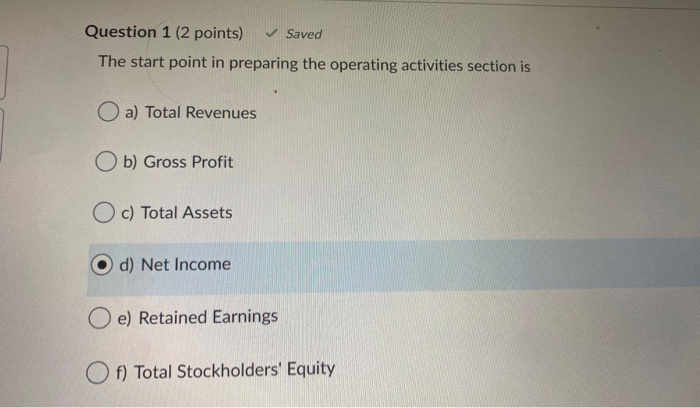

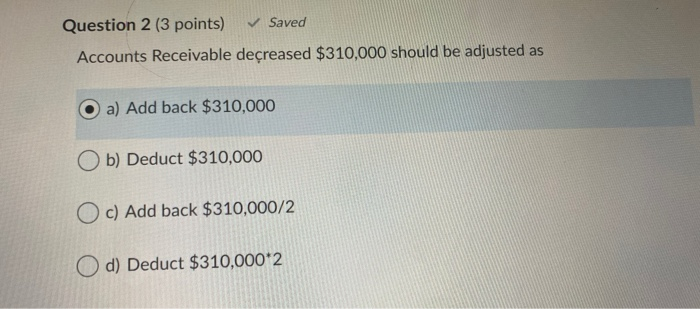

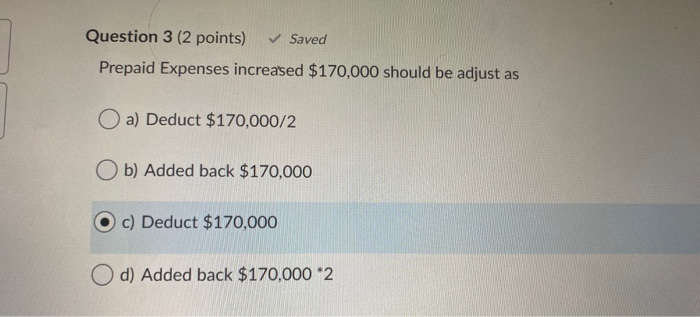

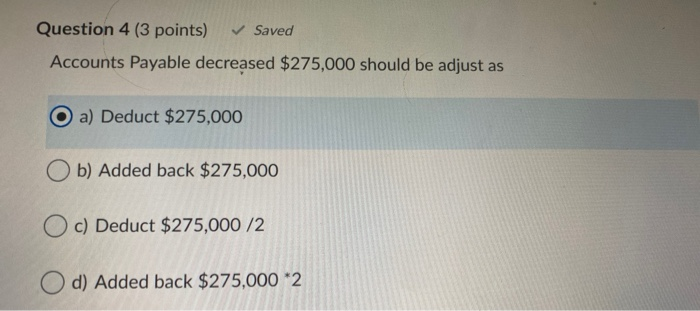

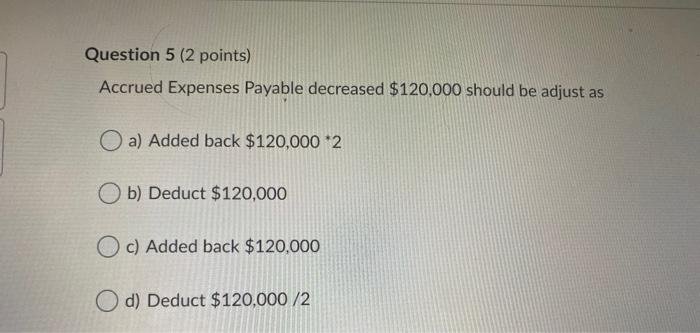

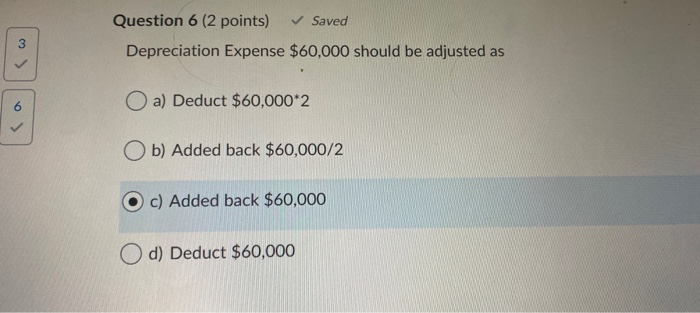

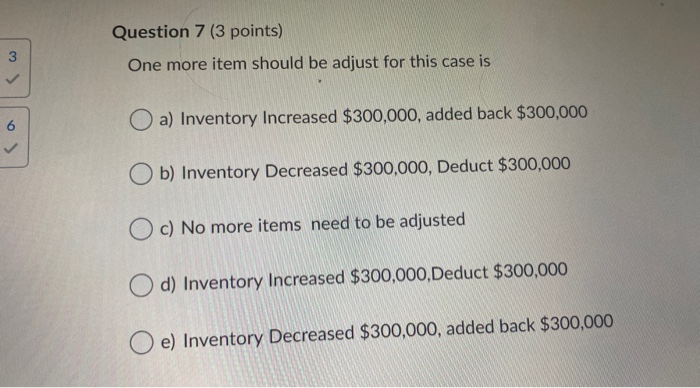

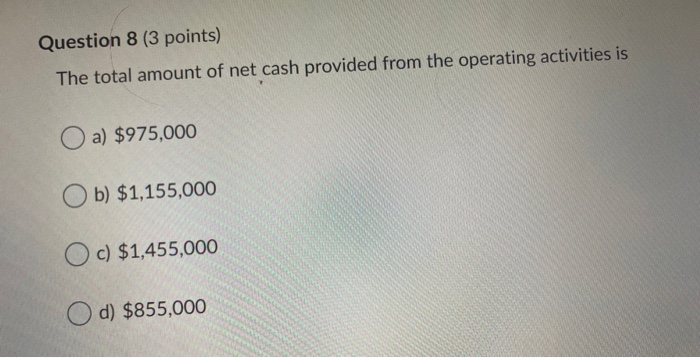

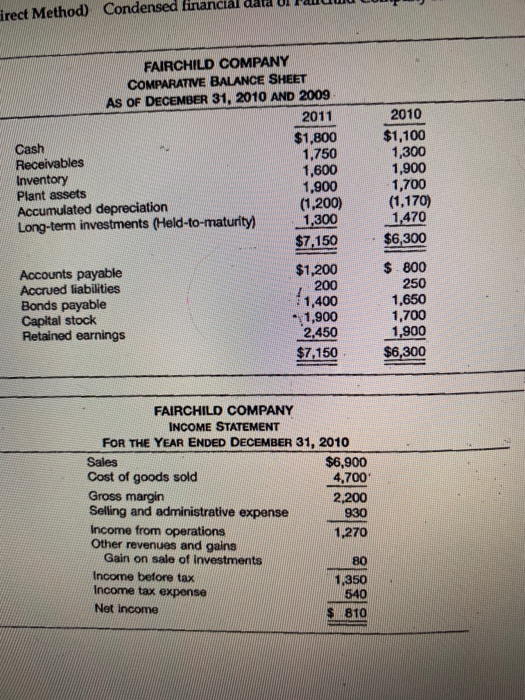

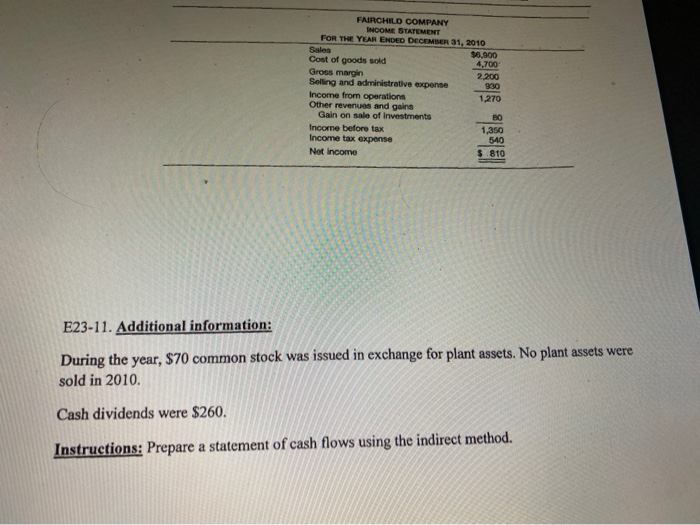

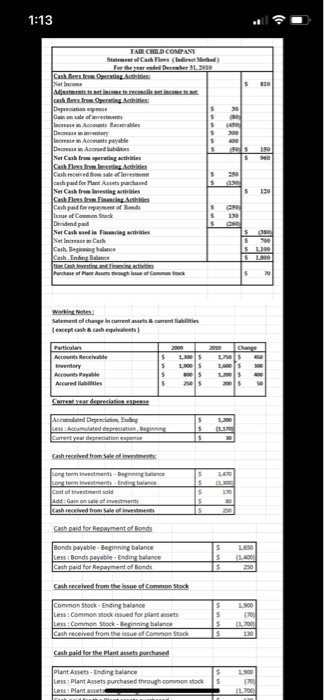

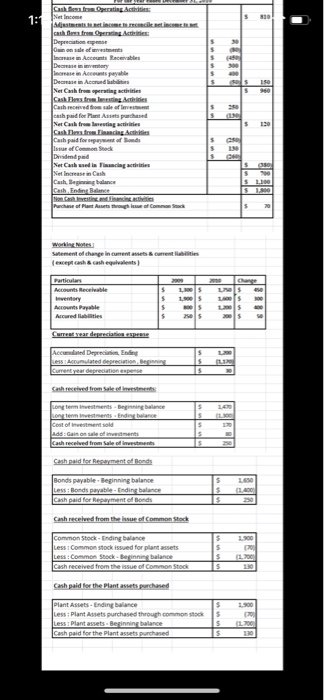

Question 1 (2 points) Saved The start point in preparing the operating activities section is a) Total Revenues Ob) Gross Profit Oc) Total Assets O d) Net Income O e) Retained Earnings Of) Total Stockholders' Equity Question 2 (3 points) Saved Accounts Receivable decreased $310,000 should be adjusted as O a) Add back $310,000 Ob) Deduct $310,000 Oc) Add back $310,000/2 Od) Deduct $310,000*2 Question 3 (2 points) Saved Prepaid Expenses increased $170,000 should be adjust as O a) Deduct $170,000/2 Ob) Added back $170,000 O c) Deduct $170,000 d) Added back $170,000 *2 Question 4 (3 points) Saved Accounts Payable decreased $275,000 should be adjust as O a) Deduct $275,000 Ob) Added back $275,000 O c) Deduct $275,000/2 Od) Added back $275,000 *2 Question 5 (2 points) Accrued Expenses Payable decreased $120,000 should be adjust as O a) Added back $120,000 *2 Ob) Deduct $120,000 c) Added back $120,000 Od) Deduct $120,000/2 Question 6 (2 points) Saved Depreciation Expense $60,000 should be adjusted as a) Deduct $60,000*2 Ob) Added back $60,000/2 Oc) Added back $60,000 O d) Deduct $60,000 Question 7 (3 points) One more item should be adjust for this case is a) Inventory Increased $300,000, added back $300,000 Ob) Inventory Decreased $300,000, Deduct $300,000 Oc) No more items need to be adjusted O d) Inventory Increased $300,000, Deduct $300,000 Oe) Inventory Decreased $300,000, added back $300,000 Question 8 (3 points) The total amount of net cash provided from the operating activities is a) $975,000 Ob) $1,155,000 Oc) $1,455,000 O d) $855,000 irect Method) Condensed financial dalaura 2010 FAIRCHILD COMPANY COMPARATIVE BALANCE SHEET AS OF DECEMBER 31, 2010 AND 2009 2011 Cash $1,800 1,750 Receivables Inventory 1,600 Plant assets 1,900 Accumulated depreciation (1,200) Long-term investments (Held-to-maturity) 1,300 $7,150 Accounts payable $1,200 Accrued liabilities 200 Bonds payable 11,400 Capital stock - 1,900 Retained earnings 2.450 $7,150 $1,100 1,300 1,900 1,700 (1,170) 1,470 $6,300 $ 800 250 1,650 1,700 1,900 $6,300 FAIRCHILD COMPANY INCOME STATEMENT FOR THE YEAR ENDED DECEMBER 31, 2010 Sales $6,900 Cost of goods sold 4.700 Gross margin 2,200 Selling and administrative expense 930 Income from operations 1,270 Other revenues and gains Gain on sale of Investments 80 Income before tax 1,350 Income tax expense