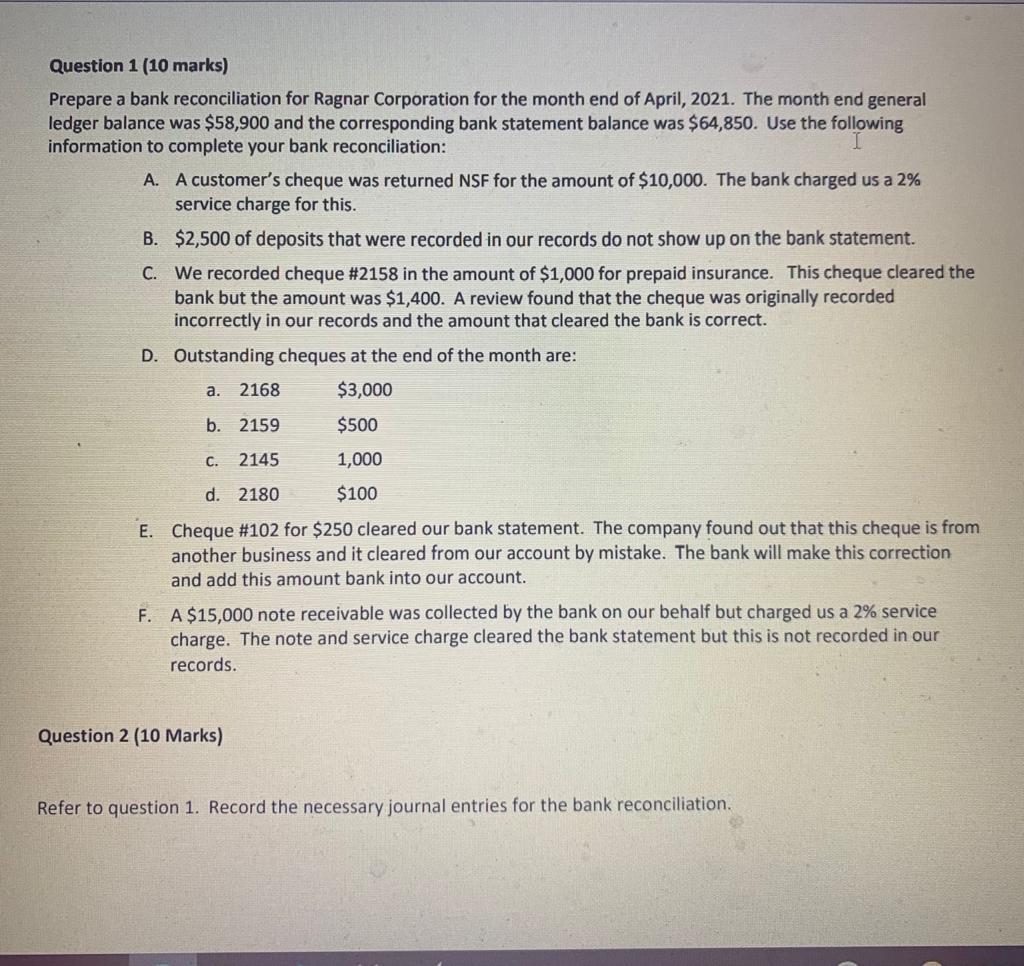

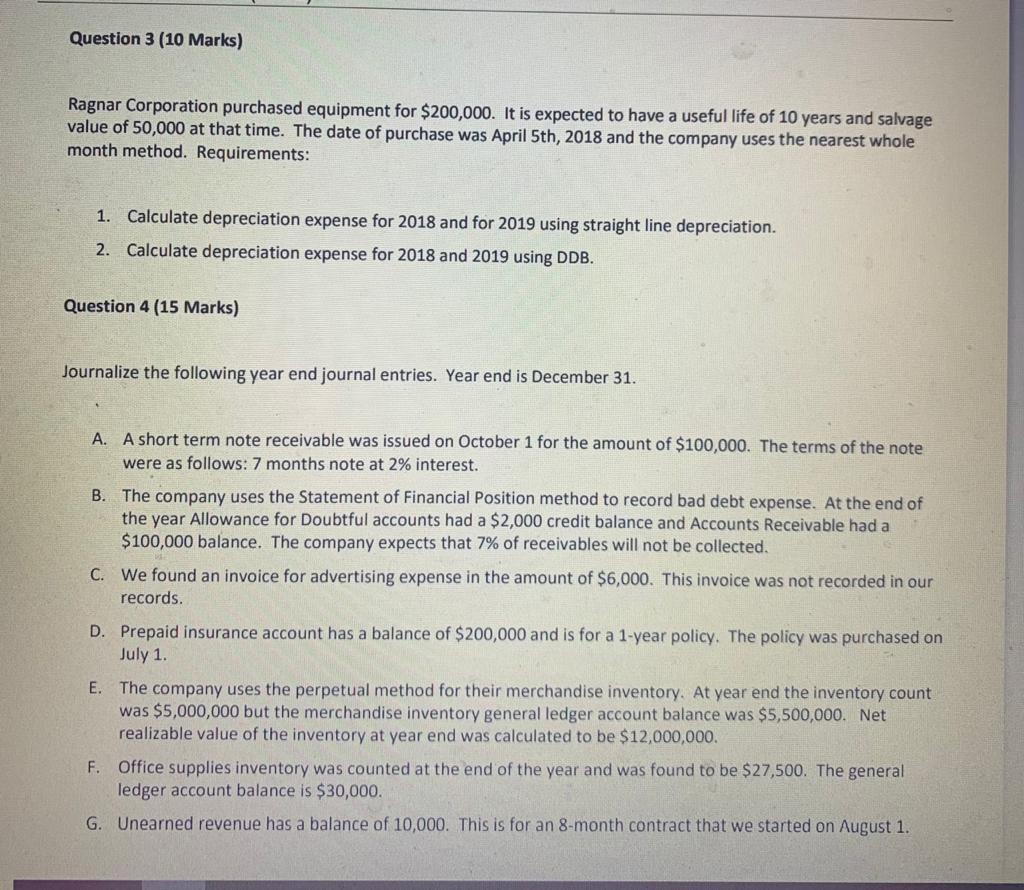

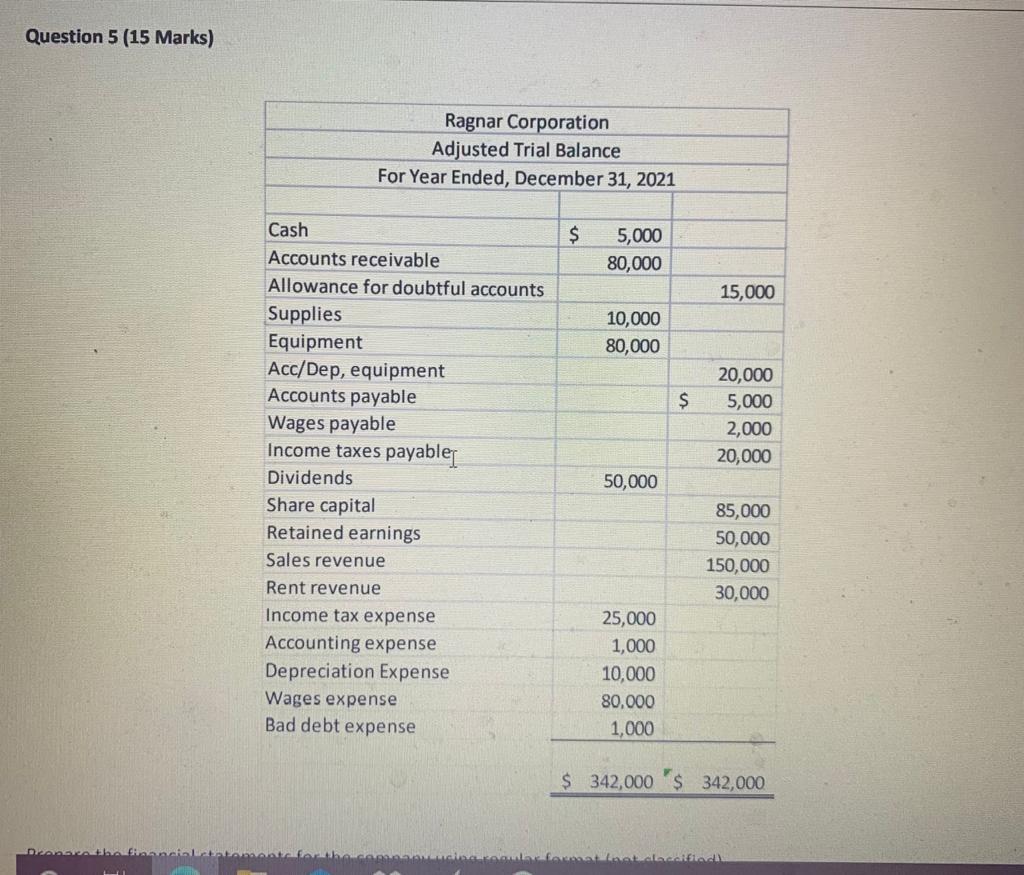

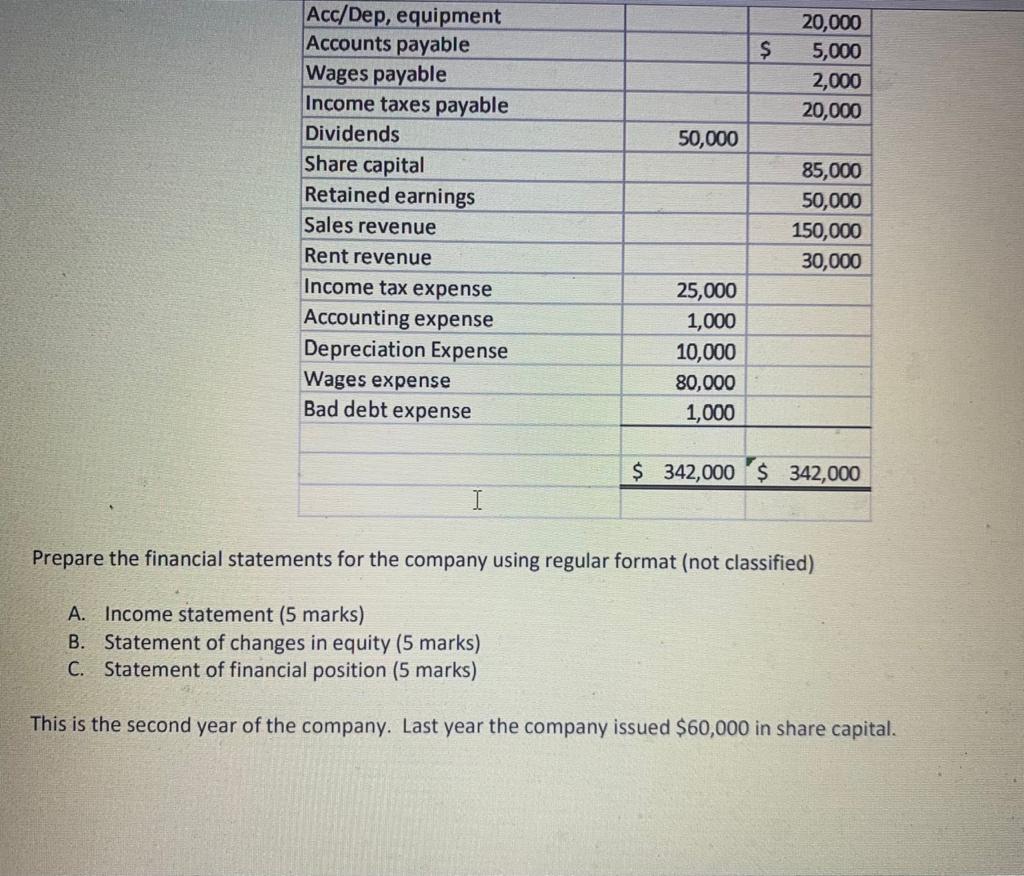

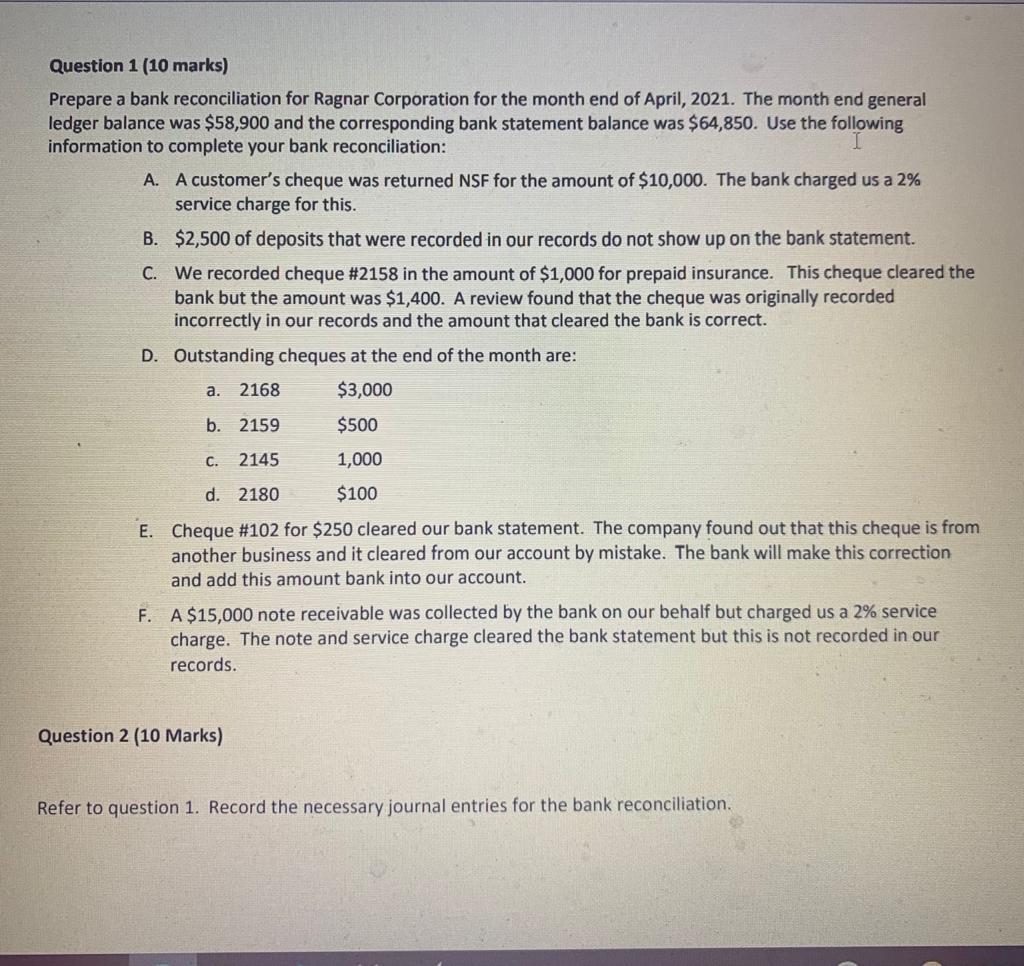

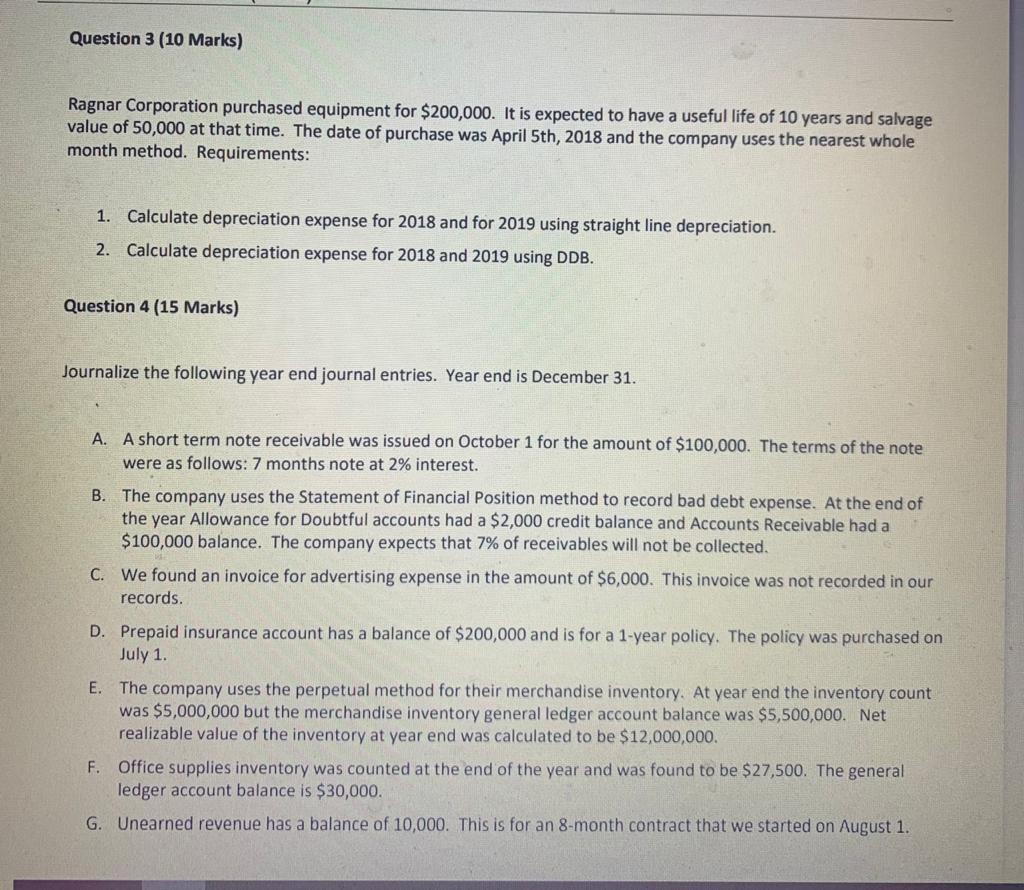

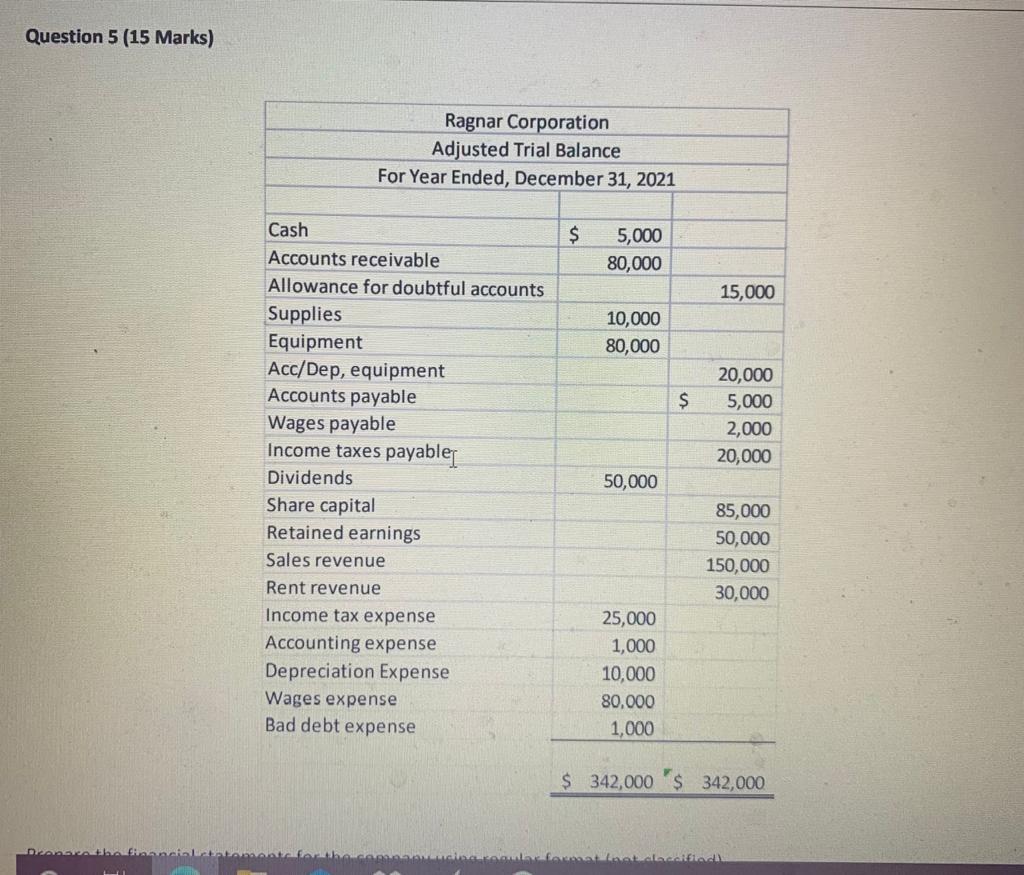

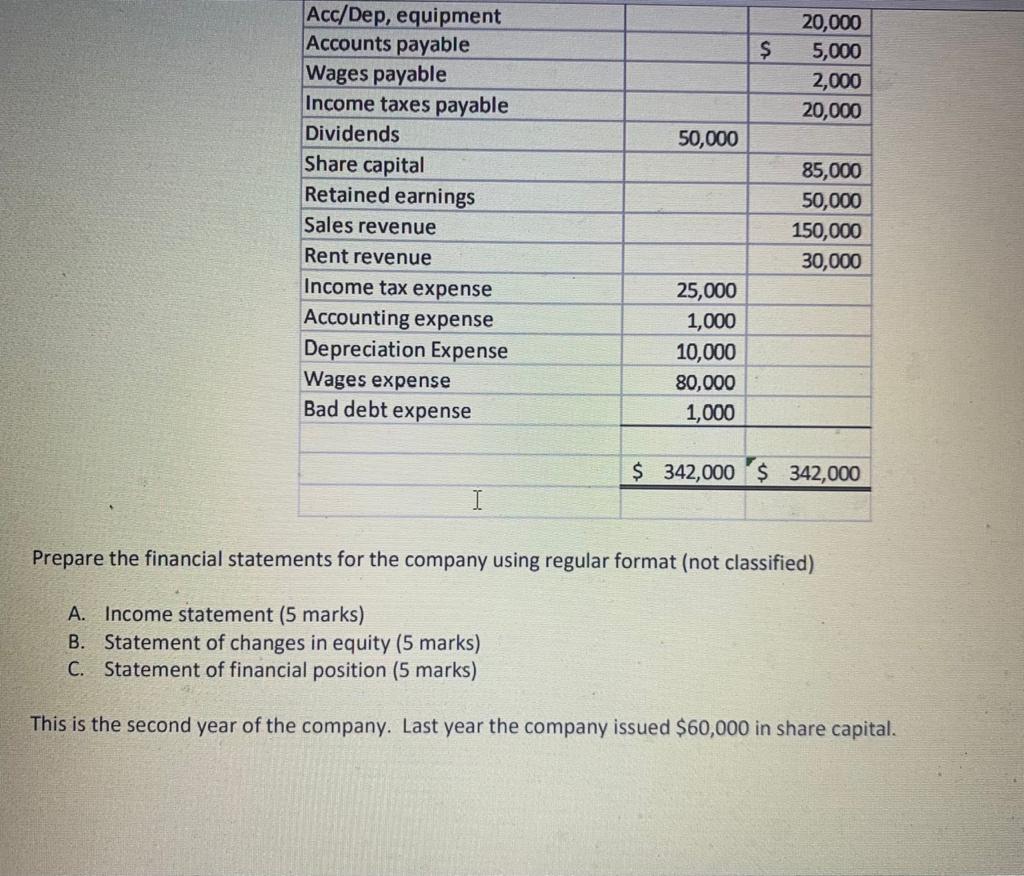

Question 1 (10 marks) Prepare a bank reconciliation for Ragnar Corporation for the month end of April, 2021. The month end general ledger balance was $58,900 and the corresponding bank statement balance was $64,850. Use the following information to complete your bank reconciliation: I A. A customer's cheque was returned NSF for the