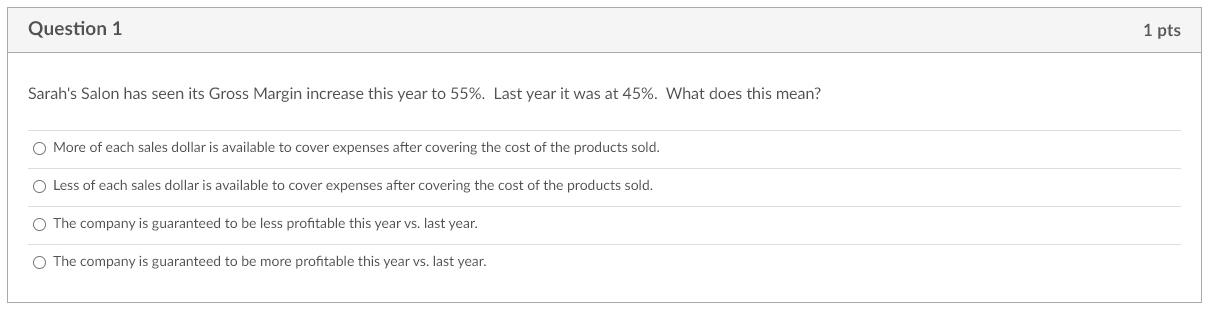

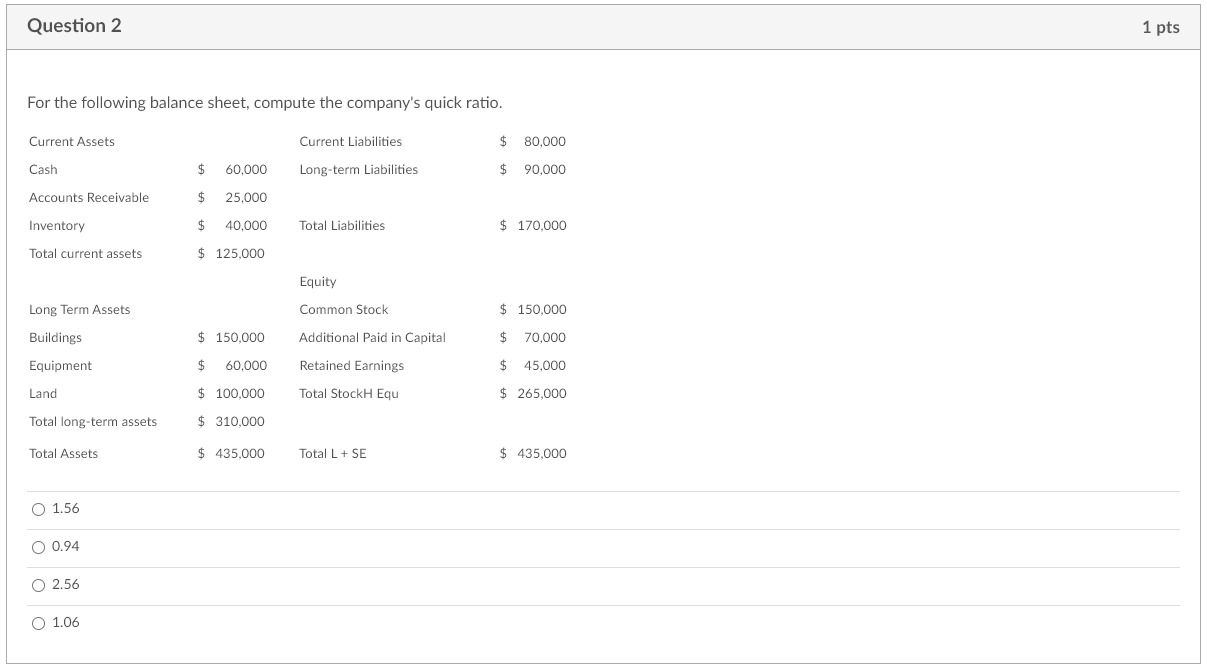

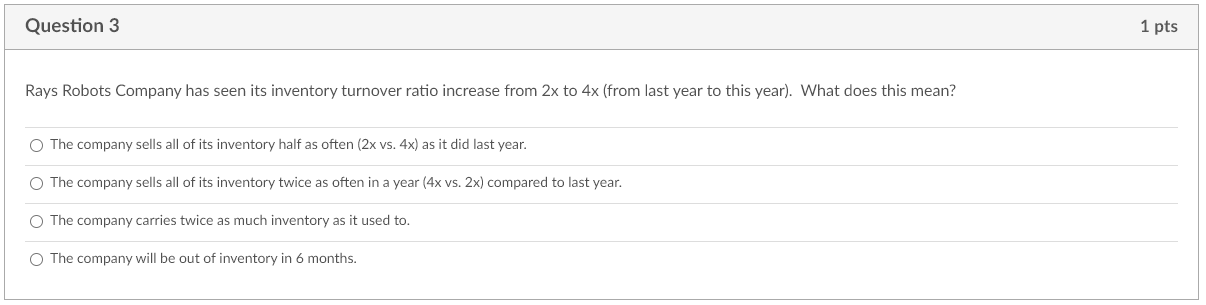

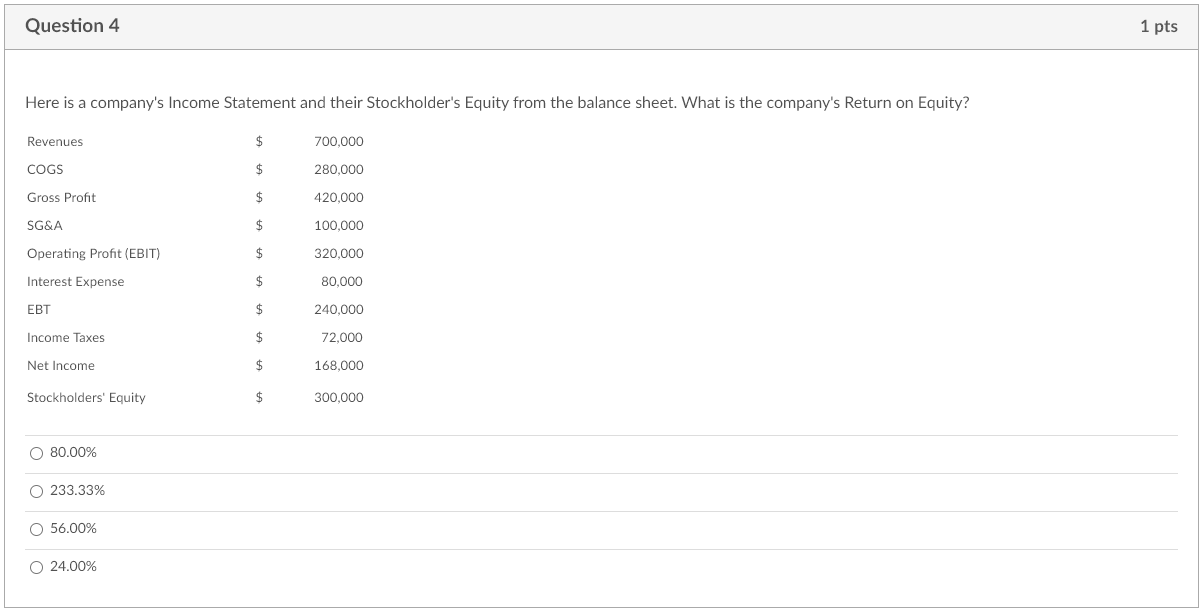

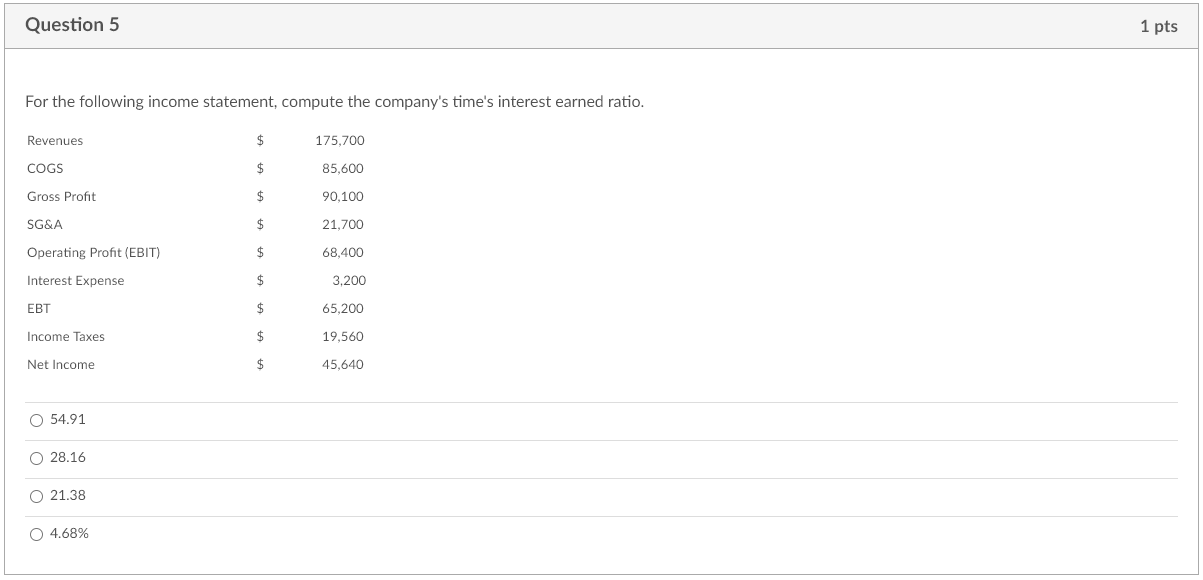

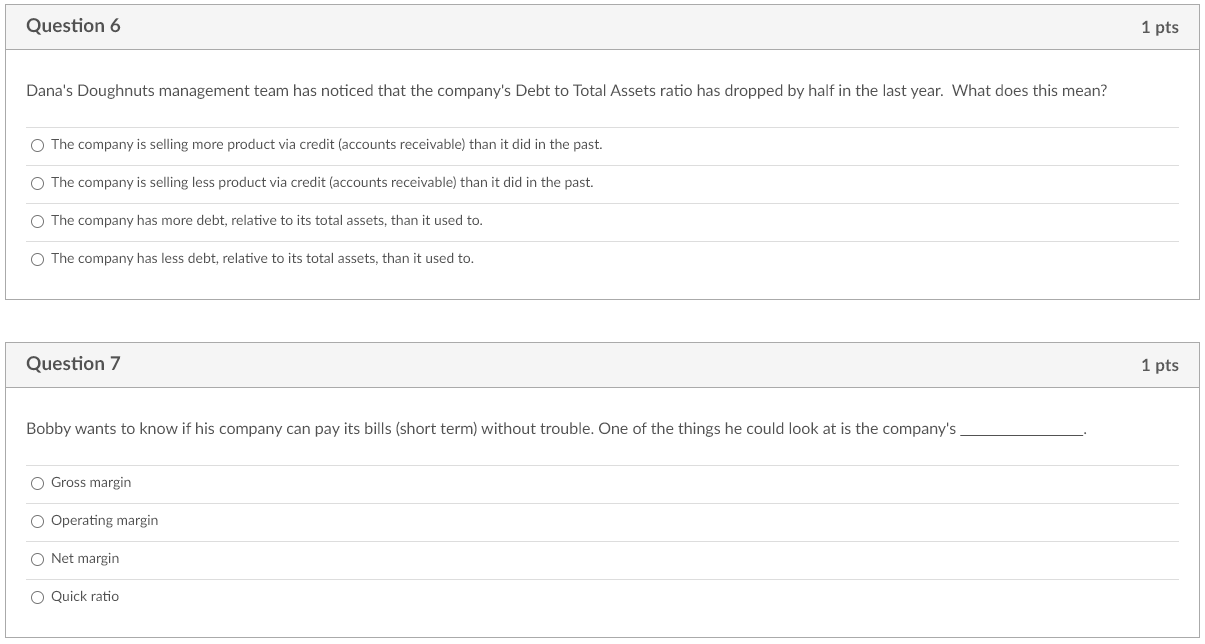

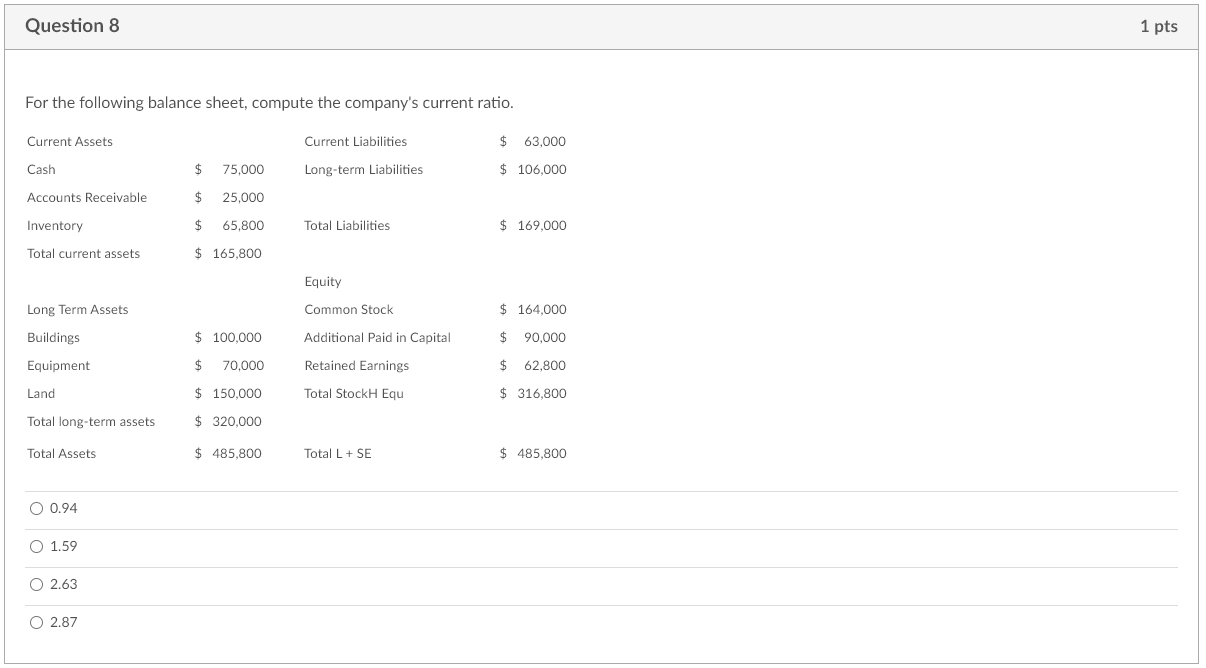

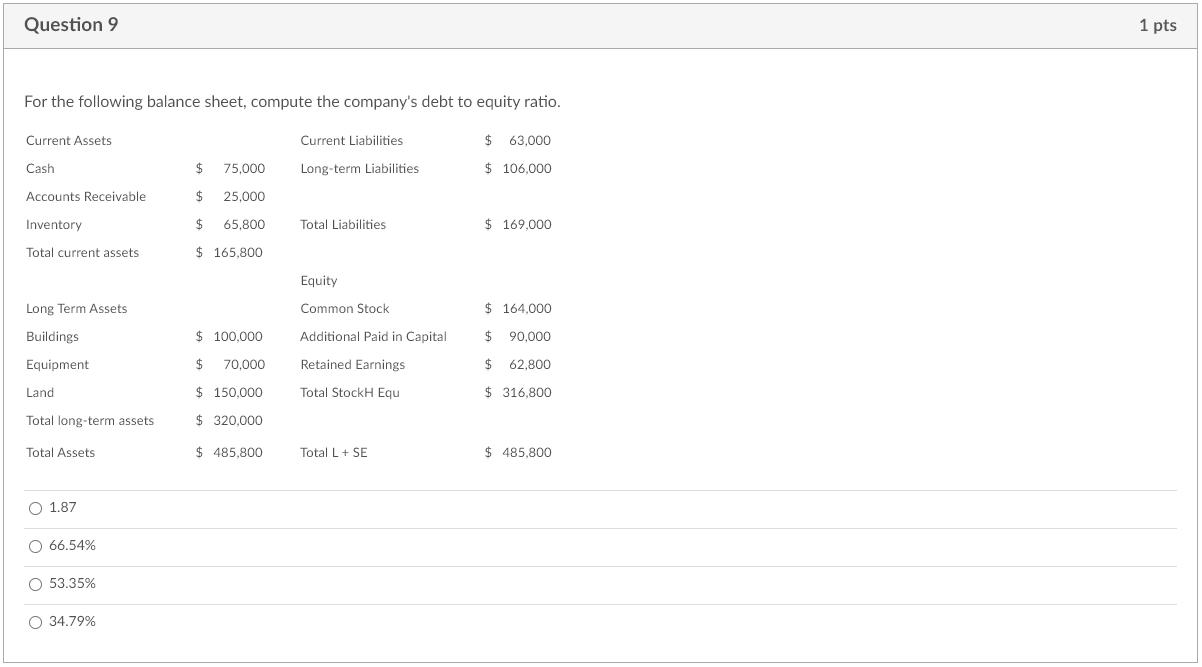

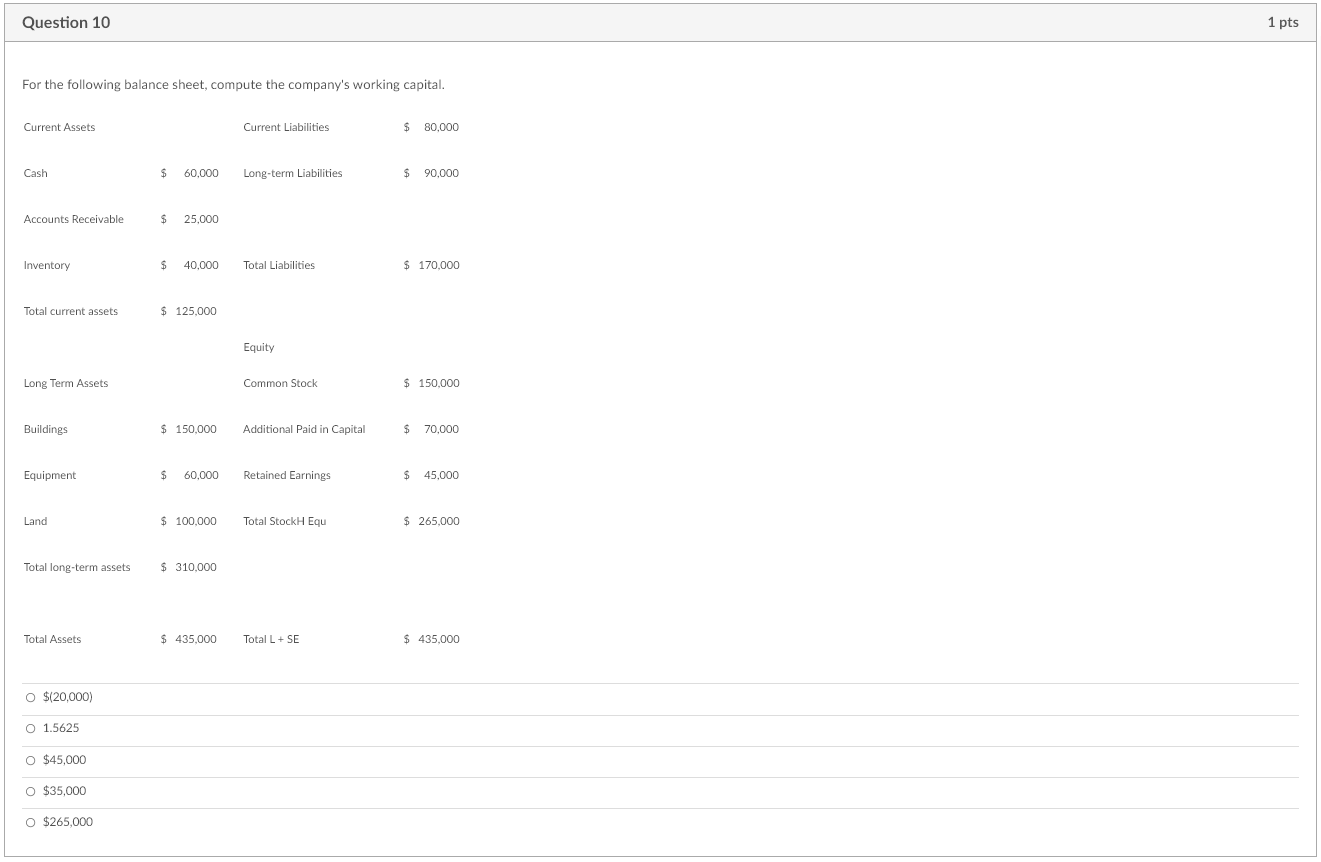

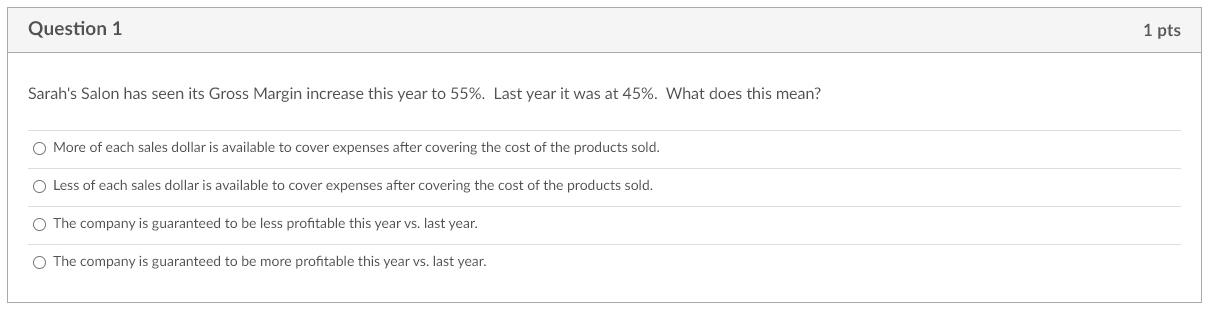

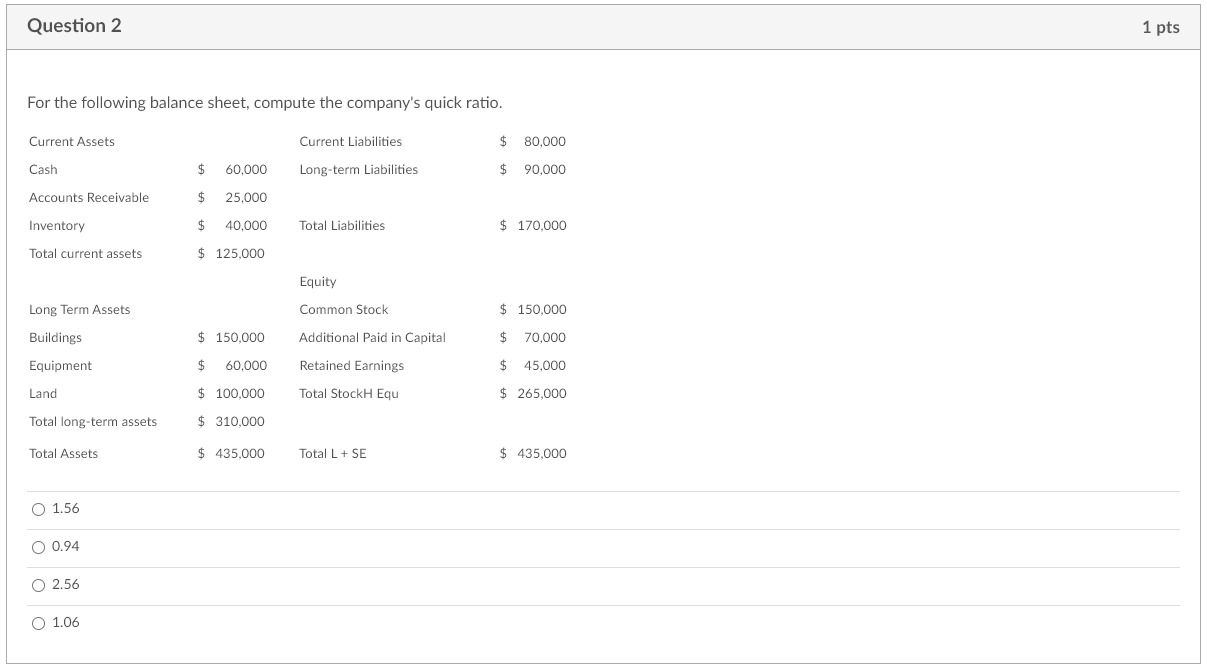

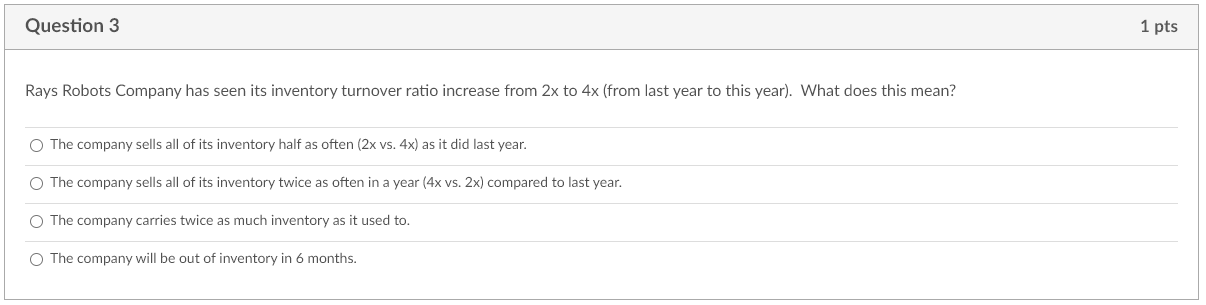

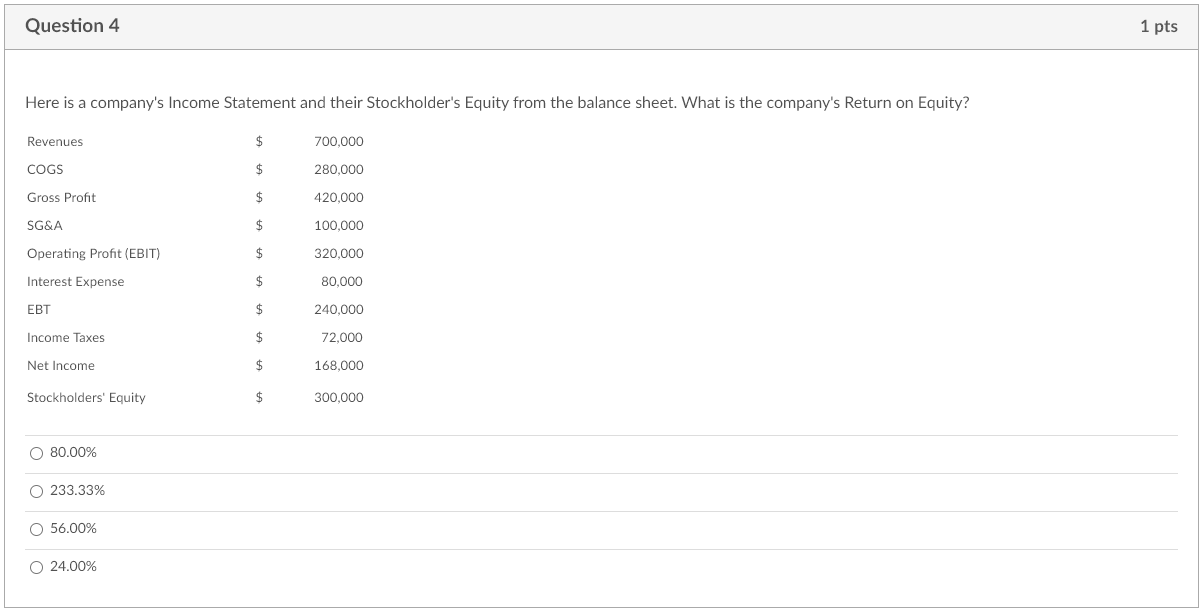

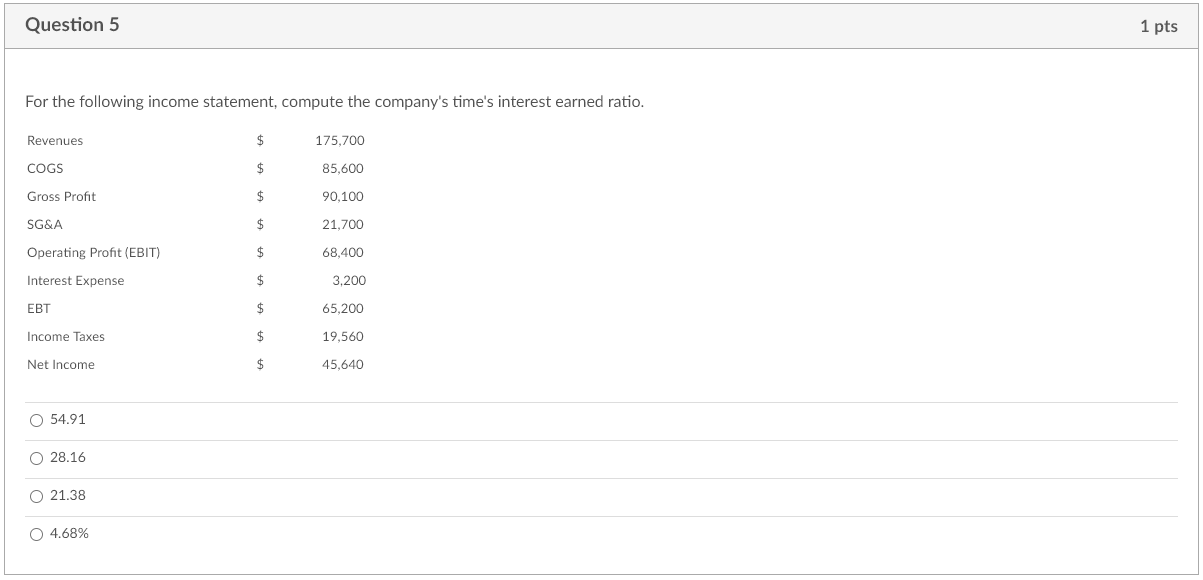

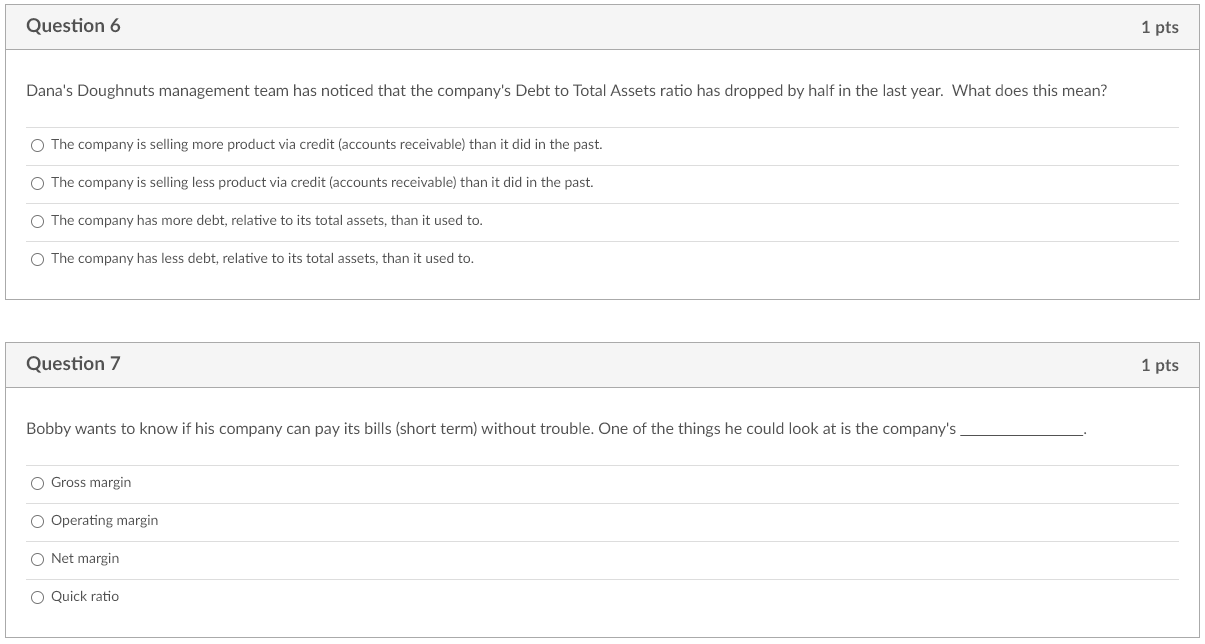

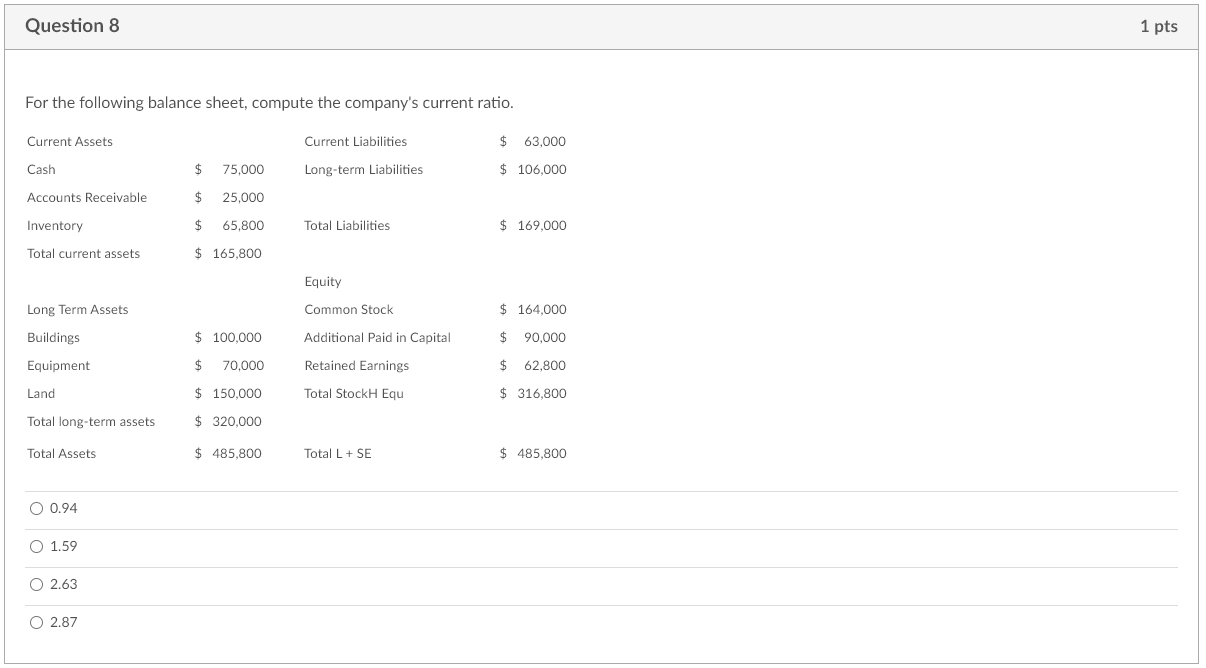

