Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 1 1.1 Credit risk can be measured using A) the ratio of non-performing loans to total bank assets the ratio of non-performing loans to

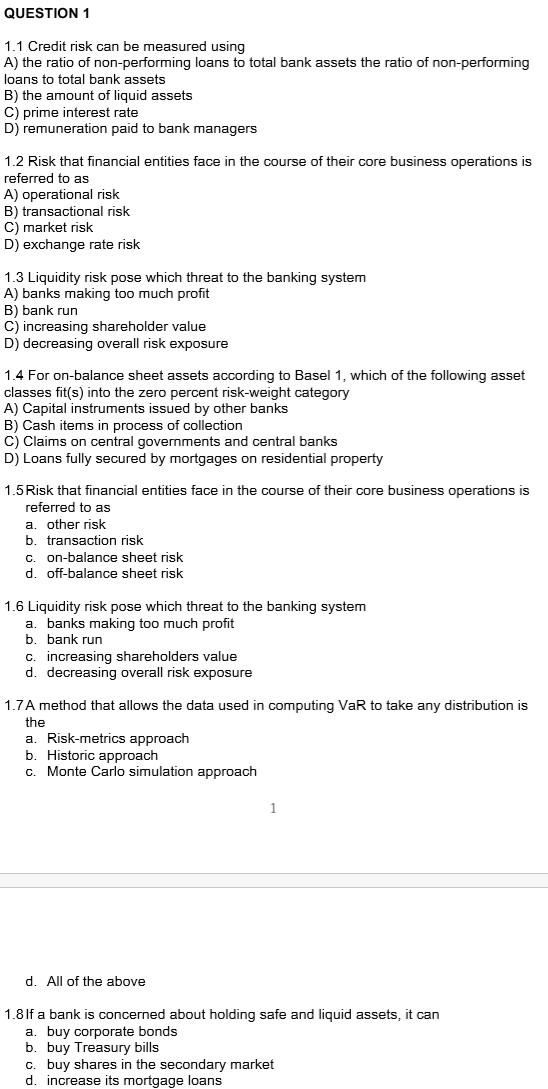

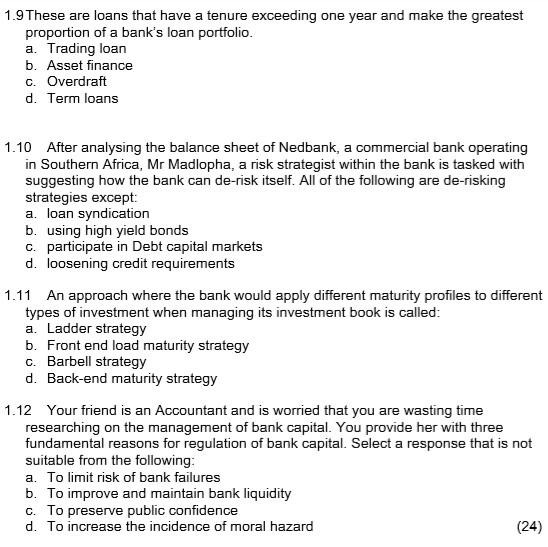

QUESTION 1 1.1 Credit risk can be measured using A) the ratio of non-performing loans to total bank assets the ratio of non-performing loans to total bank assets B) the amount of liquid assets C) prime interest rate D) remuneration paid to bank managers 1.2 Risk that financial entities face in the course of their core business operations is referred to as A) operational risk B) transactional risk C) market risk D) exchange rate risk 1.3 Liquidity risk pose which threat to the banking system A) banks making too much profit B) bank run C) increasing shareholder value D) decreasing overall risk exposure 1.4 For on-balance sheet assets according to Basel 1, which of the following asset classes fit(s) into the zero percent risk-weight category A) Capital instruments issued by other banks B) Cash items in process of collection c) Claims on central governments and central banks D) Loans fully secured by mortgages on residential property 1.5 Risk that financial entities face in the course of their core business operations is referred to as a. other risk b. transaction risk c. on-balance sheet risk d. off-balance sheet risk 1.6 Liquidity risk pose which threat to the banking system a. banks making too much profit b. bank run C. increasing shareholders value d. decreasing overall risk exposure 1.7A method that allows the data used in computing VaR to take any distribution is the a. Risk-metrics approach b. Historic approach c. Monte Carlo simulation approach 1 d. All of the above 1.8lf a bank is concerned about holding safe and liquid assets, it can a. buy corporate bonds b. buy Treasury bills c. buy shares in the secondary market d. increase its mortgage loans 1.9 These are loans that have a tenure exceeding one year and make the greatest proportion of a bank's loan portfolio. a. Trading loan b. Asset finance c. Overdraft d. Term loans 1.10 After analysing the balance sheet of Nedbank, a commercial bank operating in Southern Africa, Mr Madlopha, a risk strategist within the bank is tasked with suggesting how the bank can de-risk itself. All of the following are de-risking strategies except: a. loan syndication b. using high yield bonds c. participate in Debt capital markets d. loosening credit requirements 1.11 An approach where the bank would apply different maturity profiles to different types of investment when managing its investment book is called: a. Ladder strategy b. Front end load maturity strategy c. Barbell strategy d. Back-end maturity strategy 1.12 Your friend is an Accountant and is worried that you are wasting time researching on the management of bank capital. You provide her with three fundamental reasons for regulation of bank capital. Select a response that is not suitable from the following: a. To limit risk of bank failures b. To improve and