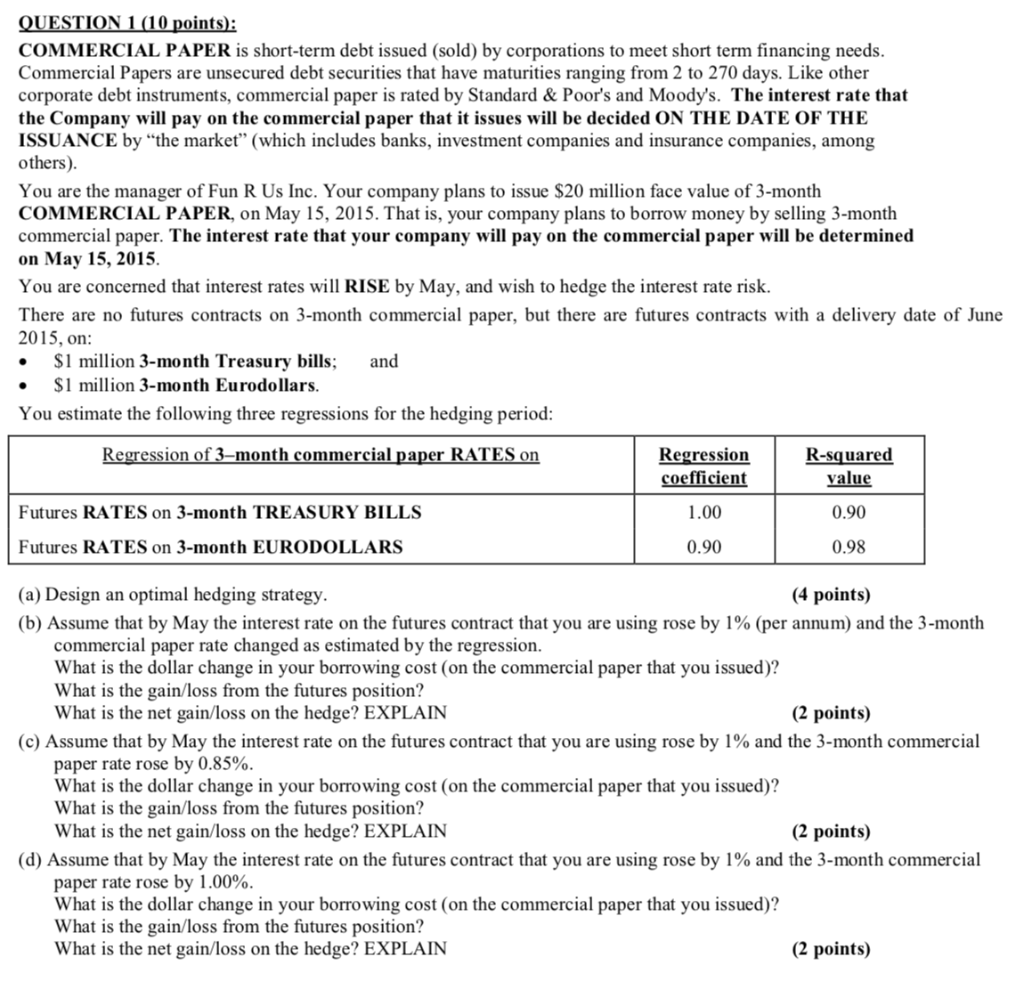

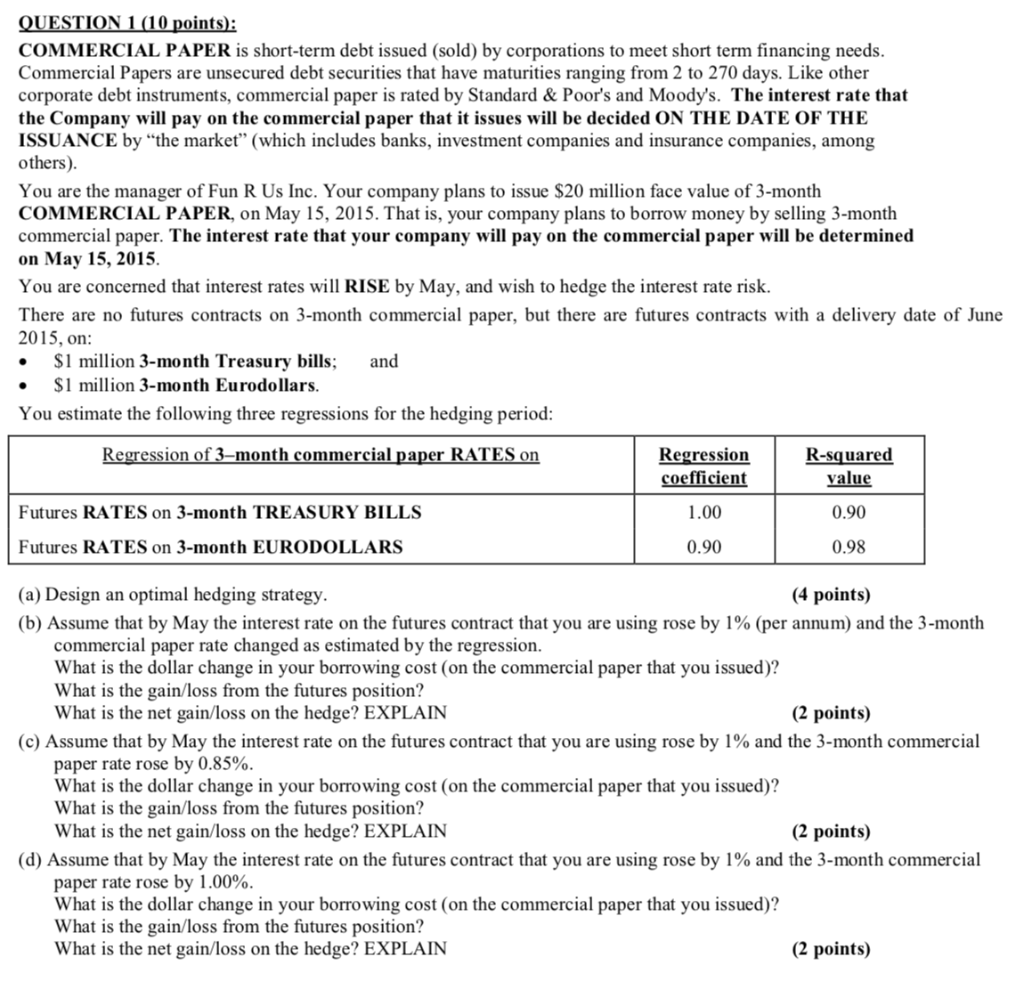

QUESTION 1 (10 points): COMMERCIAL PAPER is short-term debt issued (sold) by corporations to meet short term financing needs. Commercial Papers are unsecured debt securities that have maturities ranging from 2 to 270 days. Like other corporate debt instruments, commercial paper is rated by Standard & Poor's and Moody's. The interest rate that the Company will pay on the commercial paper that it issues will be decided ON THE DATE OF THE ISSUANCE by "the market" (which includes banks, investment companies and insurance companies, among others) You are the manager of Fun R Us Inc. Your company plans to issue $20 million face value of 3-month COMMERCIAL PAPER, on May 15, 2015. That is, your company plans to borrow money by selling 3-month commercial paper. The interest rate that your company will pay on the commercial paper will be determined on May 15, 2015. You are concerned that interest rates will RISE by May, and wish to hedge the interest rate risk. There are no futures contracts on 3-month commercial paper, but there are futures contracts with a delivery date of June 2015, on: $1 million 3-month Treasury bills; and $1 million 3-month Eurodollars. You estimate the following three regressions for the hedging period: Regression of 3-month commercial paper RATES on Regression coefficient 1.00 R-squared value 0.90 Futures RATES on 3-month TREASURY BILLS Futures RATES on 3-month EURODOLLARS 0.90 0.98 (a) Design an optimal hedging strategy. (4 points) (b) Assume that by May the interest rate on the futures contract that you are using rose by 1% (per annum) and the 3-month commercial paper rate changed as estimated by the regression. What is the dollar change in your borrowing cost (on the commercial paper that you issued)? What is the gain/loss from the futures position? What is the net gain/loss on the hedge? EXPLAIN (2 points) (c) Assume that by May the interest rate on the futures contract that you are using rose by 1% and the 3-month commercial paper rate rose by 0.85%. What is the dollar change in your borrowing cost (on the commercial paper that you issued)? What is the gain/loss from the futures position? What is the net gain/loss on the hedge? EXPLAIN (2 points) (d) Assume that by May the interest rate on the futures contract that you are using rose by 1% and the 3-month commercial paper rate rose by 1.00%. What is the dollar change in your borrowing cost (on the commercial paper that you issued)? What is the gain/loss from the futures position? What is the net