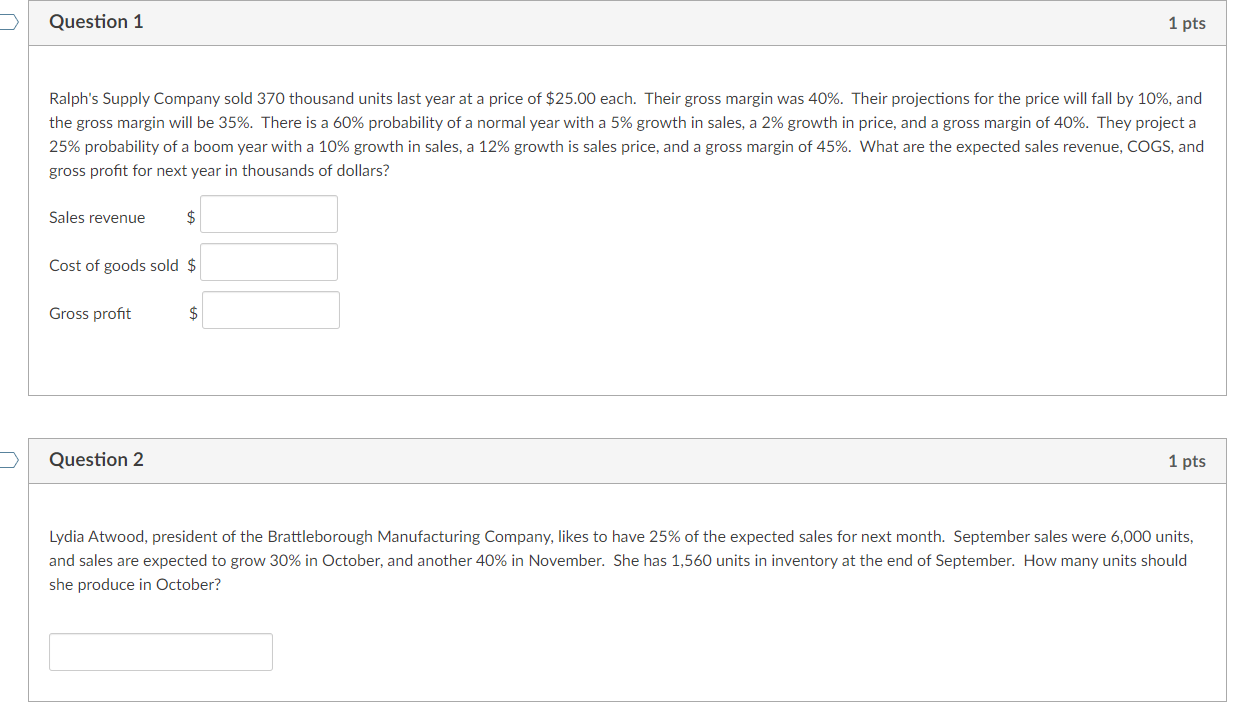

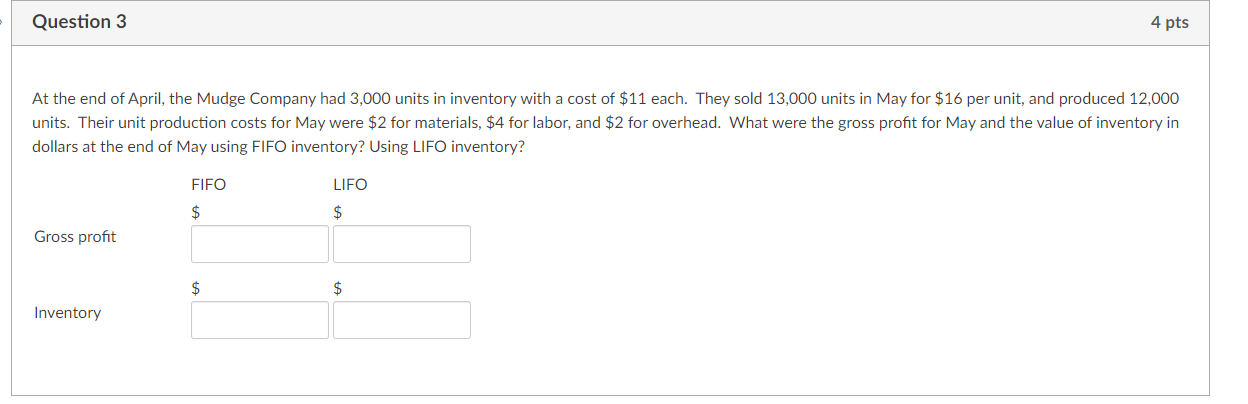

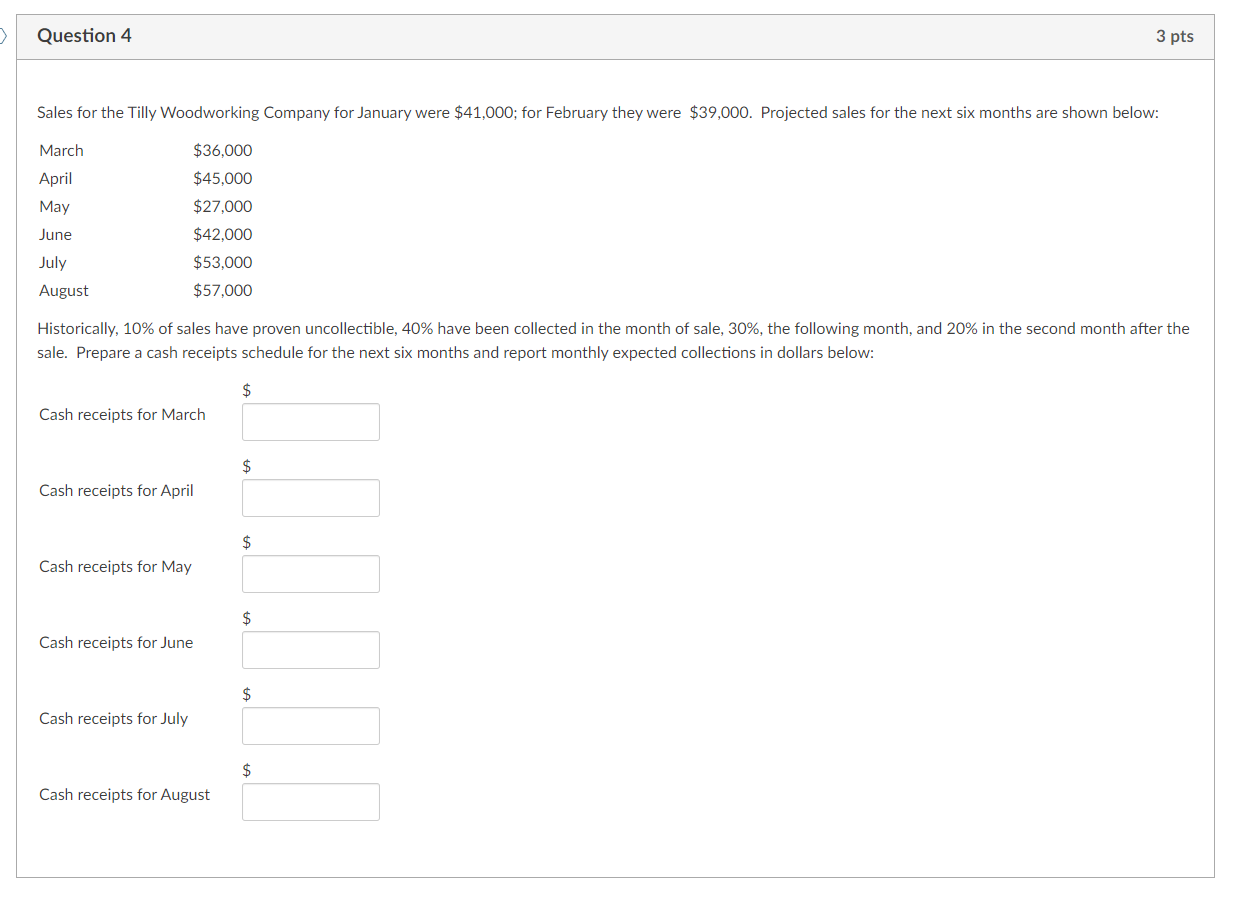

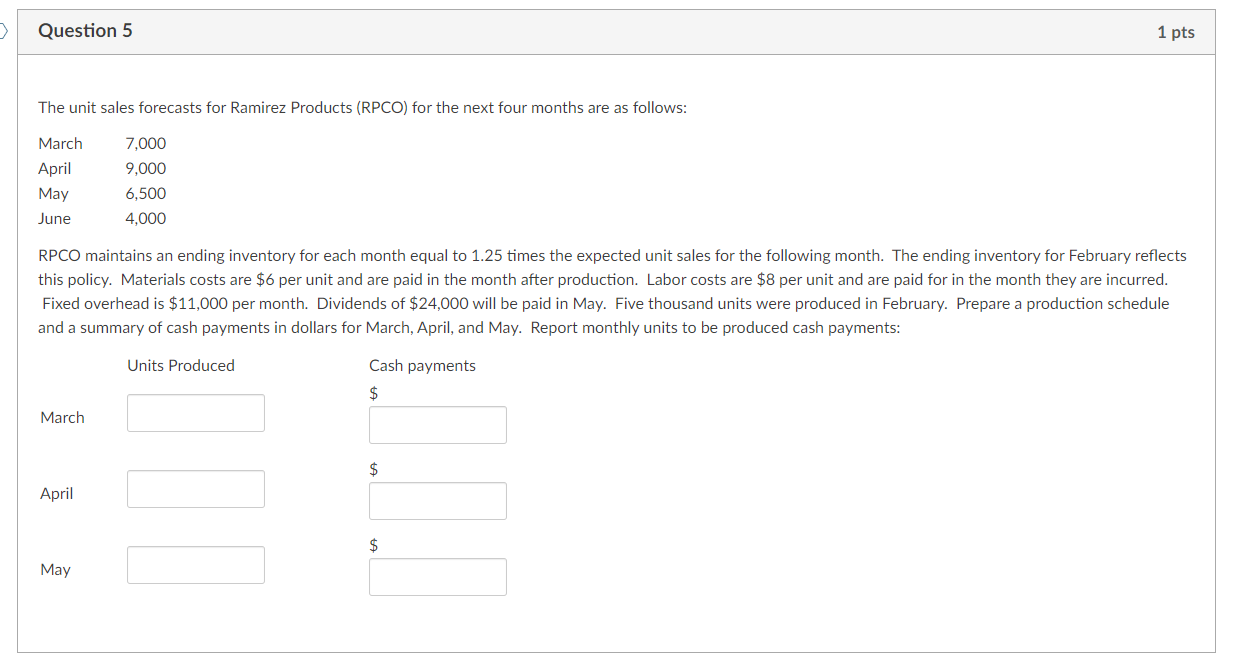

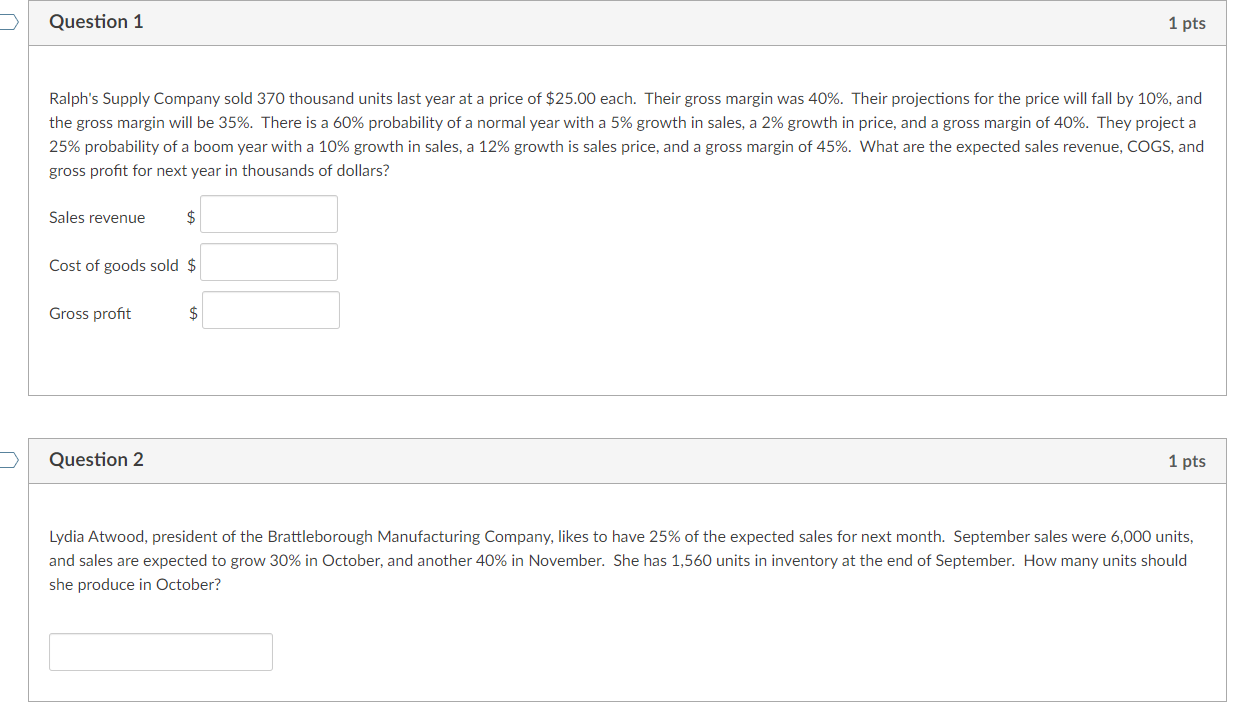

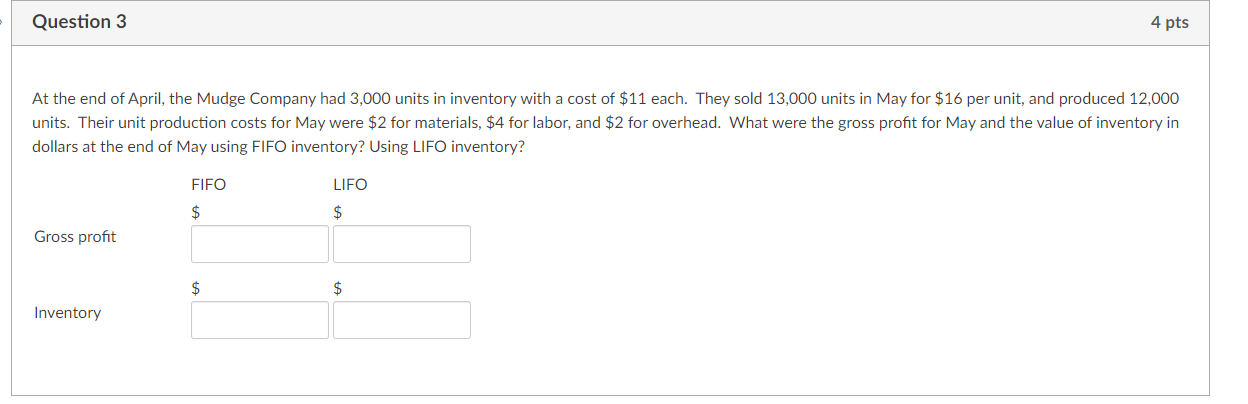

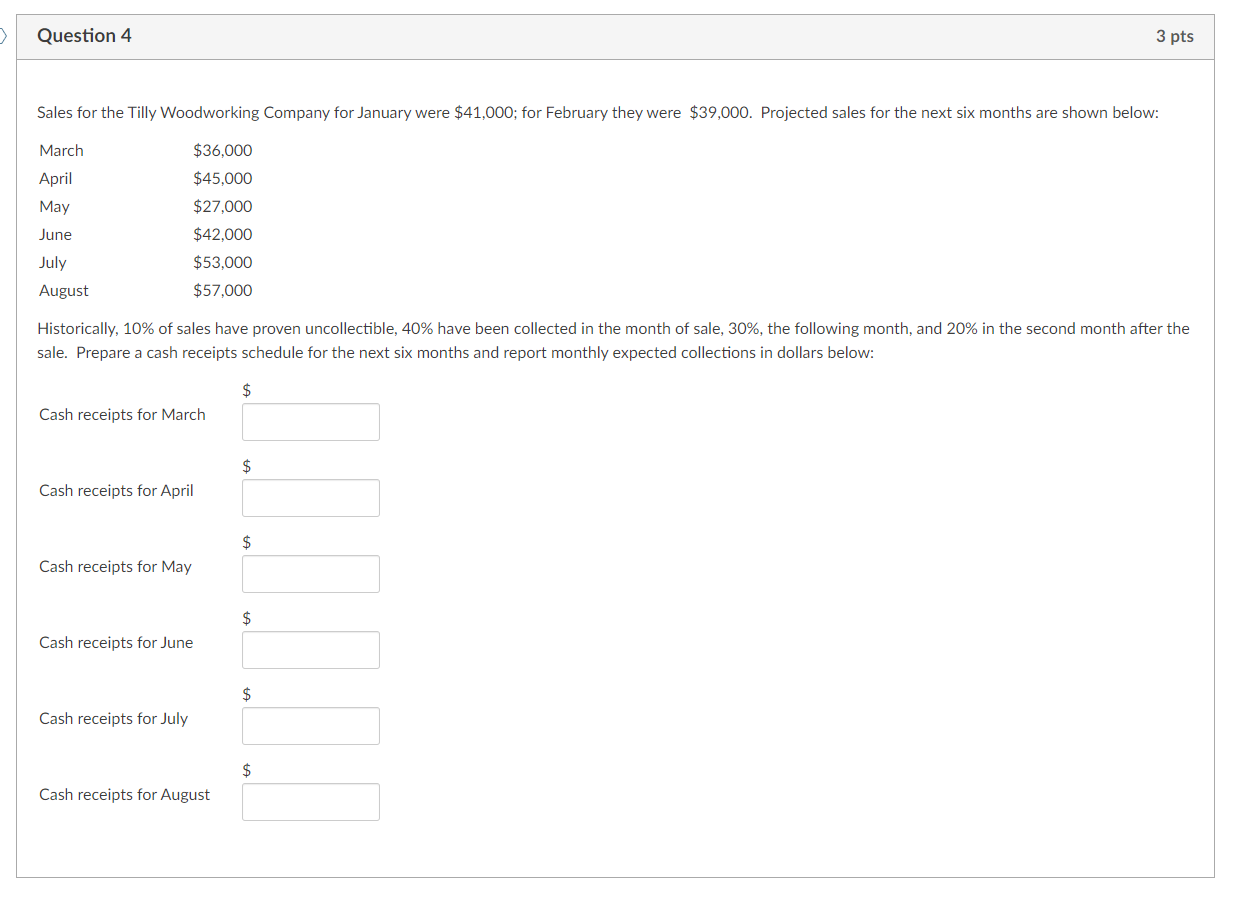

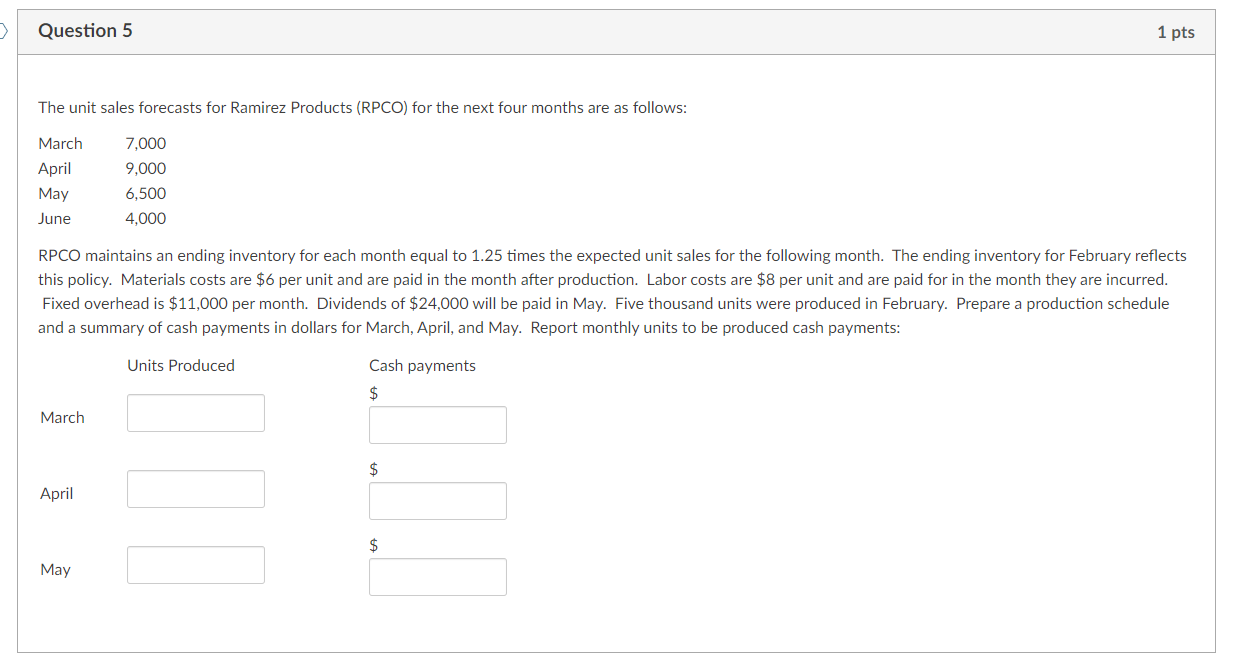

Question 1 1 pts Ralph's Supply Company sold 370 thousand units last year at a price of $25.00 each. Their gross margin was 40%. Their projections for the price will fall by 10%, and the gross margin will be 35%. There is a 60% probability of a normal year with a 5% growth in sales, a 2% growth in price, and a gross margin of 40%. They project a 25% probability of a boom year with a 10% growth in sales, a 12% growth is sales price, and a gross margin of 45%. What are the expected sales revenue, COGS, and gross profit for next year in thousands