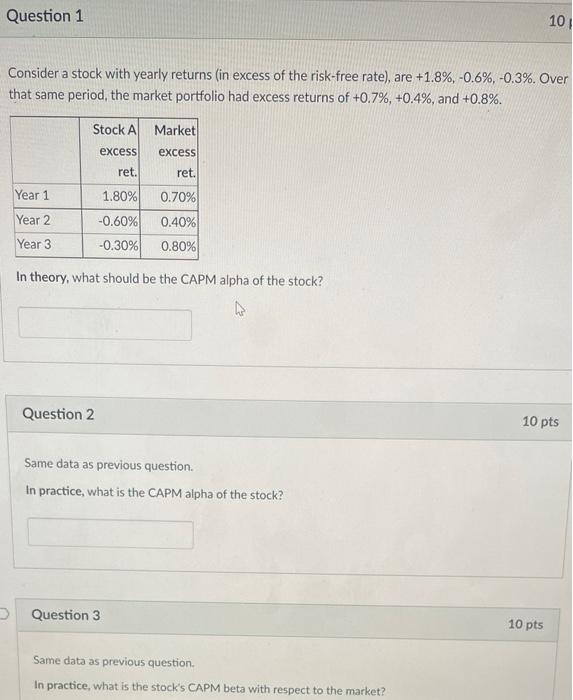

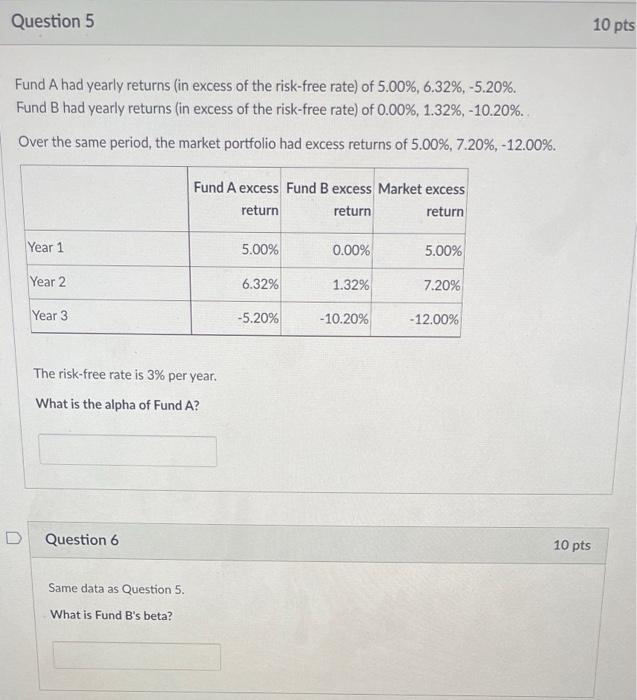

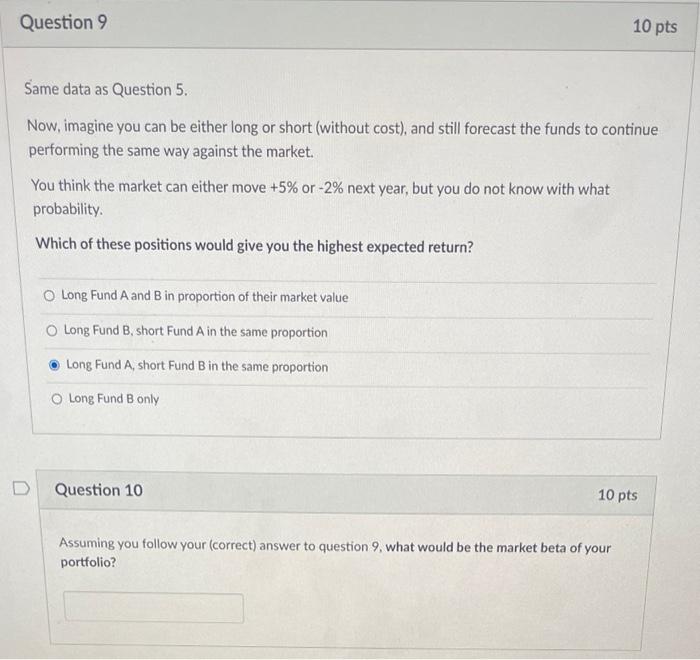

Question 1 10 Consider a stock with yearly returns (in excess of the risk-free rate), are +1.8%, -0.6%, -0,3%. Over that same period, the market portfolio had excess returns of +0.7%, +0.4%, and +0.8%. Stock Al Market excess excess ret. ret. Year 1 1.80% 0.70% Year 2 0.40% -0.60% -0.30% Year 3 0.80% In theory, what should be the CAPM alpha of the stock? Question 2 10 pts Same data as previous question. In practice, what is the CAPM alpha of the stock? Question 3 10 pts Same data as previous question In practice, what is the stock's CAPM beta with respect to the market? Question 5 10 pts Fund Ahad yearly returns (in excess of the risk-free rate) of 5.00%, 6.32%, -5.20%. Fund B had yearly returns (in excess of the risk-free rate) of 0.00%, 1.32%, -10.20%. Over the same period, the market portfolio had excess returns of 5.00%, 7.20%, -12.00%. Fund A excess Fund B excess Market excess return return return Year 1 5.00% 0.00% 5.00% Year 2 6.32% 1.32% 7.20% Year 3 -5.20% -10.20% -12.00% The risk-free rate is 3% per year. What is the alpha of Fund A? D Question 6 10 pts Same data as Question 5. What is Fund B's beta? Question 9 10 pts Same data as Question 5. Now, imagine you can be either long or short (without cost), and still forecast the funds to continue performing the same way against the market. You think the market can either move +5% or -2% next year, but you do not know with what probability Which of these positions would give you the highest expected return? O Long Fund A and B in proportion of their market value O Long Fund B, short Fund A in the same proportion Long Fund A, short Fund B in the same proportion O Long Fund B only D Question 10 10 pts Assuming you follow your correct) answer