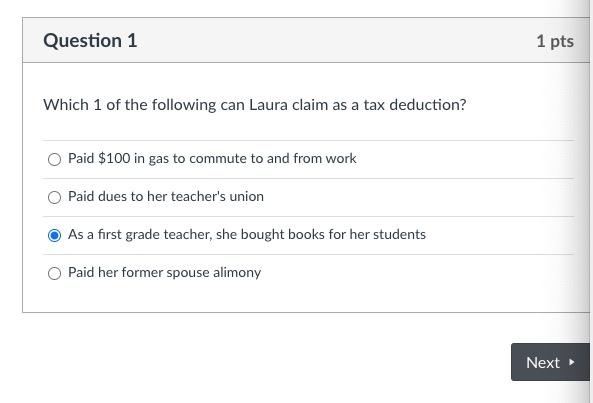

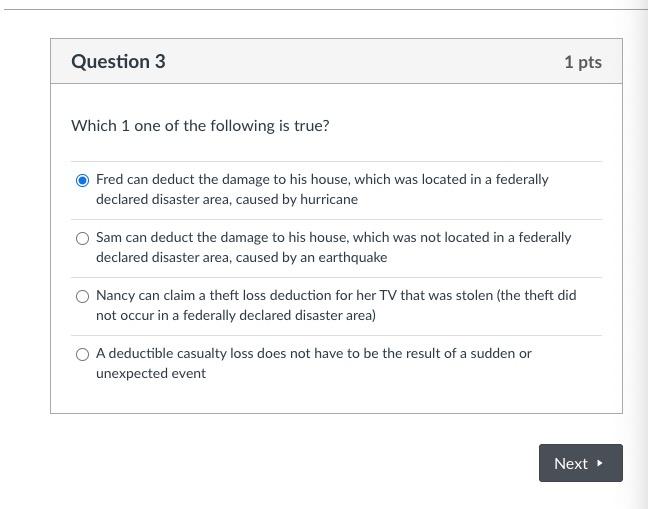

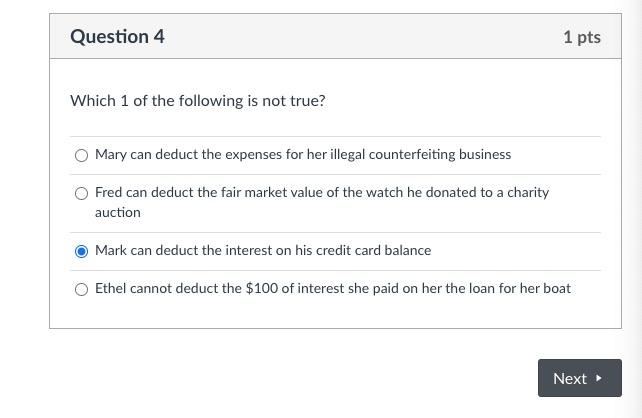

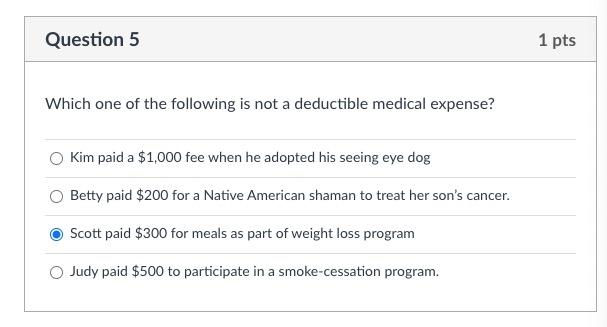

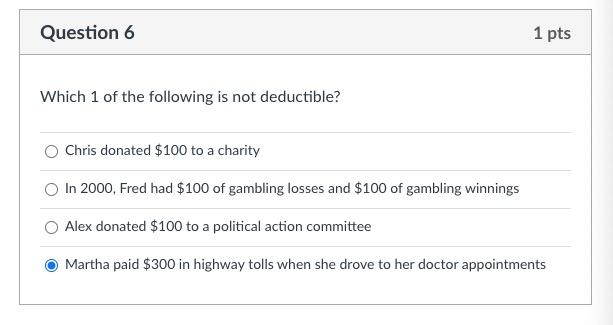

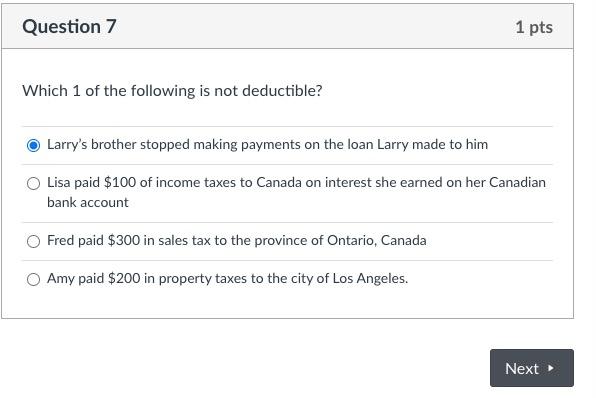

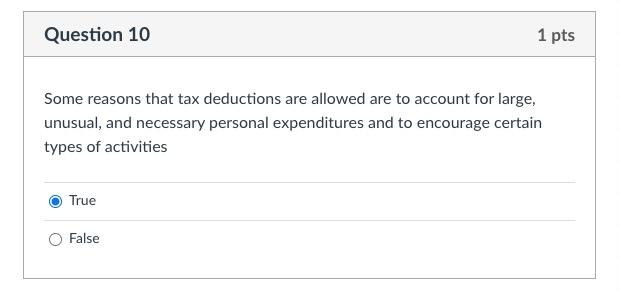

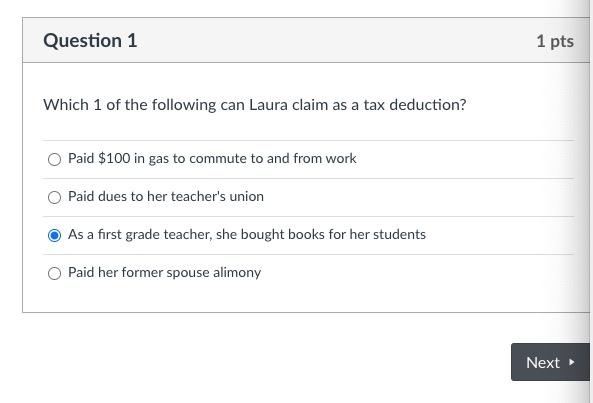

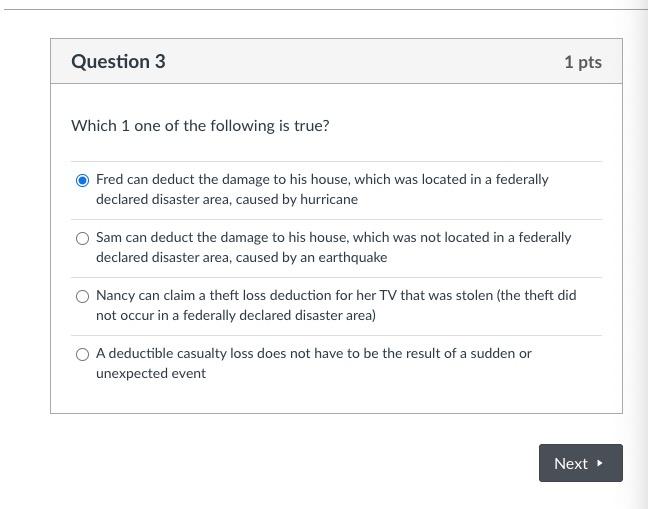

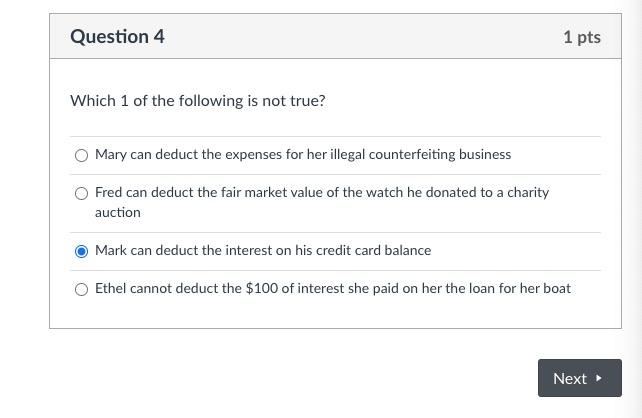

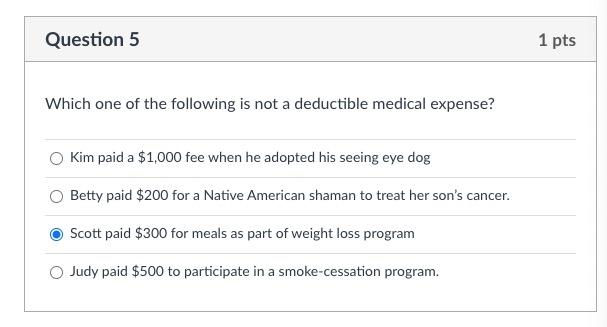

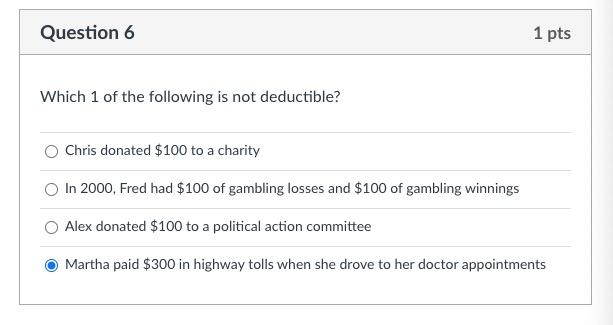

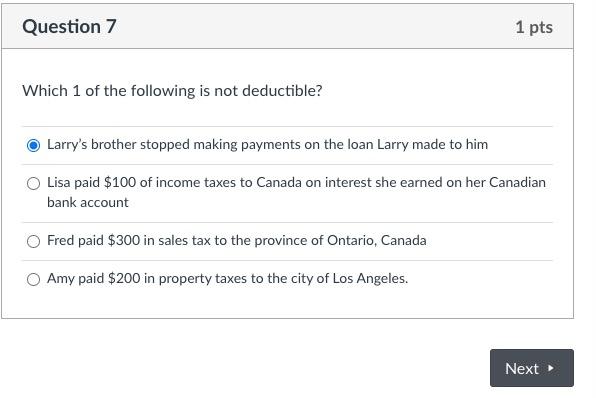

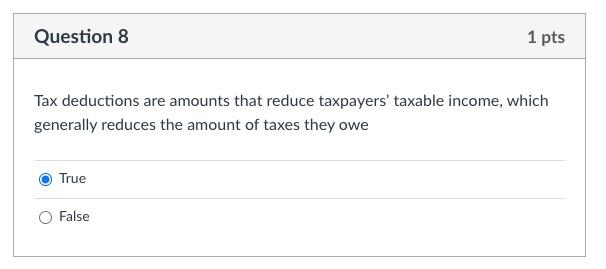

Question 1 1 pts Which 1 of the following can Laura claim as a tax deduction? Paid $100 in gas to commute to and from work Paid dues to her teacher's union As a first grade teacher, she bought books for her students Paid her former spouse alimony Next Question 3 1 pts Which 1 one of the following is true? Fred can deduct the damage to his house, which was located in a federally declared disaster area, caused by hurricane Sam can deduct the damage to