of dollars? Sales revenue $ Cost of goods sold $ Gross profit $ Question 2 1 pts Lydia Atwood, president of the Brattleborough Manufacturing Company, likes to have 25% of the expected sales for next month. September sales were 6,000 units, and sales are expected to grow 30% in October, and another 40% in November. She has 1,560 units in inventory at the end of September. How many units should she produce in October? Question 3 4 pts At the end of April, the Mudge Company had 3,000 units in inventory with a cost of $11 each. They sold 13,000 units in May for $16 per unit, and produced 12,000 units. Their unit production costs for May were $2 for materials, $4 for labor, and $2 for overhead. What were the gross profit for May and the value of inventory in dollars at the end of May using FIFO inventory? Using LIFO inventory? FIFO LIFO $ $ Gross profit $ $ Inventory > Question 4 3 pts Sales for the Tilly Woodworking Company for January were $41,000; for February they were $39,000. Projected sales for the next six months are shown below: March $36,000 April $45.000 May $27.000 June $42,000 July $53,000 August $57,000 Historically, 10% of sales have proven uncollectible, 40% have been collected in the month of sale, 30%, the following month, and 20% in the second month after the sale. Prepare a cash receipts schedule for the next six months and report monthly expected collections in dollars below: $ Cash receipts for March $ Cash receipts for April $ Cash receipts for May $ Cash receipts for June $ Cash receipts for July $ Cash receipts for August Question 5 1 pts The unit sales forecasts for Ramirez Products (RPCO) for the next four months are as follows: March April May June 7,000 9,000 6,500 4,000 RPCO maintains an ending inventory for each