Question

Question 1 : (16 marks) Describe the accounting process to show what accountants and bookkeepers do in practice. You might include a diagram as well

Question 1: (16 marks)

- Describe the accounting process to show what accountants and bookkeepers do in practice. You might include a diagram as well to show the steps involved in the accounting process. . (6 marks)

- Distinguish between the roles of the two main branches of accounting financial accounting and management accounting. Give and explain examples to show how the two roles differ. (6 marks)

- Explain how each role captures data that are processed into information. (4 marks)

Question 2: (54 marks)

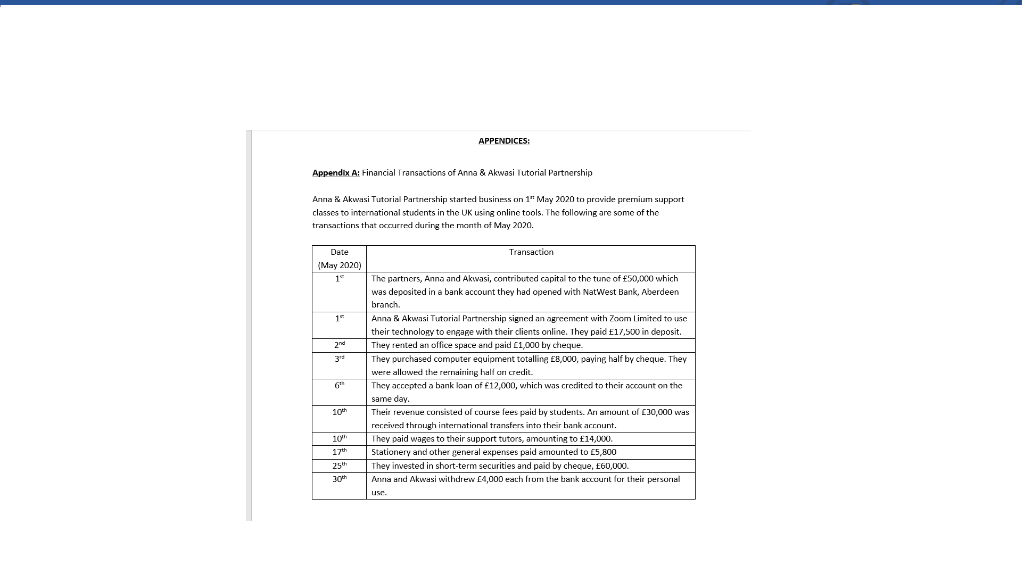

- Explain the double entry principle and apply the principle to analyse the financial transactions shown in Appendix A to this brief (financial transactions of Anna & Akwasi Tutorial Partnership. You are to explain how the first three transactions will be recorded in the books of accounts, stating the accounts to be credited and those to be debited. (12 marks)

- Using all the financial transactions in Appendix A prepare ledger accounts in the books of Anna & Akwasi Tutorial Partnership, balance off the accounts and extract a trial balance for the period. (30 marks))

- Explain the need for a trial balance, and show the extent to which businesses can rely on a trial balance as part of the process of financial reporting. (4 marks)

- Give and explain two (2) examples of errors that do not affect the agreement of a trial balance, and Illustrate how those errors can be corrected using journal entries. (8 marks)

Question 3: (40 marks)

- Explain whether or not the following are, or can be, stakeholders of Anna & Akwasi Tutorial Partnership: (i) NatWest Bank, (ii) Trade Unions, (iii) Management, and (iv) Parents of students of Anna & Akwasi Tutorial Partnership. Give reasons. . (12 marks)

- Explain the need and use of financial information for each of the stakeholders, where applicable. Give examples of specific financial information they may need to support your answer in each stakeholders case, where applicable, and explain the usefulness of the specific information so indicated. Examples of financial information include, but not limited to, income statements, statements of financial position, cash budgets and breakeven analysis. (16 marks)

