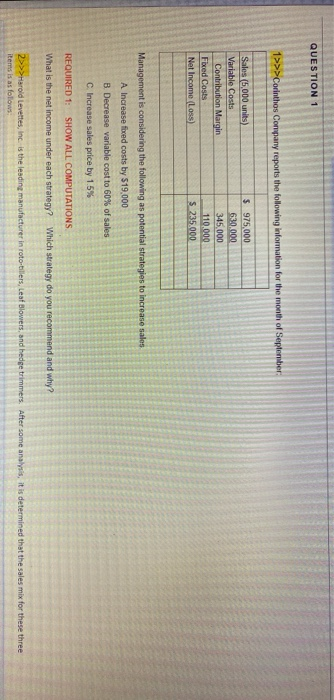

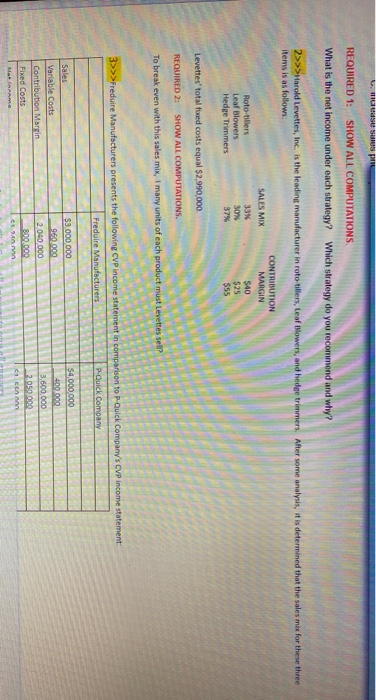

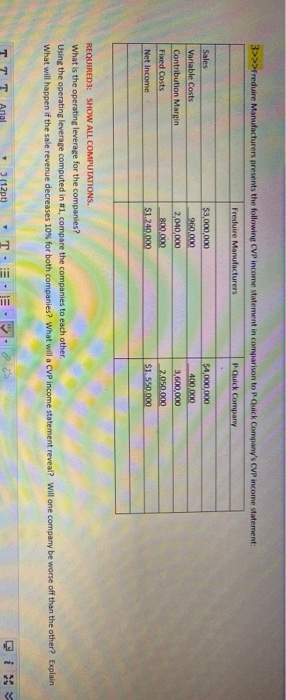

QUESTION 1 1>>>Corinthos Company reports the following information for the month of September: Sales (5,000 units) Variable Costs Contribution Margin Fixed Costs Net Income Loss) $ 975,000 630,000 345.000 110,000 $ 235.000 Management is considering the following as potential strategies to increase sales A Increase foed costs by 519,000 B. Decrease variable cost to 60% of sales C. Increase sales price by 1.5% REQUIRED 1: SHOW ALL COMPUTATIONS What is the net income under each strategy? Which strategy do you recommend and why? 2>>>Harold Levettes, Inc. is the leading manufacturer in roto-tillers, Leaf Blowers, and hedge trimmers. After some analysis, it is determined that the sales mix for these three items is as follows se Spil REQUIRED 1: SHOW ALL COMPUTATIONS What is the net income under each strategy? Which strategy do you recommend and why? 2>>>Harold Levettes, Inc. is the leading manufacturer in roto tillers, Leaf Blowers, and hedge trimmers After some analysis, it is determined that the sales mix for these three items is as follows: CONTRIBUTION SALES MIX MARGIN Roto tillers 33% $40 Leaf Blowers 30% $25 Hedge Trimmers 37% $55 Levettes' total foxed costs equal $2,990,000 REQUIRED 2: SHOW ALL COMPUTATIONS. To break even with this sales mix, I many units of each product must Levettes sell? 3>>>Freduire Manufacturers presents the following CVP income statement in comparison to P Quick Company's CVP Income statement Freduire Manufacturers P-Quick Company $4,000,000 $3.000.000 Sales Variable costs 400.000 3,600,000 2.050.000 2.040 000 800.000 ctn Contribution Martin Fixed Costs Ma RAM 3>>>Freduire Manufacturers presents the following CVP income statement in comparison to Puick Company's CVP income statement: Freduire Manufacturers PQuick Company Sales Variable costs Contribution Margin Fixed Costs Net Income $3,000,000 960,000 2,040,00 800.000 $1.240.000 $4,000,000 400,00 3,600,000 2050K $1.550.000 REQUIRED3: SHOW ALL COMPUTATIONS. What is the operating leverage for the companies? Using the operating leverage computed in #1, compare the companies to each other. What will happen if the sale revenue decreases 10% for both companies? What will a CVP income statement reveal? Will one company be worse off than the other? Explain T 3 (12pt)