Answered step by step

Verified Expert Solution

Question

1 Approved Answer

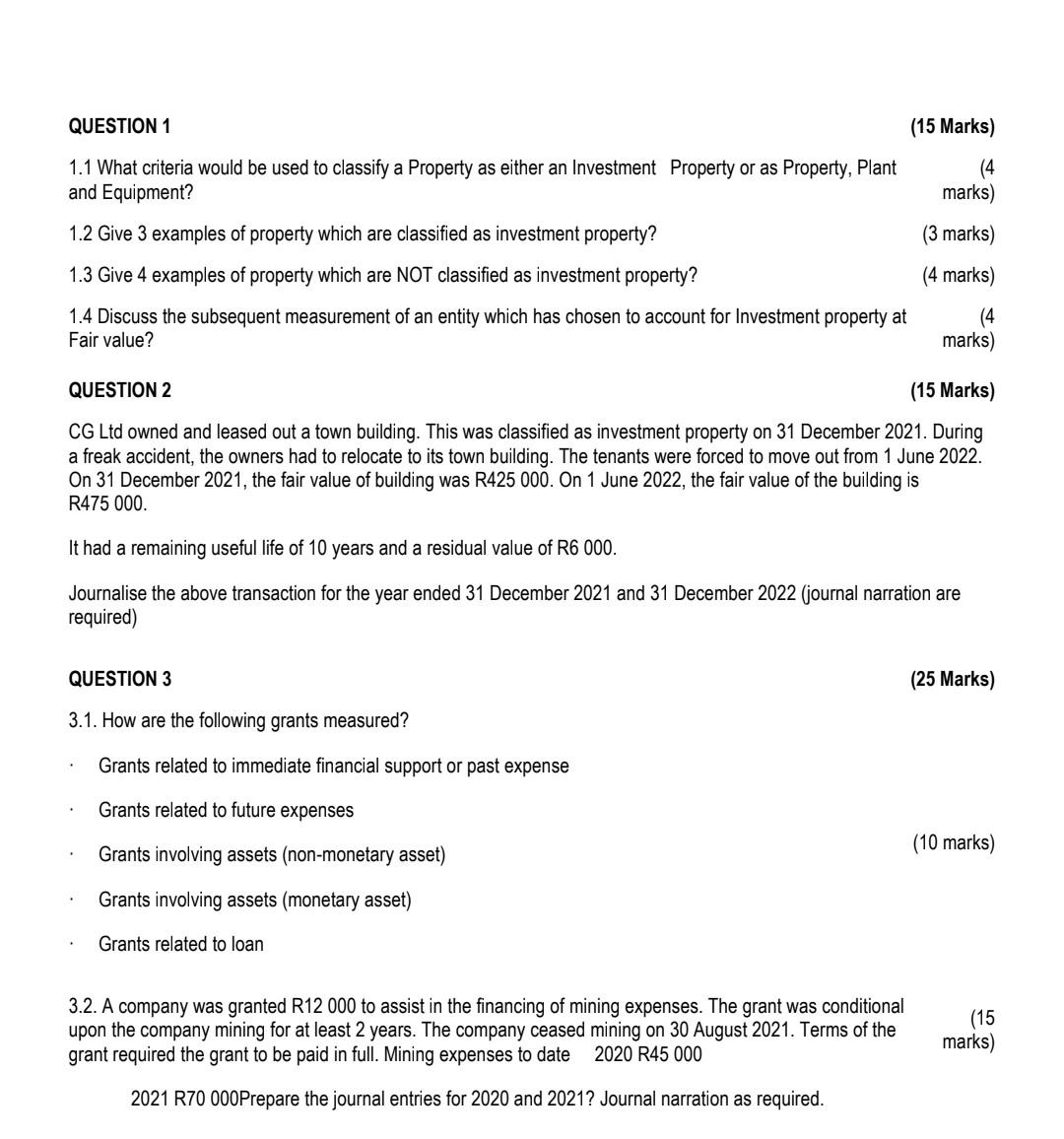

QUESTION 1 (15 Marks) 1.1 What criteria would be used to classify a Property as either an Investment Property or as Property, Plant and Equipment?

