Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 1 10 marks) Monkey Mia Ltd is having a bad year in 2014 as the company has incurred a R4.9 bilion net loss. The

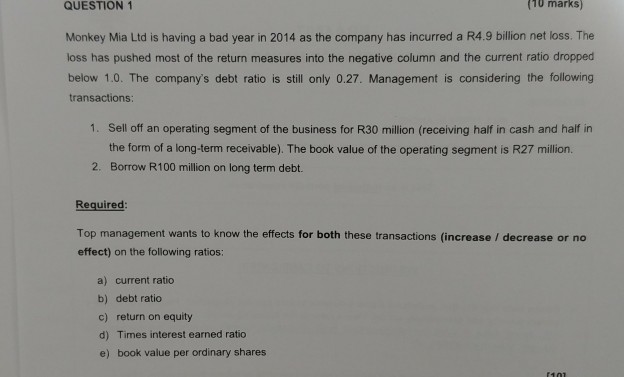

QUESTION 1 10 marks) Monkey Mia Ltd is having a bad year in 2014 as the company has incurred a R4.9 bilion net loss. The loss has pushed most of the return measures into the negative column and the current ratio dropped below 1.0. The company's debt ratio is still only 0.27. Management is considering the following transactions: Sell off an operating segment of the business for R30 million (receiving half in cash and half in the form of a long-term receivable). The book value of the operating segment is R27 million. Borrow R100 million on long term debt. 1. 2. Required: Top management wants to know the effects for both these transactions (increase decrease or no effect) on the following ratios: a) current ratio b) debt ratio c) return on equity d) Times interest earned ratio e) book value per ordinary shares

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started