Question

Question 1. (10 marks) Busted Ltd has determined the following estimated levels of EBIT along with the probability of these occurring. It has on issue

Question 1. (10 marks)

Busted Ltd has determined the following estimated levels of EBIT along with the probability of these occurring. It has on issue 80,000 shares which are currently selling at $40 each and presently has no debt. It is considering scenarios of introducing 10%, 20%, 30%, 40%, 50% and 60% levels debt. The total capital structure would remain the same with the debt replacing share capital. The company tax rate is 30%.

Busted has determined the following probabilities

| Probability of EBIT | ||

| 100 | ($000s) | 10% |

| 200 | ($000s) | 15% |

| 300 | ($000s) | 35% |

| 400 | ($000s) | 15% |

| 500 | ($000s) | 20% |

| 600 | ($000s) | 5% |

The cost of debt for each ratio (interest rate) is as follows

| Debt | Debt |

| Ratio | % |

| 0% | 0.000 |

| 10% | 0.080 |

| 20% | 0.095 |

| 30% | 0.100 |

| 40% | 0.115 |

| 50% | 0.140 |

| 60% | 0.170 |

- Compute the EPS for each expected level of EBIT. Which structure maximises EPS?

- Compute the standard deviation and coefficient of variation of EPS for all the levels. I.e. 0%, 10%, 20%, 30%, 40%, 50% and 60%. What conclusions can you draw from these measures of risk?

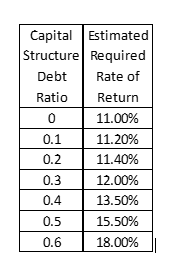

The firm also considers that the required rate of return on ordinary shares is related to its coefficient of variation on earnings per share.

- For each capital structure, what is the value of an ordinary share? Use the following earnings valuation model. Po = EPS/rs

- Which capital structure maximises shareholder wealth?

e. Compare the capital structure selected in a above with that in d and discuss the implications of your findings.

0 Capital Estimated Structure Required Debt Rate of Ratio Return 11.00% 0.1 11.20% 0.2 11.40% 0.3 12.00% 0.4 13.50% 0.5 15.50% 0.6 18.00% | 0 Capital Estimated Structure Required Debt Rate of Ratio Return 11.00% 0.1 11.20% 0.2 11.40% 0.3 12.00% 0.4 13.50% 0.5 15.50% 0.6 18.00% |Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started