month equal to 1.25 times the expected unit sales for the following month. The ending inventory for February reflects this policy. Materials costs are $6 per unit and are paid in the month after production. Labor costs are $8 per unit and are paid for in the month they are incurred. Fixed overhead is $11,000 per month. Dividends of $24,000 will be paid in May. Five thousand units were produced in February. Prepare a production schedule and a summary of cash payments in dollars for March, April, and May. Report monthly units to be produced cash payments: Units Produced Cash payments $ March $ April $ May Question 1 1 pts Ralph's Supply Company sold 370 thousand units last year at a price of $25.00 each. Their gross margin was 40%. Their projections for the price will fall by 10%, and the gross margin will be 35%. There is a 60% probability of a normal year with a 5% growth in sales, a 2% growth in price, and a gross margin of 40%. They project a 25% probability of a boom year with a 10% growth in sales, a 12% growth is sales price, and a gross margin of 45%. What are the expected sales revenue, COGS, and gross profit for next year in thousands of dollars? Sales revenue $ Cost of goods sold $ Gross profit $ Question 2 1 pts Lydia Atwood, president of the Brattleborough Manufacturing Company, likes to have 25% of the expected sales for next month. September sales were 6,000 units, and sales are expected to grow 30% in October, and another 40% in November. She has 1,560 units in inventory at the end of September. How many units should she produce in October? Question 3 4 pts At the end of April, the Mudge Company had 3,000 units in inventory with a cost of $11 each. They sold 13,000 units in May for $16 per unit, and produced 12,000 units. Their