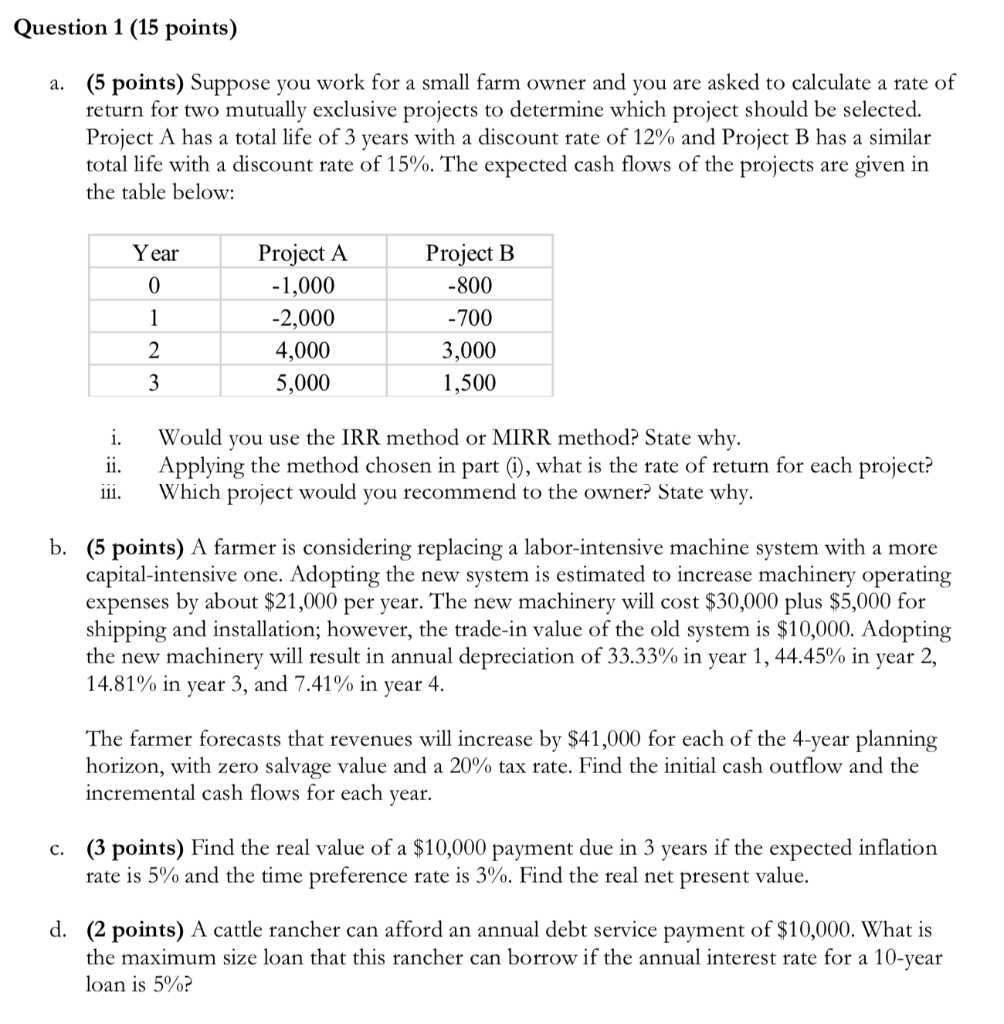

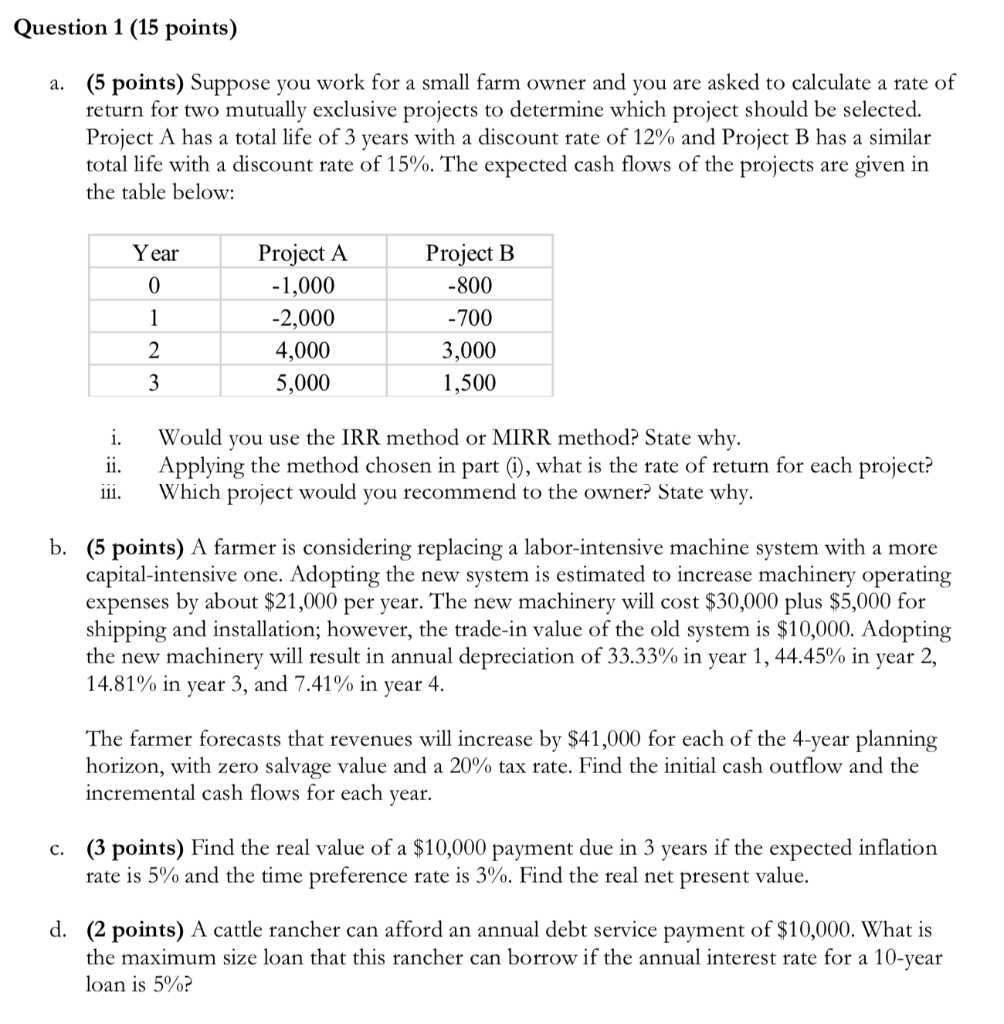

Question 1 (15 points) a. (5 points) Suppose you work for a small farm owner and you are asked to calculate a rate of return for two mutually exclusive projects to determine which project should be selected. Project A has a total life of 3 years with a discount rate of 12% and Project B has a similar total life with a discount rate of 15%. The expected cash flows of the projects are given in the table below: Year 0 1 Project A -1,000 -2,000 4,000 5,000 Project B -800 -700 3,000 1,500 2 3 i. ii. 111. Would you use the IRR method or MIRR method? State why. Applying the method chosen in part (1), what is the rate of return for each project? Which project would you recommend to the owner? State why. b. (5 points) A farmer is considering replacing a labor-intensive machine system with a more capital-intensive one. Adopting the new system is estimated to increase machinery operating expenses by about $21,000 per year. The new machinery will cost $30,000 plus $5,000 for shipping and installation; however, the trade-in value of the old system is $10,000. Adopting the new machinery will result in annual depreciation of 33.33% in year 1, 44.45% in year 2, 14.81% in year 3, and 7.41% in year 4. The farmer forecasts that revenues will increase by $41,000 for each of the 4-year planning horizon, with zero salvage value and a 20% tax rate. Find the initial cash outflow and the incremental cash flows for each year. c. (3 points) Find the real value of a $10,000 payment due in 3 years if the expected inflation rate is 5% and the time preference rate 3%. Find the real net present value. d. (2 points) A cattle rancher can afford an annual debt service payment of $10,000. What is the maximum size loan that this rancher can borrow if the annual