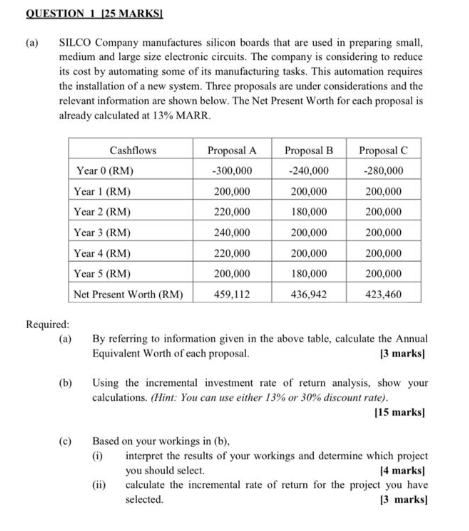

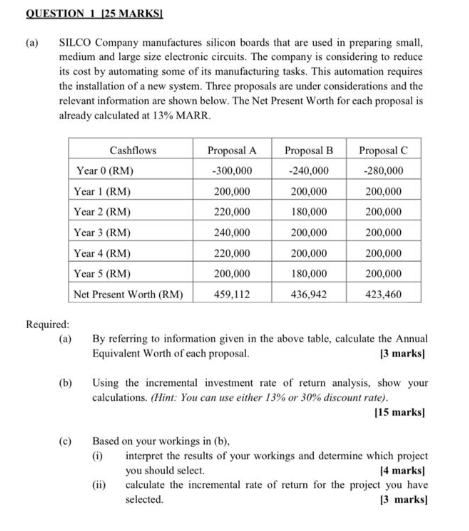

QUESTION 1 125 MARKSI (a) SILCO Company manufactures silicon boards that are used in preparing small, medium and large size electronic circuits. The company is considering to reduce its cost by automating some of its manufacturing tasks. This automation requires the installation of a new system. Three proposals are under considerations and the relevant information are shown below. The Net Present Worth for each proposal is already calculated at 13% MARR. Cashflows Year 0 (RM) Year 1 (RM) Year 2 (RM) Year 3 (RM) Year 4 (RM) Year 5 (RM) Net Present Worth (RM) Proposal A -300,000 200,000 220,000 240,000 220,000 200,000 459,112 Proposal B -240,000 200,000 180,000 200,000 200,000 180,000 436,942 Proposal -280,000 200,000 200,000 200,000 200,000 200,000 423,460 Required: (b) By referring to information given in the above table, calculate the Annual Equivalent Worth of each proposal. [3 marks) Using the incremental investment rate of return analysis, show your calculations. (Hint: You can use either 13% or 30% discount rate). [15 marks) Based on your workings in (b). (0) interpret the results of your workings and determine which project you should select 14 marks (ii) calculate the incremental rate of return for the project you have selected [3 marks (c) QUESTION 1 125 MARKSI (a) SILCO Company manufactures silicon boards that are used in preparing small, medium and large size electronic circuits. The company is considering to reduce its cost by automating some of its manufacturing tasks. This automation requires the installation of a new system. Three proposals are under considerations and the relevant information are shown below. The Net Present Worth for each proposal is already calculated at 13% MARR. Cashflows Year 0 (RM) Year 1 (RM) Year 2 (RM) Year 3 (RM) Year 4 (RM) Year 5 (RM) Net Present Worth (RM) Proposal A -300,000 200,000 220,000 240,000 220,000 200,000 459,112 Proposal B -240,000 200,000 180,000 200,000 200,000 180,000 436,942 Proposal -280,000 200,000 200,000 200,000 200,000 200,000 423,460 Required: (b) By referring to information given in the above table, calculate the Annual Equivalent Worth of each proposal. [3 marks) Using the incremental investment rate of return analysis, show your calculations. (Hint: You can use either 13% or 30% discount rate). [15 marks) Based on your workings in (b). (0) interpret the results of your workings and determine which project you should select 14 marks (ii) calculate the incremental rate of return for the project you have selected [3 marks (c)