his house, which was not located in a federally declared disaster area, caused by an earthquake Nancy can claim a theft loss deduction for her TV that was stolen (the theft did not occur in a federally declared disaster area) A deductible casualty loss does not have to be the result of a sudden or unexpected event Next Question 4 1 pts Which 1 of the following is not true? Mary can deduct the expenses for her illegal counterfeiting business Fred can deduct the fair market value of the watch he donated to a charity auction Mark can deduct the interest on his credit card balance Ethel cannot deduct the $100 of interest she paid on her the loan for her boat Next Question 5 1 pts Which one of the following is not a deductible medical expense? Kim paid a $1,000 fee when he adopted his seeing eye dog Betty paid $200 for a Native American shaman to treat her son's cancer. Scott paid $300 for meals as part of weight loss program Judy paid $500 to participate in a smoke-cessation program. Question 6 1 pts Which 1 of the following is not deductible? Chris donated $100 to a charity In 2000, Fred had $100 of gambling losses and $100 of gambling winnings Alex donated $100 to a political action committee Martha paid $300 in highway tolls when she drove to her doctor appointments Question 7 1 pts Which 1 of the following is not deductible? Larry's brother stopped making payments on the loan Larry made to him Lisa paid $100 of income taxes to Canada on interest she earned on her Canadian bank account Fred paid $300 in sales tax to the province of Ontario, Canada Amy paid $200 in property taxes to the city of Los Angeles. Next Question 8 1 pts Tax deductions are amounts that reduce taxpayers' taxable income, which generally reduces the amount of taxes they owe True False Question 9 1 pts Tax deductions are disallowed unless specifically allowed under federal tax laws True False Next Question 10 1 pts Some reasons that tax deductions are allowed are to account for large, unusual, and necessary personal expenditures and to encourage certain types of activities True False