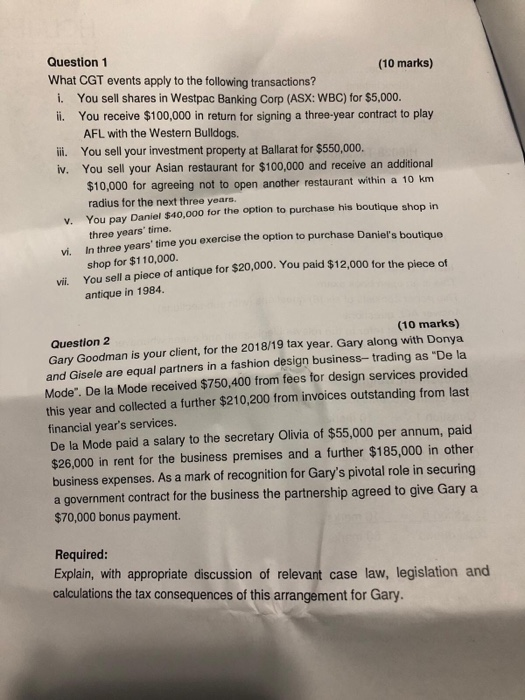

Question 1 (10 marks) What CGT events apply to the following transactions? i. You sell shares in Westpac Banking Corp (ASX: WBC) for $5,000. ii. You receive $100,000 in return for signing a three-year contract to play AFL with the Western Bulldogs. ii. You sell your investment property at Ballarat for $550,000. You sell your Asian restaurant for $100,000 and receive an additional iv. $10,000 for agreeing not to open another restaurant within a 10 km radius for the next three years. You pay Daniel $40,000 for the option to purchase his boutique shop in V. three years' time. In three years' time you exercise the option to purchase Daniel's boutique vi. shop for $110,000. You sell a piece of antique for $20,000. You paid $12,000 for the piece of vii. antique in 1984. (10 marks) Question 2 Gary Goodman is your client, for the 2018/19 tax year. Gary along with Donya and Gisele are equal partners in a fashion design business- trading as "De la Mode". De la Mode received $750,400 from fees for design services provided this year and collected a further $210,200 from invoices outstanding from last financial year's services. De la Mode paid a salary to the secretary Olivia of $55,000 per annum, paid $26,000 in rent for the business premises and a further $185,000 in other business expenses. As a mark of recognition for Gary's pivotal role in securing a government contract for the business the partnership agreed to give Gary a $70,000 bonus payment. Required: Explain, with appropriate discussion of relevant case law, legislation and calculations the tax consequences of this arrangement for Gary. Question 1 (10 marks) What CGT events apply to the following transactions? i. You sell shares in Westpac Banking Corp (ASX: WBC) for $5,000. ii. You receive $100,000 in return for signing a three-year contract to play AFL with the Western Bulldogs. ii. You sell your investment property at Ballarat for $550,000. You sell your Asian restaurant for $100,000 and receive an additional iv. $10,000 for agreeing not to open another restaurant within a 10 km radius for the next three years. You pay Daniel $40,000 for the option to purchase his boutique shop in V. three years' time. In three years' time you exercise the option to purchase Daniel's boutique vi. shop for $110,000. You sell a piece of antique for $20,000. You paid $12,000 for the piece of vii. antique in 1984. (10 marks) Question 2 Gary Goodman is your client, for the 2018/19 tax year. Gary along with Donya and Gisele are equal partners in a fashion design business- trading as "De la Mode". De la Mode received $750,400 from fees for design services provided this year and collected a further $210,200 from invoices outstanding from last financial year's services. De la Mode paid a salary to the secretary Olivia of $55,000 per annum, paid $26,000 in rent for the business premises and a further $185,000 in other business expenses. As a mark of recognition for Gary's pivotal role in securing a government contract for the business the partnership agreed to give Gary a $70,000 bonus payment. Required: Explain, with appropriate discussion of relevant case law, legislation and calculations the tax consequences of this arrangement for Gary