Answered step by step

Verified Expert Solution

Question

1 Approved Answer

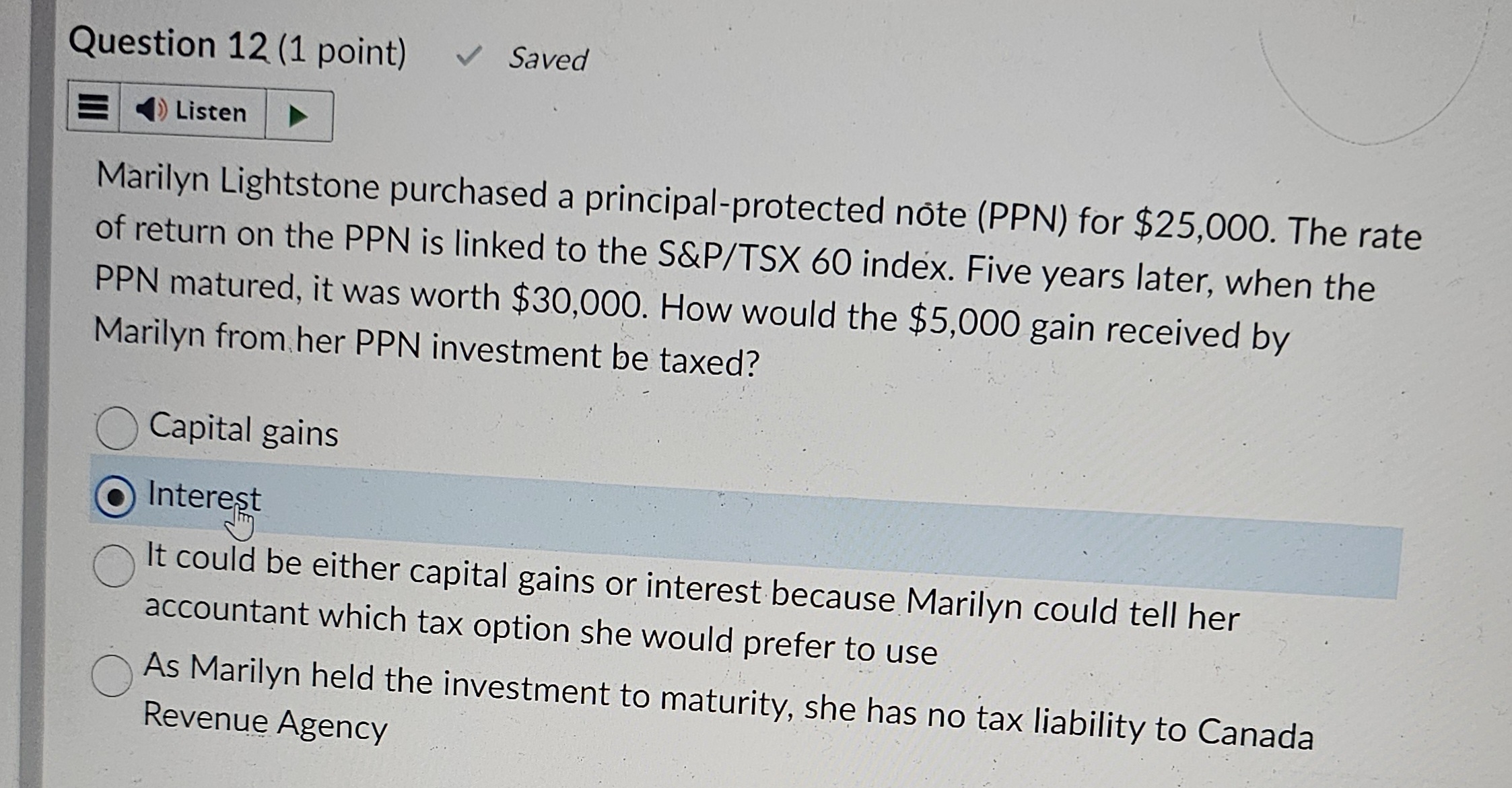

Question 1 2 ( 1 point ) Marilyn Lightstone purchased a principal - protected note ( PPN ) for $ 2 5 , 0 0

Question point

Marilyn Lightstone purchased a principalprotected note PPN for $ The rate

of return on the PPN is linked to the S&PTSX index. Five years later, when the

PPN matured, it was worth $ How would the $ gain received by

Marilyn from her PPN investment be taxed?

Capital gains

Interest

It could be either capital gains or interest because Marilyn could tell her

accountant which tax option she would prefer to use

As Marilyn held the investment to maturity, she has no tax liability to Canada

Revenue Agency

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started