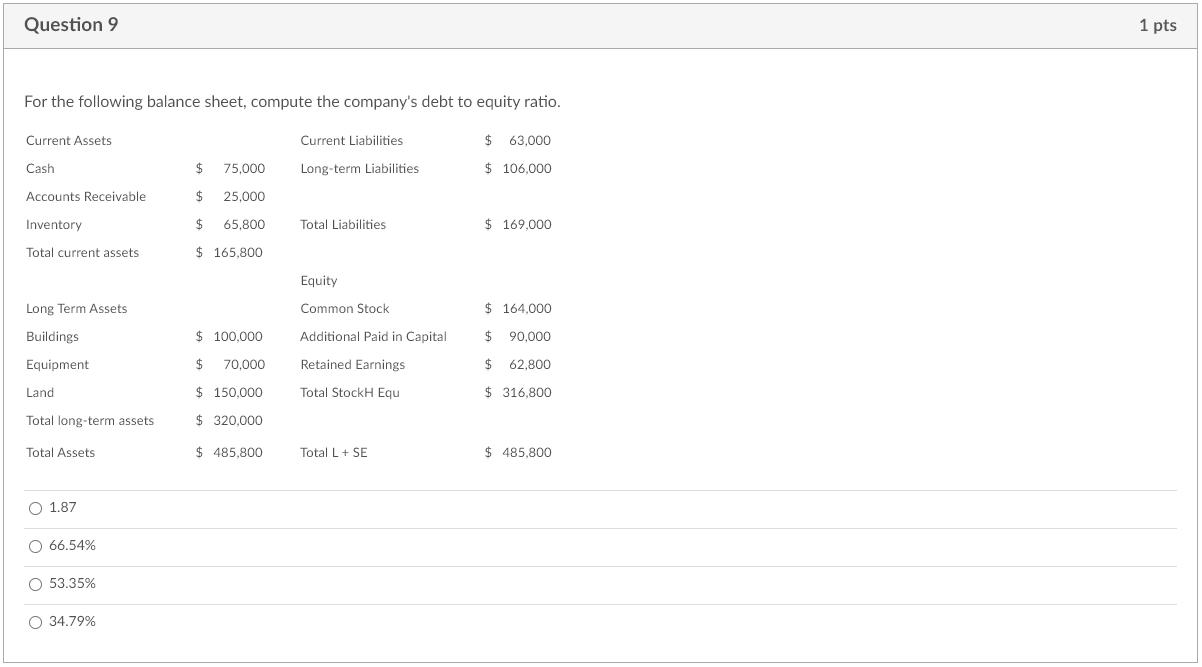

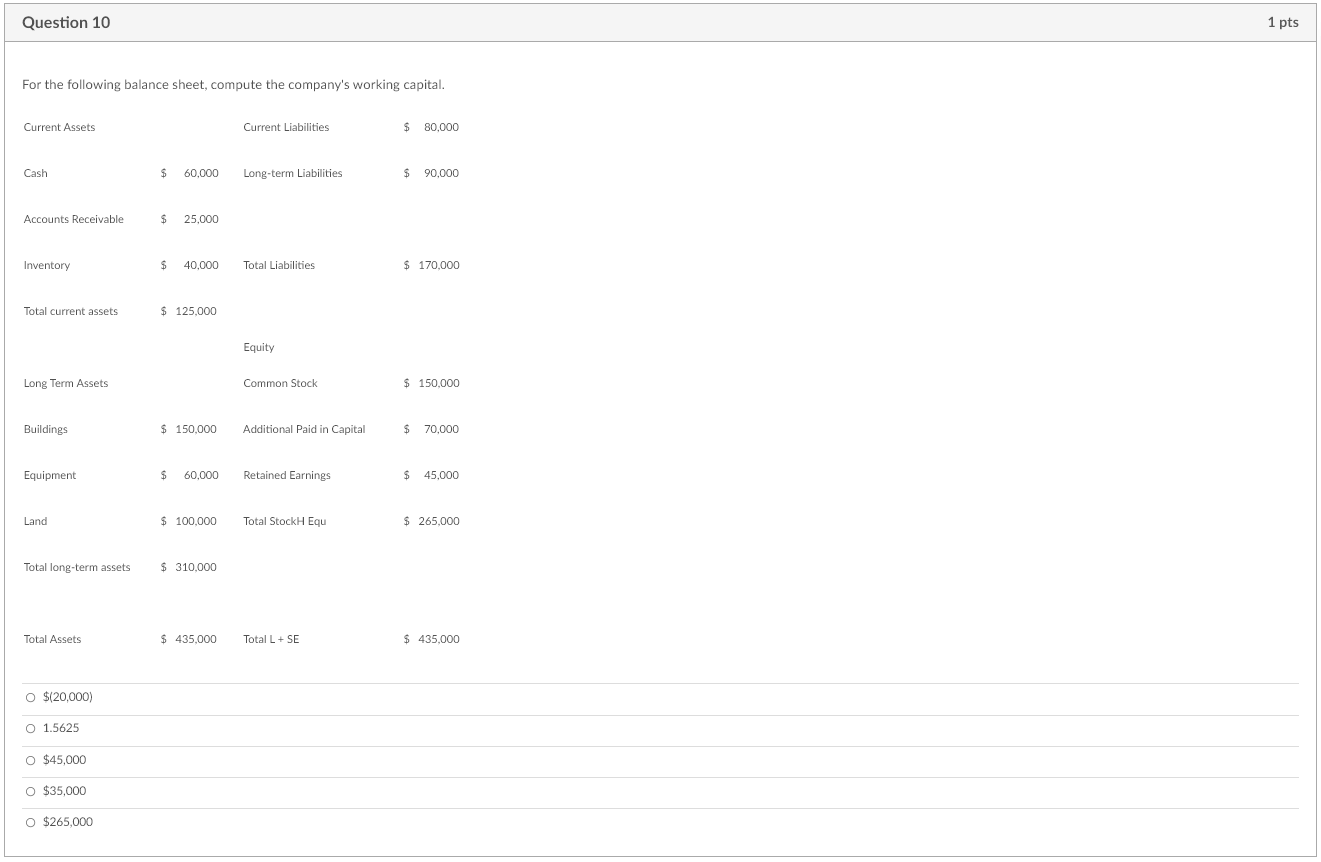

Question 1 1 pts Sarah's Salon has seen its Gross Margin increase this year to 55%. Last year it was at 45%. What does this mean? More of each sales dollar is available to cover expenses after covering the cost of the products sold. Less of each sales dollar is available to cover expenses after covering the cost of the products sold. The company is guaranteed to be less profitable this year vs. last year. The company is guaranteed to be more profitable this year vs. last year. Question 2 1 pts For the following balance sheet, compute the company's quick ratio. Current Assets Current Liabilities $ 80,000 Cash $ 60.000 Long-term Liabilities $ 90,000 Accounts Receivable $ 25,000 Inventory $ 40.000 Total Liabilities $ 170,000 Total current assets $ 125,000 Equity Long Term Assets Common Stock $ 150.000 Buildings $ 150.000 Additional Paid in Capital $ 70,000 Equipment $ 60.000 Retained Earnings $ 45,000 Land $ 100,000 Total Stock Equ $ 265,000 Total long-term assets $ 310,000 Total Assets $ 435,000 Total L + SE $ 435,000 O 1.56 O 0.94 0 2.56 O 1.06 Question 3 1 pts Rays Robots Company has seen its inventory turnover ratio increase from 2x to 4x (from last year to this year). What does this mean? The company sells all of its inventory half as often (2x vs. 4x) as it did last year. The company sells all of its inventory twice as often in a year (4x vs. 2x) compared to last year. O The company carries twice as much inventory as it used to. O The company will be out of inventory in 6 months. Question 4 1 pts Here is a company's Income Statement and their Stockholder's Equity from the balance sheet. What is the company's Return on Equity? Revenues $ 700.000 COGS $ 280,000 Gross Profit $ 420.000 SG&A $ 100,000 Operating Profit (EBIT) $ 320.000 Interest Expense $ 80,000 EBT $ 240.000 Income Taxes $ 72,000 Net Income $ 168.000 Stockholders' Equity $ 300.000 O 80.00% 233.33% 0 56.00% 0 24.00% Question 5 1 pts For the following income statement, compute the company's