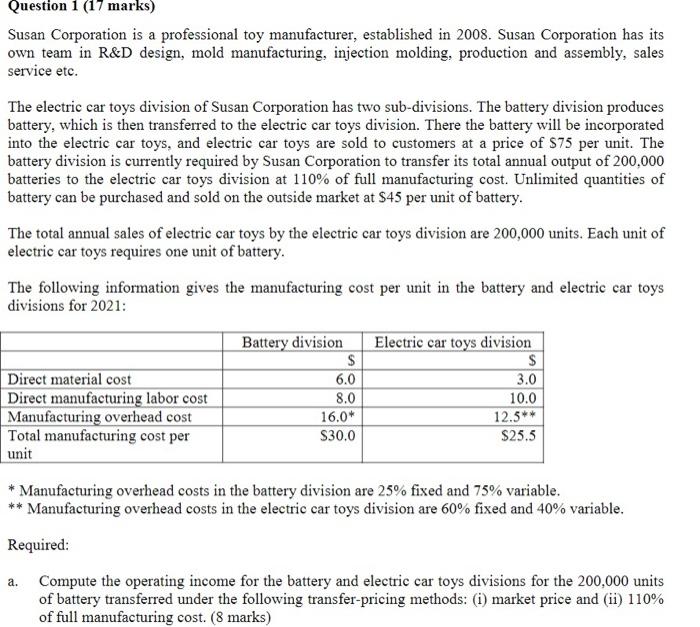

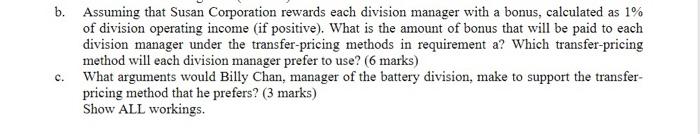

Question 1 (17 marks) Susan Corporation is a professional toy manufacturer, established in 2008. Susan Corporation has its own team in R&D design, mold manufacturing, injection molding, production and assembly, sales service etc. The electric car toys division of Susan Corporation has two sub-divisions. The battery division produces battery, which is then transferred to the electric car toys division. There the battery will be incorporated into the electric car toys, and electric car toys are sold to customers at a price of $75 per unit. The battery division is currently required by Susan Corporation to transfer its total annual output of 200,000 batteries to the electric car toys division at 110% of full manufacturing cost. Unlimited quantities of battery can be purchased and sold on the outside market at $45 per unit of battery. The total annual sales of electric car toys by the electric car toys division are 200,000 units. Each unit of electric car toys requires one unit of battery. The following information gives the manufacturing cost per unit in the battery and electric car toys divisions for 2021: Battery division Electric car toys division $ Direct material cost 6.0 3.0 8.0 10.0 Direct manufacturing labor cost Manufacturing overhead cost 16.0* 12.5** $25.5 $30.0 Total manufacturing cost per unit * Manufacturing overhead costs in the battery division are 25% fixed and 75% variable. ** Manufacturing overhead costs in the electric car toys division are 60% fixed and 40% variable. Required: a. Compute the operating income for the battery and electric car toys divisions for the 200,000 units of battery transferred under the following transfer-pricing methods: (i) market price and (ii) 110% of full manufacturing cost. (8 marks) S b. Assuming that Susan Corporation rewards each division manager with a bonus, calculated as 1% of division operating income (if positive). What is the amount of bonus that will be paid to each division manager under the transfer-pricing methods in requirement a? Which transfer-pricing method will each division manager prefer to use? (6 marks) C. What arguments would Billy Chan, manager of the battery division, make to support the transfer- pricing method that he prefers? (3 marks) Show ALL workings