amount of $10,000. The bank charged us a 2% service charge for this. B. $2,500 of deposits that were recorded in our records do not show up on the bank statement. C. We recorded cheque #2158 in the amount of $1,000 for prepaid insurance. This cheque cleared the bank but the amount was $1,400. A review found that the cheque was originally recorded incorrectly in our records and the amount that cleared the bank is correct. D. Outstanding cheques at the end of the month are: a. 2168 $3,000 b. 2159 $500 C. 2145 1,000 $100 d. 2180 E. Cheque #102 for $250 cleared our bank statement. The company found out that this cheque is from another business and it cleared from our account by mistake. The bank will make this correction and add this amount bank into our account. F. A $15,000 note receivable was collected by the bank on our behalf but charged us a 2% service charge. The note and service charge cleared the bank statement but this is not recorded in our records. Question 2 (10 Marks) Refer to question 1. Record the necessary journal entries for the bank reconciliation. Question 3 (10 Marks) Ragnar Corporation purchased equipment for $200,000. It is expected to have a useful life of 10 years and salvage value of 50,000 at that time. The date of purchase was April 5th, 2018 and the company uses the nearest whole month method. Requirements: 1. Calculate depreciation expense for 2018 and for 2019 using straight line depreciation. 2. Calculate depreciation expense for 2018 and 2019 using DDB. Question 4 (15 Marks) Journalize the following year end journal entries. Year end is December 31. A. A short term note receivable was issued on October 1 for the amount of $100,000. The terms of the note were as follows: 7 months note at 2% interest. B. The company uses the Statement of Financial Position method to record bad debt expense. At the end of the year Allowance for Doubtful accounts had a $2,000 credit balance and Accounts Receivable had a $100,000 balance. The company expects that 7% of