Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 1 10 years ago, H. E. Bhd., purchased a lathe for trimming molded plastics at a cost of RM7,500. The machine had an

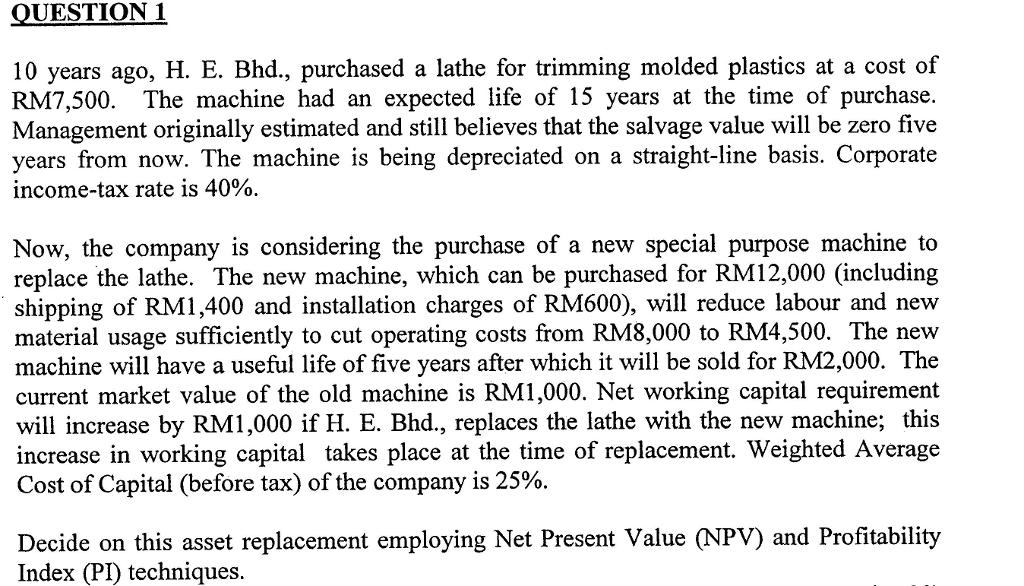

QUESTION 1 10 years ago, H. E. Bhd., purchased a lathe for trimming molded plastics at a cost of RM7,500. The machine had an expected life of 15 years at the time of purchase. Management originally estimated and still believes that the salvage value will be zero five years from now. The machine is being depreciated on a straight-line basis. Corporate income-tax rate is 40%. Now, the company is considering the purchase of a new special purpose machine to replace the lathe. The new machine, which can be purchased for RM12,000 (including shipping of RM1,400 and installation charges of RM600), will reduce labour and new material usage sufficiently to cut operating costs from RM8,000 to RM4,500. The new machine will have a useful life of five years after which it will be sold for RM2,000. The current market value of the old machine is RM1,000. Net working capital requirement will increase by RM1,000 if H. E. Bhd., replaces the lathe with the new machine; this increase in working capital takes place at the time of replacement. Weighted Average Cost of Capital (before tax) of the company is 25%. Decide on this asset replacement employing Net Present Value (NPV) and Profitability Index (PI) techniques.

Step by Step Solution

★★★★★

3.35 Rating (176 Votes )

There are 3 Steps involved in it

Step: 1

Computation of initial investment Installed cost of new machine Salvage value of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started