interest rate for a 10-year loan is 5%? Question 1 (15 points) a. (5 points) Suppose you work for a small farm owner and you are asked to calculate a rate of return for two mutually exclusive projects to determine which project should be selected. Project A has a total life of 3 years with a discount rate of 12% and Project B has a similar total life with a discount rate of 15%. The expected cash flows of the projects are given in the table below: Year 0 1 Project A -1,000 -2,000 4,000 5,000 Project B -800 -700 3,000 1,500 2 3 i. ii. 111. Would you use the IRR method or MIRR method? State why. Applying the method chosen in part (1), what is the rate of return for each project? Which project would you recommend to the owner? State why. b. (5 points) A farmer is considering replacing a labor-intensive machine system with a more capital-intensive one. Adopting the new system is estimated to increase machinery operating expenses by about $21,000 per year. The new machinery will cost $30,000 plus $5,000 for shipping and installation; however, the trade-in value of the old system is $10,000. Adopting the new machinery will result in annual depreciation of 33.33% in year 1, 44.45% in year 2, 14.81% in year 3, and 7.41% in year 4. The farmer forecasts that revenues will increase by $41,000 for each of the 4-year planning horizon, with zero salvage value and a 20% tax rate. Find the initial cash outflow and the incremental cash flows for each year. c. (3 points) Find the real value of a $10,000 payment due in 3 years if the expected inflation rate is 5% and the time preference rate 3%. Find the real net present value. d. (2 points) A cattle rancher can afford an annual debt service payment of $10,000. What is the maximum size loan that this rancher can borrow if the annual interest rate for a 10-year loan is 5%