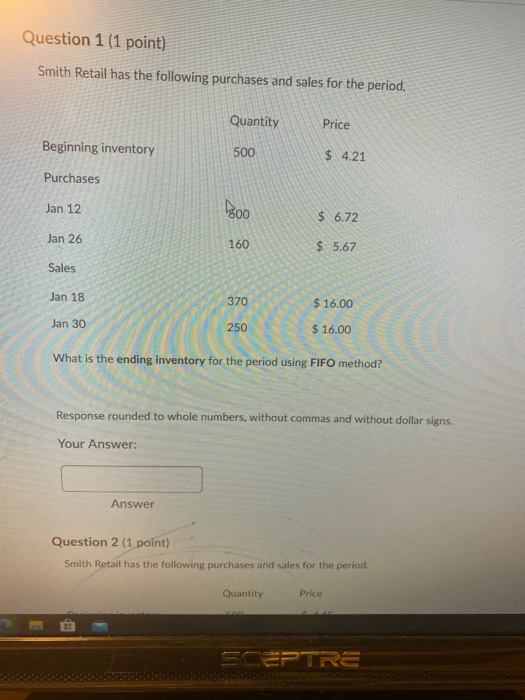

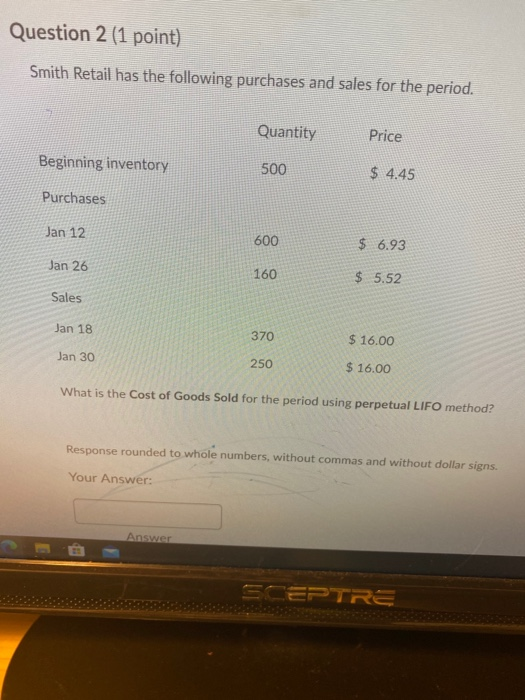

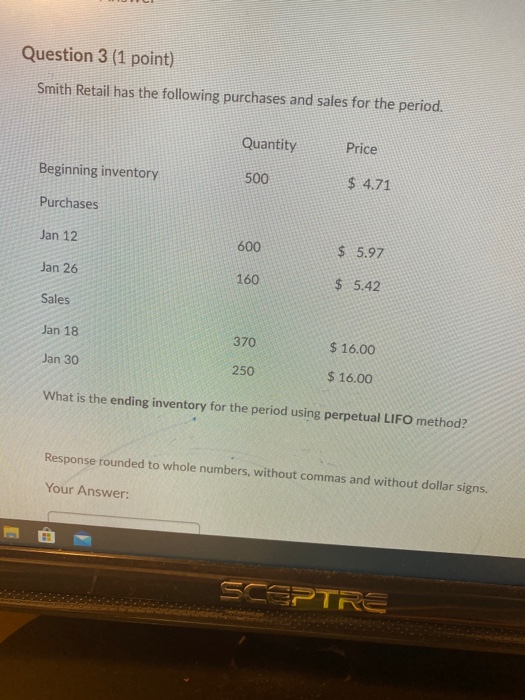

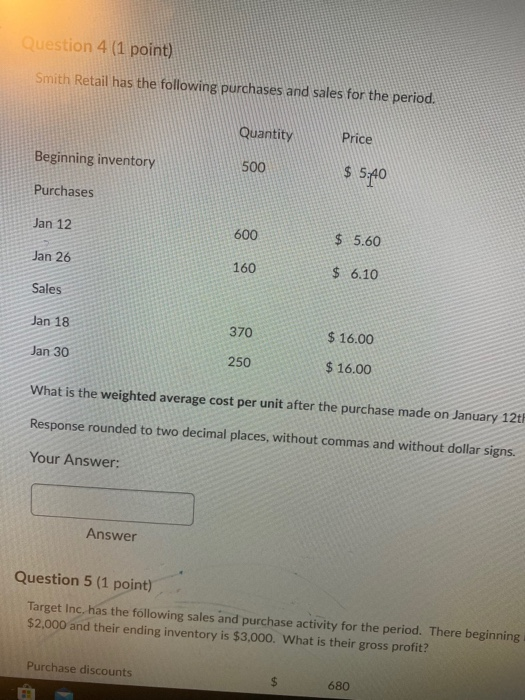

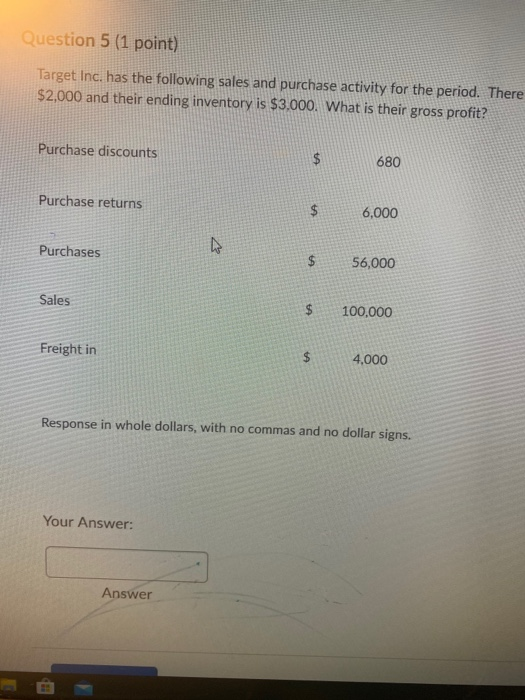

Question 1 (1 point) Smith Retail has the following purchases and sales for the period. Quantity Price Beginning inventory 500 $ 4.21 Purchases Jan 12 1800 $ 6.72 Jan 26 160 $ 5.67 Sales Jan 18 370 $ 16.00 Jan 30 250 $ 16.00 What is the ending inventory for the period using FIFO method? Response rounded to whole numbers, without commas and without dollar signs. Your Answer: Answer Question 2 (1 point) Smith Retail has the following purchases and sales for the period. Quantity Price SCEPTRE Question 2 (1 point) Smith Retail has the following purchases and sales for the period. Quantity Price Beginning inventory 500 $ 4.45 Purchases Jan 12 600 $ 6.93 Jan 26 160 $ 5.52 Sales Jan 18 370 $ 16.00 Jan 30 250 $ 16.00 What is the Cost of Goods Sold for the period using perpetual LIFO method? Response rounded to whole numbers, without commas and without dollar signs. Your Answer: Answer SCEPTRE Question 3 (1 point) Smith Retail has the following purchases and sales for the period. Quantity Price Beginning inventory 