maintain bank liquidity c. To preserve public confidence d. To increase the incidence of moral hazard (24) QUESTION 1 1.1 Credit risk can be measured using A) the ratio of non-performing loans to total bank assets the ratio of non-performing loans to total bank assets B) the amount of liquid assets C) prime interest rate D) remuneration paid to bank managers 1.2 Risk that financial entities face in the course of their core business operations is referred to as A) operational risk B) transactional risk C) market risk D) exchange rate risk 1.3 Liquidity risk pose which threat to the banking system A) banks making too much profit B) bank run C) increasing shareholder value D) decreasing overall risk exposure 1.4 For on-balance sheet assets according to Basel 1, which of the following asset classes fit(s) into the zero percent risk-weight category A) Capital instruments issued by other banks B) Cash items in process of collection c) Claims on central governments and central banks D) Loans fully secured by mortgages on residential property 1.5 Risk that financial entities face in the course of their core business operations is referred to as a. other risk b. transaction risk c. on-balance sheet risk d. off-balance sheet risk 1.6 Liquidity risk pose which threat to the banking system a. banks making too much profit b. bank run C. increasing shareholders value d. decreasing overall risk exposure 1.7A method that allows the data used in computing VaR to take any distribution is the a. Risk-metrics approach b. Historic approach c. Monte Carlo simulation approach 1 d. All of the above 1.8lf a bank is concerned about holding safe and liquid assets, it can a. buy corporate bonds b. buy Treasury bills c. buy shares in the secondary market d. increase its mortgage loans 1.9 These are loans that have a tenure exceeding one year and make the greatest proportion of a bank's loan portfolio. a. Trading loan b. Asset finance c. Overdraft d. Term loans 1.10 After analysing the balance sheet of Nedbank, a commercial bank operating in Southern Africa, Mr Madlopha, a risk strategist within the bank is tasked with suggesting how the bank can de-risk itself. All of the following are de-risking strategies except: a. loan syndication b. using high yield bonds c. participate in Debt capital markets d. loosening credit requirements 1.11 An approach where the bank would apply different maturity profiles to different types of investment when managing its investment book is called: a. Ladder strategy b. Front end load maturity strategy c. Barbell strategy d. Back-end maturity strategy 1.12 Your friend is an Accountant and is worried that you are wasting time researching on the management of bank capital. You provide her with three fundamental reasons for regulation of bank capital. Select a response that is not suitable from the following: a. To limit risk of bank failures b. To improve and maintain bank liquidity c. To preserve public confidence d. To increase the incidence of moral hazard (24)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started