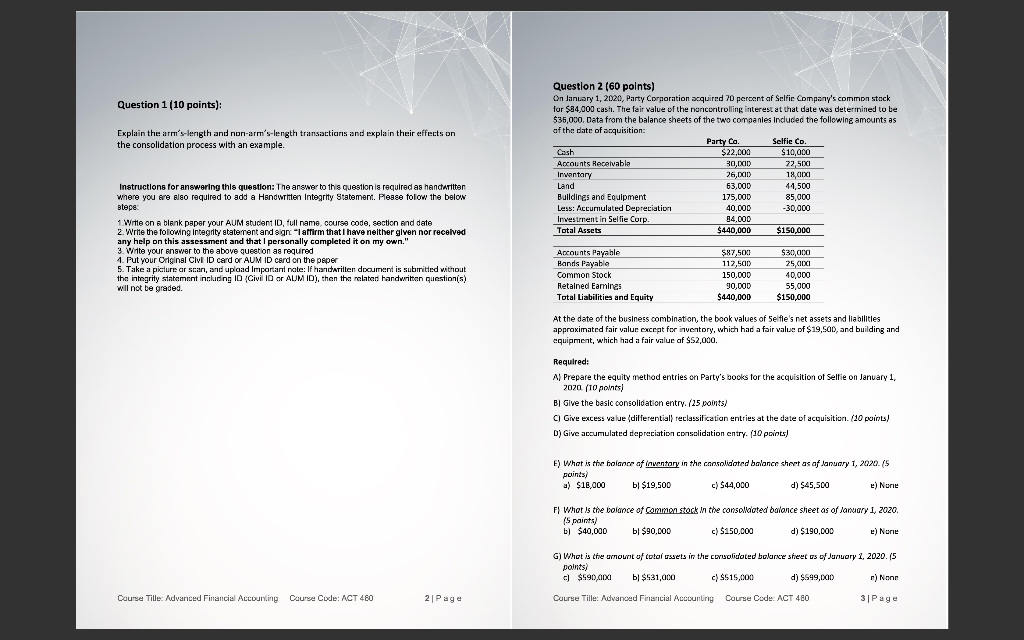

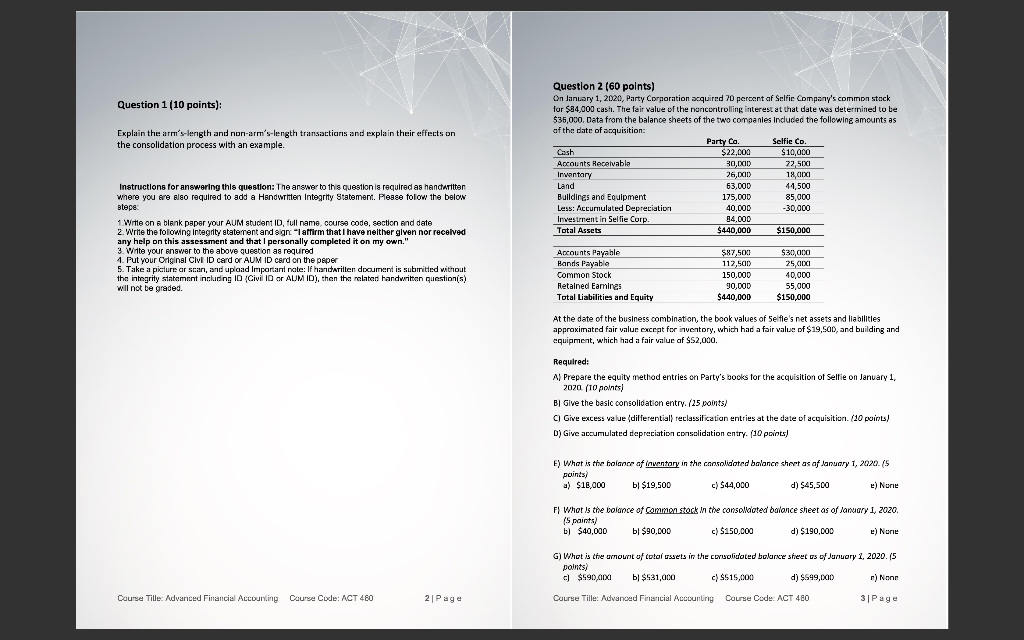

Question 1 (10 points): Explain the arm's-lerigth and non-arm's-length transactions and explain their effects on the consolidation process with an example. Question 2 (60 points) On January 1, 2020, Party Corporation acquired 70 percent af Selfie Company's common stock for $34,000 casin. The fair value of the noncontrolling interest at that date was determined to be $35,000. Data from the balance sheets of the two comoanles Induced the following amounts as of the date of acquisition: Party Ca. Selfie Co. Cash $22,000 $10,000 Accounts Recalvable 30,DXIE) 22,501 Inventary 26,000 18,CICI Land 63,000 44,500 Buildings and Equipment 175,000 85,000 Less: Accumulated Depreciation 40.000 -30,000 Investment in Selfie Corp. 84.000 Total Assets $440,000 $150,000 Instructions for answering this question: The answer to this question is required as handaritten where you are also required to add a Handwriten Integrity Statement. Please folow the below Btepe 1. Witte on a blank paper your AUM student ID full name, course code, section and date 2. Write the folowing integrity statement and signe "I affirm that I have neither given nor received any help on this assessment and that I personally completed it on my own." 3. Write your answer to the above question as requred 1. Put your Original Civi ID card or AUM ID card on the peper 5. Take a picture ar scan, and upload Important nate: If handaritten document is submitted without the integrity statement including In Civil ID or ALM ID), then the related handwritten questions) will not be graded Accounts Payable Hands Payable Common Stock Retained Eamines Total Liabilities and Equity $87,50% 112,500 150,000 90,000 $440,000 $30,000 25,00 40,000 55,000 $150,000 At the date of the business combination, the book values of Sefle's net assets and liabilities approximated fair valur exceat for inventory, which had a fair value of $19,500), and building and equipment, which had a fair value of SS2,000. Required: Al Prepare the equity method entries on Party's books for the acquisition of Selfie on January 1, 2020. (TO points Bj Give the basic consolidation entry. (25 points) C) Give excess value (differential reclassification entries at the date of acquisition. (10 points) D) Give accumulated depreciation consolidation entry. (10 points) E) What is the holance af inventory in the consolidated balance sheet as of January 1, 2020. (5 points) a) $18,000 bl $19,500 c) $44,000 d) $45,500 e) Nurie F) What is the bolance of common stock in the consolidated balance sheet as of January 1, 2020. (5 points) b) $40,000 bl $90.000 c) $150,000 d) $190,000 e) None G) What is the mount of total ossets in the couclidoted bolurse sheet es of January 1, 2020.15 points) c) $590,000 bl $531,000 c) S515,000 d) $599,000 c) Non Course Tille: Advanced Financial Accounting Course Code: ACT 480 2 Page Course Tille: Advanced Financial