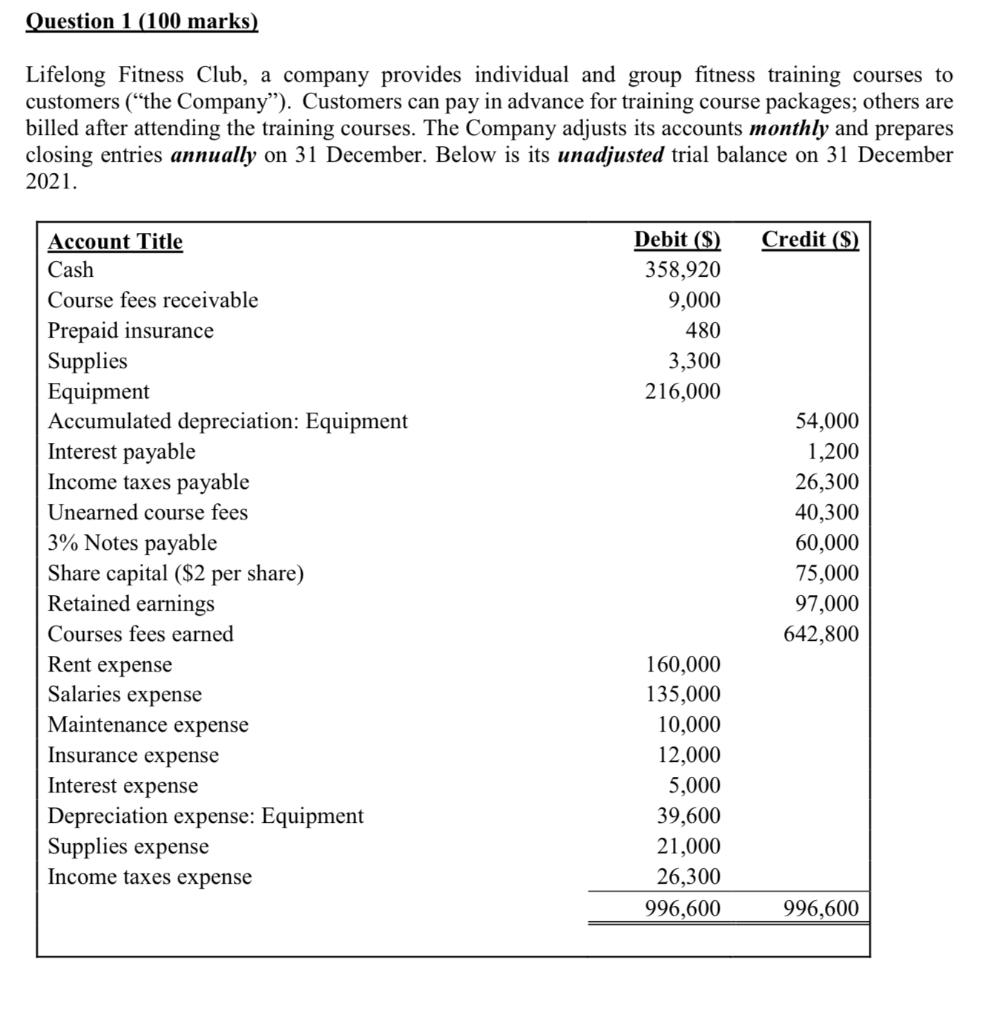

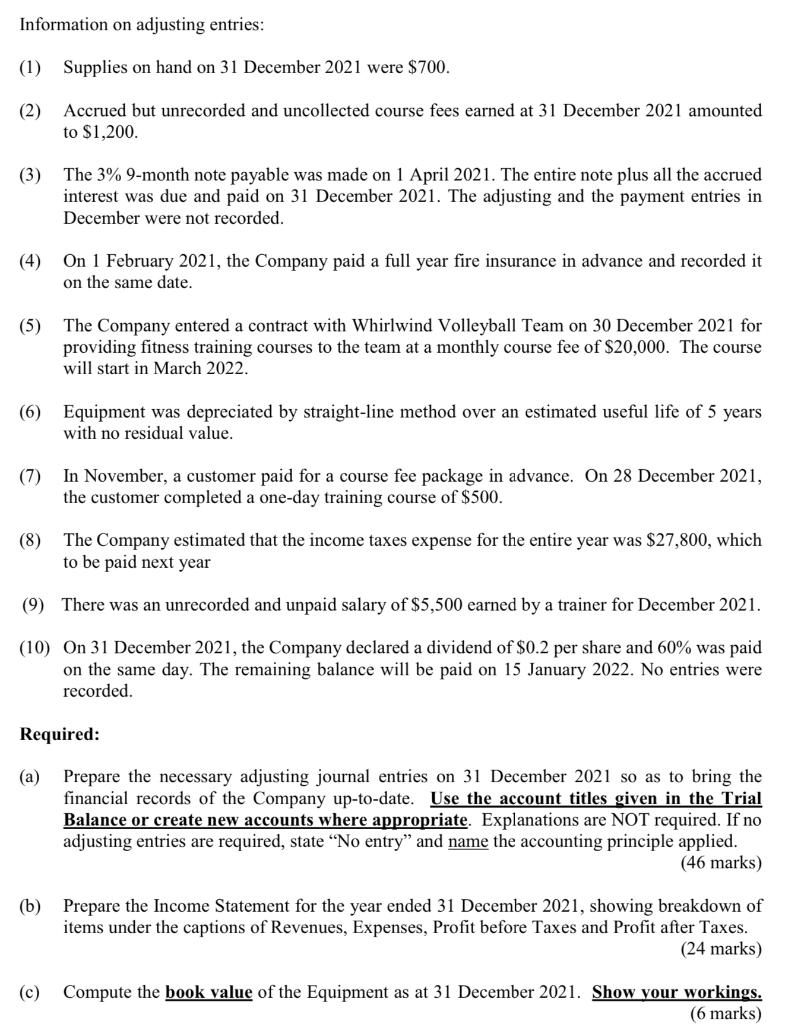

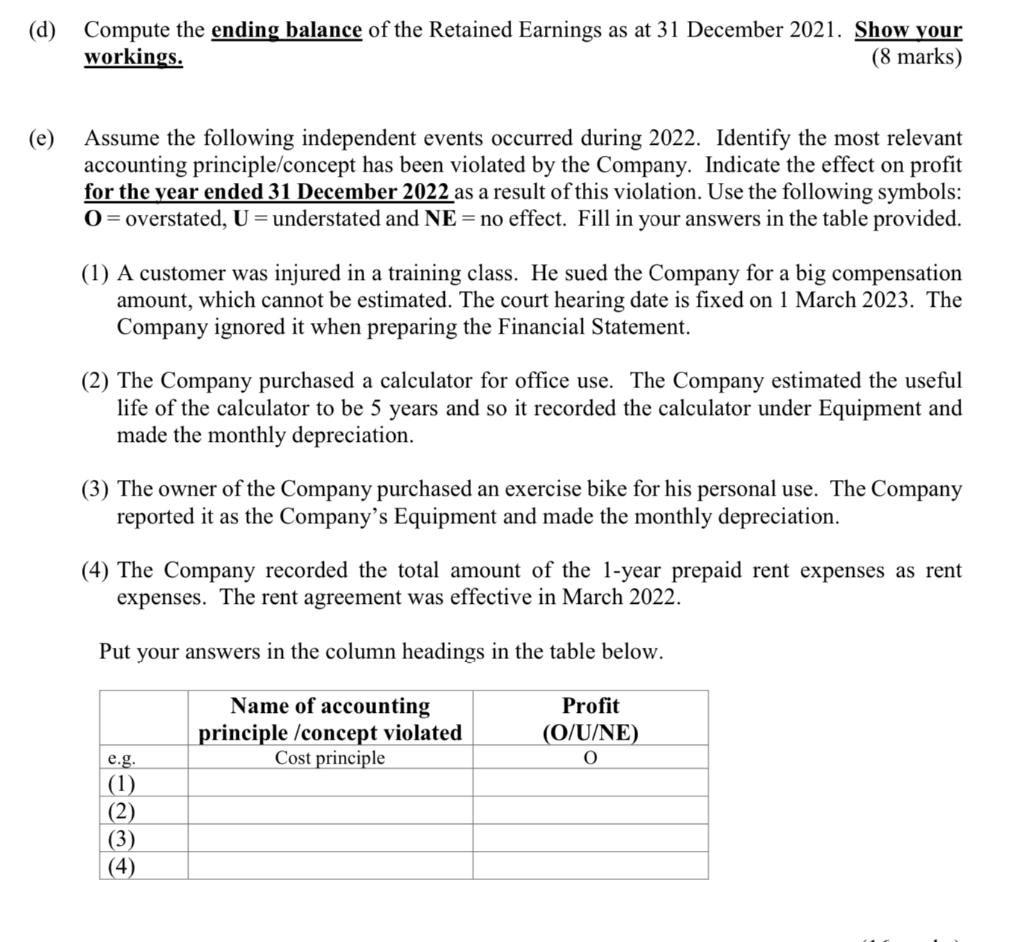

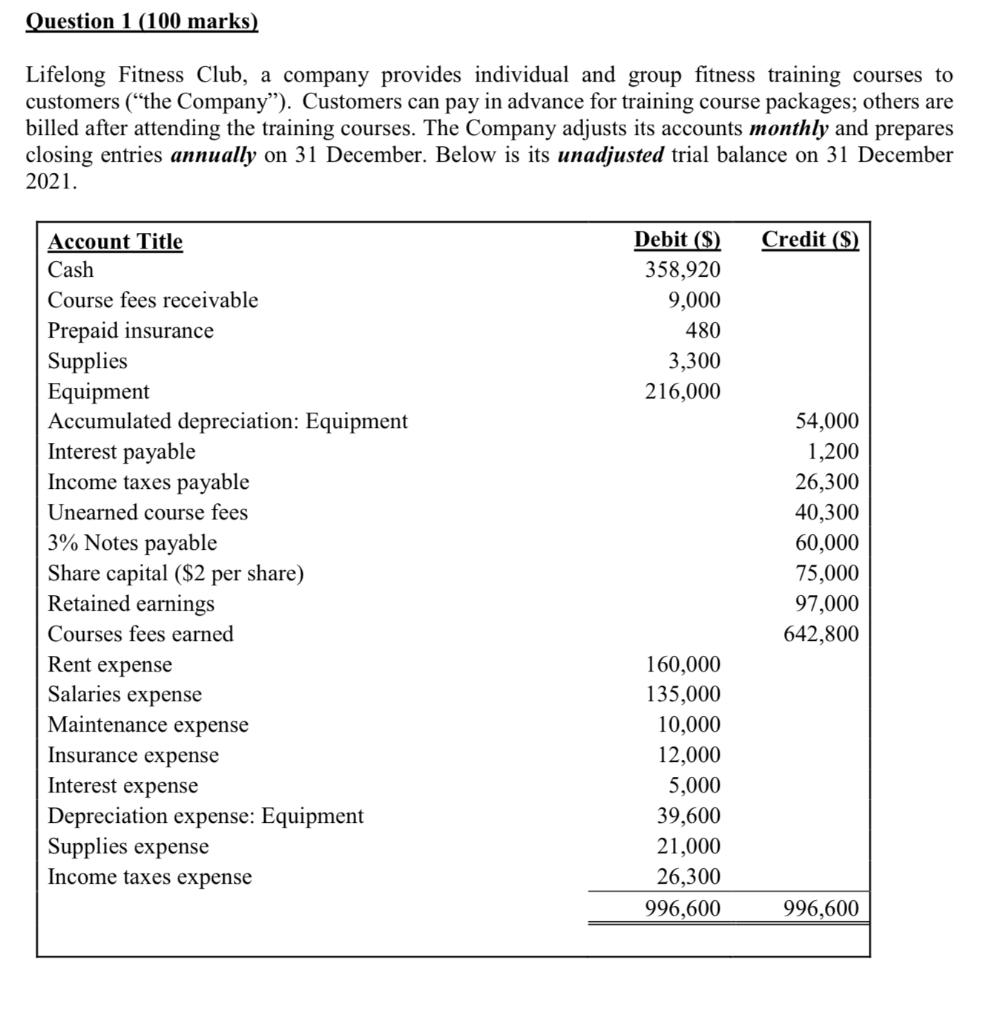

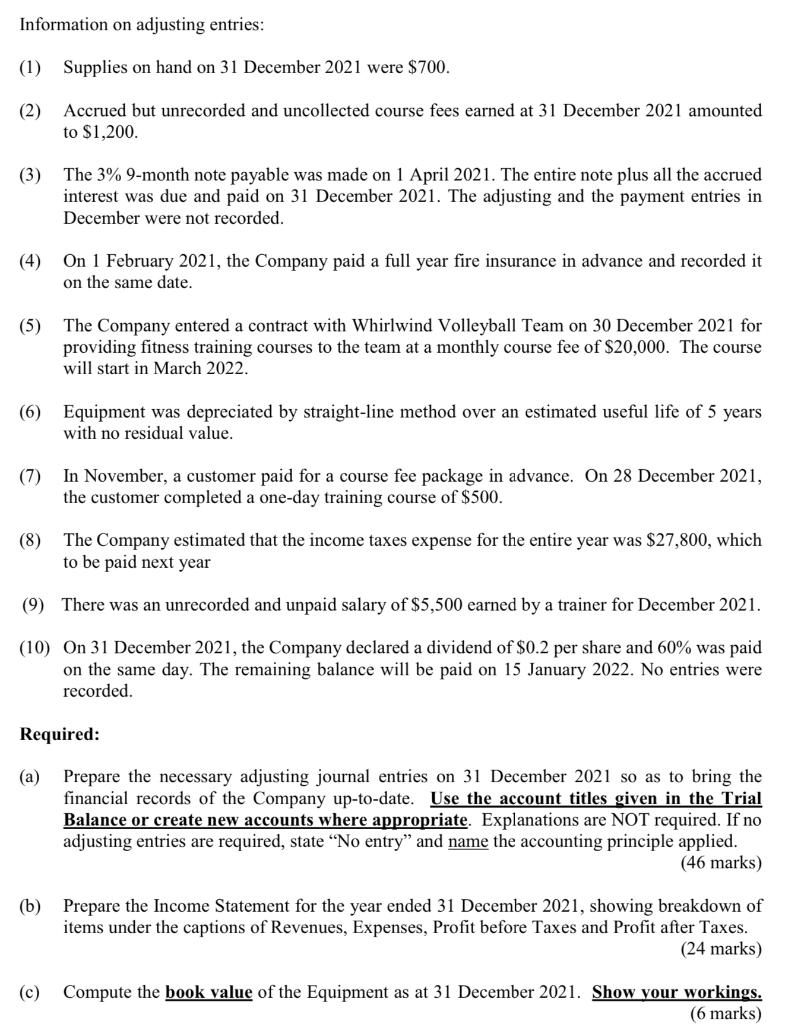

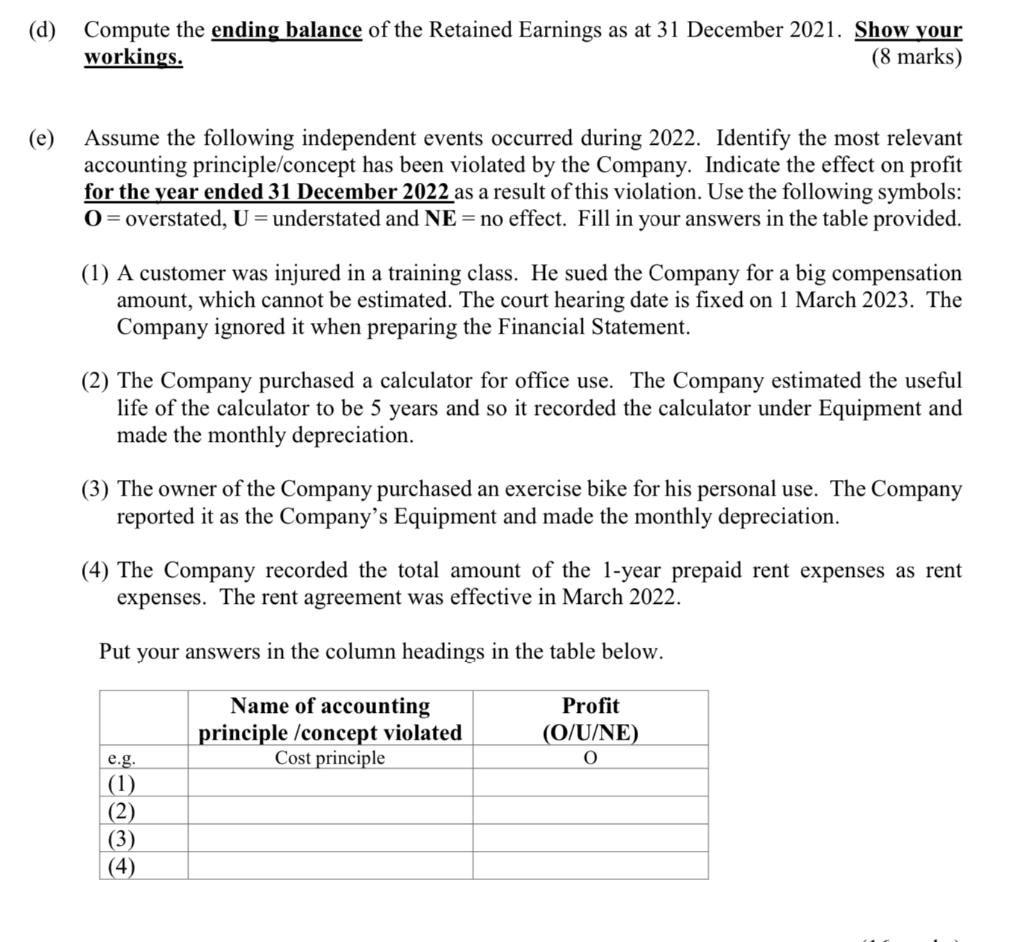

Question 1 (100 marks) Lifelong Fitness Club, a company provides individual and group fitness training courses to customers (the Company'). Customers can pay in advance for training course packages; others are billed after attending the training courses. The Company adjusts its accounts monthly and prepares closing entries annually on 31 December. Below is its unadjusted trial balance on 31 December 2021. Credit ($). Debit ($) 358,920 9,000 480 3,300 216,000 Account Title Cash Course fees receivable Prepaid insurance Supplies Equipment Accumulated depreciation: Equipment Interest payable Income taxes payable Unearned course fees 3% Notes payable Share capital ($2 per share) Retained earnings Courses fees earned Rent expense Salaries expense Maintenance expense Insurance expense Interest expense Depreciation expense: Equipment Supplies expense Income taxes expense 54,000 1,200 26,300 40,300 60,000 75,000 97,000 642,800 160,000 135,000 10,000 12,000 5,000 39,600 21,000 26,300 996,600 996,600 Information on adjusting entries: (1) Supplies on hand on 31 December 2021 were $700. (2) Accrued but unrecorded and uncollected course fees earned at 31 December 2021 amounted to $1,200. (3) The 3% 9-month note payable was made on 1 April 2021. The entire note plus all the