Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Using the Excel spreadsheet in the course page, please answer the following questions: 1) Volkswagen multiple (P/E ratio) is 16.3, while the industry average

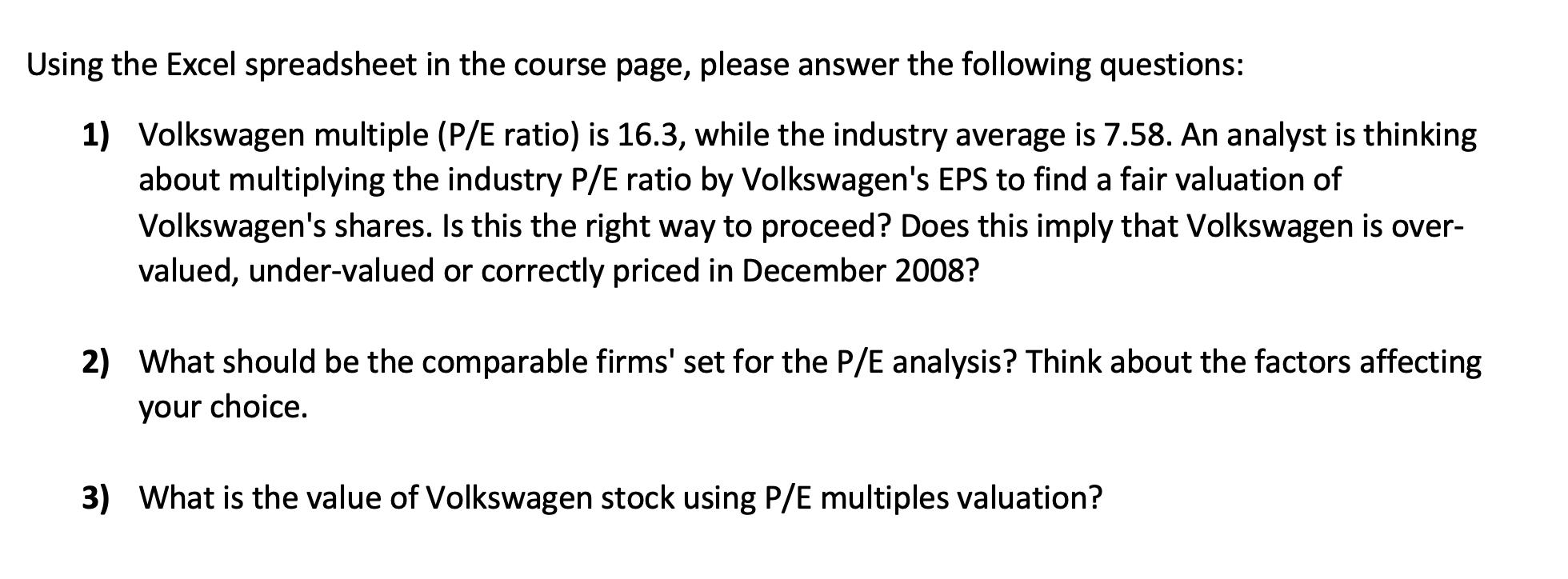

Using the Excel spreadsheet in the course page, please answer the following questions: 1) Volkswagen multiple (P/E ratio) is 16.3, while the industry average is 7.58. An analyst is thinking about multiplying the industry P/E ratio by Volkswagen's EPS to find a fair valuation of Volkswagen's shares. Is this the right way to proceed? Does this imply that Volkswagen is over- valued, under-valued or correctly priced in December 2008? 2) What should be the comparable firms' set for the P/E analysis? Think about the factors affecting your choice. 3) What is the value of Volkswagen stock using P/E multiples valuation?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To assess if the method mentioned by the analyst is appropriate and whether Volkswagen is overvalued undervalued or correctly priced follow these step...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started