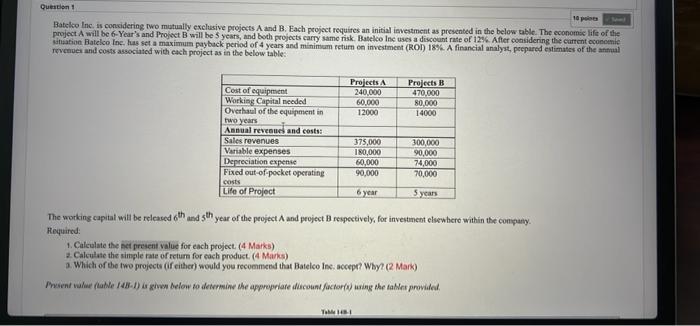

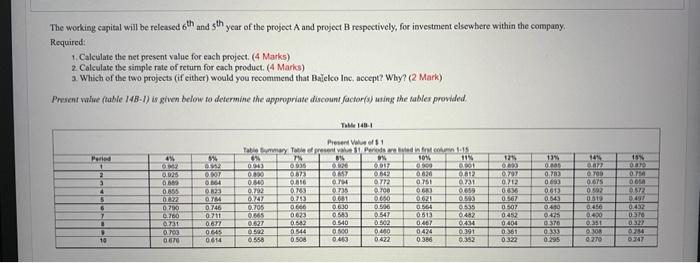

Question 1 10 points Batelco Inc. is considering two mutually exclusive projects A and B. Each project requires an initial investment as presented in the below table. The economic life of the project A will be 6-Year's and Project B will be 5 years, and both projects carry same risk. Batelco Inc uses a discount rate of 12%. After considering the current economic situation Batelco Inc. has set a maximum payback period of 4 years and minimum return on investment (ROI) 18%. A financial analyst, prepared estimates of the annual revenues and costs associated with each project as in the below table: Projects B Projects A 240,000 470,000 Cost of equipment Working Capital needed 60,000 80,000 Overhaul of the equipment in 12000 14000 two years Annual revenues and costs: Sales revenues 375,000 300,000 Variable expenses 180,000 90,000 Depreciation expense 60,000 74,000 Fixed out-of-pocket operating 90,000 70,000 costs Life of Project 6 year 5 years The working capital will be released 6th and 5th year of the project A and project B respectively, for investment elsewhere within the company. Required: 1. Calculate the net present value for each project. (4 Marks) 2. Calculate the simple rate of return for each product. (4 Marks) a. Which of the two projects (if either) would you recommend that Batelco Inc. accept? Why? (2 Mark) Present value (table 148-1) is given below to determine the appropriate discount factor(s) using the tables provided. T HB-I and sth. year of the project A and project B respectively, for investment elsewhere within the company. 1. Calculate the net present value for each project. (4 Marks) 2. Calculate the simple rate of return for each product. (4 Marks) 3. Which of the two projects (if either) would you recommend that Bajelco Inc. accept? Why? (2 Mark) Present value (table 14B-1) is given below to determine the appropriate discount factor(s) using the tables provided. Present Value of $1 Table Summary Table of present value $1. Periods are buted in first column 1-15 Period 4% 5% 6% 7% 8% 9% 10% 11% 13% 0.405 092 0552 0.943 0935 0.920 0.017 0909 0901 0.925 0.007 0800 0873 0.657 0842 0.826 0.812 0.783 3 0.869 0.864 6722 0.840 0816 0.704 0772 0.751 0693 coma 0.731 vse 4 0.855 4 0.702 0.763 0.735 0.708 0683 ves 0.659 0613 S 0822 0784 6.747 0.713 0.681 0.650 0621 0.590 0.543 0.790 0746 0.705 0600 0.630 0.506 0.564 spee 0535 0.450 0.760 0.711 0.665 00 0.583 0.547 0513 0.482 0425 0731 0677 0.627 0.582 0.540 0.502 0.467 0.434 0.376 0.703 0645 0.592 0.544 0500 0.400 0424 0.391 0.333 0.670 0614 0.558 0.508 0.463 0.422 0.386 0.352 0.295 The working capital will be released 6th, Required: 23 6 7 1 10 12% 0800 0.797 0712 0636 0.567 0507 0.452 0404 0.361 0.322 14% 6.877 6.700 0.675 0.592 0.519 0.456 0400 0.351 0308 0.270 15% 0870 0.714 0614 0572 0.497 0.432 0.376 0.327 0254 0347