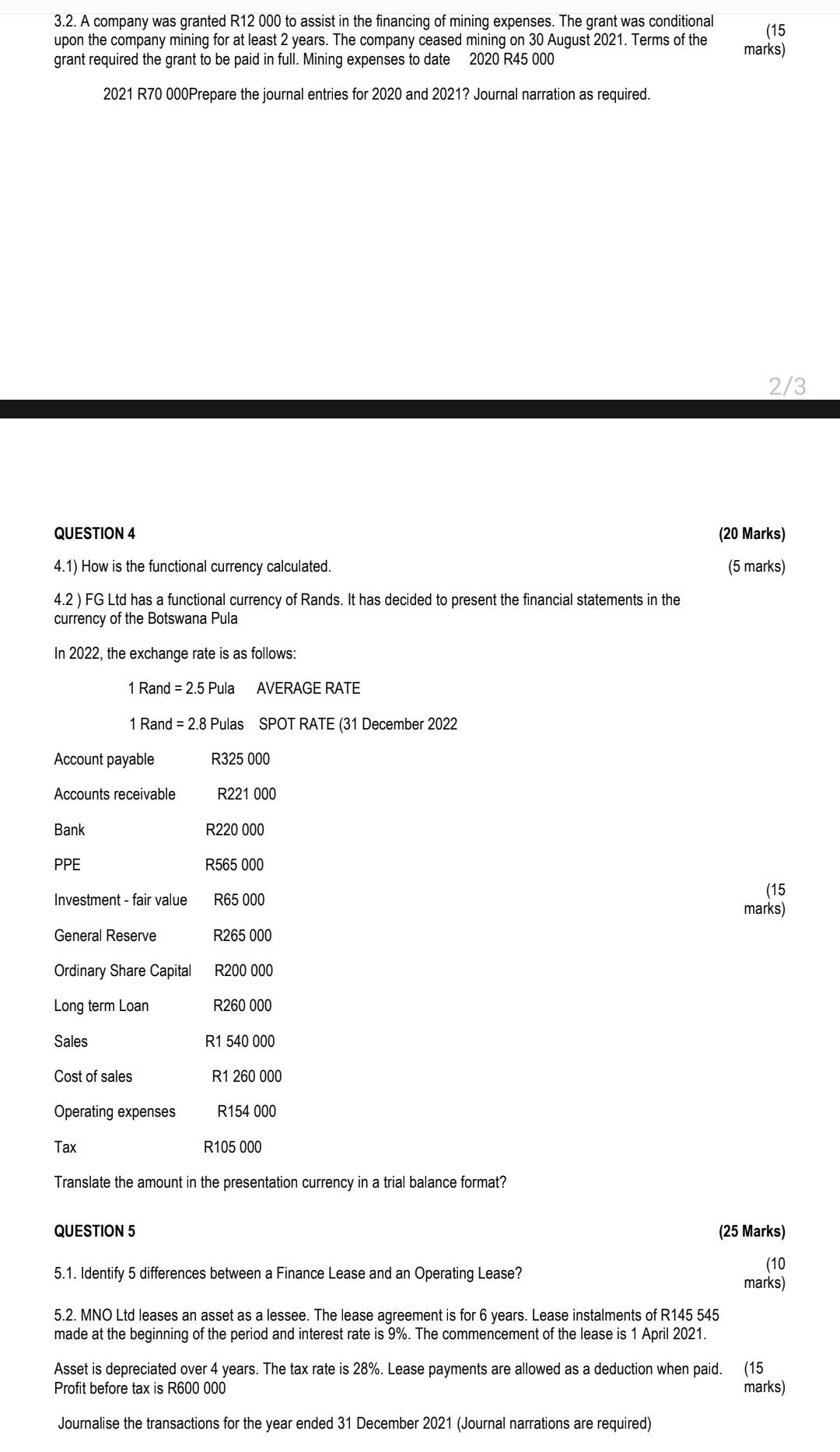

QUESTION 1 (15 Marks) 1.1 What criteria would be used to classify a Property as either an Investment Property or as Property, Plant and Equipment? (4 1.2 Give 3 examples of property which are classified as investment property? marks) 1.3 Give 4 examples of property which are NOT classified as investment property? (3 marks) 1.4 Discuss the subsequent measurement of an entity which has chosen to account for Investment property at (4 marks) Fair value? (4 marks) QUESTION 2 (15 Marks) CG Ltd owned and leased out a town building. This was classified as investment property on 31 December 2021. During a freak accident, the owners had to relocate to its town building. The tenants were forced to move out from 1 June 2022. On 31 December 2021, the fair value of building was R425 000. On 1 June 2022, the fair value of the building is R475 000 . It had a remaining useful life of 10 years and a residual value of R6000. Journalise the above transaction for the year ended 31 December 2021 and 31 December 2022 (journal narration are required) QUESTION 3 (25 Marks) 3.1. How are the following grants measured? Grants related to immediate financial support or past expense Grants related to future expenses Grants involving assets (non-monetary asset) (10 marks) Grants involving assets (monetary asset) Grants related to loan 3.2. A company was granted R12 000 to assist in the financing of mining expenses. The grant was conditional upon the company mining for at least 2 years. The company ceased mining on 30 August 2021. Terms of the grant required the grant to be paid in full. Mining expenses to date 2020 R45 000 (15 marks) 2021 R70 000Prepare the journal entries for 2020 and 2021? Journal narration as required. 3.2. A company was granted R12 000 to assist in the financing of mining expenses. The grant was conditional upon the company mining for at least 2 years. The company ceased mining on 30 August 2021. Terms of the grant required the grant to be paid in full. Mining expenses to date 2020 R45 000 (15 marks) 2021 R70 000Prepare the journal entries for 2020 and 2021? Journal narration as required. QUESTION 4 (20 Marks) 4.1) How is the functional currency calculated. (5 marks) 4.2 ) FG Ltd has a functional currency of Rands. It has decided to present the financial statements in the currency of the Botswana Pula In 2022, the exchange rate is as follows: 1Rand=2.5PulaAVERAGERATE1Rand=2.8PulasSPOTRATE(31December2022 (15 marks) Translate the amount in the presentation currency in a trial balance format? QUESTION 5 (25 Marks) 5.1. Identify 5 differences between a Finance Lease and an Operating Lease? (10 marks) 5.2. MNO Ltd leases an asset as a lessee. The lease agreement is for 6 years. Lease instalments of R145 545 made at the beginning of the period and interest rate is 9%. The commencement of the lease is 1 April 2021. Asset is depreciated over 4 years. The tax rate is 28%. Lease payments are allowed as a deduction when paid. (15 Profit before tax is R600 000 marks) Journalise the transactions for the year ended 31 December 2021 (Journal narrations are required)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started