accrued interest was due and paid on 31 December 2021. The adjusting and the payment entries in December were not recorded. (4) On 1 February 2021, the Company paid a full year fire insurance in advance and recorded it on the same date. (5) The Company entered a contract with Whirlwind Volleyball Team on 30 December 2021 for providing fitness training courses to the team at a monthly course fee of $20,000. The course will start in March 2022. (6) Equipment was depreciated by straight-line method over an estimated useful life of 5 years with no residual value. (7) In November, a customer paid for a course fee package in advance. On 28 December 2021, the customer completed a one-day training course of $500. (8) The Company estimated that the income taxes expense for the entire year was $27,800, which to be paid next year (9) There was an unrecorded and unpaid salary of $5,500 earned by a trainer for December 2021. (10) On 31 December 2021, the Company declared a dividend of $0.2 per share and 60% was paid on the same day. The remaining balance will be paid on 15 January 2022. No entries were recorded. Required: (a) Prepare the necessary adjusting journal entries on 31 December 2021 so as to bring the financial records of the Company up-to-date. Use the account titles given in the Trial Balance or create new accounts where appropriate. Explanations are NOT required. If no adjusting entries are required, state "No entry" and name the accounting principle applied. (46 marks) (b) Prepare the Income Statement for the year ended 31 December 2021, showing breakdown of items under the captions of Revenues, Expenses, Profit before Taxes and Profit after Taxes. (24 marks) (c) Compute the book value of the Equipment as at 31 December 2021. Show your workings. (6 marks) (d) Compute the ending balance of the Retained Earnings as at 31 December 2021. Show your workings. (8 marks) (e) Assume the following independent events occurred during 2022. Identify the most relevant accounting principle/concept has been violated by the Company. Indicate the effect on profit for the year ended 31 December 2022 as a result of this violation. Use the following symbols: 0 = overstated, U = understated and NE = no effect. Fill in your answers in the table provided. (1) A customer was injured in a training class. He sued the Company for a big compensation amount, which cannot be estimated. The court hearing date is fixed on 1 March 2023. The Company ignored it when preparing the Financial Statement. (2) The Company purchased a calculator for office use. The Company estimated the useful life of the calculator to be 5 years and so it recorded the calculator under Equipment and made the monthly depreciation. (3) The owner of the Company purchased an exercise bike for his personal use. The Company reported it as the Company's Equipment and made the monthly depreciation. (4) The Company recorded the total amount of the 1-year prepaid rent expenses as rent expenses. The rent agreement was effective in March 2022. Put your answers in the column