gain/loss on the hedge? EXPLAIN (2 points) QUESTION 1 (10 points): COMMERCIAL PAPER is short-term debt issued (sold) by corporations to meet short term financing needs. Commercial Papers are unsecured debt securities that have maturities ranging from 2 to 270 days. Like other corporate debt instruments, commercial paper is rated by Standard & Poor's and Moody's. The interest rate that the Company will pay on the commercial paper that it issues will be decided ON THE DATE OF THE ISSUANCE by "the market" (which includes banks, investment companies and insurance companies, among others) You are the manager of Fun R Us Inc. Your company plans to issue $20 million face value of 3-month COMMERCIAL PAPER, on May 15, 2015. That is, your company plans to borrow money by selling 3-month commercial paper. The interest rate that your company will pay on the commercial paper will be determined on May 15, 2015. You are concerned that interest rates will RISE by May, and wish to hedge the interest rate risk. There are no futures contracts on 3-month commercial paper, but there are futures contracts with a delivery date of June 2015, on: $1 million 3-month Treasury bills; and $1 million 3-month Eurodollars. You estimate the following three regressions for the hedging period: Regression of 3-month commercial paper RATES on Regression coefficient 1.00 R-squared value 0.90 Futures RATES on 3-month TREASURY BILLS Futures RATES on 3-month EURODOLLARS 0.90 0.98 (a) Design an optimal hedging strategy. (4 points) (b) Assume that by May the interest rate on the futures contract that you are using rose by 1% (per annum) and the 3-month commercial paper rate changed as estimated by the regression. What is the dollar change in your borrowing cost (on the commercial paper that you issued)? What is the gain/loss from the futures position? What is the net gain/loss on the hedge? EXPLAIN (2 points) (c) Assume that by May the interest rate on the futures contract that you are using rose by 1% and the 3-month commercial paper rate rose by 0.85%. What is the dollar change in your borrowing cost (on the commercial paper that you issued)? What is the gain/loss from the futures position? What is the net gain/loss on the hedge? EXPLAIN (2 points) (d) Assume that by May the interest rate on the futures contract that you are using rose by 1% and the 3-month commercial paper rate rose by 1.00%. What is the dollar change in your borrowing cost (on the commercial paper that you issued)? What is the gain/loss from the futures position? What is the net gain/loss on the hedge? EXPLAIN (2 points)