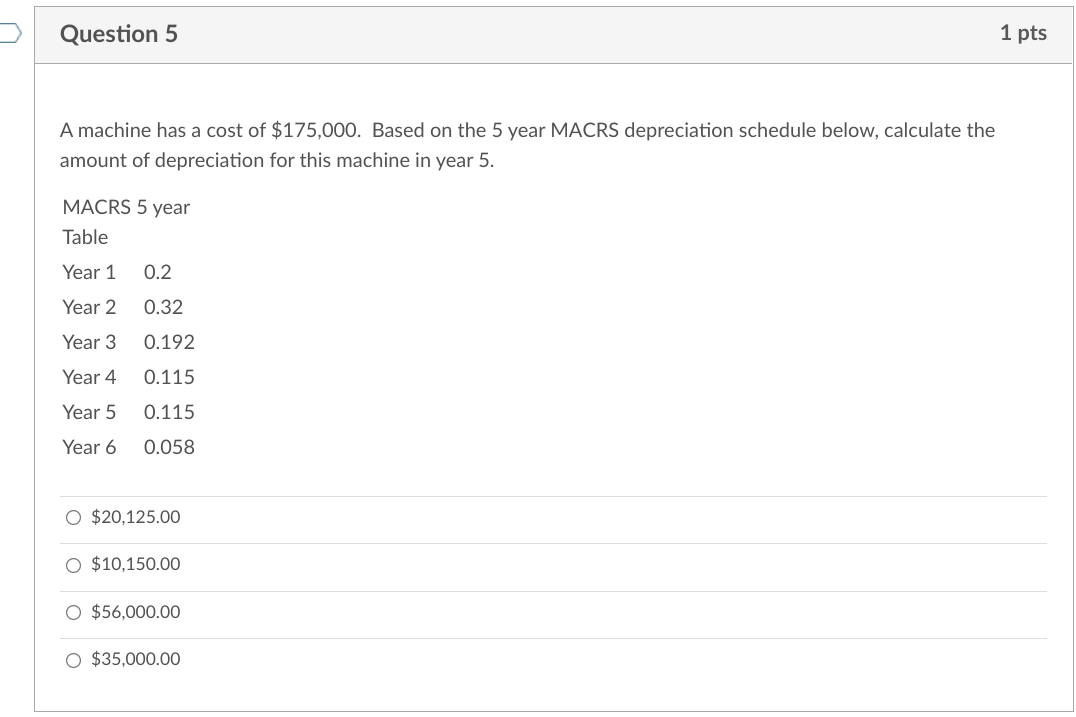

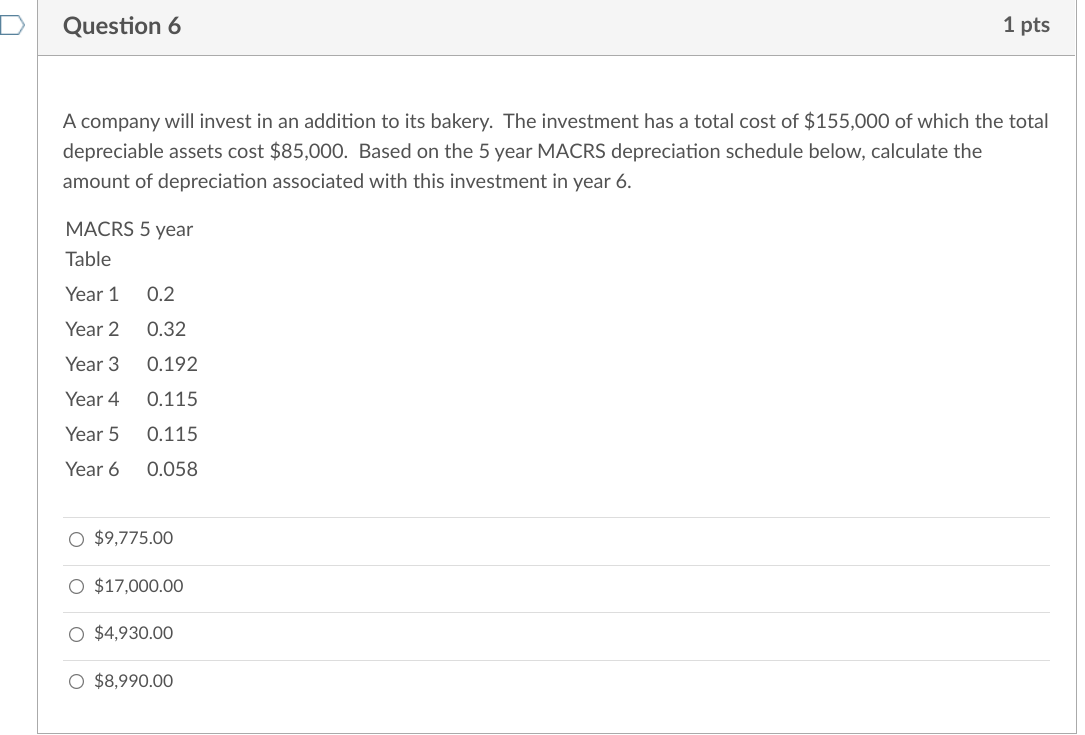

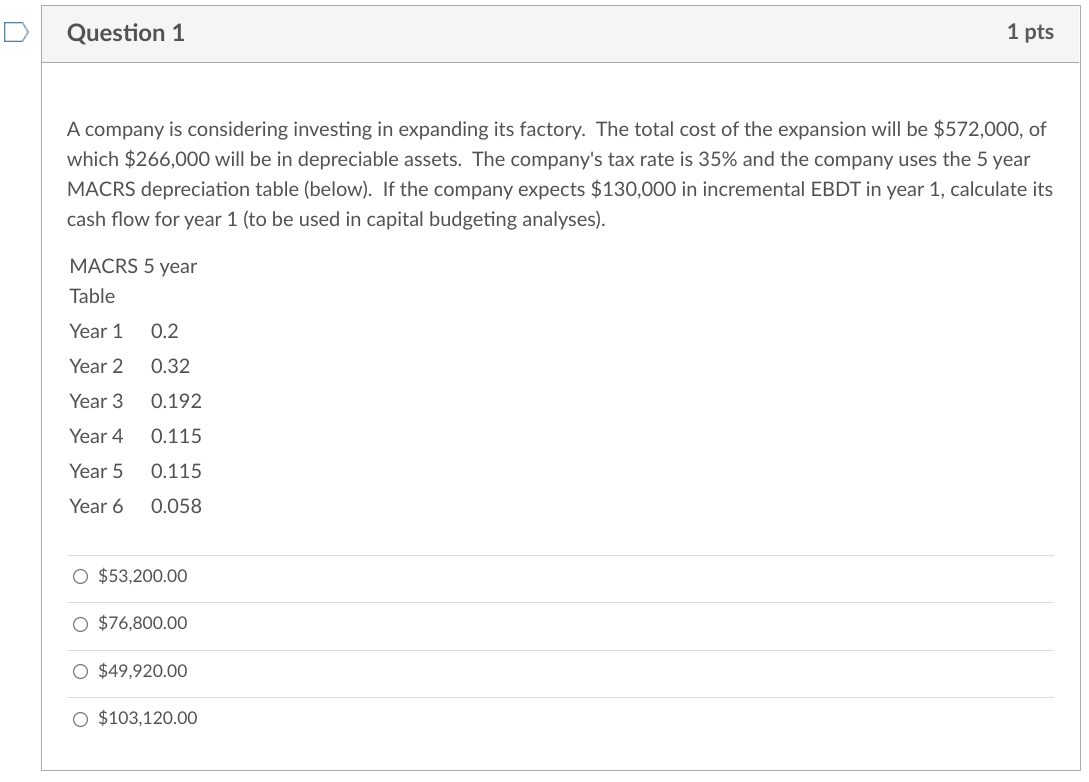

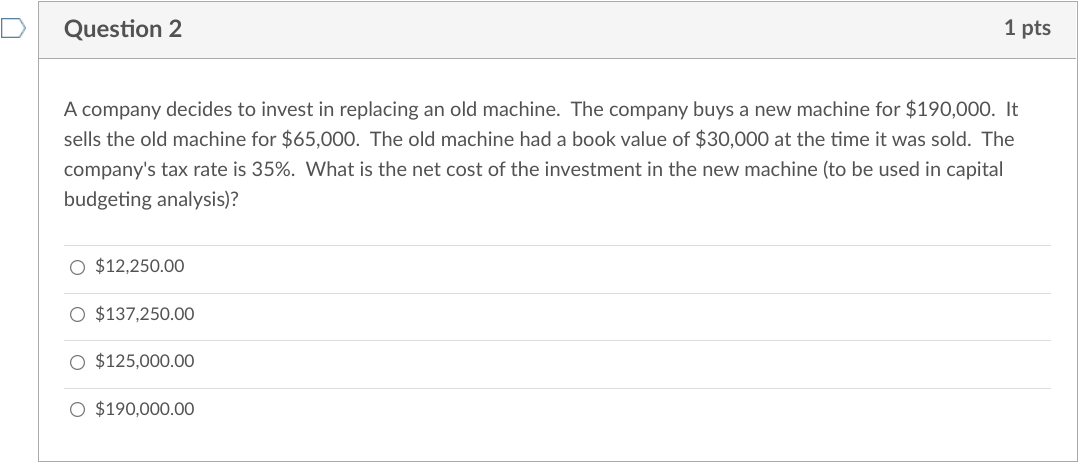

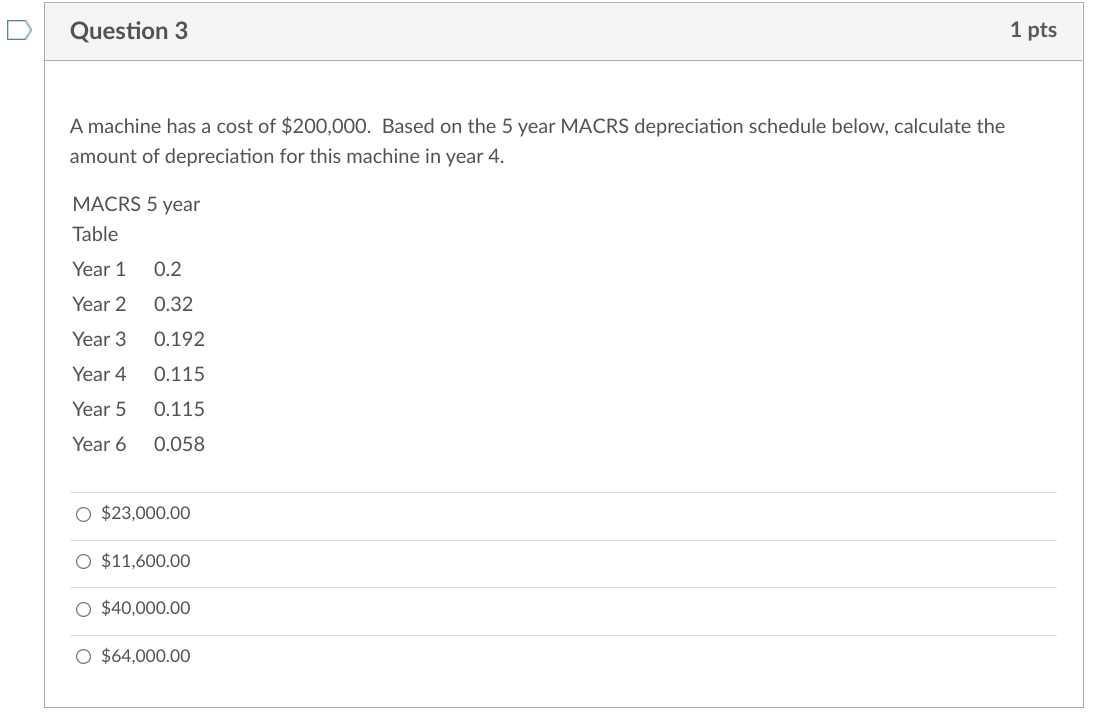

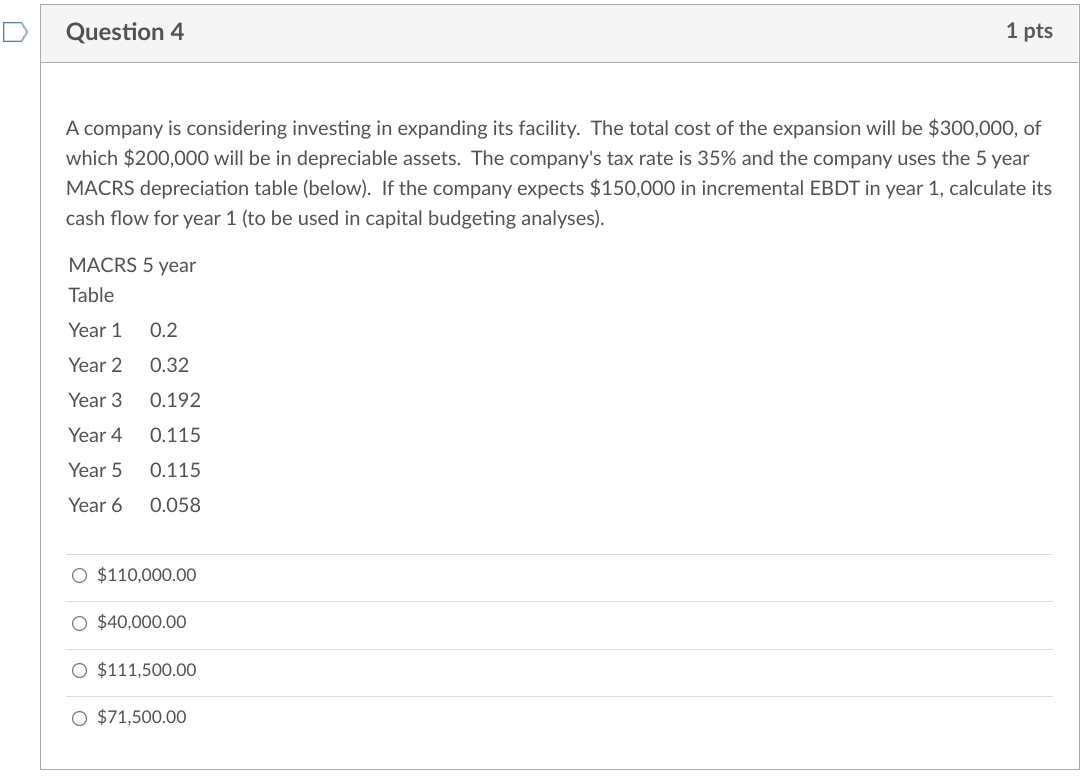

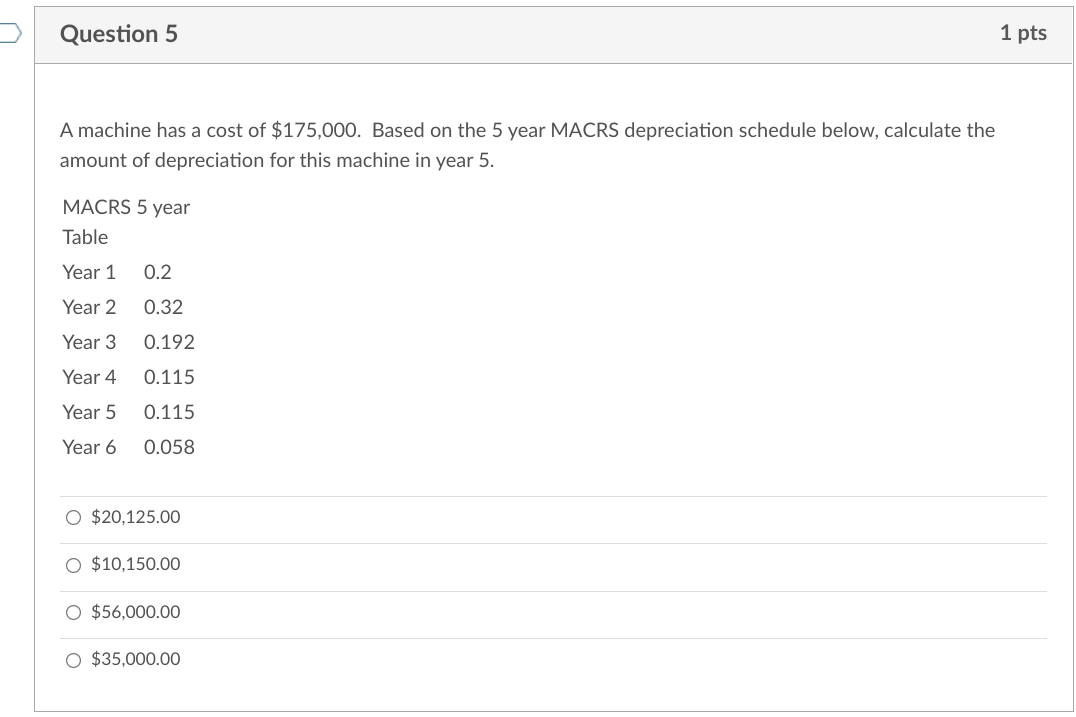

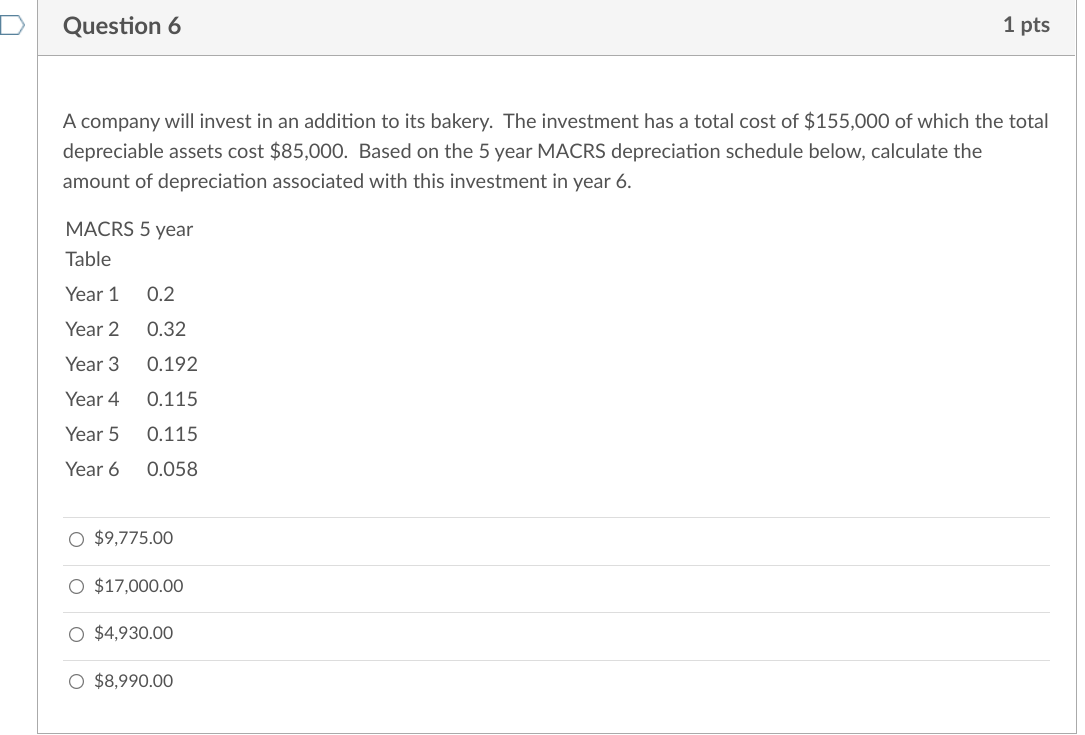

Question 1 1 pts A company is considering investing in expanding its factory. The total cost of the expansion will be $572,000, of which $266,000 will be in depreciable assets. The company's tax rate is 35% and the company uses the 5 year MACRS depreciation