headings in the table below. Name of accounting principle /concept violated Cost principle Profit (O/U/NE O e.g. (1) (2) (3) (4) Question 1 (100 marks) Lifelong Fitness Club, a company provides individual and group fitness training courses to customers (the Company'). Customers can pay in advance for training course packages; others are billed after attending the training courses. The Company adjusts its accounts monthly and prepares closing entries annually on 31 December. Below is its unadjusted trial balance on 31 December 2021. Credit ($). Debit ($) 358,920 9,000 480 3,300 216,000 Account Title Cash Course fees receivable Prepaid insurance Supplies Equipment Accumulated depreciation: Equipment Interest payable Income taxes payable Unearned course fees 3% Notes payable Share capital ($2 per share) Retained earnings Courses fees earned Rent expense Salaries expense Maintenance expense Insurance expense Interest expense Depreciation expense: Equipment Supplies expense Income taxes expense 54,000 1,200 26,300 40,300 60,000 75,000 97,000 642,800 160,000 135,000 10,000 12,000 5,000 39,600 21,000 26,300 996,600 996,600 Information on adjusting entries: (1) Supplies on hand on 31 December 2021 were $700. (2) Accrued but unrecorded and uncollected course fees earned at 31 December 2021 amounted to $1,200. (3) The 3% 9-month note payable was made on 1 April 2021. The entire note plus all the accrued interest was due and paid on 31 December 2021. The adjusting and the payment entries in December were not recorded. (4) On 