Answered step by step

Verified Expert Solution

Question

1 Approved Answer

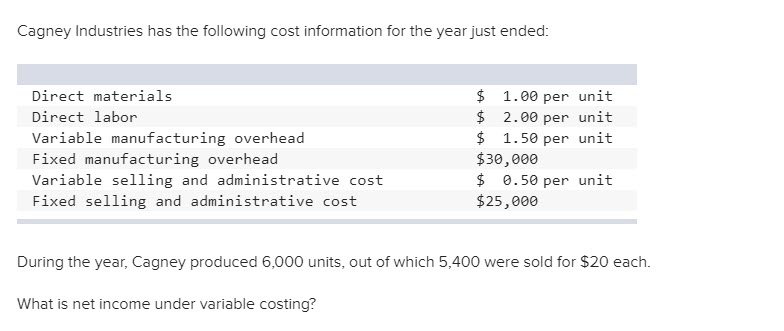

Question: 1) 2) 3) *Please Provide with explanation* Cagney Industries has the following cost information for the year just ended: Direct materials Direct labor Variable

Question:

1)

2)

3)

*Please Provide with explanation*

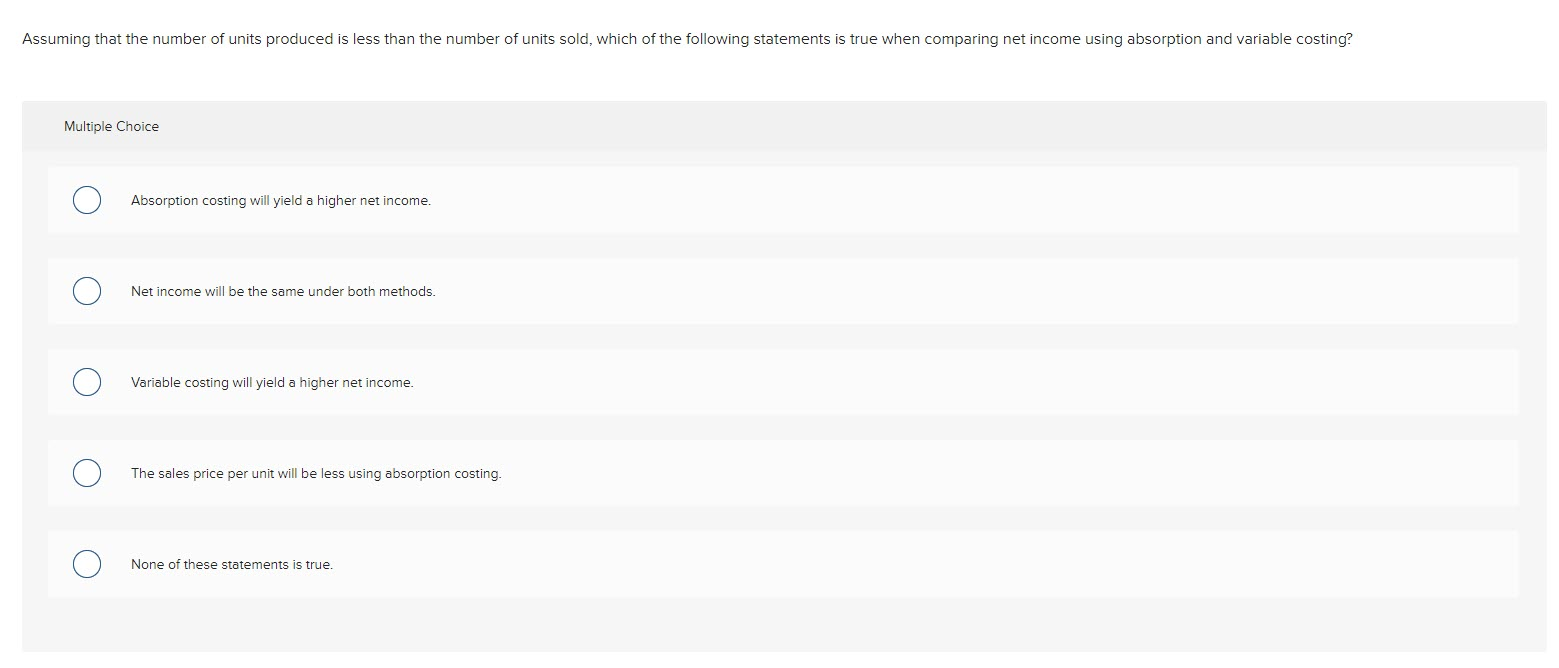

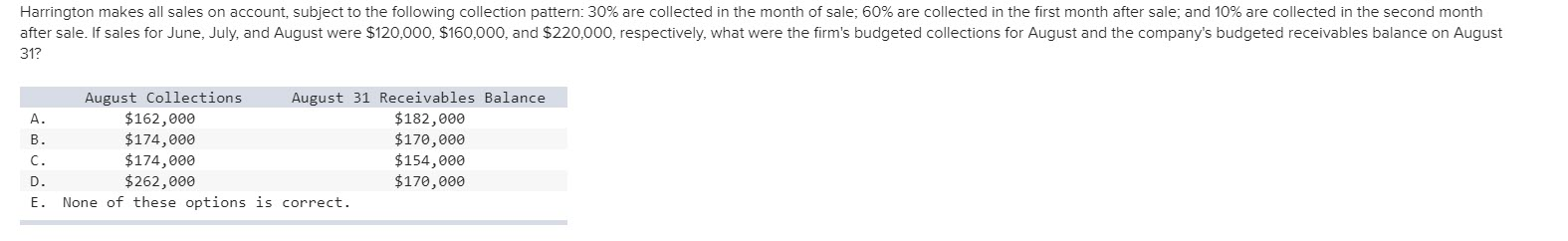

Cagney Industries has the following cost information for the year just ended: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Variable selling and administrative cost Fixed selling and administrative cost $ 1.00 per unit $ 2.00 per unit $ 1.50 per unit $30,000 $ 0.50 per unit $25,000 During the year, Cagney produced 6,000 units, out of which 5,400 were sold for $20 each. What is net income under variable costing? Assuming that the number of units produced is less than the number of units sold, which of the following statements is true when comparing net income using absorption and variable costing? Multiple Choice Absorption costing will yield a higher net income. Net income will be the same under both methods. Variable costing will yield a higher net income. The sales price per unit will be less using absorption costing. O None of these statements is true. Harrington makes all sales on account, subject to the following collection pattern: 30% are collected in the month of sale; 60% are collected in the first month after sale, and 10% are collected in the second month after sale. If sales for June, July, and August were $120,000, $160,000, and $220,000, respectively, what were the firm's budgeted collections for August and the company's budgeted receivables balance on August 31? A. B. C. D. E. August Collections August 31 Receivables Balance $162,000 $182,000 $174,000 $170,000 $174,000 $154,000 $262,000 $170,000 None of these options is correctStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started