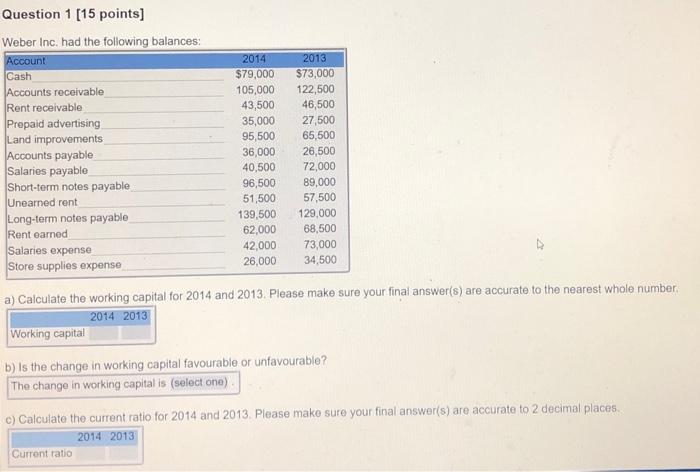

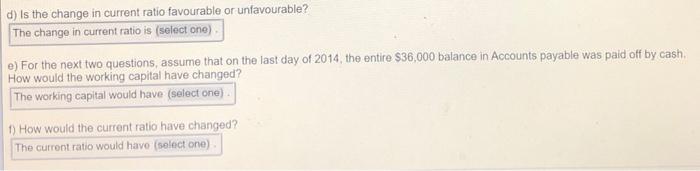

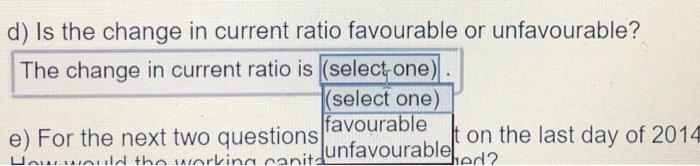

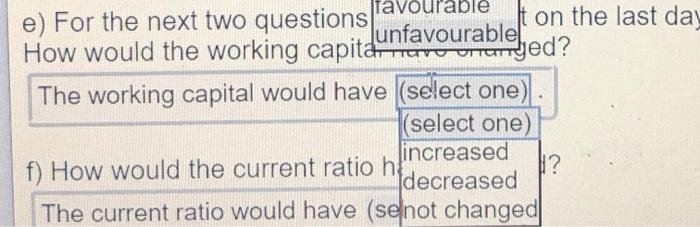

Question 1 (15 points] Weber Inc. had the following balances: Account 2014 2013 Cash $79,000 $73,000 Accounts receivable 105,000 122,500 Rent receivable 43,500 46,500 Prepaid advertising 35,000 27,500 Land improvements 95,500 65,500 Accounts payable 36,000 26,500 Salaries payable 40,500 72,000 Short-term notes payable 96,500 89,000 Unearned rent 51,500 57,500 Long-term notes payable 139,500 129,000 Rent earned 62,000 68,500 Salaries expense 42,000 73,000 Store supplies expense 26,000 34,500 a) Calculate the working capital for 2014 and 2013. Please make sure your final answer(s) are accurate to the nearest whole number 2014 2013 Working capital b) Is the change in working capital favourable or unfavourable? The change in working capital is (select one) c) Calculate the current ratio for 2014 and 2013. Please make sure your final answer(s) are accurate to 2 decimal places 2014 2013 Current ratio d) is the change in current ratio favourable or unfavourable? The change in current ratio is (select one) e) For the next two questions, assume that on the last day of 2014, the entire $36,000 balance in Accounts payable was paid off by cash, How would the working capital have changed? The working capital would have (select one) 1) How would the current ratio have changed? The current ratio would have (select one) d) Is the change in current ratio favourable or unfavourable? The change in current ratio is (select one) (select one) favourable e) For the next two questions t on the last day of 2014 muild the workina nanit-unfavourable U hed? able e) For the next two questions on the last da How would the working capitanaroor unfavourable ed? The working capital would have (select one) (select one) increased f) How would the current ratio h ? decreased The current ratio would have (se not changed 1) How would the current ratio have changed? The current ratio would have (select ofje) (select one) increased decreased Official Time: 21:34:05 not changed b) Is the change in working capital favourable o The change in working capital is (select one) (select one) favourable c) Calculate the current ratio for unfavourable [13