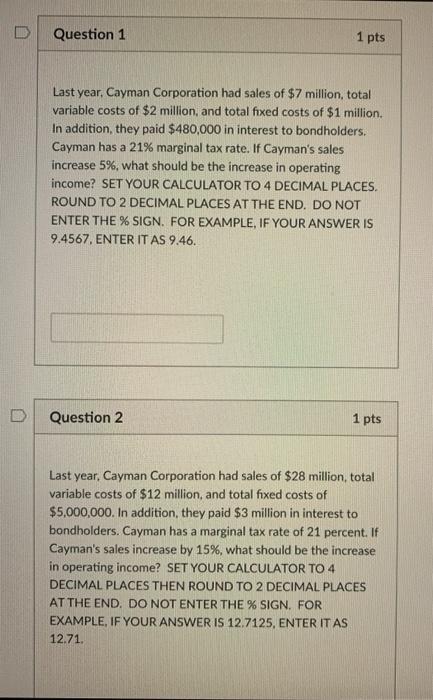

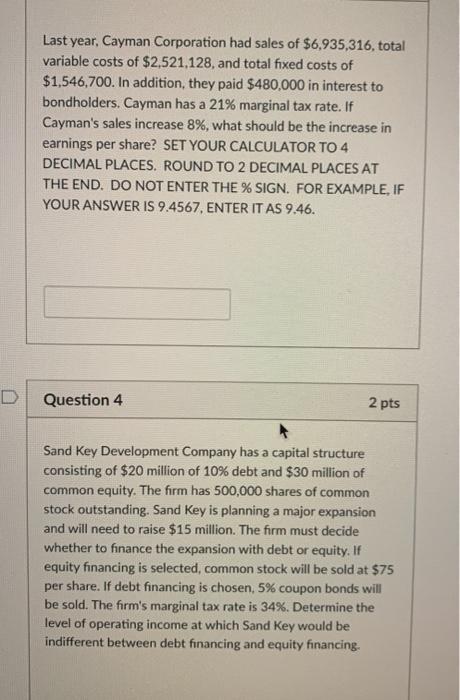

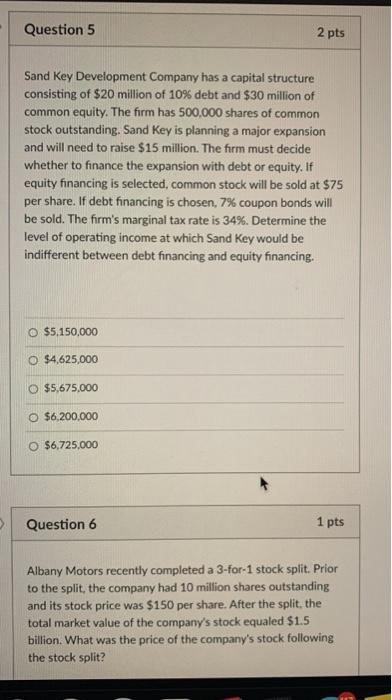

Question 1 1 pts Last year, Cayman Corporation had sales of $7 million, total variable costs of $2 million, and total fixed costs of $1 million In addition, they paid $480,000 in interest to bondholders. Cayman has a 21% marginal tax rate. If Cayman's sales increase 5%, what should be the increase in operating income? SET YOUR CALCULATOR TO 4 DECIMAL PLACES ROUND TO 2 DECIMAL PLACES AT THE END. DO NOT ENTER THE % SIGN. FOR EXAMPLE, IF YOUR ANSWER IS 9.4567. ENTER IT AS 9.46. Question 2 1 pts Last year, Cayman Corporation had sales of $28 million total variable costs of $12 million, and total fixed costs of $5,000,000. In addition, they paid $3 million in interest to bondholders. Cayman has a marginal tax rate of 21 percent. If Cayman's sales increase by 15%, what should be the increase in operating income? SET YOUR CALCULATOR TO 4 DECIMAL PLACES THEN ROUND TO 2 DECIMAL PLACES AT THE END. DO NOT ENTER THE % SIGN. FOR EXAMPLE, IF YOUR ANSWER IS 12.7125, ENTER IT AS 12.71. Last year, Cayman Corporation had sales of $6,935,316, total variable costs of $2,521.128, and total fixed costs of $1,546,700. In addition, they paid $480,000 in interest to bondholders. Cayman has a 21% marginal tax rate. If Cayman's sales increase 8%, what should be the increase in earnings per share? SET YOUR CALCULATOR TO 4 DECIMAL PLACES. ROUND TO 2 DECIMAL PLACES AT THE END. DO NOT ENTER THE % SIGN. FOR EXAMPLE, IF YOUR ANSWER IS 9.4567. ENTER IT AS 9.46. D Question 4 2 pts Sand Key Development Company has a capital structure consisting of $20 million of 10% debt and $30 million of common equity. The firm has 500,000 shares of common stock outstanding. Sand Key is planning a major expansion and will need to raise $15 million. The firm must decide whether to finance the expansion with debt or equity. If equity financing is selected, common stock will be sold at $75 per share. If debt financing is chosen, 5% coupon bonds will be sold. The firm's marginal tax rate is 34%. Determine the level of operating income at which Sand Key would be indifferent between debt financing and equity financing. Question 5 2 pts Sand Key Development Company has a capital structure consisting of $20 million of 10% debt and $30 million of common equity. The firm has 500,000 shares of common stock outstanding. Sand Key is planning a major expansion and will need to raise $15 million. The form must decide whether to finance the expansion with debt or equity. If equity financing is selected, common stock will be sold at $75 per share. If debt financing is chosen, 7% coupon bonds will be sold. The firm's marginal tax rate is 34%. Determine the level of operating income at which Sand Key would be indifferent between debt financing and equity financing. O $5,150,000 O $4,625,000 O $5,675.000 $6,200,000 $6,725.000 Question 6 1 pts Albany Motors recently completed a 3-for-1 stock split. Prior to the split, the company had 10 million shares outstanding and its stock price was $150 per share. After the split the total market value of the company's stock equaled $1.5 billion. What was the price of the company's stock following the stock split