Net Income 640 FAIRCHILD COMPANY INCOME STATEMENT FOR THE YEAR ENDED DECEMBER 31, 2010 Sales $5.900 Cost of goods sold 4,700 Gross margin 2.200 Selling and administrative expense Income from operations 1,270 Other revenues and gains Gain on sale of investments Income before tax Income tax expense Not Income $.810 E23-11. Additional information: During the year, $70 common stock was issued in exchange for plant assets. No plant assets were sold in 2010. Cash dividends were $260. Instructions: Prepare a statement of cash flows using the indirect method. 1:13 FAIRCHILD COMPANY SCM Fredere CDA M erci . ch. . Curs med change in me plash cash equivales) Mots Recette Acceder Bonds payable Beginning balance Cash paid for Repayment of Bonds Cash receberom the Common Stock Common Stock Ending balance Les common stocked for plant assets Less Common Stock - Beginning balance Cash received from these of Common Stock s Cash paid for the Plantats purchased Plant Assets Ending balance Less Plant Assets purchased through common stock 1: Case Inc c M reconcilicet Depreciation Iner Accounts Receivables De Acords Net Custrating the Cash Flows from dig e s cash paid for t h e Cashlari & cash Ace Deco Ending commitment Bonds payable Beginning balance Common Stock Ending balance cash received from the issue of Cash paid for the Plantats purchased Plant A t Ending balance Les Plant Assets purchased through common stock