Accounting Course Code: ACT 480 31 Page Question 1 (10 points): Explain the arm's-lerigth and non-arm's-length transactions and explain their effects on the consolidation process with an example. Question 2 (60 points) On January 1, 2020, Party Corporation acquired 70 percent af Selfie Company's common stock for $34,000 casin. The fair value of the noncontrolling interest at that date was determined to be $35,000. Data from the balance sheets of the two comoanles Induced the following amounts as of the date of acquisition: Party Ca. Selfie Co. Cash $22,000 $10,000 Accounts Recalvable 30,DXIE) 22,501 Inventary 26,000 18,CICI Land 63,000 44,500 Buildings and Equipment 175,000 85,000 Less: Accumulated Depreciation 40.000 -30,000 Investment in Selfie Corp. 84.000 Total Assets $440,000 $150,000 Instructions for answering this question: The answer to this question is required as handaritten where you are also required to add a Handwriten Integrity Statement. Please folow the below Btepe 1. Witte on a blank paper your AUM student ID full name, course code, section and date 2. Write the folowing integrity statement and signe "I affirm that I have neither given nor received any help on this assessment and that I personally completed it on my own." 3. Write your answer to the above question as requred 1. Put your Original Civi ID card or AUM ID card on the peper 5. Take a picture ar scan, and upload Important nate: If handaritten document is submitted without the integrity statement including In Civil ID or ALM ID), then the related handwritten questions) will not be graded Accounts Payable Hands Payable Common Stock Retained Eamines Total Liabilities and Equity $87,50% 112,500 150,000 90,000 $440,000 $30,000 25,00 40,000 55,000 $150,000 At the date of the business combination, the book values of Sefle's net assets and liabilities approximated fair valur exceat for inventory, which had a fair value of $19,500), and building and equipment, which had a fair value of SS2,000. Required: Al Prepare the equity method entries on Party's books for the acquisition of Selfie on January 1, 2020. (TO points Bj Give the basic consolidation entry. (25 points) C) Give excess value (differential reclassification entries at the date of acquisition. (10 points) D) Give accumulated depreciation consolidation entry. (10 points) E) What is the holance af inventory in the consolidated balance sheet as of January 1, 2020. (5 points) a) $18,000 bl $19,500 c) $44,000 d) $45,500 e) Nurie F) What is the bolance of common stock in the consolidated balance sheet as of January 1, 2020. (5 points) b) $40,000 bl $90.000 c) $150,000 d) $190,000 e) None G) What is the mount of total ossets in the couclidoted bolurse sheet es of January 1, 2020.15 points) c) $590,000 bl $531,000 c) S515,000 d) $599,000 c) Non Course Tille: Advanced Financial Accounting Course Code: ACT 480 2 Page Course Tille: Advanced Financial Accounting Course Code: ACT 480 31 Page