500 $ 4.71 Purchases Jan 12 600 $ 5.97 Jan 26 160 $ 5.42 Sales Jan 18 370 $ 16.00 Jan 30 250 $ 16.00 What is the ending inventory for the period using perpetual LIFO method? Response rounded to whole numbers, without commas and without dollar signs. Your Answer: SCEPTRE Question 4 (1 point) Smith Retail has the following purchases and sales for the period. Quantity Price Beginning inventory 500 $ 5:40 Purchases Jan 12 600 $ 5.60 Jan 26 160 $ 6.10 Sales Jan 18 370 $ 16.00 Jan 30 250 $ 16.00 What is the weighted average cost per unit after the purchase made on January 12tF Response rounded to two decimal places, without commas and without dollar signs. Your Answer: Answer Question 5 (1 point) Target Inc. has the following sales and purchase activity for the period. There beginning $2.000 and their ending inventory is $3,000. What is their gross profit? Purchase discounts 680 Question 5 (1 point) Target Inc. has the following sales and purchase activity for the period. There $2,000 and their ending inventory is $3.000. What is their gross profit? Purchase discounts $ 680 Purchase returns 6,000 Purchases $ 56,000 Sales $ 100,000 Freight in $ 4.000 Response in whole dollars, with no commas and no dollar signs. Your