixty-two to sixty-five. True False -- Question 7 (1 point) This benefit is paid to the spouse living with the worker at the time of death, or a spouse otherwise entitled, or children entitled of a fully or currently insured worker. It has not increased since the Social Security legislation was passed in 1935. Identify this benefit. 9 12 Early retirement benefit Disability benefit Health benefit Lump-sum death benefit 15 Late retirement benefit 18 Question 8 (1 point) Identify the figures of a mortality table that relate to an insured population where the possible effects of medical examinations used for selecting the terms of insurance do not influence the findings. Question 8 (1 point) Identify the figures of a mortality table that relate to an insured population where the possible effects of medical examinations used for selecting the terms of insurance do not influence the findings. Ultimate tables Expectancy tables Select tables Morbidity tables Exclusive tables Question 9 (1 point) Saved Insured population tends to be healthier than the uninsured population because: they have insurance Question 9 (1 point) Saved Insured population tends to be healthier than the uninsured population because they have insurance they are typically employed and pass medical screenings as a condition of insurability, their mortality rates tend to be significantly higher than those of uninsured populations. they can typically keep a tab on their health conditions every month. the uninsured population do not have the various options of medical treatment that the insured population have access to Question 10 (1 point) A widow or widower of a fully insured deceased worker is qualified for benefits at age fifty, if disabled. True False Question 11 (1 point) To be eligible to receive Social Security benefits, a worker must: Obe above 18 years of age. Obe unemployed for atleast a period of 6 months. O not be disabled O achieve insured status O not have a criminal record. Question 12 (1 point) If we assume that the cash flow grows at an annual rate of 3 percent, and the relevant interest rate is 6 percent, we can assume a constant income stream and discount it at a net interest rate of approximately: percent O2 percent. Question 13 (1 point) Identify the life table that can be constructed by following a cohort of people that were born during a particular year over a long period of time and recording all deaths until the last one dies. Longevity life table Expectancy life table Morbidity life table Survival life table Generation life table Question 14 (1 point) Which of the following statements is true about mortality tables? The mortality rate for males is relatively low at birth than that of the females. The mortality rate for males rises to a peak between the ages of eighteen to twenty-two. Question 14 (1 point) Which of the following statements is true about mortality tables? The mortality rate for males is relatively low at birth than that of the females. The mortality rate for males rises to a peak between the ages of eighteen to twenty-two. The mortality rate for males rises to a peak between the ages of twenty-three and twenty-nine. The rise in mortality tables is continuous for males above age ten and for females after age twenty-nine. The mortality rate for females rises to a peak between the ages of ten to sixteen. Question 15 (1 point) Both public assistance programs and social insurance programs are organized and undertaken by the government and have the broad social purpose of reducing want and destitution. True False Question 16 (1 point) Social Security benefits protect the dependents of a fully or currently insured deceased worker, disability O survivors' carly retirement medical late retirement Question 17 (1 point) To be eligible to receive benefits, a worker must achieve insured status. This status is achieved if the Social Security beneficiary has at least six credits in the thirteen-quarter period ending with the quarter of death. Identify this insured status. Currently insured status Inclusively insured status 5 Question 17 (1 point) To be eligible to receive benefits, a worker must achieve insured status. This status is achieved if the Social Security beneficiary has at least six credits in the thirteen-quarter period ending with the quarter of death. Identify this insured status. Currently insured status Inclusively insured status 2 Fully insured status Disability insured status 5 Exclusively insured status 8 Question 18 (1 point) The first part of OASDHI is the old-age, survivors', and disability (OASD) insurance program known as: social security Question 18 (1 point) The first part of OASDHT is the old-age, survivors, and disability (OASD) insurance program known as: social security O public assistance. welfare program Medicare workers' compensation Question 19 (1 point) The Social Security program is the foundation for health benefits for the retired population under the Medicare plans. Managed care medicine is included in of the Medicare plan Part A Por PartR Question 19 (1 point) The Social Security program is the foundation for health benefits for the retired population under the Medicare plans. Managed care medicine is included in of the Medicare plan Part A Part B Part Part D Part E Question 20 (1 point) If an individual qualifies as both a worker and as the spouse of a worker, the beneficiary will receive whichever primary insurance amount is greater, but not both. True False Question 21 (1 point) The objective of this program is to provide a "floor of protection" or a reasonable level of living." It is the foundation on which retirement, survivors, and disability benefits should be designed. In addition, the program is the foundation for health benefits for the retired population under Medicare Part A Part B, Part C, and Part D. Identify this program 4 5 6 7 8 9 Social Security Retirement plan administration program 10 11 12 Medicaid Workers' compensation program 3 14 15 Unemployment benefit program 17 18 Question 22 (1 point) The general population is typically healthier than the insured population True False ---- Like social insurance, employers and employees pay into the public assistance system to earn their rights to benefits. True False Question 24 (1 point) The present value at 6 percent interest rate would be higher than the present value at 3 percent interest rate for the same person True False Question 25 (1 point) Mortality tables and life tables are essential tools in the hands of actuaries. The actuary needs only one of the tables for making all the required calculations since one table can be derived from the other. True False