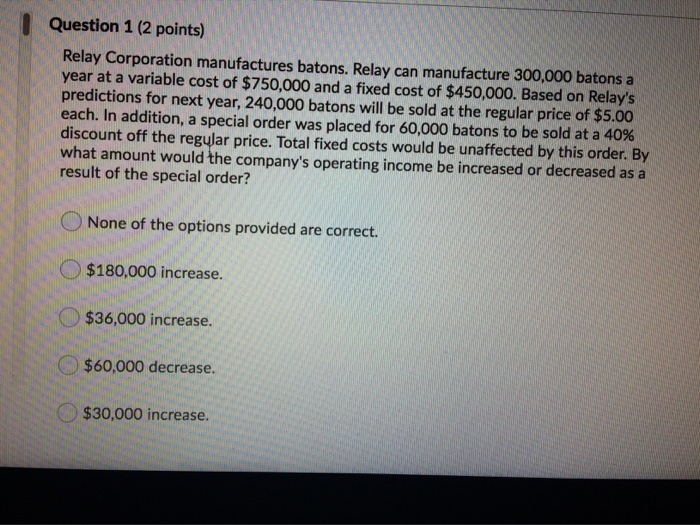

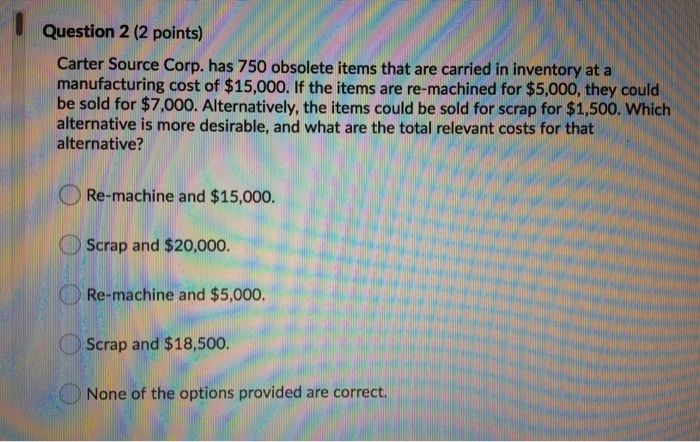

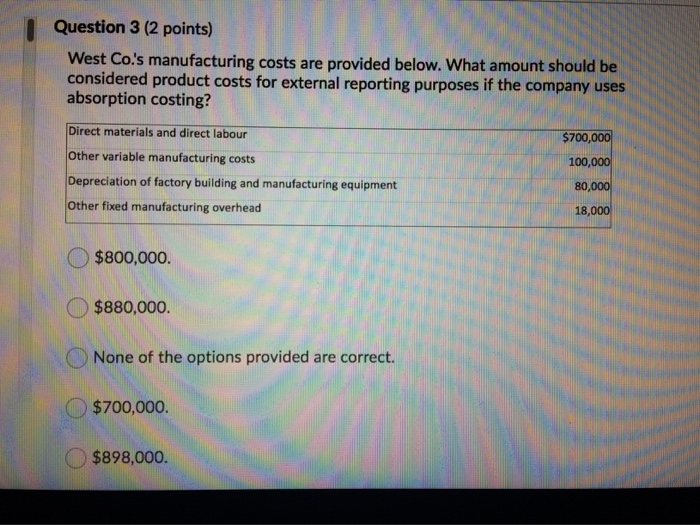

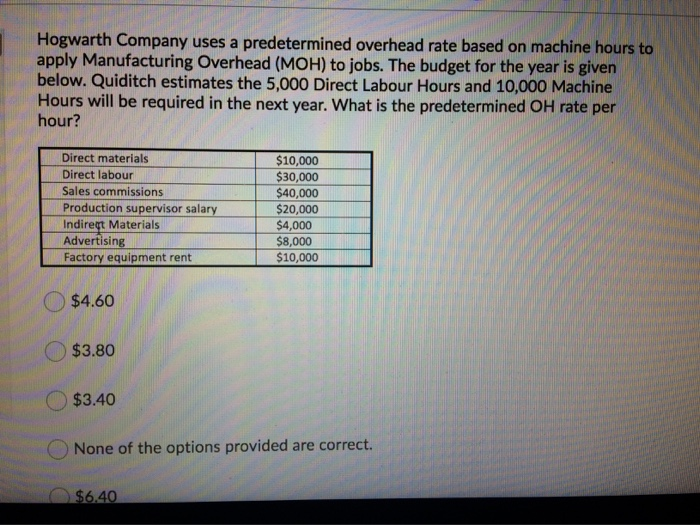

Question 1 (2 points) Relay Corporation manufactures batons. Relay can manufacture 300,000 batons a year at a variable cost of $750,000 and a fixed cost of $450,000. Based on Relay's predictions for next year, 240,000 batons will be sold at the regular price of $5.00 each. In addition, a special order was placed for 60,000 batons to be sold at a 40% discount off the regular price. Total fixed costs would be unaffected by this order. By what amount would the company's operating income be increased or decreased as a result of the special order? None of the options provided are correct. $180,000 increase. $36,000 increase. $60,000 decrease. $30,000 increase Question 2 (2 points) Carter Source Corp. has 750 obsolete items that are carried in inventory at a manufacturing cost of $15,000. If the items are re-machined for $5,000, they could be sold for $7,000. Alternatively, the items could be sold for scrap for $1.500. Which alternative is more desirable, and what are the total relevant costs for that alternative? Re-machine and $15,000. Scrap and $20,000. Re-machine and $5,000. Scrap and $18,500. None of the options provided are correct Question 3 (2 points) West Co.'s manufacturing costs are provided below. What amount should be considered product costs for external reporting purposes if the company uses absorption costing? $700,000 Direct materials and direct labour Other variable manufacturing costs ufacturing costs Depreciation of factory building and manufacturing equipment Other fixed manufacturing overhead and the 100,000 80,000 18,000 $800,000. $880,000. None of the options provided are correct. $700,000. $898,000. Hogwarth Company uses a predetermined overhead rate based on machine hours to apply Manufacturing Overhead (MOH) to jobs. The budget for the year is given below. Quiditch estimates the 5,000 Direct Labour Hours and 10,000 Machine Hours will be required in the next year. What is the predetermined OH rate per hour? Direct materials Direct labour Sales commissions Production supervisor salary Indirect Materials Advertising Factory equipment rent $10,000 $30,000 $40,000 $20,000 $4,000 $8,000 $10,000 $4.60 $3.80 $3.40 None of the options provided are correct. $6.40