unit production costs for May were $2 for materials, $4 for labor, and $2 for overhead. What were the gross profit for May and the value of inventory in dollars at the end of May using FIFO inventory? Using LIFO inventory? FIFO LIFO $ $ Gross profit $ $ Inventory > Question 4 3 pts Sales for the Tilly Woodworking Company for January were $41,000; for February they were $39,000. Projected sales for the next six months are shown below: March $36,000 April $45.000 May $27.000 June $42,000 July $53,000 August $57,000 Historically, 10% of sales have proven uncollectible, 40% have been collected in the month of sale, 30%, the following month, and 20% in the second month after the sale. Prepare a cash receipts schedule for the next six months and report monthly expected collections in dollars below: $ Cash receipts for March $ Cash receipts for April $ Cash receipts for May $ Cash receipts for June $ Cash receipts for July $ Cash receipts for August Question 5 1 pts The unit sales forecasts for Ramirez Products (RPCO) for the next four months are as follows: March April May June 7,000 9,000 6,500 4,000 RPCO maintains an ending inventory for each month equal to 1.25 times the expected unit sales for the following month. The ending inventory for February reflects this policy. Materials costs are $6 per unit and are paid in the month after production. Labor costs are $8 per unit and are paid for in the month they are incurred. Fixed overhead is $11,000 per month. Dividends of $24,000 will be paid in May. Five thousand units were produced in February. Prepare a production schedule and a summary of cash payments in dollars for March, April, and May. Report monthly units to be produced cash payments: Units Produced Cash payments $ March $ April $ May