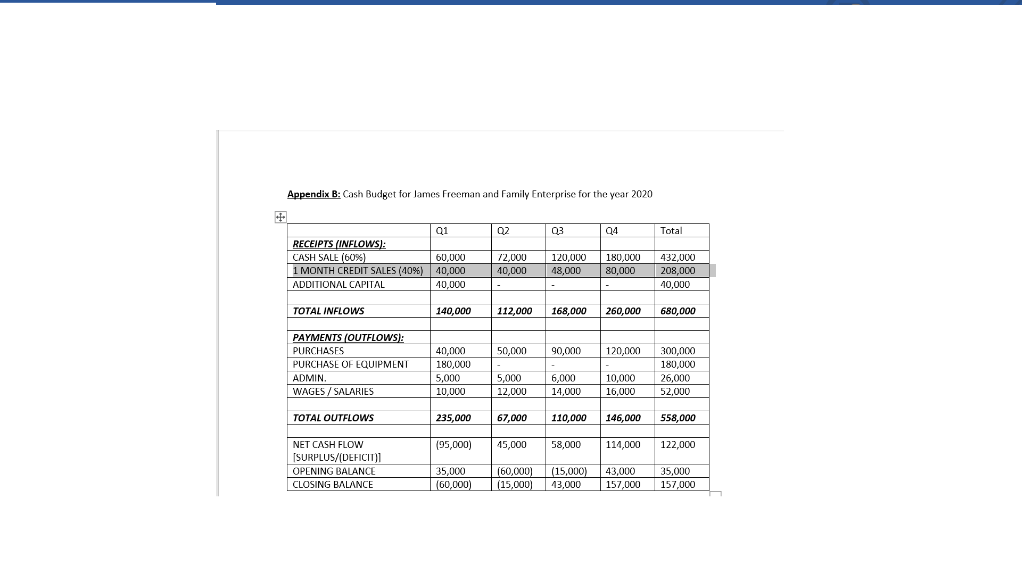

- Specifically, discuss how the cash budget in Appendix B (for James Freeman and Family Enterprise for the year 2020), and the statement of financial position in Appendix C (for Janet Zhang) could be useful to (i) employees, and (ii) lenders of the respective organisations. . (12 marks)

Question 4: (10 marks)

Explain the difference between profit and cash. Use information in the cash budget (Appendix B) and the income statement (Appendix D), respectively, to illustrate the difference. (10 marks)

Appendix C: Statement of Financial Position of Janet Zhang as at 31st December 2019

|

| ||

| Non-Current Assets: Plant & Machinery Buildings Motor Vehicles at cost Fixtures & Fittings

Current Assets: Inventory Trade receivables Cash at Bank

Less: Current Liabilities Trade payables

Net current assets (working capital) Total Assets CL

Less: Non- Current Liabilities .. .. Net Assets

Financed by: Capital Profit

LESS: Drawings |

18,000 26,010 3,092 47,102

(20,386)

0 0

|

5,000 50,000 10,800 2,100 67,900

26,716 94,616

(0) 94616

93,450 8,366 101,816 (7,200) 94,616

|

Appendix D: Income Statement of Janet Zhang for the period ended 31st December 2019

|

| ||

| Net Sales: Sales Sales returns

LESS: Cost of sales: Opening inventory Purchases Carriage in Purchases returns

LESS: Closing inventory Gross Profit Add: Other incomes: .

LESS: Expenses: Carriage out Salaries & Wages Rent & Rates Insurance Motor expenses Telephone Electricity General expenses |

14,208 71,244 1,860 (2,6 02) 84,710 (18,000)

0

1,200 22,640 1,824 1,000 2,856 2,624 996 1,884 |

111,600 (1,500) 110,100

(66,710) 43,390

0 43,390

(35,024) |

| Net Profit |

| 8,366 |

Appendix E: Organising your folder of notes and answers

Remember that a copy of the folder will be handed to the panel of interviewers, so it should be organised properly, logically and neatly. You may wish to use the suggested format below or any another format that could look presentable.