table (below). If the company expects $130,000 in incremental EBDT year 1, calculate its cash flow for year 1 (to be used in capital budgeting analyses). MACRS 5 year Table Year 1 0.2 Year 2 0.32 Year 3 0.192 Year 4 0.115 Year 5 0.115 Year 6 0.058 $53,200.00 $76,800.00 $49,920.00 O $103,120.00 Question 2 1 pts A company decides to invest in replacing an old machine. The company buys a new machine for $190,000. It sells the old machine for $65,000. The old machine had a book value of $30,000 at the time it was sold. The company's tax rate is 35%. What is the net cost of the investment in the new machine (to be used in capital budgeting analysis)? O $12,250.00 O $137,250.00 O $125,000.00 O $190,000.00 Question 3 1 pts A machine has a cost of $200,000. Based on the 5 year MACRS depreciation schedule below, calculate the amount of depreciation for this machine in year 4. MACRS 5 year Table Year 1 0.2 Year 2 0.32 Year 3 0.192 Year 4 0.115 Year 5 0.115 Year 6 0.058 O $23,000.00 O $11,600.00 O $40,000.00 O $64,000.00 Question 4 1 pts A company is considering investing in expanding its facility. The total cost of the expansion will be $300,000, of which $200,000 will be in depreciable assets. The company's tax rate is 35% and the company uses the 5 year MACRS depreciation table (below). If the company expects $150,000 in incremental EBDT in year 1, calculate its cash flow for year 1 (to be used in capital budgeting analyses). MACRS 5 year Table Year 1 0.2 Year 2 0.32 Year 3 0.192 Year 4 0.115 Year 5 0.115 Year 6 0.058 O $110,000.00 O $40,000.00 O $111,500.00 O $71,500.00 Question 5 1 pts A machine has a cost of $175,000. Based on the 5 year MACRS depreciation schedule below, calculate the amount of depreciation for this machine in year 5. MACRS 5 year Table Year 1 0.2 Year 2 0.32 Year 3 0.192 Year 4 0.115 Year 5 0.115 Year 6 0.058 O $20,125.00 $10,150.00 $56,000.00 O $35,000.00 Question 6 1 pts A company will invest in an addition to its bakery. The investment has a total cost of $155,000 of which the total depreciable assets cost $85,000. Based on the 5 year MACRS depreciation schedule below, calculate the amount of depreciation associated with this investment in year 6. MACRS 5 year Table Year 1 0.2 Year 2 0.32 Year 3 0.192 Year 4 0.115 Year 5 0.115 Year 6 0.058 O $9,775.00 O $17,000.00 O $4,930.00 O $8,990.00