1 February 2021, the Company paid a full year fire insurance in advance and recorded it on the same date. (5) The Company entered a contract with Whirlwind Volleyball Team on 30 December 2021 for providing fitness training courses to the team at a monthly course fee of $20,000. The course will start in March 2022. (6) Equipment was depreciated by straight-line method over an estimated useful life of 5 years with no residual value. (7) In November, a customer paid for a course fee package in advance. On 28 December 2021, the customer completed a one-day training course of $500. (8) The Company estimated that the income taxes expense for the entire year was $27,800, which to be paid next year (9) There was an unrecorded and unpaid salary of $5,500 earned by a trainer for December 2021. (10) On 31 December 2021, the Company declared a dividend of $0.2 per share and 60% was paid on the same day. The remaining balance will be paid on 15 January 2022. No entries were recorded. Required: (a) Prepare the necessary adjusting journal entries on 31 December 2021 so as to bring the financial records of the Company up-to-date. Use the account titles given in the Trial Balance or create new accounts where appropriate. Explanations are NOT required. If no adjusting entries are required, state "No entry" and name the accounting principle applied. (46 marks) (b) Prepare the Income Statement for the year ended 31 December 2021, showing breakdown of items under the captions of Revenues, Expenses, Profit before Taxes and Profit after Taxes. (24 marks) (c) Compute the book value of the Equipment as at 31 December 2021. Show your workings. (6 marks) (d) Compute the ending balance of the Retained Earnings as at 31 December 2021. Show your workings. (8 marks) (e) Assume the following independent events occurred during 2022. Identify the most relevant accounting principle/concept has been violated by the Company. Indicate the effect on profit for the year ended 31 December 2022 as a result of this violation. Use the following symbols: 0 = overstated, U = understated and NE = no effect. Fill in your answers in the table provided. (1) A customer was injured in a training class. He sued the Company for a big compensation amount, which cannot be estimated. The court hearing date is fixed on 1 March 2023. The Company ignored it when preparing the Financial Statement. (2) The Company purchased a calculator for office use. The Company estimated the useful life of the calculator to be 5 years and so it recorded the calculator under Equipment and made the monthly depreciation. (3) The owner of the Company purchased an exercise bike for his personal use. The Company reported it as the Company's Equipment and made the monthly depreciation. (4) The Company recorded the total amount of the 1-year prepaid rent expenses as rent expenses. The rent agreement was effective in March 2022. Put your answers in the column headings in the table below. Name of accounting principle /concept violated Cost principle Profit (O/U/NE O e.g. (1) (2) (3) (4)