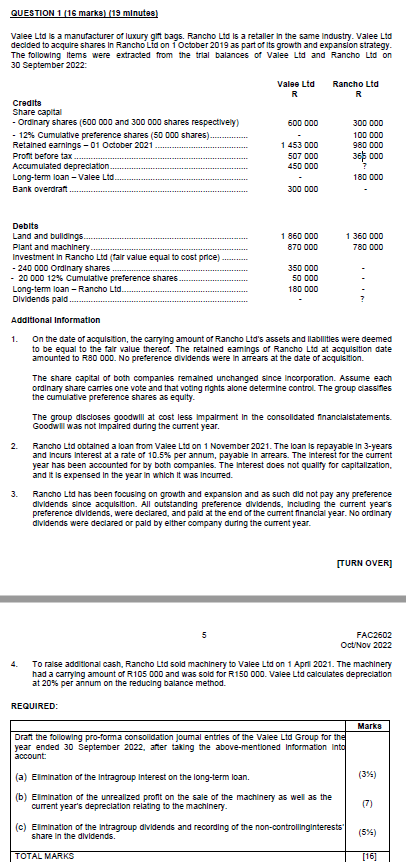

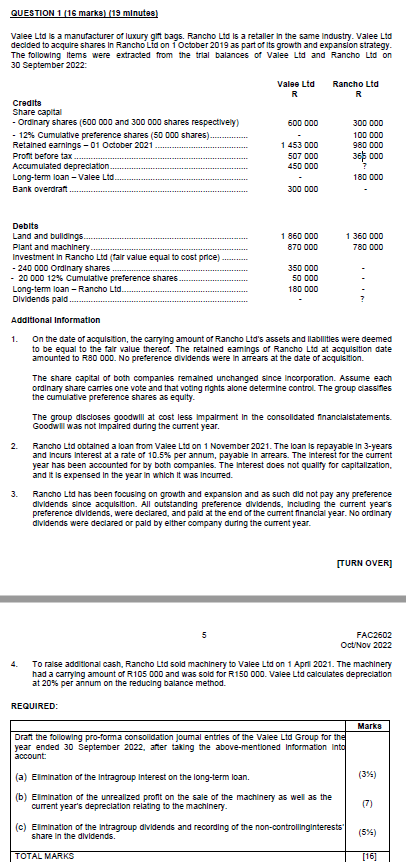

QUESTION 1 [16 marks) (19 minutes] Valee Ltd is a manufacturer of luxury gitt bags. Rancho Ltd is a retaller in the same industry. Valee Ltd decided to acquire shares in Rancho Ltd on 1 October 2019 as part of its growth and expansion strategy. The following Items were extracted from the trial balances of Valee Ltd and Rancho Ltd on 30 September 2022 : Additional Information 1. On the date of acqulsition, the carrying amount of Rancho Ltd's assets and llabilitles were deemed to be equal to the fair value thereof. The retained eamings of Rancho Ltd at acquisition date amounted to R80 000. No preference dividends were in arrears at the date of acquistition. The share capital of both companles remained unchanged since incorporation. A.ssume each ordinary share carries one vote and that voting rights alone determine control. The group classifles the cumulative preference shares as equity. The group discloses goodwill at cost less impalrment In the consolidated financialstatements. Goodwlll was not Impalred during the current year. 2. Rancho Ltd obtained a loan from Valee Ltd on 1 November 2021 . The loan is repayable in 3-years and incurs interest at a rate of 10.5% per annum, payable in arrears. The interest for the current year has been accounted for by both companles. The interest does not qualify for capitallzation, and it is expensed in the year in which it was incurred. 3. Rancho Ltd has been focusing on growth and expansion and as such did not pay any preference dlvidends since acquisition. All outstanding preference dlvidends, Including the current year's preference dlvidends, were declared, and paid at the end of the current financlal year. No ordinary dlvidends were declared or pald by elther company during the current year. [TURN OVER] 5 FAC2602 Oct/Nov 2022 4. To ralse additional cash, Rancho Ltd sold machinery to Valee Ltd on 1 April 2021. The machinery had a carryling amount of R105 D00 and was sold for R150 000. Valee Ltd calculates depreclation at 20% per annum on the reducing balance method. QUESTION 1 [16 marks) (19 minutes] Valee Ltd is a manufacturer of luxury gitt bags. Rancho Ltd is a retaller in the same industry. Valee Ltd decided to acquire shares in Rancho Ltd on 1 October 2019 as part of its growth and expansion strategy. The following Items were extracted from the trial balances of Valee Ltd and Rancho Ltd on 30 September 2022 : Additional Information 1. On the date of acqulsition, the carrying amount of Rancho Ltd's assets and llabilitles were deemed to be equal to the fair value thereof. The retained eamings of Rancho Ltd at acquisition date amounted to R80 000. No preference dividends were in arrears at the date of acquistition. The share capital of both companles remained unchanged since incorporation. A.ssume each ordinary share carries one vote and that voting rights alone determine control. The group classifles the cumulative preference shares as equity. The group discloses goodwill at cost less impalrment In the consolidated financialstatements. Goodwlll was not Impalred during the current year. 2. Rancho Ltd obtained a loan from Valee Ltd on 1 November 2021 . The loan is repayable in 3-years and incurs interest at a rate of 10.5% per annum, payable in arrears. The interest for the current year has been accounted for by both companles. The interest does not qualify for capitallzation, and it is expensed in the year in which it was incurred. 3. Rancho Ltd has been focusing on growth and expansion and as such did not pay any preference dlvidends since acquisition. All outstanding preference dlvidends, Including the current year's preference dlvidends, were declared, and paid at the end of the current financlal year. No ordinary dlvidends were declared or pald by elther company during the current year. [TURN OVER] 5 FAC2602 Oct/Nov 2022 4. To ralse additional cash, Rancho Ltd sold machinery to Valee Ltd on 1 April 2021. The machinery had a carryling amount of R105 D00 and was sold for R150 000. Valee Ltd calculates depreclation at 20% per annum on the reducing balance method