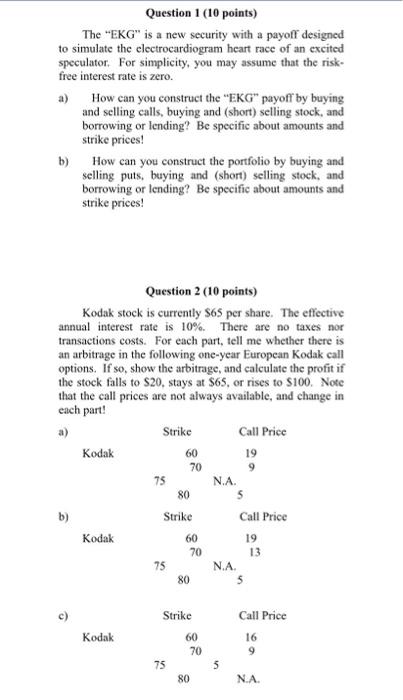

Question 1 (10 points) The "EKG" is a new security with a payoff designed to simulate the electrocardiogram heart race of an excited speculator. For simplicity, you may assume that the risk- free interest rate is zero. a) How can you construct the "EKG payoff by buying and selling calls, buying and (short) selling stock, and borrowing or lending? Be specific about amounts and strike prices! b) How can you construct the portfolio by buying and selling puts, buying and (short) selling stock, and borrowing or lending? Be specific about amounts and strike prices! Question 2 (10 points) Kodak stock is currently $65 per share. The effective annual interest rate is 10%. There are no taxes nor transactions costs. For each part, tell me whether there is an arbitrage in the following one-year European Kodak call options. If so, show the arbitrage, and calculate the profit if the stock falls to S20. stays at $65, or rises to $100 Note that the call prices are not always available, and change in each part! a) Strike Call Price Kodak 19 75 NA 5 b) Strike Call Price Kodak 60 70 13 75 NA 80 5 60 70 9 80 19 Strike Call Price 16 Kodak 60 70 9 75 5 80 NA Question 1 (10 points) The "EKG" is a new security with a payoff designed to simulate the electrocardiogram heart race of an excited speculator. For simplicity, you may assume that the risk- free interest rate is zero. a) How can you construct the "EKG payoff by buying and selling calls, buying and (short) selling stock, and borrowing or lending? Be specific about amounts and strike prices! b) How can you construct the portfolio by buying and selling puts, buying and (short) selling stock, and borrowing or lending? Be specific about amounts and strike prices! Question 2 (10 points) Kodak stock is currently $65 per share. The effective annual interest rate is 10%. There are no taxes nor transactions costs. For each part, tell me whether there is an arbitrage in the following one-year European Kodak call options. If so, show the arbitrage, and calculate the profit if the stock falls to S20. stays at $65, or rises to $100 Note that the call prices are not always available, and change in each part! a) Strike Call Price Kodak 19 75 NA 5 b) Strike Call Price Kodak 60 70 13 75 NA 80 5 60 70 9 80 19 Strike Call Price 16 Kodak 60 70 9 75 5 80 NA