Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 (10 marks) Bartowski Ltd. is a Canadian controlled private tech support company. It has a December 31 year end and has been a

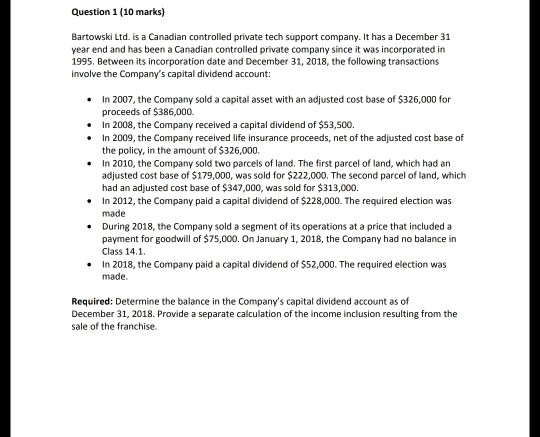

Question 1 (10 marks) Bartowski Ltd. is a Canadian controlled private tech support company. It has a December 31 year end and has been a Canadian controlled private company since it was incorporated in 1995, Between its incorporation date and December 31, 2018, the following transactions involve the Company's capital dividend account: In 2007, the Company sold a capital asset with an adjusted cost base of $326,000 for proceeds of $386,000. .In 2008, the Company received a capital dividend of $53,500. .In 2009, the Company received life insurance proceeds, net of the adjusted cost base of the policy, in the amount of $326,000. .In 2010, the Company sold two parcels of land. The first parcel of land, which had an adjusted cost base of $179,000, was sold for $222,000. The second parcel of land, which had an adjusted cost base of $347,000, was sold for $313,000. In 2012, the Company paid a capital dividend of $228,000. The required election was During 2018, the Company sold a segment of its operations at a price that included a payment for goodwill of $75,000. On January 1, 2018, the Company had no balance in Class 14.1. .In 2018, the Company paid a capital dividend of $52,000. The required election was Required: Determine the balance in the Company's capital dividend account as of December 31, 2018. Provide a separate calculation of the income inclusion resulting from the sale of the franchise. Question 1 (10 marks) Bartowski Ltd. is a Canadian controlled private tech support company. It has a December 31 year end and has been a Canadian controlled private company since it was incorporated in 1995, Between its incorporation date and December 31, 2018, the following transactions involve the Company's capital dividend account: In 2007, the Company sold a capital asset with an adjusted cost base of $326,000 for proceeds of $386,000. .In 2008, the Company received a capital dividend of $53,500. .In 2009, the Company received life insurance proceeds, net of the adjusted cost base of the policy, in the amount of $326,000. .In 2010, the Company sold two parcels of land. The first parcel of land, which had an adjusted cost base of $179,000, was sold for $222,000. The second parcel of land, which had an adjusted cost base of $347,000, was sold for $313,000. In 2012, the Company paid a capital dividend of $228,000. The required election was During 2018, the Company sold a segment of its operations at a price that included a payment for goodwill of $75,000. On January 1, 2018, the Company had no balance in Class 14.1. .In 2018, the Company paid a capital dividend of $52,000. The required election was Required: Determine the balance in the Company's capital dividend account as of December 31, 2018. Provide a separate calculation of the income inclusion resulting from the sale of the franchise

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started