APPENDICES: Appendix A: Financial Transactions of Anna & Akwasi Tutorial Partnership Anna Akwasi Tutorial Partnership started business on 1" May 2020 to provide premium support classes to international students in the UK using online tools. The following are some of the transactions that occurred during the month of May 2020. Transaction Date (May 2020) 14 The partners, Anna and Akwasi, contributed capital to the tune of 50,000 which was deposited in a bank account they had opened with NatWest Bank, Aberdeen branch, 1 2nd 3 Anna & Akwasi Tutorial Partnership signed an agreement with Zoom Limited to use their technology to engage with their clients online. They paid E17,500 in deposit. They rented an office space and paid C1,000 by cheque They purchased computer equipment totalline E8,000, paying half by cheque. They were allowed the remaining half or credit. They accepted a bank loan of 12,000, which was credited to their account on the same day. Their revenue consisted of course fees paid by students. An amount of 30,000 was received through international transfers into their bank account. They paid wages to their support tutors, amounting to 14,000 Stationery and other general expenses paid amounted to 5,500 They invested in short-term securities and paid by cheque, 60,000. Anna and Akwasi withdrew 4,000 each liom the bank account for their personal 100 10' 17" 25" 30 Appendix B: Cash Budget for lames Freeman and Family Enterprise for the year 2020 02 Q3 94 Total Q1 RECEIPTS (INFLOWS: CASH SALL (60%) 60,000 1 MONTH CREDIT SALES (40%) 40,000 ADDITIONAL CAPITAL 40,000 72,000 40,000 120,000 48,000 180,000 80,000 432,000 208,000 40,000 TOTAL INFLOWS 140,000 112,000 168,000 260,000 680,000 50.000 90,000 120,000 PAYMENTS (OUTFLOWS: PURCHASES PURCHASE OF EQUIPMENT ADMIN WAGES / SALARIES 40.000 180,000 5,000 10,000 300.000 180,000 26,000 52,000 5,000 12,000 6,000 14,000 10,000 16,000 TOTAL OUTFLOWS 235,000 67,000 110,000 146,000 558,000 (95,000) 45,000 58,000 114,000 122,000 NET CASH FLOW TSURPLUS/(DEFICIT) OPENING BALANCE CLOSING BALANCE 35,000 (60,000) (60,000) (15,000) (15,000) 13,000 43,000 157,000 35,000 157,000 APPENDICES: Appendix A: Financial Transactions of Anna & Akwasi Tutorial Partnership Anna Akwasi Tutorial Partnership started business on 1" May 2020 to provide premium support classes to international students in the UK using online tools. The following are some of the transactions that occurred during the month of May 2020. Transaction Date (May 2020) 14 The partners, Anna and Akwasi, contributed capital to the tune of 50,000 which was deposited in a bank account they had opened with NatWest Bank, Aberdeen branch, 1 2nd 3 Anna & Akwasi Tutorial Partnership signed an agreement with Zoom Limited to use their technology to engage with their clients online. They paid E17,500 in deposit. They rented an office space and paid C1,000 by cheque They purchased computer equipment totalline E8,000, paying half by cheque. They were allowed the remaining half or credit. They accepted a bank loan of 12,000, which was credited to their account on the same day. Their revenue consisted of course fees paid by students. An amount of 30,000 was received through international transfers into their bank account. They paid wages to their support tutors, amounting to 14,000 Stationery and other general expenses paid amounted to 5,500 They invested in short-term securities and paid by cheque, 60,000. Anna and Akwasi withdrew 4,000 each liom the bank account for their personal 100 10' 17" 25" 30 Appendix B: Cash Budget for lames Freeman and Family Enterprise for the year 2020 02 Q3 94 Total Q1 RECEIPTS (INFLOWS: CASH SALL (60%) 60,000 1 MONTH CREDIT SALES (40%) 40,000 ADDITIONAL CAPITAL 40,000 72,000 40,000 120,000 48,000 180,000 80,000 432,000 208,000 40,000 TOTAL INFLOWS 140,000 112,000 168,000 260,000 680,000 50.000 90,000 120,000 PAYMENTS (OUTFLOWS: PURCHASES PURCHASE OF EQUIPMENT ADMIN WAGES / SALARIES 40.000 180,000 5,000 10,000 300.000 180,000 26,000 52,000 5,000 12,000 6,000 14,000 10,000 16,000 TOTAL OUTFLOWS 235,000 67,000 110,000 146,000 558,000 (95,000) 45,000 58,000 114,000 122,000 NET CASH FLOW TSURPLUS/(DEFICIT) OPENING BALANCE CLOSING BALANCE 35,000 (60,000) (60,000) (15,000) (15,000) 13,000 43,000 157,000 35,000 157,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started