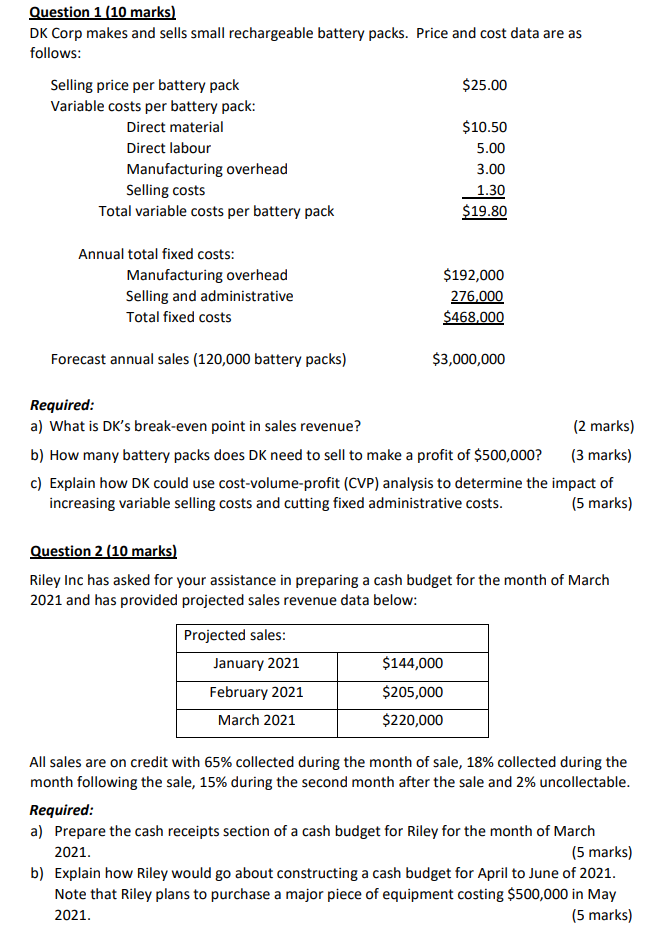

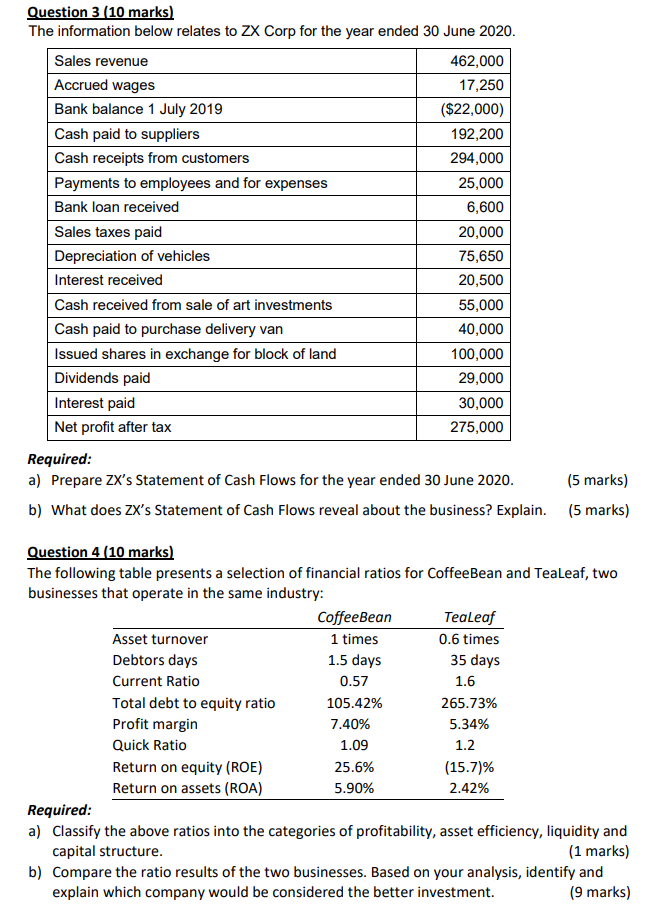

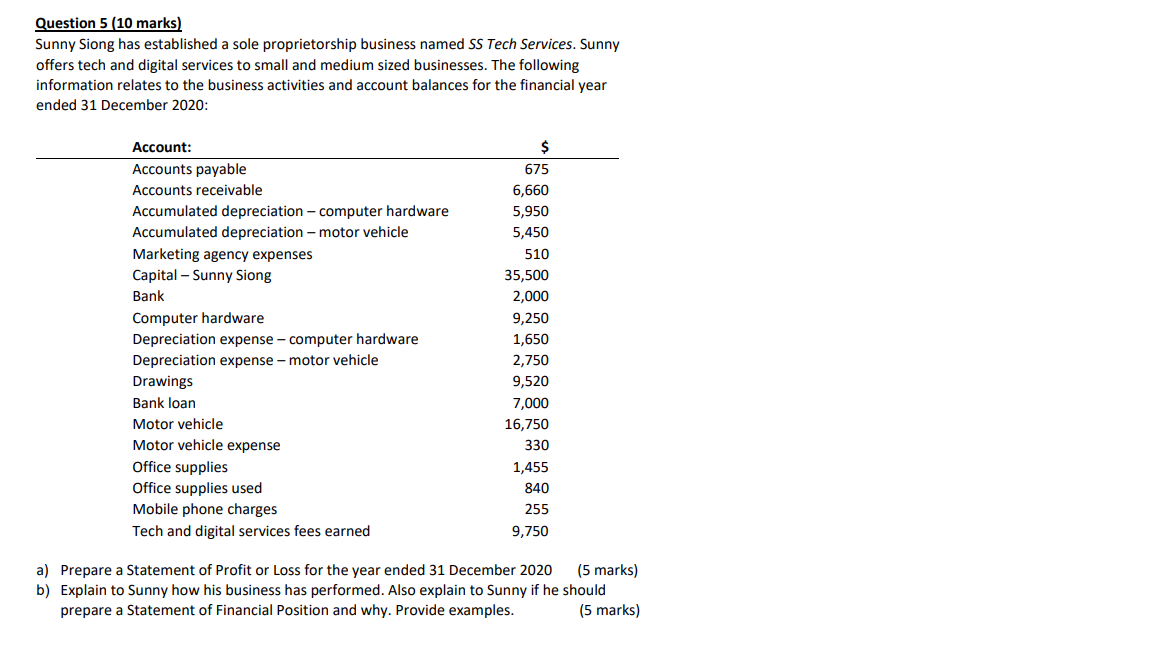

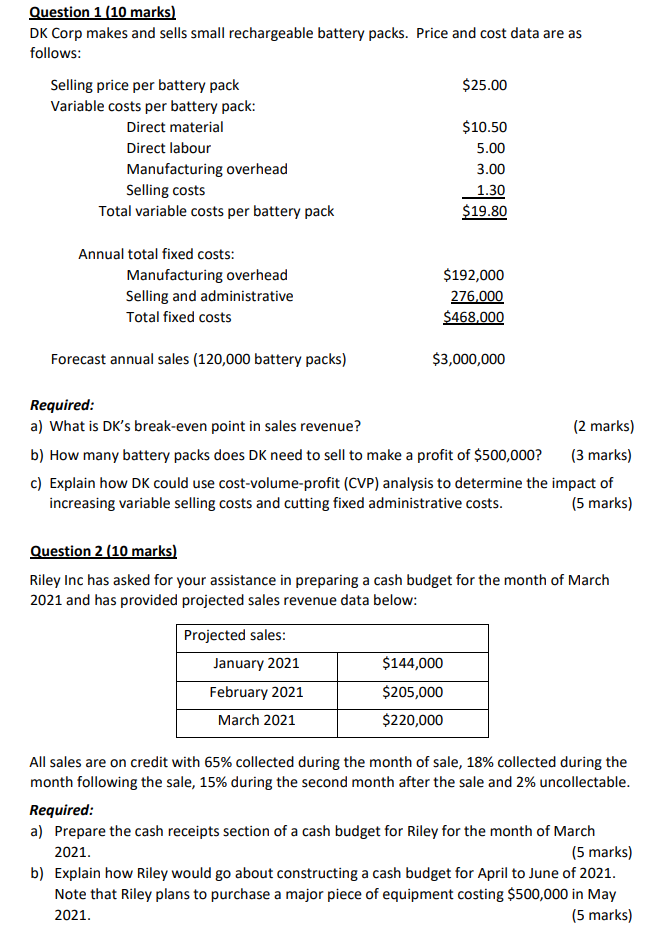

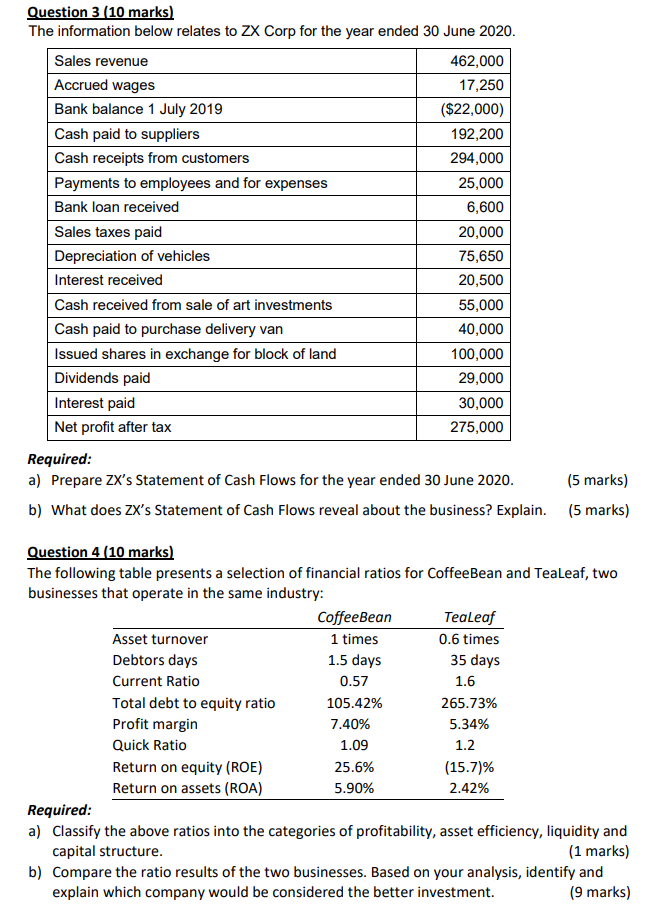

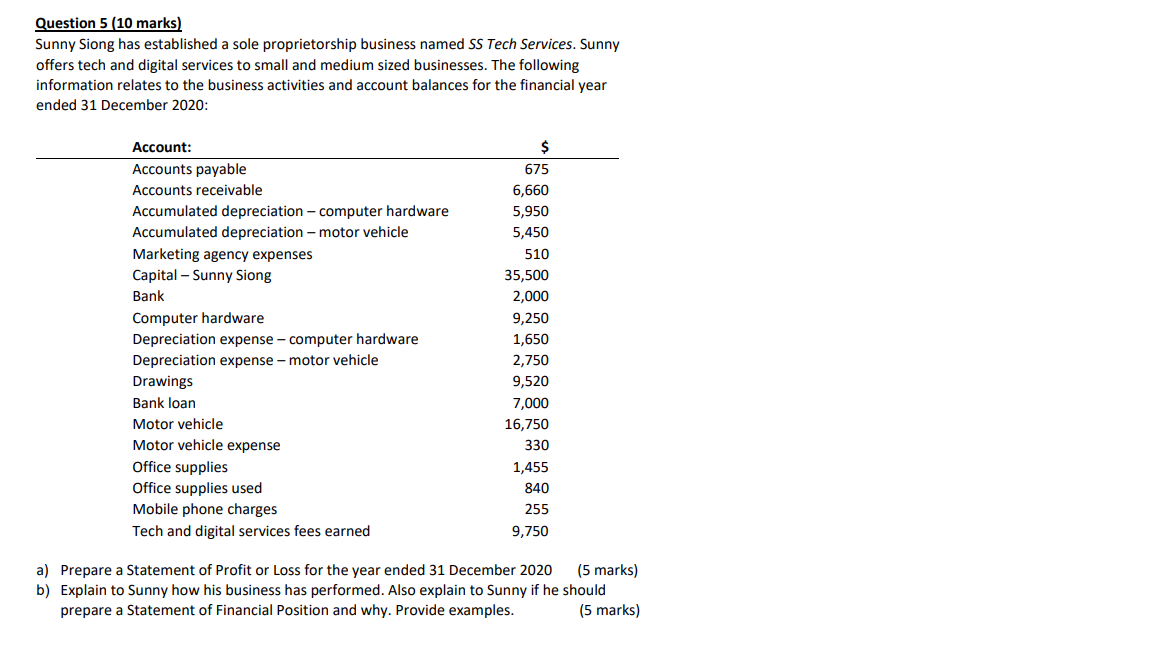

Question 1 (10 marks) DK Corp makes and sells small rechargeable battery packs. Price and cost data are as follows: Selling price per battery pack $25.00 Variable costs per battery pack: Direct material $10.50 Direct labour 5.00 Manufacturing overhead 3.00 Selling costs 1.30 Total variable costs per battery pack $19.80 Annual total fixed costs: Manufacturing overhead Selling and administrative Total fixed costs $192,000 276,000 $468,000 Forecast annual sales (120,000 battery packs) $3,000,000 Required: a) What is DK's break-even point in sales revenue? (2 marks) b) How many battery packs does DK need to sell to make a profit of $500,000? (3 marks) c) Explain how DK could use cost-volume-profit (CVP) analysis to determine the impact of increasing variable selling costs and cutting fixed administrative costs. (5 marks) Question 2 (10 marks) Riley