time's interest earned ratio. Revenues $ 175,700 COGS $ 85,600 Gross Profit $ 90,100 SG&A $ 21,700 Operating Profit (EBIT) $ 68,400 Interest Expense 3,200 EBT $ 65,200 Income Taxes $ 19,560 Net Income $ 45,640 O 54.91 O 28.16 O 21.38 O 4.68% Question 6 1 pts Dana's Doughnuts management team has noticed that the company's Debt to Total Assets ratio has dropped by half in the last year. What does this mean? The company is selling more product via credit (accounts receivable) than it did in the past. The company is selling less product via credit (accounts receivable) than it did in the past. The company has more debt, relative to its total assets, than it used to The company has less debt, relative to its total assets, than it used to. Question 7 1 pts Bobby wants to know if his company can pay its bills (short term) without trouble. One of the things he could look at is the company's O Gross margin o Operating margin O Net margin O Quick ratio Question 8 1 pts For the following balance sheet, compute the company's current ratio. Current Assets Current Liabilities $ 63,000 Cash 75,000 Long-term Liabilities $ 106,000 Accounts Receivable $ 25,000 Inventory $ 65,800 Total Liabilities $ 169,000 Total current assets $ 165,800 Equity Long Term Assets Common Stock $ 164,000 Buildings $ 100.000 Additional Paid in Capital $ 90,000 Equipment $ 70,000 Retained Earnings $ 62,800 Land $ 150,000 Total Stock Equ $ 316,800 Total long-term assets $ 320,000 Total Assets $ 485,800 Total L + SE $ 485,800 O 0.94 O 1.59 0 2.63 O 2.87 Question 9 1 pts For the following balance sheet, compute the company's debt to equity ratio. Current Assets Current Liabilities $ 63,000 Cash $ 75,000 Long-term Liabilities $ 106,000 Accounts Receivable $ 25.000 Inventory $ 65,800 Total Liabilities $ 169,000 Total current assets $ 165,800 Equity Long Term Assets Common Stock $ 164,000 Buildings $ 100,000 Additional Paid in Capital $ 90,000 Equipment $ 70,000 Retained Earnings $ 62,800 Land $ 150,000 Total Stock Equ $ 316,800 Total long-term assets $ 320,000 Total Assets $ 485,800 Total L + SE $ 485,800 O 1.87 O 66.54% 0 53.35% O 34.79% Question 10 1 pts For the following balance sheet, compute the company's working capital. Current Assets Current Liabilities $ 80,000 Cash $ 60,000 Long-term Liabilities $ 90,000 Accounts Receivable $ 25,000 Inventory $ 40,000 Total Liabilities $ 170,000 Total current assets $ 125.000 Equity Long Term Assets Common Stock $ 150.000 Buildings $ 150,000 Additional Paid in Capital $ 70,000 Equipment $ 60,000 Retained Earnings $ 45.000 Land $ 100.000 Total Stock Equ $ 265.000 Total long-term assets $ 310,000 Total Assets Total Assets $ 435.000 Total L + SE $ 435.000 O $(20,000) O 1.5625 O $45,000 O $35,000 O $265,000