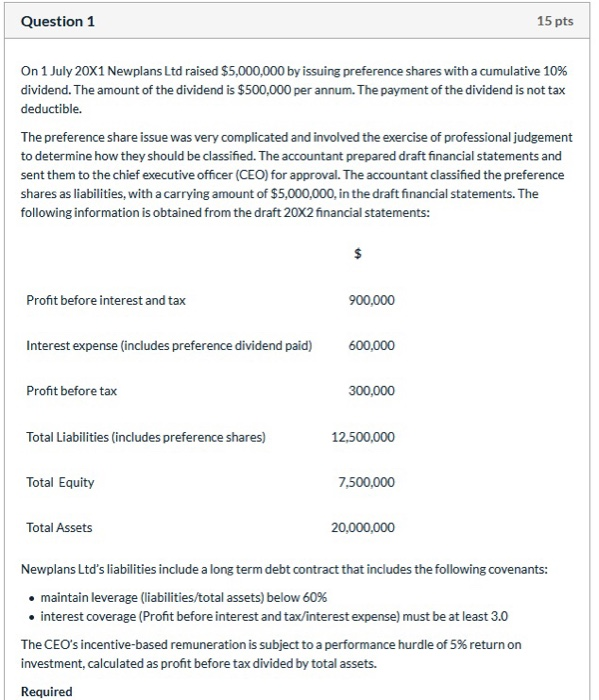

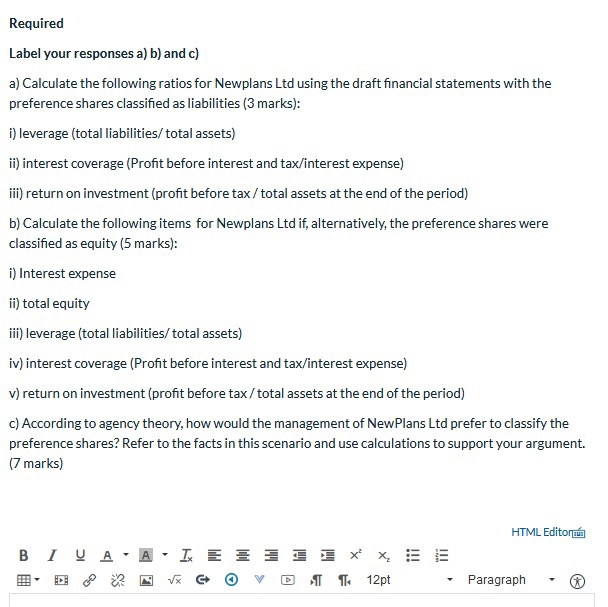

Question 1 15 pts On 1 July 20X1 Newplans Ltd raised $5,000,000 by issuing preference shares with a cumulative 10% dividend. The amount of the dividend is $500,000 per annum. The payment of the dividend is not tax deductible. The preference share issue was very complicated and involved the exercise of professional judgement to determine how they should be classified. The accountant prepared draft financial statements and sent them to the chief executive officer (CEO) for approval. The accountant classified the preference shares as liabilities, with a carrying amount of $5,000,000, in the draft financial statements. The following information is obtained from the draft 20X2 financial statements: $ Profit before interest and tax 900,000 Interest expense (includes preference dividend paid) 600,000 Profit before tax 300,000 Total Liabilities (includes preference shares) 12,500,000 Total Equity 7,500,000 Total Assets 20,000,000 Newplans Ltd's liabilities include a long term debt contract that includes the following covenants: maintain leverage (liabilities/total assets) below 60% interest coverage (Profit before interest and tax/interest expense) must be at least 3.0 The CEO's incentive-based remuneration is subject to a performance hurdle of 5% return on investment, calculated as profit before tax divided by total assets. Required Required Label your responses a) b) and c) a) Calculate the following ratios for Newplans Ltd using the draft financial statements with the preference shares classified as liabilities (3 marks): i) leverage (total liabilities/total assets) ii) interest coverage (Profit before interest and tax/interest expense) iii) return on investment (profit before tax /total assets at the end of the period) b) Calculate the following items for Newplans Ltd if, alternatively, the preference shares were classified as equity (5 marks): i) Interest expense ii) total equity iii) leverage (total liabilities/total assets) iv) interest coverage (Profit before interest and tax/interest expense) v) return on investment (profit before tax/total assets at the end of the period) c) According to agency theory, how would the management of NewPlans Ltd prefer to classify the preference shares? Refer to the facts in this scenario and use calculations to support your argument. (7 marks) HTML Editori B IV A * 12pt Paragraph