Answered step by step

Verified Expert Solution

Question

1 Approved Answer

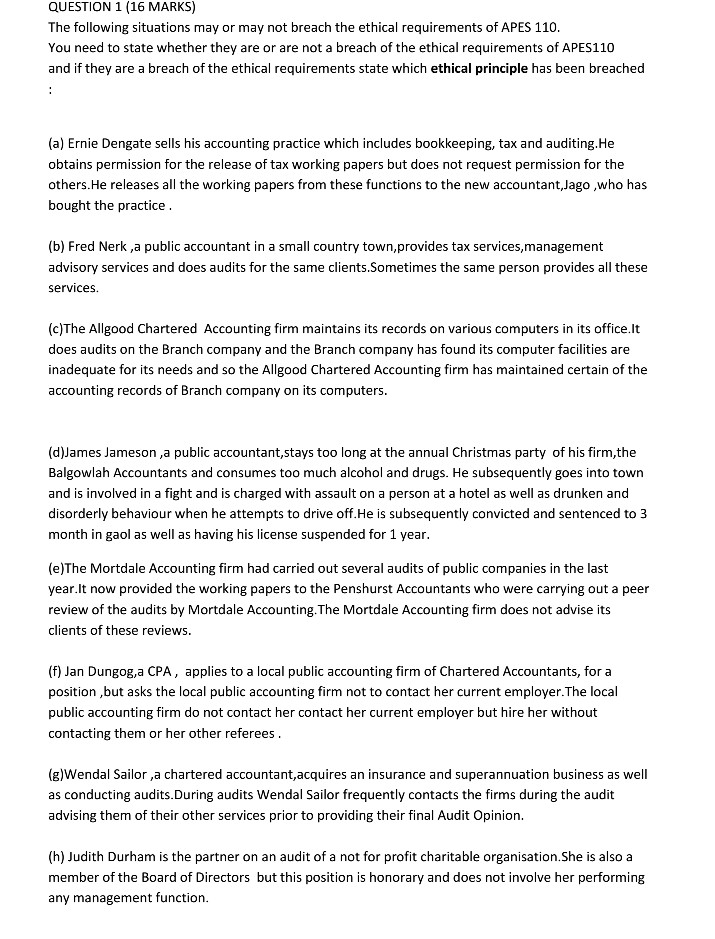

QUESTION 1 (16 MARKS) The following situations may or may not breach the ethical requirements of APES 110 You need to state whether they are

QUESTION 1 (16 MARKS) The following situations may or may not breach the ethical requirements of APES 110 You need to state whether they are or are not a breach of the ethical requirements of APES110 and if they are a breach of the ethical requirements state which ethical principle has been breached (a) Ernie Dengate sells his accounting practice which includes bookkeeping, tax and auditing.He obtains permission for the release of tax working papers but does not request permission for the others.He releases all the working papers from these functions to the new accountant,Jago ,who has bought the practice (b) Fred Nerk ,a public accountant in a small country town,provides tax services,management advisory services and does audits for the same clients.Sometimes the same person provides all these services (c)The Allgood Chartered Accounting firm maintains its records on various computers in its office.lt does audits on the Branch company and the Branch company has found its computer facilities are inadequate for its needs and so the Allgood Chartered Accounting firm has maintained certain of the accounting records of Branch company on its computers (d)James Jameson ,a public accountant,stays too long at the annual Christmas party of his firm,the Balgowlah Accountants and consumes too much alcohol and drugs. He subsequently goes into town and is involved in a fight and is charged with assault on a person at a hotel as well as drunken and disorderly behaviour when he attempts to drive off.He is subsequently convicted and sentenced to 3 month in gaol as well as having his license suspended for 1 year (e)The Mortdale Accounting firm had carried out several audits of public companies in the last year.lt now provided the working papers to the Penshurst Accountants who were carrying out a peer review of the audits by Mortdale Accounting.The Mortdale Accounting firm does not advise its clients of these reviews (f) Jan Dungog,a CPA, applies to a local public accounting firm of Chartered Accountants, for a position ,but asks the local public accounting firm not to contact her current employer.The local public accounting firm do not contact her contact her current employer but hire her without contacting them or her other referees (g)Wendal Sailor ,a chartered accountant,acquires an insurance and superannuation business as well as conducting audits.During audits Wendal Sailor frequently contacts the firms during the audit advising them of their other services prior to providing their final Audit Opinion. (h) Judith Durham is the partner on an audit of a not for profit charitable organisation.She is also a member of the Board of Directors but this position is honorary and does not involve her performing any management function

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started