Answered step by step

Verified Expert Solution

Question

1 Approved Answer

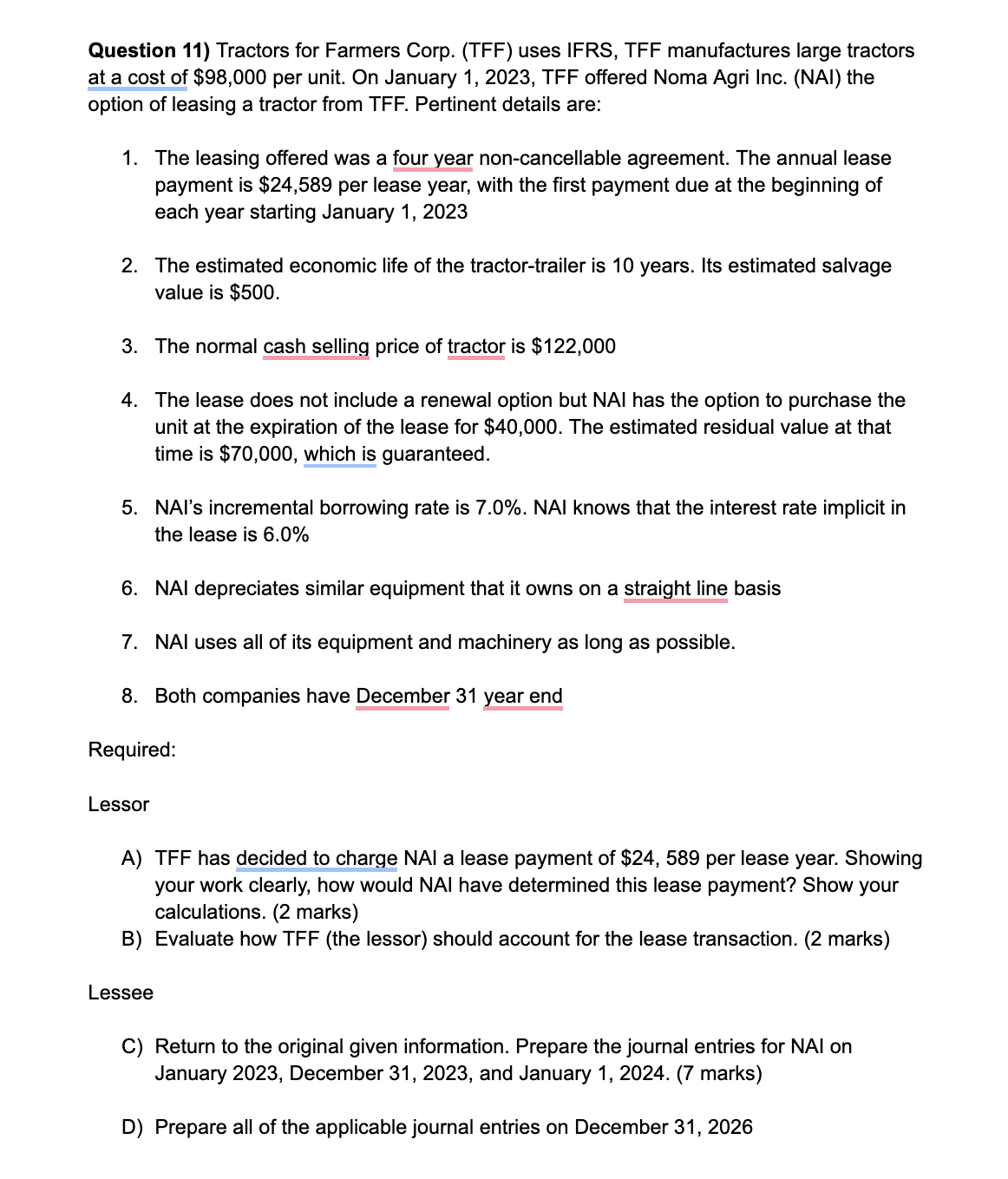

Question 1 1 ) Tractors for Farmers Corp. ( TFF ) uses IFRS, TFF manufactures large tractors at a cost of $ 9 8 ,

Question Tractors for Farmers Corp. TFF uses IFRS, TFF manufactures large tractors

at a cost of $ per unit. On January TFF offered Noma Agri Inc. NAI the

option of leasing a tractor from TFF Pertinent details are:

The leasing offered was a four year noncancellable agreement. The annual lease

payment is $ per lease year, with the first payment due at the beginning of

each year starting January

The estimated economic life of the tractortrailer is years. Its estimated salvage

value is $

The normal cash selling price of tractor is $

The lease does not include a renewal option but NAI has the option to purchase the

unit at the expiration of the lease for $ The estimated residual value at that

time is $ which is guaranteed.

NAI's incremental borrowing rate is NAI knows that the interest rate implicit in

the lease is

NAI depreciates similar equipment that it owns on a straight line basis

NAI uses all of its equipment and machinery as long as possible.

Both companies have December year end

Required:

Lessor

A TFF has decided to charge NAI a lease payment of $ per lease year. Showing

your work clearly, how would NAI have determined this lease payment? Show your

calculations. marks

B Evaluate how TFF the lessor should account for the lease transaction. marks

Lessee

C Return to the original given information. Prepare the journal entries for NAI on

January December and January marks

D Prepare all of the applicable journal entries on December

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started