receivables will not be collected. C. We found an invoice for advertising expense in the amount of $6,000. This invoice was not recorded in our records. D. Prepaid insurance account has a balance of $200,000 and is for a 1-year policy. The policy was purchased on July 1. E. The company uses the perpetual method for their merchandise inventory. At year end the inventory count was $5,000,000 but the merchandise inventory general ledger account balance was $5,500,000. Net realizable value of the inventory at year end was calculated to be $12,000,000. F. Office supplies inventory was counted at the end of the year and was found to be $27,500. The general ledger account balance is $30,000. G. Unearned revenue has a balance of 10,000. This is for an 8-month contract that we started on August 1. Question 5 (15 Marks) Ragnar Corporation Adjusted Trial Balance For Year Ended, December 31, 2021 $ 5,000 80,000 15,000 10,000 80,000 $ 20,000 5,000 2,000 20,000 Cash Accounts receivable Allowance for doubtful accounts Supplies Equipment Acc/Dep, equipment Accounts payable Wages payable Income taxes payable Dividends Share capital Retained earnings Sales revenue Rent revenue Income tax expense Accounting expense Depreciation Expense Wages expense Bad debt expense 50,000 85,000 50,000 150,000 30,000 25,000 1,000 10,000 80,000 1,000 $ 342,000 $ 342,000 . stad $ 20,000 5,000 2,000 20,000 50,000 Acc/Dep, equipment Accounts payable Wages payable Income taxes payable Dividends Share capital Retained earnings Sales revenue Rent revenue Income tax expense Accounting expense Depreciation Expense Wages expense Bad debt expense 85,000 50,000 150,000 30,000 25,000 1,000 10,000 80,000 1,000 $ 342,000$ 342,000 I Prepare the financial statements for the company using regular format (not classified) A. Income statement (5 marks) B. Statement of changes in equity (5 marks) C. Statement of financial position (5 marks) This is the second year of the company. Last year the company issued $60,000 in share capital