Inc has asked for your assistance in preparing a cash budget for the month of March 2021 and has provided projected sales revenue data below: $144,000 Projected sales: January 2021 February 2021 March 2021 $205,000 $220,000 All sales are on credit with 65% collected during the month of sale, 18% collected during the month following the sale, 15% during the second month after the sale and 2% uncollectable. Required: a) Prepare the cash receipts section of a cash budget for Riley for the month of March 2021. (5 marks) b) Explain how Riley would go about constructing a cash budget for April to June of 2021. Note that Riley plans to purchase a major piece of equipment costing $500,000 in May 2021. (5 marks) Question 3 (10 marks) The information below relates to ZX Corp for the year ended 30 June 2020. Sales revenue 462,000 Accrued wages 17,250 Bank balance 1 July 2019 ($22,000) Cash paid to suppliers 192,200 Cash receipts from customers 294,000 Payments to employees and for expenses 25,000 Bank loan received 6,600 Sales taxes paid 20,000 Depreciation of vehicles 75,650 Interest received 20,500 Cash received from sale of art investments 55,000 Cash paid to purchase delivery van 40,000 Issued shares in exchange for block of land 100,000 Dividends paid 29,000 Interest paid 30,000 Net profit after tax 275,000 Required: a) Prepare ZX's Statement of Cash Flows for the year ended 30 June 2020. (5 marks) b) What does ZX's Statement of Cash Flows reveal about the business? Explain. (5 marks) Question 4 (10 marks) The following table presents a selection of financial ratios for CoffeeBean and Tealeaf, two businesses that operate in the same industry: Coffee Bean TeaLeaf Asset turnover 1 times 0.6 times Debtors days 1.5 days 35 days Current Ratio 0.57 1.6 Total debt to equity ratio 105.42% 265.73% Profit margin 7.40% 5.34% Quick Ratio 1.09 1.2 Return on equity (ROE) 25.6% (15.7)% Return on assets (ROA) 5.90% 2.42% Required: a) Classify the above ratios into the categories of profitability, asset efficiency, liquidity and capital structure. (1 marks) b) Compare the ratio results of the two businesses. Based on your analysis, identify and explain which company would be considered the better investment. (9 marks) Question 5 (10 marks) Sunny Siong has established a sole proprietorship business named SS Tech Services. Sunny offers tech and digital services to small and medium sized businesses. The following information relates to the business activities and account balances for the financial year ended 31 December 2020: $ 675 6,660 5,950 5,450 Account: Accounts payable Accounts receivable Accumulated depreciation - computer hardware Accumulated depreciation - motor vehicle Marketing agency expenses Capital - Sunny Siong Bank Computer hardware Depreciation expense - computer hardware Depreciation expense - motor vehicle Drawings Bank loan Motor vehicle Motor vehicle expense Office supplies Office supplies used Mobile phone charges Tech and digital services fees earned 510 35,500 2,000 9,250 1,650 2,750 9,520 7,000 16,750 330 1,455 840 255 9,750 a) Prepare a statement of Profit or Loss for the year ended 31 December 2020 (5 marks) b) Explain to Sunny how his business has performed. Also explain to Sunny if he should prepare a statement of Financial Position and why. Provide examples