to question 9, what would be the market beta of your portfolio? Question 1 10 Consider a stock with yearly returns (in excess of the risk-free rate), are +1.8%, -0.6%, -0,3%. Over that same period, the market portfolio had excess returns of +0.7%, +0.4%, and +0.8%. Stock Al Market excess excess ret. ret. Year 1 1.80% 0.70% Year 2 0.40% -0.60% -0.30% Year 3 0.80% In theory, what should be the CAPM alpha of the stock? Question 2 10 pts Same data as previous question. In practice, what is the CAPM alpha of the stock? Question 3 10 pts Same data as previous question In practice, what is the stock's CAPM beta with respect to the market? Question 5 10 pts Fund Ahad yearly returns (in excess of the risk-free rate) of 5.00%, 6.32%, -5.20%. Fund B had yearly returns (in excess of the risk-free rate) of 0.00%, 1.32%, -10.20%. Over the same period, the market portfolio had excess returns of 5.00%, 7.20%, -12.00%. Fund A excess Fund B excess Market excess return return return Year 1 5.00% 0.00% 5.00% Year 2 6.32% 1.32% 7.20% Year 3 -5.20% -10.20% -12.00% The risk-free rate is 3% per year. What is the alpha of Fund A? D Question 6 10 pts Same data as Question 5. What is Fund B's beta? Question 9 10 pts Same data as Question 5. Now, imagine you can be either long or short (without cost), and still forecast the funds to continue performing the same way against the market. You think the market can either move +5% or -2% next year, but you do not know with what probability Which of these positions would give you the highest expected return? O Long Fund A and B in proportion of their market value O Long Fund B, short Fund A in the same proportion Long Fund A, short Fund B in the same proportion O Long Fund B only D Question 10 10 pts Assuming you follow your correct) answer to question 9, what would be the market beta of your portfolio